JHVEPhoto

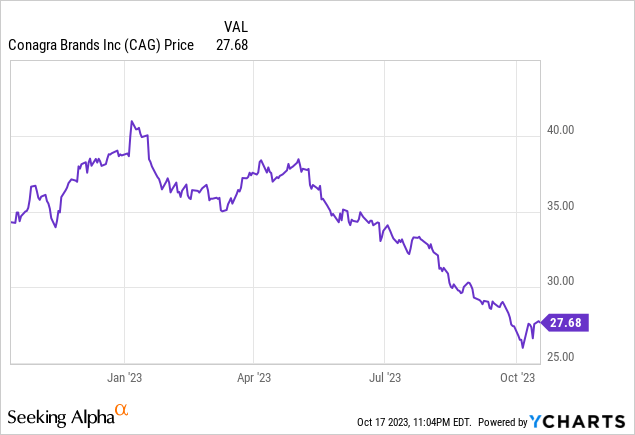

Conagra Manufacturers (NYSE:CAG) is likely to be sitting at 52-weeks lows however the firm is scuffling with quantity declines and a stale portfolio. With low profitability, curiosity protection is tight from the 2018 Pinnacle Meals acquisition nonetheless and can proceed to pull on earnings within the larger curiosity setting. The corporate is beginning to get my consideration on the new valuation however I want to see volumes get better earlier than I get excited by this mature firm’s low P/E.

Newest Quarterly Outcomes

Conagra not too long ago reported their Q1 fiscal year 2024 results on October fifth and the share worth exhibits the continued disappointment. Within the quarter, web gross sales had been $2.9 billion with a 0.3% lower in natural web gross sales offset by a 0.3% improve from the favorable FX impacts. The 0.3% lower in natural web gross sales was pushed by a 6.6% lower in quantity and defined by administration as largely resulting from an industry-wide slowdown in consumption and up to date shopper conduct shifts. These steep quantity declines had been partially offset by a 6.3% enchancment in worth/combine, to maintain gross sales comparatively flat total. Within the prior yr Q1 2023 quarter, volumes additionally confirmed a YoY decline of 4.6% in a worrying development that goes past a pair quarters.

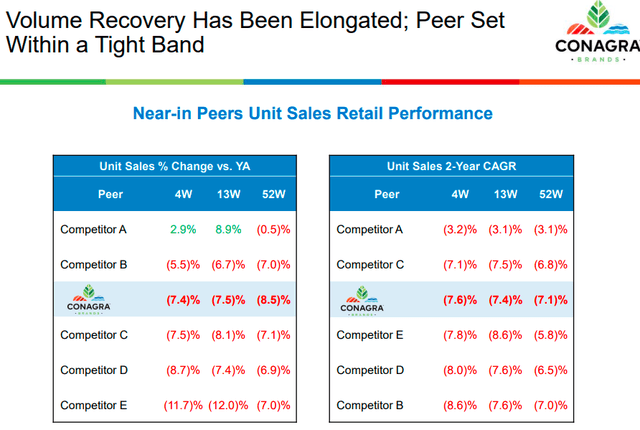

Volumes stay within the dumps, down round 7-8% from prior yr averages as may be seen from the under slide within the Q1 FY 2024 presentation. That is in the midst of the peer set Conagra makes use of however on the low finish of sure opponents I’ve written about not too long ago similar to Normal Mills and Kraft Heinz have quantity decreases across the 2% and seven% stage, respectively.

Conagra Volumes vs Friends (from firm Q1 FY24 presentation)

The corporate reaffirmed its fiscal 2024 steerage reflecting natural web gross sales progress of roughly 1.0% in comparison with fiscal 2023 with adjusted working margin between 16.0% and 16.5%. EPS steerage from administration is for an adjusted EPS between $2.70 and $2.75 which on the midpoint would place Conagra meals at a ten.1x ahead P/E for a 9.9% earnings yield. This can be a good adjusted earnings yield which we are going to examine later on this article to some historic yields primarily based off money flows and fairness returns.

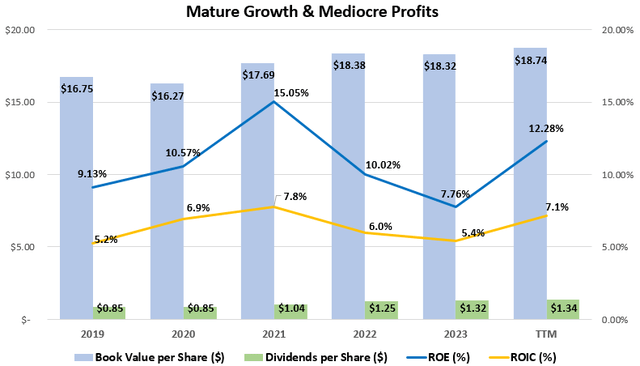

A Mature Firm with Mediocre Income

Conagra’s model portfolio has allowed the corporate to keep up a mediocre stage of profitability and return first rate money flows to shareholders. Since 2018, the corporate has solely achieved common return on fairness (ROE) and return on invested capital (ROIC) of 10.8% and 6.4% respectively. This stage of profitability is nicely under my rule of thumb of 15% ROE and 9% ROIC, giving me pause whether or not, in my view, the corporate is ready to preserve its intrinsic worth sooner or later.

Historic Income and Development (compiled by creator from firm financials)

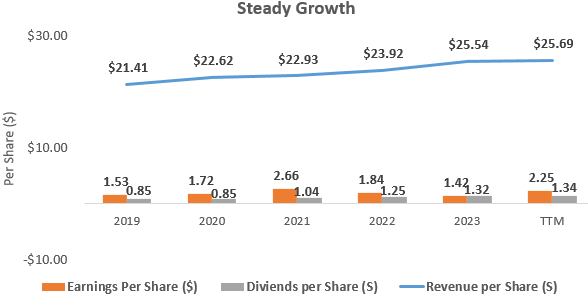

The low ROIC simply staying above 5% by way of the 5-year interval is seeking to be barely leverageable at as we speak’s present rates of interest and I might be anxious going ahead concerning the giant debt load if charges do not lower. Within the TTM interval, curiosity expense was $418.5 million, a rise of $35.7 (+9.3%) from fiscal 2022. The rise was pushed by the next weighted common rate of interest on excellent debt in a development I see set to proceed. On the expansion aspect over the identical interval, income progress has averaged solely 6.5% yearly, with unadjusted diluted EPS growing 10.1% and dividends rising at 12.1% annualized over the interval. Let’s get into shareholder returns now and have a look at money flows.

Per Share Development at Conagra (compiled by creator from firm financials)

Robust Model & Big Extra Money Flows

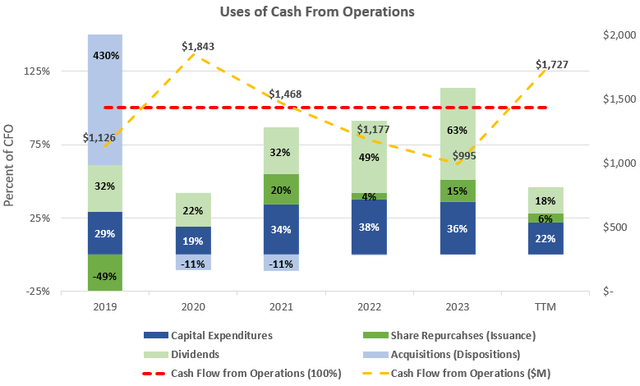

Robust mature companies with well-known manufacturers similar to Conagra Manufacturers are capable of generate money past what is required to fund operations. If we exclude the $10.1B Pinnacle Foods acquisition, capital expenditures have taken up on common 30% of money movement from operations over the previous 5 years. This would depart 70% to be returned to buyers within the type of dividends and share repurchases.

Money Circulation Evaluation at Conagra (compiled by creator from firm financials)

With common money movement from operations of $1.3 billion over the previous three years, this 70% would indicate free money movement to shareholders of $928 million for round a 7.0% free money movement yield on the present $13.2 billion market capitalization. This can be a decently excessive free money movement yield on the close to 52-week low inventory worth for Conagra Meals. Including a conservative progress fee of three% to characterize the corporate progress alongside world progress might convey this yield above my goal 9% fee.

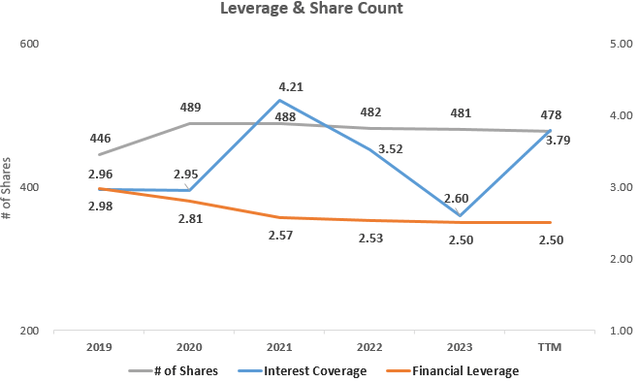

Curiosity Protection & Debt

Since 2018, finance leverage at Conagra has decreased barely to 2.50x as may be seen within the chart under however share repurchases haven’t been an everyday a part of shareholder returns which I wish to see usually. The corporate’s curiosity protection ratio stays tight at 3.8x within the TTM interval as a result of low profitability of the belongings being leveraged. This can be a low stage of curiosity protection and one thing I anticipate to harm Conagra’s profitability within the years to return as sensitivity to curiosity bills modifications are extra important from Conagra than opponents. For instance, Kraft Heinz (KHC) additionally has a big debt load however has larger curiosity coverages ranges round 5.5x as of their TTM interval since once I final wrote about them.

Capital Construction & Leverage (compiled by creator from firm financials)

Getting a Sense of Valuation

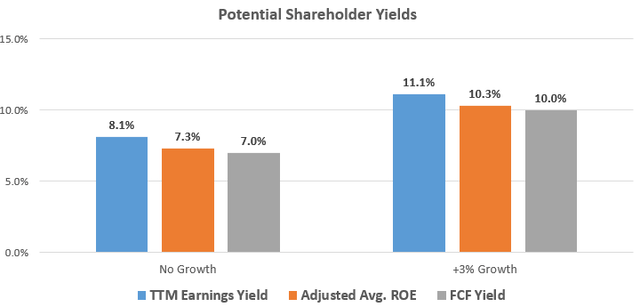

Conagra’s 12.3x TTM P/E ratio may also be expressed as a 8.1% earnings yield, however I additionally at all times like to look at the connection between common ROE and price-to-book worth in what I name the Buyers’ Adjusted ROE. It examines the common ROE over a enterprise cycle and adjusts that ROE for the value buyers are at present paying for the corporate’s guide worth or fairness per share. Conagra has a mediocre ROE, however potential returns for buyers depend upon the a number of paid for the guide worth of fairness within the public inventory market.

With Conagra incomes a median ROE of 10.8% since 2018 and shares at present buying and selling at a price-to-book worth of 1.48x when the value is $27.68, this could yield an buyers’ Adjusted ROE of seven.3% for an buyers’ fairness at that buy worth, if historical past repeats itself. This no progress fee is nicely under the 9% that I wish to see, however including conservative 3% progress to characterize the corporate rising alongside GDP might transfer it into my goal yield. Under is a desk outlining the potential earnings yield estimates from this buyers’ adjusted ROE determine in addition to the money movement and earnings yields mentioned.

Potential Shareholder Yields (compiled by creator from market knowledge and firm financials)

Takeaway for Buyers

Conagra is a mediocre firm that’s buying and selling at an excellent worth of 12.3x TTM P/E. The corporate is having points with quantity progress, albeit, many traditional shopper staple manufacturers are as nicely. Income progress has been first rate over the mid time period however I want to see volumes come again to life earlier than getting too excited as money flows are solely contemplating natural capital expenditures to drive progress.