Dragon Claws

Funding Thesis

Comtech Telecommunications Corp. (NASDAQ:CMTL) is an American communications infrastructure and options supplier headquartered in Melville, New York. On this thesis, I’ll analyze the corporate’s not too long ago introduced first-quarter outcomes and its future development prospects. I will even be analyzing its valuation at present value ranges and the upside potential within the inventory value. I imagine CMTL has managed to develop its income considerably and on a constant foundation. The brand new contracts awarded to the corporate present a wholesome order guide and income visibility for FY24-25, and therefore, I assign a purchase score for CMTL.

Firm Overview

CMTL is a pacesetter in offering superior communication options that tackle the advanced issues confronted by authorities and business clients within the telecommunications trade. It specializes within the design and manufacturing of satellite tv for pc communication methods, together with earth station tools, modems, and amplifiers. These options cater to a various vary of purposes, similar to navy, authorities, and business communications. Its community applied sciences embrace superior routing and switching options, in addition to managed providers that make sure the reliability and safety of communication networks. CMTL has a various buyer base, together with authorities companies, protection organizations, and business enterprises.

Q1 FY2024 Outcome

CMTL posted sturdy first-quarter outcomes, with vital development in revenues and increasing working margins. As per my evaluation, the Satellite tv for pc and House Communications phase proved to be the outperformer, with a strong 26.6% income development y-o-y. I imagine this phase will proceed to develop at a quick tempo given the technological edge that it has, particularly within the satellite tv for pc communications trade, which is resulting in a stronger order guide for the corporate.

Investor Presentation CMTL

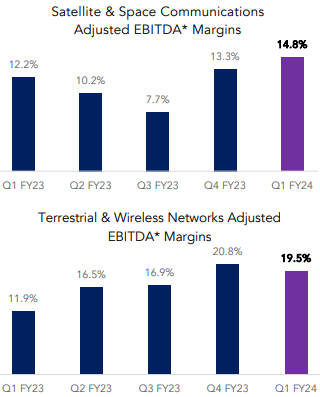

It reported net sales of $151.9 million, a big 16% in comparison with $131.1 million in the identical quarter final 12 months. As I discussed earlier, the Satellite tv for pc and House Communications phase was the first income driver, with a rise of 26.6% to $102.4 million, in comparison with $80.9 million in Q1 FY23. Nevertheless, the Terrestrial and wi-fi Networks phase skilled a decline of 1.6% to $49.5 million, in comparison with $50.3 million within the corresponding quarter final 12 months. Even with a decline in revenues, I’ve confidence within the Terrestrial and wi-fi Networks phase, given its potential to cater to the 5G communication expertise globally. The 5G expertise has not been fully adopted by nations globally, together with the U.S. and Asia Pacific, presenting an incredible alternative that CMTL can make the most of within the coming years. The expansion potential is mirrored within the file web reserving that it acquired within the final two quarters at $57.1 million and $48.4 million in This fall FY23 and Q1 FY24, respectively. It reported an working revenue of $2.08 million, in comparison with a web working lack of $9.7 million. This enchancment within the working margins was the results of decreased analysis and improvement prices and excessive income development. CMTL reported a web loss per share of $0.11, in comparison with a web loss per share of $0.46 in the identical quarter final 12 months. The online decline in web loss was primarily pushed by improved operational revenue, partially offset by larger curiosity bills.

Total, the corporate managed to outperform in a number of parameters, together with income development and operational effectivity. The corporate is on a strong development observe, and it’s mirrored within the Q2 FY24 steerage by the administration. It estimates the Q2 revenues to be within the vary of $153.5-156.5 million, representing a y-o-y enhance of 17% on the upper finish. The adjusted EBITDA margins are anticipated to be within the vary of 11%-13%, in comparison with the Q1 FY24 margins of 12.1%. I imagine it ought to have the ability to obtain these targets given the file contracts awarded to the corporate throughout Q1, which embrace a U.S. Army Contract with a $544 Million income Ceiling and a $20 million order from the U.Ok.’s spectra group.

Key Threat Issue

Excessive Debt Obligation: As of October 31, 2023, it reported money and money equivalents of $18.1 million towards the debt obligation of $203.8 million. The excessive debt obligation is placing vital stress on the steadiness sheet and will affect its future fundraising because it may have a adverse affect on its functioning. The excessive debt obligation has additionally resulted in a big enhance within the curiosity bills, with the Q1 FY24 curiosity bills of $4.9 million, up an enormous 121% in comparison with $2.2 million in the identical quarter final 12 months. The upper curiosity bills are placing a dent in its revenue margins. I might advocate traders take into account this danger earlier than investing in CMTL.

Valuation

CMTL is presently buying and selling at a share value of $8, a YTD decline of 35%. It has a market cap of $221 million. It’s buying and selling at a ahead non-GAAP P/E a number of of 8.25x, with an FY24 EPS estimate of $0.94. Evaluating this to the sector P/E of 24.9x, I imagine it’s considerably undervalued at present value ranges. With a long-term view of three–5 years, the inventory may present stellar returns. The market reacted negatively to the Q1 outcomes, and the inventory value witnessed a steep decline. I imagine this can be a nice alternative for traders searching for a development firm at a low valuation.

Conclusion

The constant income development charge, coupled with bettering revenue margins, signifies that the corporate is heading in the right direction. The file order guide and optimistic steerage by the administration instill vital confidence. It’s buying and selling at an inexpensive valuation with a ahead P/E a number of of 8.25x. The corporate faces the chance of excessive debt obligation, however the total profile gives a positive risk-reward profile. Contemplating all these components, I assign a Purchase advice for CMTL.