Editor’s observe: Searching for Alpha is proud to welcome Empyrean Analysis as a brand new contributor. It is simple to change into a Searching for Alpha contributor and earn cash on your greatest funding concepts. Energetic contributors additionally get free entry to SA Premium. Click on right here to search out out extra »

Funtay

Funding Highlights

I’m initiating protection of Pc Modelling Group (TSX:CMG:CA, OTCPK:CMDXF). CMG is a dominant participant within the reservoir simulation software program trade, benefiting from important boundaries to entry and excessive buyer switching prices. Current shifts in CMG’s technique, led by CEO Pramod Jain, spotlight the corporate’s intent to capitalize on the rising carbon seize and sequestration (“CCS”) area, leveraging the headwinds affecting its conventional O&G enterprise. With a considerable money steadiness and no debt, CMG can be well-positioned to pursue strategic acquisitions, probably driving future development. I imagine the market is but to completely admire the main enterprise transformation CMG is executing, presenting a gorgeous entry level.

Enterprise Overview

What Does CMG Do?

Headquartered in Calgary, CMG is a number one supplier of superior reservoir simulation software program to shoppers in over 60 international locations, providing merchandise that cater to various kinds of reservoirs and restoration processes.

The petroleum trade makes use of reservoir simulation to realize insights into reservoir habits below completely different restoration strategies. By way of these visible fashions, consultants can predict fluid stream, decide drilling areas, and assess working circumstances, dangers, and funding returns. Simulating how a reservoir responds to restoration methods earlier than precise drilling and chemical injections is more cost effective and fewer dangerous than experimenting on actual wells.

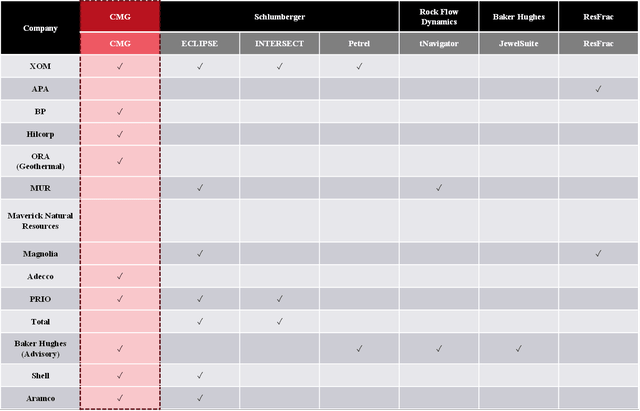

The market is dominated by a few major players: CMG (IMEX, GEM, and STARS), Schlumberger (SLB) (ECLIPSE, INTERSECT, and Petrel), Baker Hughes (BKR) (JewelSuite), Rock Movement Dynamics (tNavigator), and ResFrac.

Because of the excessive technical complexity of reservoir simulation and its integration with E&P’s extraction course of, boundaries to entry and switching prices are extraordinarily excessive.

How Does CMG Make Cash?

CMG has three segments (two software program and one skilled companies/consulting). CMG sells two sorts of software program contracts: Annuity & Upkeep (“A&M”), and Perpetual. Inside every section, CMG additionally breaks out 4 geographic segments: Canada, US, LatAm, and Jap Hemisphere (Europe, Africa, Asia, and Australia).

A&M contracts are usually 1-year lengthy and supply clients a set variety of consumer licenses. Additionally they sometimes embody a upkeep element for technical assist and permit clients to entry the newest variations of CMG’s merchandise annually as they’re upgraded. CMG considers A&M income to be recurring, although I take into account it quasi-recurring. Prospects usually renew year-to-year, however A&M income can fluctuate considerably as clients scale up or down the variety of consumer licenses they purchase primarily based on oil market fundamentals and capital funding plans.

Perpetual license gross sales are non-recurring, although they generally embody a separate, recurring upkeep element. Perpetual income is extraordinarily lumpy and largely generated within the Firm’s Jap Hemisphere section.

The Skilled Companies section affords coaching and workshops to assist customers maximize the worth of its merchandise and technical assist in advanced simulation challenges.

Qualitative Evaluation

What’s CMG’s Moat?

CMG’s aggressive positioning primarily advantages from excessive boundaries to entry and buyer switching prices.

The existence of sturdy boundaries to entry within the trade is supported by the restricted variety of gamers and the steadiness of the market construction over time.

The desk under reveals the main suppliers of reservoir simulation software program and their merchandise (horizontal axis) and which merchandise numerous power corporations use (vertical axis). This info was gathered from reservoir simulation engineer job postings from every firm. It’s fascinating to notice that many corporations use a number of simulation merchandise from the highest 5 suppliers. This is because of the truth that completely different merchandise are tailor-made to various kinds of extraction strategies and drawback units. I imagine that is useful, because it mitigates the danger of dropping all of a buyer’s enterprise if they’re able to overcome the excessive switching prices of fixing software program suppliers (see under).

Writer

Switching prices are substantial for the next causes:

Coaching and Experience: Customers should be educated within the new software program, which takes time and sources

Integration with Present Methods: Firms have current workflows and methods that the brand new software program should be appropriate with. Transitioning to new software program might require updates or redesigns of those methods

Information Migration: Transferring historic knowledge, fashions, and reservoir simulations from the outdated software program to the brand new one

Vendor Relationship and Help: Firms should set up new relationships with the software program vendor, which might contain negotiating contracts, and understanding assist choices

Moreover, the oil and gasoline trade is dealing with a big scarcity of technical and engineering expertise. In accordance with Texas Tech’s annual survey of petroleum engineering applications, the variety of PetEng grads in 2024 is anticipated to be solely 500 throughout the US, down ~80% for the reason that peak of ~2,600 in 2017. To compensate for the shrinking PetEng workforce, corporations possible lack the manpower to handle a transition to rival software program. That is supported by the truth that clients are rising increasingly reliant on CMG’s consulting business, which has accounted for ~43% of income development since FY2012 and has been the fastest-growing section for the previous six years (excluding the perpetual section attributable to its lumpy and unpredictable gross sales cycle).

These aggressive benefits have enabled CMG to keep up ~43% and ~47% common EBIT and EBITDA margins, respectively, from FY2013-FY2023 and capital effectivity (n.b., common ~45% ROE from FY2013-FY2023 with no internet debt).

Enterprise Transformation: Transition to Vitality Transition / CCS

In Could 2020, Pramod Jain took over as CEO. In his first shareholder letter, Jain outlined his intent to double down on power transition and M&A as avenues for development. Within the context of CMG, power transition primarily means carbon seize and sequestration, which presents comparable engineering issues to underground hydrocarbon restoration. Over the previous a number of quarters, the technique seems to be working. Vitality transition accounted for ~22% of Q1 FY2024 income, up from ~14% in FY2023. In February 2023, CMG introduced the primary acquisition within the Firm’s historical past, Unconventional Subsurface Integration, an early-stage AI-based knowledge analytics expertise for maximizing asset valuation and manufacturing efficiency of shale reservoirs.

I imagine CMG’s renewed concentrate on CCS and M&A is important for a number of causes.

Firstly, though its core O&G enterprise is extremely engaging, it’s cyclical and has exhibited nearly no topline development throughout current cycles. As a result of nearly all of CMG’s software program income is derived from 1-year A&M contracts, clients are capable of scale their variety of consumer licenses up or down with the commodity cycle at common intervals. M&A activity across the US and Canada has enabled clients to appreciate synergies and scale back their variety of consumer licenses over time. The 2015 Oil Crash and up to date local weather coverage modifications have additionally considerably impacted the North American O&G panorama. E&Ps are exercising way more cost and capital discipline, dampening exercise and, by extension, CMG’s development potential.

By exploiting its competitively advantaged place to pursue CCS alternatives, CMG can unlock a big, untapped development alternative. The coverage modifications which have been headwinds for CMG’s core O&G enterprise will act as tailwinds for its CCS enterprise. I imagine this might have the impact of tilting the market’s development expectations up and decreasing the perceived threat of development, which may probably drive a number of growth.

Secondly, the push into CCS may, at a minimal, alleviate any “hydrocarbon low cost” and should ultimately result in an ESG premium.

Thirdly, with its giant money steadiness (n.b., C$64.2MM at Q1 FY2024, ~9% of market cap), CMG has quite a lot of dry powder for acquisitions. Contemplating that the Firm has no debt, there’s additionally substantial upside in tapping its latent debt capability to fund bigger acquisitions or to finance buybacks.

Valuation

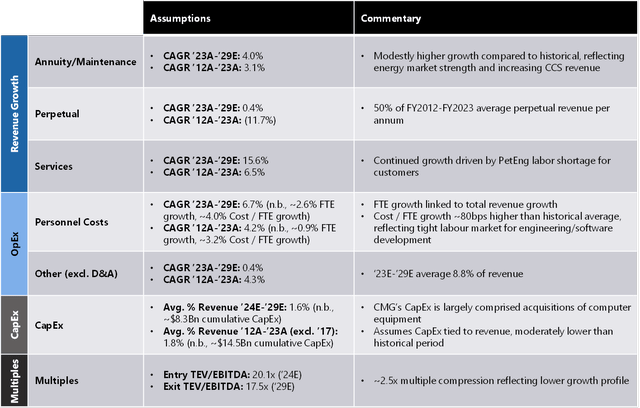

Draw back Case

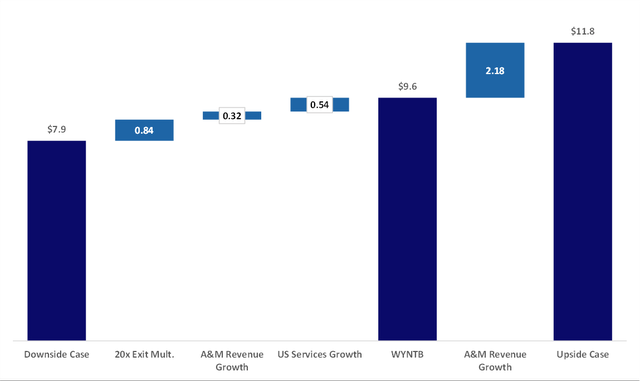

My valuation begins with a draw back case. A&M income development is barely greater than the historic common. Whereas this can be a draw back case, I imagine this can be a affordable assumption given the sturdy demand for CCS options seen in current quarters and the constructive near-term O&G fundamentals. Because of the unpredictable nature of perpetual license gross sales, I simplistically assume 50% of the annual common historic gross sales. Companies income development stays elevated relative to historicals in all geographies, reflecting clients’ must outsource simulation workflows because of the PetEng labor scarcity. The draw back case ends in a goal worth of ~C$7.9/share assuming a 12% low cost charge and a pair of.5x of EBITDA a number of compression, implying ~9% draw back. Be aware that assuming no a number of compression, the goal worth is according to the present share worth.

Writer

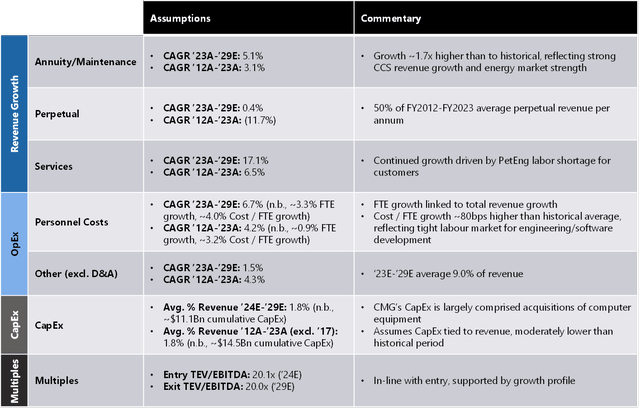

Central Case

The central “What You Have to Imagine” (“WYNTB”) case assumes a complete income CAGR ~120bps greater than the draw back case and no a number of compression, and ends in a ~C$9.6/share goal worth at a 12% low cost charge, implying ~10% upside.

Writer

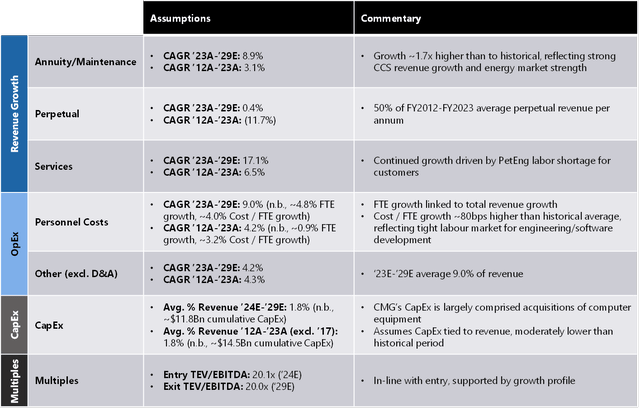

Upside Case

The upside case assumes complete income development ~280bps greater than the WYNTB case attributable to a slower taper of the expansion charges. It additionally assumes a relentless a number of and a 12% low cost charge. This case ends in a ~C$11.8/share goal worth, implying ~35% upside.

Writer

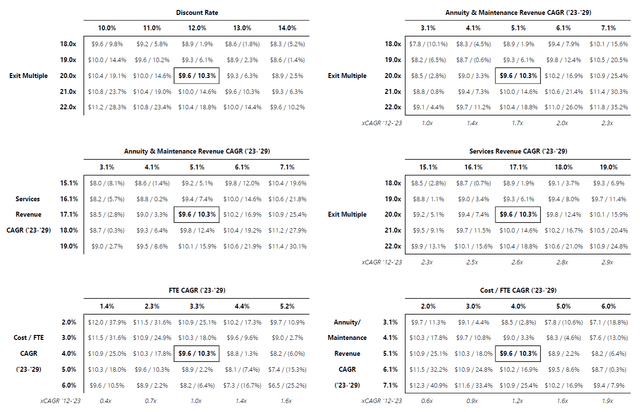

Sensitivities

The sensitivities under consult with the WYNTB case. Moreover, it’s value noting that the perpetual section accounts for ~C$0.5/share in my mannequin (i.e., assuming zero perpetual license gross sales would scale back the goal worth by ~C$0.5/share).

Writer

Writer

Evaluation of Friends

CMG is the one public pure-play reservoir simulation firm. Its principal opponents are both giant, diversified conglomerates (e.g., SLB and BKR) or smaller, personal corporations (e.g., ResFrac and Rock Movement Dynamics).

Capital IQ, PitchBook

The market is sort of opaque, with detailed info on pricing and market share both unavailable or maintained behind paywalls. Nevertheless, primarily based on CMG’s historic income evolution, and anecdotal studies on reservoir engineering boards, I imagine the market shares have remained comparatively steady over time. With out a technical background or trade expertise, it’s tough to find out the relative power of every firm’s product choices. Nevertheless, there are some knowledge factors that I imagine reinforce the standard of CMG’s software program. CMG’s software program is taught in lots of university-level reservoir engineering programs and reservoir engineering research labs. It is a testomony to its merchandise’ prevalence, ease of use, and performance. I imagine it additionally has the additional advantage of perpetuating the trade’s use of CMG, much like how Adobe has remained trade customary, largely because of the reality it’s taught in design applications.

Dangers

By way of my evaluation, I’ve gained enough consolation with CMG’s enterprise mannequin and the market dynamics. Listed here are the principle dangers which have the potential to alter my thoughts:

CCS Demand Danger: Uptake of CCS choices is slower than anticipated, or enterprise is misplaced to opponents.

Mitigation: With oil demand anticipated to proceed rising by 2030, and flatline by 2050, CCS might be a cornerstone of the decarbonization agenda. Authorities incentives ought to assist adoption.

Commodity Danger: A pointy and/or extended downturn in oil markets would depress core reservoir simulation and companies income.

Mitigation: Growing contribution of CCS income ought to mitigate the cyclicality of the core O&G enterprise. Recent actions by OPEC and a continual under-investment on the availability aspect ought to assist oil costs within the near- and medium-term.

M&A Danger: Though I’ve not assumed any M&A in my valuation and left it as a speculative upside, there’s at all times threat of value-destructive M&A.

Mitigation: M&A inside the trade (i.e., buying smaller opponents) would solely serve to enhance CMG’s aggressive place by consolidating an already concentrated trade, and is unlikely to be value-destructive except administration considerably overpays. Up to now, administration has been prudent with capital (e.g., share buybacks, focused M&A), so I view this as unlikely.

Conclusion

Regardless of at ~50% rally YTD, present costs possible current a chance to amass a high-quality software program enterprise with an enormous development runway at an inexpensive worth.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.