- Coinbase’s Q3 income dropped amid diminished buying and selling however achieved a $75 million revenue.

- The agency strengthened its crypto stance with a $1 billion buyback and Fairshake PAC assist.

In an surprising flip, on the thirtieth of October, Coinbase revealed a drop in quarterly income. This factors to a decline in crypto buying and selling exercise amongst customers over the summer time months.

As per the report, the trade’s income dipped to $1.2 billion in Q3 2024, down from $1.45 billion within the prior quarter. Regardless of this, Coinbase posted a notable turnaround with a $75 million revenue.

It is a stark enchancment from the $2 million loss reported final 12 months.

Coinbase Q3 income sparks considerations

Coinbase skilled a 27% drop in transaction charges in comparison with the earlier quarter as a consequence of declining buying and selling volumes.

The corporate’s shareholder letter outlined ongoing market challenges. The letter highlighted that subscription and companies income had decreased by 7%, bringing in $556.1 million for the quarter.

This income comes from merchandise like stablecoins, staking, and leverage for Prime merchants.

In its shareholder letter, the agency famous,

“We’re working to drive income progress by means of merchandise like derivatives, worldwide growth, custody, and deeper integration of USDC into the cryptoeconomy.”

Nevertheless, Anil Gupta, Coinbase’s vp of investor relations, appeared constructive as highlighted in a dialog with a publication the place he marked the corporate’s fourth consecutive worthwhile quarter.

“It was a stable quarter for the enterprise throughout the three priorities we set forth early within the 12 months: driving income, driving crypto utility, and driving regulatory readability.”

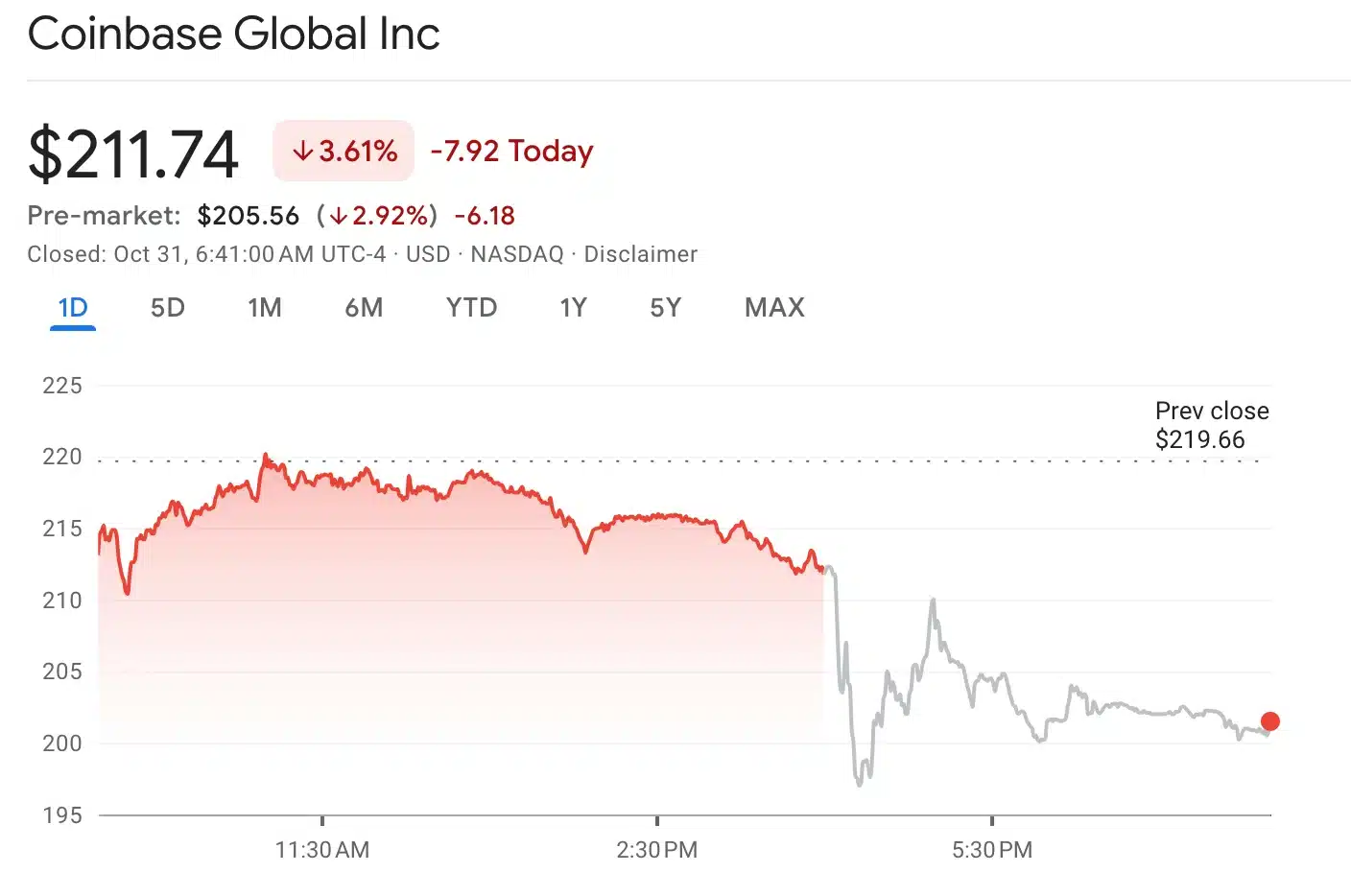

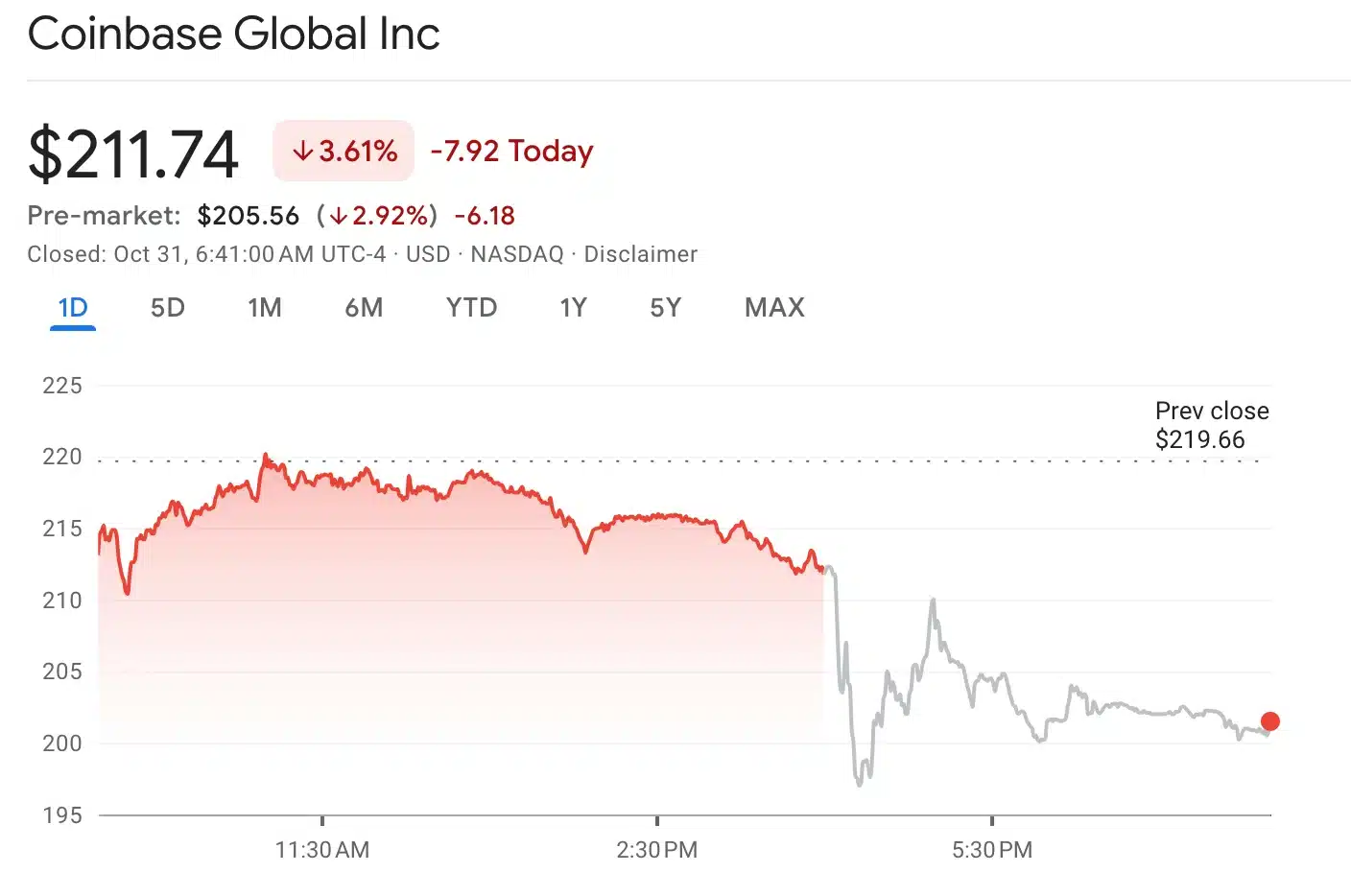

Coinbase inventory value pattern

In March, Coinbase’s inventory value surged to a peak of $279, fueled by Bitcoin [BTC] reaching a report excessive of practically $73,000.

Though shares have since dipped to $211 as of thirtieth October’s shut, they continue to be up 35% year-to-date.

Nevertheless, in after-hours buying and selling, Coinbase’s inventory noticed an additional decline, dropping to $202.

As of the most recent replace, Bitcoin’s price settled at $72,288.21 after a slight 0.37% lower within the final 24 hours, whereas Coinbase shares traded at $211.74, down by 3.61% at press time.

Supply: Google Finance

What lies forward?

Oppenheimer analysts projected a dip in Coinbase’s buying and selling quantity as a consequence of a scarcity of robust market catalysts and election uncertainty.

Analysts stay cautiously optimistic, noting VP Kamala Harris’s endorsement of a digital asset regulatory framework.

This might drive Coinbase buying and selling exercise in This fall, doubtlessly offsetting the slowdown.

The introduction of a $1 billion inventory buyback program underscores the corporate’s optimistic long-term outlook, geared toward rewarding traders.

Moreover, Coinbase’s stablecoin income noticed progress, significantly with USDC, supported by platform incentives and expanded product integration.

On the political entrance, Coinbase is reinforcing its dedication to pro-crypto coverage by contributing $25 million to Fairshake PAC, a transfer supposed to again crypto-friendly candidates within the 2026 elections.

This can solidify its position in shaping favorable regulatory outcomes for digital property.

Supply: Brian Armstrong/X