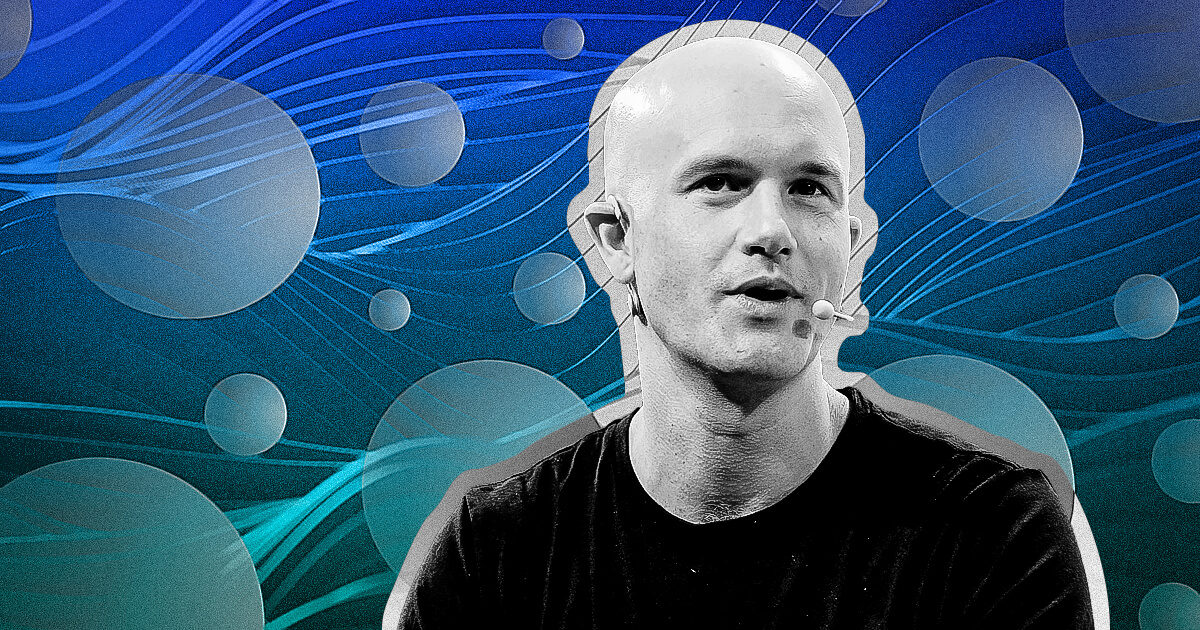

Coinbase CEO Brian Armstrong has referred to as for an overhaul of the token itemizing course of, citing the explosive progress of cryptocurrencies and the boundaries of conventional analysis strategies.

His feedback, made in a Jan. 26 social media put up, come because the business grapples with an unprecedented inflow of latest tokens pushed by blockchain innovation and the rise of platforms permitting folks to launch new tokens with out technical information on the click on of a button.

Armstrong’s statements spotlight the stress between speedy innovation within the crypto business and the capability of current techniques to handle the surge in exercise. Analysts word that the rise of instruments like token mills and no-code blockchain options has contributed to the proliferation of digital property.

Overwhelming the system

Armstrong revealed that roughly 1 million new tokens are created every week, overwhelming the present system, which depends on centralized approval processes to evaluate every asset individually.

The Coinbase CEO famous:

“It is a high-quality downside to have, however evaluating every one after the other is not possible.”

He proposed shifting to a block-list system that assumes tokens are accessible by default until flagged as dangerous. The strategy would depend on a mix of person suggestions and automatic on-chain knowledge scans to establish potential dangers. Armstrong argued this method would empower customers whereas making the ecosystem extra scalable.

He additionally urged regulators to adapt their frameworks, declaring that current token approval processes are inadequate to satisfy the calls for of at present’s quickly rising crypto panorama. He referred to as for innovation in regulatory approaches to maintain tempo with technological developments.

In keeping with Armstrong:

“Regulators and the business should acknowledge that the size of crypto innovation can’t be managed with outdated techniques.”

He added that each private and non-private sectors have to collaborate on options that shield traders whereas fostering innovation.

Decentralization and Consumer Expertise

Along with his feedback on token listings, Armstrong reiterated Coinbase’s plans to combine decentralized trade (DEX) assist extra deeply into its platform.

By streamlining entry to each centralized (CEX) and decentralized (DEX) buying and selling choices, Coinbase goals to ship a seamless expertise that eliminates the necessity for customers to differentiate between the 2.

Armstrong stated:

“Our aim is to make decentralized buying and selling as accessible and intuitive as centralized platforms, making certain customers can interact with the blockchain ecosystem effortlessly.”

With Coinbase’s market place as one of many largest crypto exchanges globally, its strategy may set the tone for the way the business navigates these challenges. Armstrong’s remarks additionally sign the platform’s dedication to transparency, decentralization, safety, and person empowerment in an period of accelerating blockchain improvement.