Tarcisio Schnaider/iStock Editorial by way of Getty Pictures

Following the optimistic information of S&P Global Ratings, we’re again to touch upon CNH Industrial N.V. in the present day (NYSE: NYSE:CNHI). Right here on the Lab, we now have a deep protection of the Exor investments, and after the Q3 outcomes, we determined to scale back our goal value and estimates for the agricultural and development gear participant. Even when we now anticipate a softer 2024 with a downcycle underway, we nonetheless anticipate CNH to attain price takeouts, so we’re nonetheless chubby the corporate.

Beginning the S&P World announcement, CNH Industrial’s score was raised from ‘BBB’ to ‘BBB+.’ S&P World additionally confirmed the short-term debt score at A-2. Following that, the score company now categorised the economic group among the many non-speculative issuers.

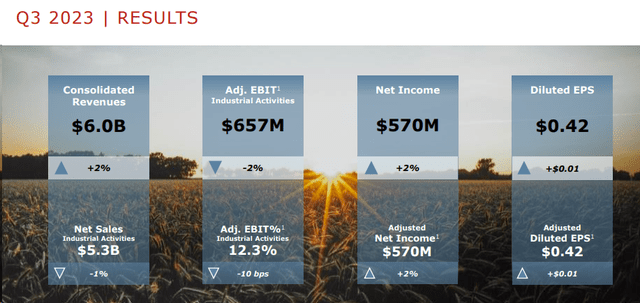

Whereas the corporate is able to be delisted from the Italian inventory alternate (this can occur on January 2nd), in early November, CNH offered its Q3 outcomes, recording a internet revenue of $570 million and a diluted EPS of $0.42, above analysts’ consensus estimates of $0.41. CHN top-line gross sales reached $5.99 billion with a plus 2% vs. Q3 2022 and a miss on Wall Avenue numbers ($6.06 billion). Wanting on the divisional stage, the agriculture phase’s internet gross sales income decreased by 2.6% to $4.38 billion, primarily as a result of decrease quantity, significantly in EMEA and South America. These outcomes had been partially offset by a great product combine in North America and value will increase. The money move from working actions recorded a plus of $232 million, however the free money move from industrial actions was unfavorable by $127 million.

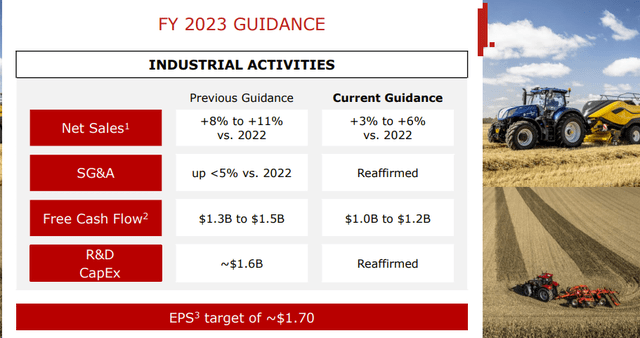

Within the Q3 outcomes presentation, the corporate additionally introduced a steerage reduce, with gross sales from industrial actions now anticipated to develop by 3%-6% in 2023 in comparison with a earlier estimate of between +8% and +11%. FCF was negatively re-forecasted to $1/$1.2 billion from $1.3/$1.5 billion. Within the Q&A name, the CEO reported an industrial slowdown, particularly in South America.

CNH Industrial Q3 Financials in a Snap

Supply: CNH Industrial Q3 results presentation – Fig 1

CNH Industrial steerage

Fig 2

Adjustments to our forecast

Right here on the Lab, we imagine that CNH Industrial Is Set For Lengthy-Time period Development. That is supported by 1) inhabitants development (we additionally backed this evaluation up with our fertilizer protection: LSB Industries, Corteva, and Yara Worldwide), 2) land shortage, and three) product automation with increased productiveness (this helps farmers to profit of their day-to-day work and produce extra outputs). As well as, we advise our readers examine our publication on the corporate’s M&A Optionality. Regardless of that and after listening to Deere’s newest name (DE is guiding a equipment market demand down by approximately 10% for 2024), we determined to decrease our 2024-2025 numbers. Earlier than going into the small print, additionally it is vital to recap the 9M mixture outcomes.

In 9M, CNH revenues elevated by 8% to $17.89 billion, with industrial exercise gross sales rising by 6% to $16.06 billion. Internet earnings additionally elevated by 22% to $1.766 billion, with an EPS of $1.30. Within the Q3 outcomes, the corporate introduced a restructuring plan, adopted by a whole evaluation of its company, administrative, and gross sales price construction. The plan goals to scale back the CNH workforce by 5%, however this course of shall be carried out with a full evaluation of the corporate’s bills. In 2024, CNH expects a price discount of 10-15% of its whole company prices and plans to incur a sunk price of $200 million. Subsequently, there are mitigating components in our ahead CNH estimates. We now anticipate and information the next:

- Decline in gross sales by mid-single digits in 2024, with development top-line gross sales estimates to minus 5%. That is based mostly on a softer world development demand and more durable comps within the US. For the above cause, our gross sales 2024 and 2025 gross sales projections are at $21.16 and $20.4 billion;

- As famous, the corporate forecasts a 2024 price discount/effectivity objective. CNH remarked that will probably be on monitor to attain $550 million in operational effectivity. Right here on the Lab, we forecast that 30% effectivity shall be realized in 2023, with the remaining in 2024. Subsequently 2024, regardless of decrease gross sales, we anticipate a 40 foundation factors margin enlargement. In our estimates, we venture an EBIT margin of 12.6% in 2024 (from a core working revenue of 12.2% in 2023).

- With our adjustments, we arrived at EPS of $1.67 and $1.6 in 2024 and 2025 respectively. We’re lowering the CNH deleveraging course of on the debt facet following a decrease FCF growth. Our DPS estimate is unchanged at $0.4 per share. Simply to remind you, CNH not too long ago announced a $1 billion buyback program, which we imagine shall be useful to present shareholders.

Conclusion and Valuation

CNH inventory trades at a 6x P/E on our 2024 EPS, and we imagine this a number of will not be justified provided that CNH demonstrated earnings resiliency. As well as, even when we venture a slowdown in gross sales, with a delisting course of and value optimization goal, CNH will possible profit from its working leverage (EPS goal is ready at $1.7). To mirror an industrial slowdown and upon execution of CNH’s price discount technique, we lowered our P/E a number of to 9.5x from 11x (this was the corporate’s historic P/E valuation), and we arrived at a valuation of $15.86 per share (from $18.7). This goal value nonetheless implied a possible upside of 44%. Our purchase score is then confirmed. Draw back dangers are included in our evaluation known as Structural Development To Be Priced In (Ranking Improve).