Sundry Pictures

Because the AI Revolution takes full drive, Cloudflare (NYSE:NET) is ready to profit from AI work shifting to the community edge. The content material distribution community helps the safety, efficiency and reliability of the web. My funding thesis is Impartial on the inventory, primarily because of valuation, although the temptation is to pay any worth for this AI infrastructure alternative.

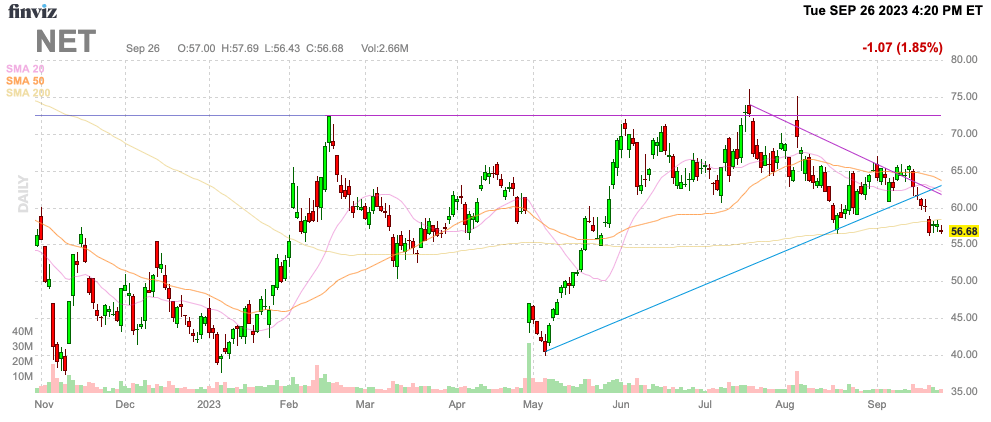

Supply: Finviz

AI Shifting To The Community Edge

In current weeks, each Intel (INTC) and Qualcomm (QCOM) have mentioned AI chips for edge units. Intel is engaged on a computing chip for notebooks whereas Qualcomm is usually engaged on an AI chip for smartphones.

At an occasion final week, Intel introduced new AI chips with the purpose of offering AI acceleration and native inference to the PC. The Core Extremely processors are slated to be launched on December 14.

The entire idea is to maneuver AI computing energy nearer to the utilization through inclusion of associated chips within the private units of shoppers. The transfer will pace up the computing course of and personalize the AI companies for customers.

The one catch is that a number of inference functions and fashions require far an excessive amount of computing energy for a tool. In these instances, Cloudflare is uniquely positioned to deal with the extra difficult language fashions on the community edge getting the instruments out on the sting of the community, as shut as attainable to the units.

Cloudflare affords a cloud platform in a position to host AI information on the edge. The corporate has signed a number of offers with main producing AI firms already, together with a $1.7 million contract for 1-year of service.

Per CEO Matthew Prince on the Q2’23 earnings name, the shopper had this to say about Cloudflare:

We see Cloudflare as a strategic foundational glue throughout all our companies. Cloudflare continues to be our greatest strategic associate of all companions.

The corporate makes use of AI and machine studying to energy safety for the cloud, resulting in AI startups using the service. Additionally, Cloudflare supplies a service to arbitrage GPU prices to coach AI fashions, safety to guard the AI programs and the community edge to carry out inference.

The AI market will doubtless shift from coaching fashions to AI edge networks and units for inferencing, offering the most important alternative for Cloudflare.

Huge TAM

As with most tech firms, an enormous key to success is increasing the market alternative with new merchandise and options. Any tech firm that does not develop finally ends up dying.

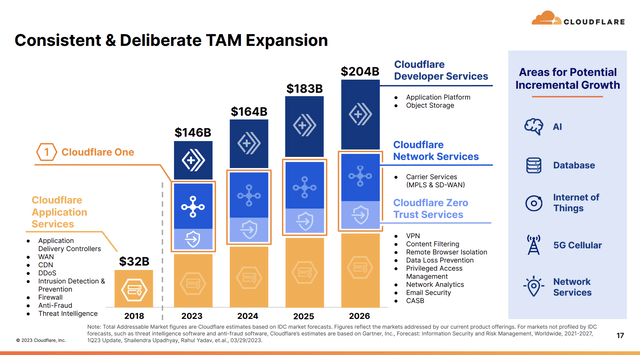

Cloudflare has efficiently expanded their TAM from solely $32 billion again in 2018 to a purpose of $164 billion by 2024. The most important development has come from the addition of community companies and developer companies.

Supply: Cloudflare Q2’23 presentation

The full TAM may have grown by over 400% throughout this 6-year interval. Now, Cloudflare is just concentrating on 2023 revenues within the $1.3 vary, or not even 1% of the TAM.

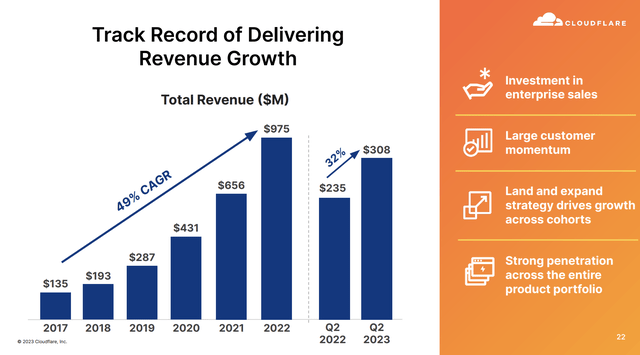

The corporate is a uncommon enterprise that did not hand over any of the income development from the Covid increase in 2020 and 2021. Cloudflare noticed revenues surge even additional throughout 2022 with a 49% development clip, and the corporate continues to be sustaining 32%+ development charges at the moment.

Supply: Cloudflare Q2’23 presentation

The one actual hiccup within the Cloudflare story is the inventory valuation. Cloudflare has a market cap of $19 billion, leaving the inventory buying and selling at 15.0x 2023 gross sales targets. The inventory continues to be costly, buying and selling at 11.5x 2024 income targets of $1.67 billion.

Even with 30% gross sales development forecasted for the years forward, a inventory most likely should not commerce at way more than 10x gross sales targets. Cloudflare is worthwhile and has a powerful money stability of $1.6 billion, so the inventory doubtless would not have the identical draw back threat inherent in most wealthy a number of shares.

The inventory market weak point not too long ago has main tech shares promoting off. If Cloudflare can dip again in direction of the Could lows round $40, traders would have an unimaginable entry level to play the AI Revolution and shift to the community edge.

Takeaway

The important thing investor takeaway is that Cloudflare is a uncommon tech firm nonetheless sustaining 30% development charges and already signing precise AI contracts. The AI safety and edge community firm could be way more interesting, if the inventory can fall again to the lows in Could and early 2023.

Buyers ought to use additional market and inventory weak point to load up on Cloudflare.