Violka08/iStock through Getty Photos

I final coated CleanSpark (NASDAQ:CLSK) for In search of Alpha in late August. At the moment, the corporate was working 9 EH/s and the inventory was buying and selling somewhat below $6 per share. In response to the discharge of the corporate’s full 2023 fiscal 12 months efficiency, the inventory has been completely ripping. As of article submission, CLSK shares are buying and selling for nicely over $7. On this replace, we’ll have a look at some key takeaways from the quarter ended September thirtieth, in addition to November manufacturing figures, and a few extra concerns with 5 months remaining till the dreaded Bitcoin (BTC-USD) block reward halving.

Earnings Response

In calendar 12 months Q3, CleanSpark reported a sequential improve in income of 15% from $45.5 million to $52.5 million. Full 12 months income got here in at $168.4 million which was barely beneath what some analysts had been anticipating. At 47% quarter over quarter, price of revenues really grew sooner than income. Whereas down sequentially, 12 months over 12 months gross revenue grew from $9.5 to $22.1 million. Progress in whole opex was massive. CleanSpark noticed a 20% 12 months over 12 months improve in SG&A and a 255% improve in depreciation and amortization.

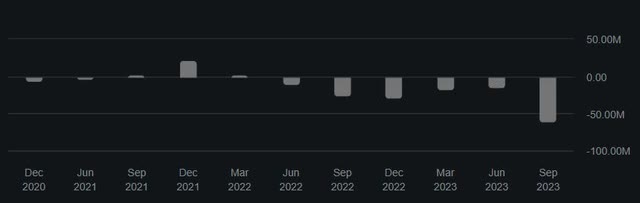

CleanSpark Working Revenue (In search of Alpha)

For the quarter, working earnings was destructive $61 million. After two quarters of enchancment in working earnings, this result’s disappointing. But it surely needs to be famous that the corporate ate a $32.7 million depreciation cost associated to out of service older miners in preparation for the halving. Apparently, the market largely shrugged off the working loss.

CLSK shares are up 82% within the final month. Moreover, this rally has continued even after earnings that I would view as pretty destructive and a 22% improve in shares excellent over the prior quarter. The optimism within the Bitcoin mining area is not restricted to only CleanSpark.

Sector Efficiency (In search of Alpha)

However whereas many of those shares have moved by as a lot as 200 to 300% 12 months so far, CLSK has been the highest performer over the past month and over the past six months. Along with steering for exahash progress, what I’ve personally favored about CleanSpark particularly is the corporate’s Bitcoin treasury administration technique this 12 months.

Manufacturing & HODL Method

Shortly after releasing earnings, CleanSpark additionally dropped November manufacturing outcomes available on the market. In November, the corporate mined a document 666 BTC. Of that manufacturing, CleanSpark bought 402 BTC at a mean worth of $36.6k. This comes after administration bought 562 BTC in October at a mean worth of $28.6k. Combining these two months of BTC gross sales, CleanSpark already has $30.8 million in calendar This fall income which is forward of final 12 months’s income outcome for the whole quarter. And once more, we nonetheless have a full month of manufacturing remaining and BTC is flirting with $40k.

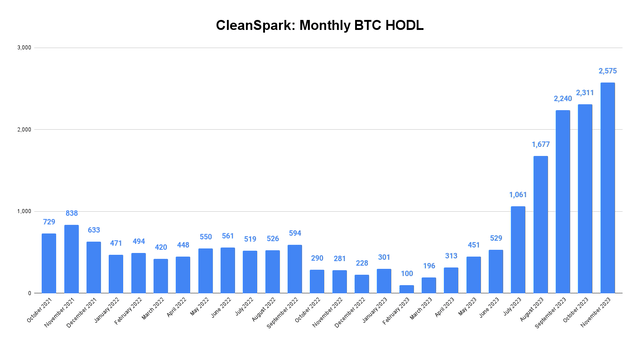

BTC Treasury (Writer Chart through CleanSpark Disclosures)

Regardless of these BTC gross sales in October and November, CleanSpark has managed to develop HODL stack for 9 consecutive months and at present holds 2,575 BTC. At an article submission Bitcoin worth of $38.8k, CleanSpark’s BTC treasury has a good worth of just below $100 million. That is capital that the corporate can put to make use of for enlargement or maintain for worth appreciation. On the convention name, CEO Zach Bradford appeared to point the corporate will take a balanced strategy from right here:

You will discover that we grew our stability swiftly over the previous couple of months. We did this to strategically enhance the stability, as we sense worth enchancment was on the horizon. We count on to proceed to develop our Bitcoin treasury, however we’ve shifted again to a method of utilizing our Bitcoin for bills and holding the distinction.

This strategy to treasury administration is in stark distinction to whole manufacturing liquidation that we see from among the different fast-growing mining corporations. It’s my private view that the balanced strategy will show the higher technique, particularly post-halving.

On The Halving

At this level, I really feel I’ve talked about the halving as a looming threat for Bitcoin miners in a few dozen completely different BTC miner articles. If the fairness market hasn’t priced this occasion in at this level, I would be very shocked. What’s but unknowable is to what diploma the transaction price marketplace for Bitcoin will likely be sticky sooner or later. We noticed an instance of transaction charges spike as a proportion of the Bitcoin block reward again in Might. That spike was short-lived and returned to historic norms by the summer season.

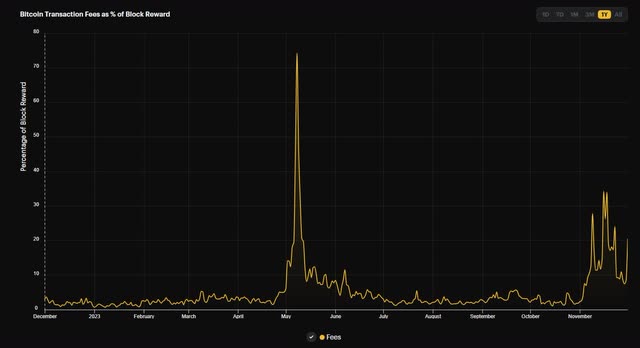

Transaction Payment Share (HashRateIndex)

In November, we noticed that price market transfer up once more and this time it seems to be much less of a flash within the pan and extra sustained. Fairly than observing a dramatic spike that takes transaction charges to 75% of whole block reward for a short time frame like we noticed in Might, we have seen nearly a complete month of the transaction price share of block reward above 10%.

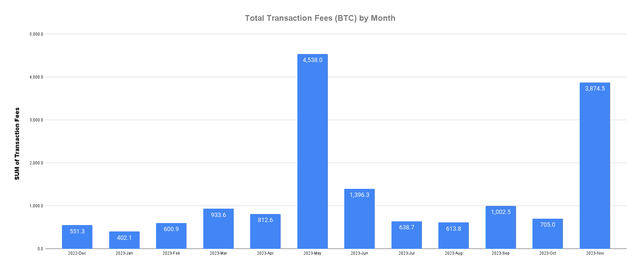

BTC Transaction Charges (Writer Chart through IntoTheBlock Knowledge)

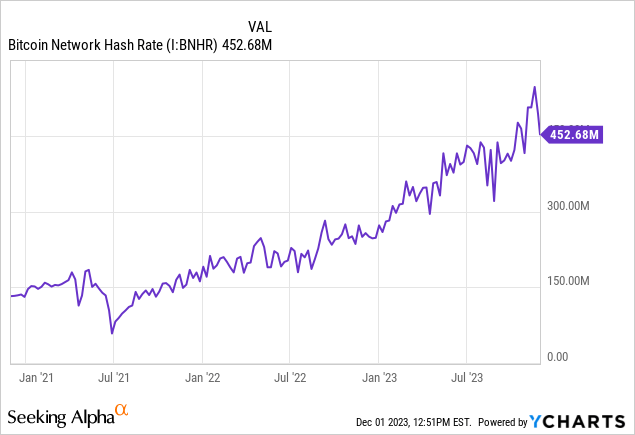

It arguably hasn’t include as a lot fanfare, however the whole BTC paid to miners from transaction charges in November was solely 15% beneath that of Might. If this continues, we may even see shock upsides to income in This fall. In fact, the counter to that is the truth that as mining income will increase with extra transaction charges, international hash charge can even improve as extra market contributors wish to compete for the reward. We’re clearly seeing that story play out as nicely:

It is admittedly been unstable, however the long run pattern could be very clear. There’s rising competitors for BTC mining whether or not it comes from charges or contemporary provide. Regardless of how excessive hash charge will get, contemporary BTC emissions won’t improve with hash. In reality, the availability is designed to lower. That is the most important threat to each Bitcoin miner each personal and public and it is why I’ve tried to spotlight the significance of transaction charges going ahead. From my February Bitcoin article discussing the emergence of Ordinals on Bitcoin’s block area:

If the Bitcoiners who do not just like the Ordinals mission wish to cease what they view as community spam with a real free market resolution, they will have to start out utilizing the bottom layer chain extra and be prepared to pay transaction charges which are massive sufficient to incentivize miners selecting their transactions because the precedence.

Miner incentives are all the pieces. For my part, you may’t probably be bullish Bitcoin long run and settle for that miners are going to safe the community out of the goodness of their hearts.

Miner Profitability (BitInfoCharts)

It’s at present extra worthwhile to mine Bitcoin than it was right now final 12 months. However the long term pattern remains to be horrendous. For my part, it is extra possible that we’ll see BTC’s worth appreciation alleviate this downside post-halving than transaction charges subsequent 12 months. Which means miners with the correct mix of each manufacturing and HODL stack will outperform those that may’t sustain with international hash progress. CleanSpark is at present my prime miner holding.

Remaining Ideas

On the finish of the quarter, CleanSpark had $761.6 million in whole property and simply $74.1 million in whole liabilities. The corporate has clearly been funding progress with dilution and that has been a threat that I’ve identified in earlier protection. CEO Zach Bradford has indicated that the corporate will begin utilizing BTC for bills once more. The one query is what’s going to the worth of BTC be when CleanSpark makes these gross sales. Personally, I feel CleanSpark has performed a pleasant job navigating crypto winter and I feel it is a necessary holding for the upcoming Bitcoin bull run. That stated, do not forget to take some revenue alongside the best way and handle positions responsibly.