zhengzaishuru

Civitas Assets (NYSE:CIVI) has remade itself after a collection of acquisitions. Barely over half of its whole manufacturing is anticipated to return from the Permian after its newest $2.1 billion Vencer acquisition.

All these acquisitions have resulted in a big quantity of internet debt for Civitas, which is projected at round $5 billion on the finish of 2023 proforma for its newest acquisition.

Civitas is projected to generate near $1.5 billion in free money movement in 2024 on the present strip. It ought to be capable of scale back its debt to a bit over $4.2 billion on the finish of 2024, whereas additionally paying out round $7 per share in base plus variable dividends.

I now estimate Civitas’s worth at round $86 per share in a long-term $75 WTI oil and $3.75 NYMEX gasoline atmosphere.

Vencer Acquisition

Civitas is paying approximately $2.11 billion for Vencer Vitality’s Midland Basin property. These embody round 44,000 internet acres with present manufacturing that’s round 62,000 BOEPD (50% oil).

Civitas is paying $1 billion in money (topic to buy worth changes) at deal shut together with 7.3 million shares. One other $550 million in money is due in January 2025, though this will likely be decreased to $500 million if Civitas chooses to pay this extra quantity on the time limit (anticipated in early 2024). Civitas is paying a high-single digits rate of interest on its borrowings, so it will save a modest quantity (internet of further curiosity prices) if it paid $500 million upon closing.

Civitas expects the manufacturing from the acquired property to say no a bit from present ranges in 2024, which also needs to assist money movement a bit. It expects roughly 55,000 BOEPD (46% oil) in 2024 manufacturing, together with roughly $750 million EBITDA at $80 WTI oil and $3.50 NYMEX gasoline in 2024. With $400 million in projected capex for these property, that would go away $350 million in asset-level free money movement for these property.

On the present 2024 strip of $75 to $76 WTI oil together with round $3.60 NYMEX, 2024 EBITDA could be decreased to round $715 million, leading to $315 million in free money movement. The acquisition worth is thus 2.95x 2024 EBITDA (at present strip) and the free money movement yield is roughly 15%.

General the Vencer deal seems to be pretty typical of the present market when it comes to pricing and multiples. Civitas mentions that round 80% of the acquisition worth is attributable to the proved developed reserves, which suggests a 0.9x a number of to PD PV-10 (at three-year strip) plus round $1 million per gross location for stock.

Potential 2024 Outlook

If the Vencer acquisition closes at the beginning of 2024, Civitas expects to common round 335,000 BOEPD in manufacturing throughout 2024. This consists of 160,000 barrels per day in oil manufacturing. Civitas’s manufacturing combine could be roughly 48% oil, 25% NGLs, and 27% pure gasoline.

Barely over half of Civitas’s 2024 oil manufacturing is coming from its Permian property. The narrower Permian oil differential ought to scale back its general firm oil differential to beneath $3 per barrel.

Present strip is round $75 to $76 WTI oil together with round $3.60 NYMEX gasoline. At these commodity costs, Civitas is anticipated to generate $5.544 billion in oil and gasoline revenues, whereas its 2024 hedges have round unfavourable $34 million in worth. Civitas’s hedging place was final reported as of the top of July 2023.

| Kind | Items | $/Unit | $ Million |

| Oil (Barrels) | 58,400,000 |

$73.25 |

$4,278 |

| NGLs (Barrels) | 30,249,375 | $25.00 | $756 |

| Pure Gasoline [MCF] | 201,753,750 | $2.85 | $575 |

| Hedge Worth | -$34 | ||

| Complete Income | $5,575 |

For 2024, it seems that Civitas’s money opex may find yourself slightly below $10 per BOE. This consists of lease working expense, GT&P expense, midstream expense, and money G&A.

Civitas additionally expects roughly $2.1 billion in capital expenditures after its Vencer acquisition.

| Bills | $ Million |

| Money Opex | $1,192 |

| Manufacturing Taxes | $435 |

| Money Curiosity | $360 |

| CapEx | $2,100 |

| Complete Bills | $4,087 |

This leads to a projection of $1.488 billion in free money movement for Civitas on the present strip. This does not embody the potential impression of money revenue taxes for Civitas. It would not anticipate to pay money taxes in 2023 however doesn’t seem to have talked about 2024 expectations but.

Civitas talked about anticipating roughly $1.8 billion in free money movement at $80 WTI oil, however the present oil strip is round $4 to $5 decrease than that now. I’ve additionally assumed that Civitas will largely fund the money portion of the Vencer acquisition by issuing further notes (mentioned extra under), which might improve Civitas’s curiosity prices.

Debt Scenario And Dividends

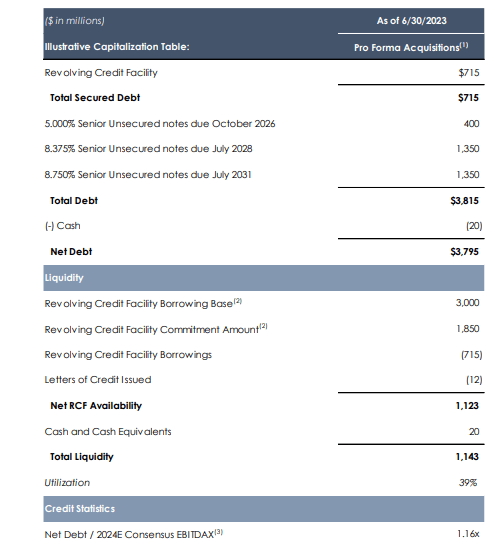

Civitas had roughly $3.8 billion in internet debt on the finish of Q2 2023, proforma for its Faucet Rock and Hibernia acquisitions that closed in August.

Proforma for its Vencer acquisition, it might finish 2023 with roughly $5 billion in internet debt (together with deferred consideration).

I anticipate Civitas to problem further notes to assist fund the Vencer acquisition, so I’m modeling issues as if Civitas provides $500 million in 2028 notes and $500 million in 2031 notes as tack-on choices.

This would go away Civitas with $4.1 billion in excellent notes and $900 million in credit score facility debt on the finish of 2023.

Civitas’s Debt (civitasresources.com)

Civitas now has roughly 101 million excellent shares, so its $0.50 per share quarterly dividend provides as much as round $202 million per 12 months. It might additionally pay round $5 per share in variable dividends in 2024, including as much as round $505 million in variable dividends. Civitas’s variable dividend relies on trailing 12-month free money movement, so it’s going to take a little bit of time for its acquisitions to totally have an effect on its variable dividend.

This leaves $781 million for debt discount and share repurchases. If Civitas places that every one in the direction of debt discount, it will finish 2024 with round $4.22 billion in internet debt or leverage of round 1.1x. That is increased than Civitas’s 0.9x leverage projection, which was performed based mostly on $80 WTI oil.

Civitas has additionally talked about a goal of $300 million in non-core asset gross sales by mid-2024.

Notes On Valuation

I now estimate Civitas’s worth at roughly $86 per share at my long-term commodity worth estimates of $75 WTI oil and $3.75 NYMEX gasoline. This interprets right into a 3.25x EV to unhedged EBITDA a number of based mostly on Civitas’s 2024 manufacturing ranges and projected year-end 2024 internet debt.

At $86 per share, Civitas also needs to be capable of ship a 12% to 13% free money movement yield at $75 WTI oil and $3.75 NYMEX gasoline whereas sustaining manufacturing ranges. This additionally assumes that Civitas is a full money revenue taxpayer. With out money revenue taxes, its free money movement yield could be nearer to 16% on this state of affairs.

Conclusion

Civitas has considerably elevated its manufacturing by way of a collection of Permian acquisitions, of which the $2.1 billion Vencer acquisition is the latest one. Civitas now has barely over 50% of its manufacturing coming from the Permian.

This has elevated its internet debt to round $5 billion after its most up-to-date acquisition, though its general leverage nonetheless seems to be acceptable. Civitas might be able to generate near $1.5 billion in free money movement in 2024 at mid-$70s WTI oil. This could enable it to pay $7 per share in whole dividends whereas additionally paying down its debt by over $750 million.

I estimate Civitas’s worth at round $86 per share in a long-term $75 WTI oil and $3.75 NYMEX gasoline atmosphere. Civitas’s manufacturing is round 48% oil, so it’s considerably delicate to the worth of pure gasoline and NGLs.