Within the fourth quarter of 2023, the cryptocurrency market skilled a exceptional resurgence, accompanied by the expectation of a possible Bitcoin ETF Approval. One of many standout performers throughout this era was Fantom (FTM), a Layer-1 protocol launched in 2018.

In keeping with a latest report by Messari, Fantom witnessed vital development, with its circulating market capitalization rising by 140% quarter-on-quarter, from $0.5 billion to $1.3 billion.

This efficiency exceeded the whole market capitalization development of all cryptocurrencies by 54% within the fourth quarter. As well as, Fantom rose out there capitalization rankings, rising 5 locations from 63 to 58 by the tip of the quarter.

FTM’s potential for future development

FTM’s circulating provide remained comparatively secure quarter-on-quarter, with adjustments in provide dynamics between the fourth quarter of 2022 and the primary quarter of 2023.

Notably, Fantom launched the Ecosystem vault and the Gasoline Monetization program through the fourth quarter of 2023, which is able to cut back transaction payment consumption and allocate a portion of charges to the Gasoline Monetization program and Ecosystem Vault.

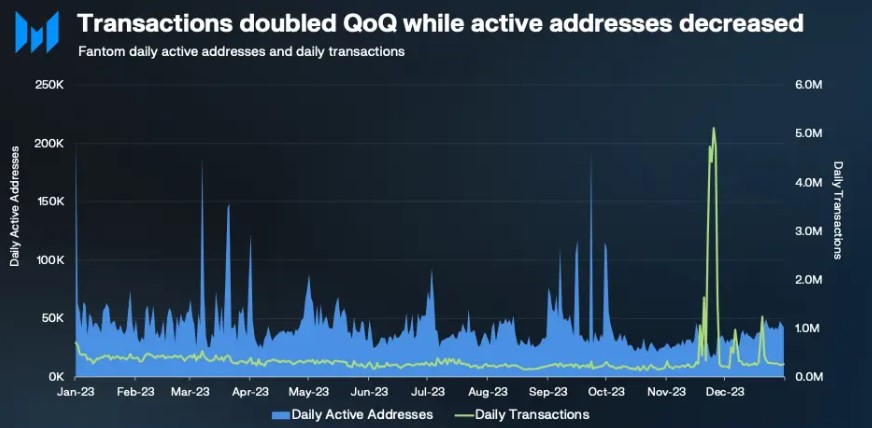

The variety of day by day energetic addresses on the Fantom community fell 27% quarter-on-quarter, reaching a mean of 32,700 within the fourth quarter of 2023. Nevertheless, a gentle improve within the variety of day by day energetic addresses in December indicators potential future development now that the crypto market is popping out of the bearish part.

Associated Studying: Helium (HNT) Heats Up: 21% Soar After Telefónica Deal Fuels Development

Common day by day transactions on Fantom reversed their downward pattern and rose 126% to 531,000. This improve was primarily attributed to the rise of Fantom Inscription FRC20swith November 25 marking a report excessive of 5.11 million transactions, together with 4.99 million registrations.

By way of new addresses, there was a rise of 10% within the fourth quarter of 2023 to a mean of 21,100 new addresses per day. Messari means that the rise in day by day new addresses might be attributed to the launch of Estfor Kingdom, a preferred blockchain-based sport on Fantom that gained traction in late Q3’23. December additionally noticed a rise within the variety of day by day new addresses, most likely because of improved market circumstances.

Fantom DeFi ecosystem

In keeping with the report, Fantom’s Complete Worth Locked (TVL) in USD elevated 58% quarter-over-quarter, from $51 million within the third quarter to $81 million within the fourth quarter. Nevertheless, TVL chimed in FTM fell by 29% over the identical interval, primarily because of fluctuations in asset costs.

This autumn 23 additionally noticed shifts within the high DeFi purposes on Fantom, with newcomers comparable to Equalizer Trade, WigoSwap and SpiritSwap gaining market share. Notable protocols from TVL included Spookyswap, Beethoven X, Equalizer Trade, WigoSwap, Tomb Finance and SpiritSwap.

These protocols collectively delivered $29 million in TVL, accounting for almost 100% of Fantom’s TVL development within the fourth quarter. Equalizer and WigoSwap had the biggest market share will increase.

The common per day decentralized change (DEX) quantity on Fantom fell 10% to $10.2 million in This autumn 2023. Nonetheless, rising new DEXs comparable to Equalizer Trade and WigoSwap contributed to the general development of the ecosystem.

Associated studying: Bitcoin whales proceed to purchase as costs fall. This is how a lot they purchased

In abstract, Fantom’s efficiency was exceptional within the fourth quarter of 2023. The protocol skilled sturdy market cap development, sturdy income development, and an increasing DeFi ecosystem. Nevertheless, the unique token has decreased considerably.

Regardless of the latest sharp correction within the cryptocurrency market, Fantom’s native token FTM is not any exception. At the moment, the token is buying and selling at $0.3306, which displays a decline of over 3% prior to now 24 hours, 37% prior to now 30 days, and an 18% decline this yr.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is for instructional functions solely. It doesn’t signify NewsBTC’s views on shopping for, promoting or holding investments and naturally investing includes dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use the knowledge on this web site totally at your personal danger.