Prostock-Studio/iStock through Getty Pictures

In my earlier article on Cielo, I highlighted the corporate’s path to restoration after hitting its lows early final 12 months. Cielo applied measures corresponding to value discount, NPS enchancment, and an elevated presence in mid-tier companies to realize this. Nonetheless, I additionally famous that macroeconomic headwinds, signaling a slowdown within the Brazilian economic system within the 12 months’s second half, fierce competitors, and rising turbulence in whole traded quantity solid doubt on the long-term funding thesis.

Cielo (OTCPK:CIOXY) launched its second quarter leads to early August this 12 months. These combined outcomes marked the eighth consecutive quarter of revenue progress growth. Nonetheless, in addition they revealed fragile volumes, elevating doubts about the potential for a extra sturdy restoration all year long, particularly as competitors within the profitable mid-tier buyer phase intensifies, resulting in a worth conflict.

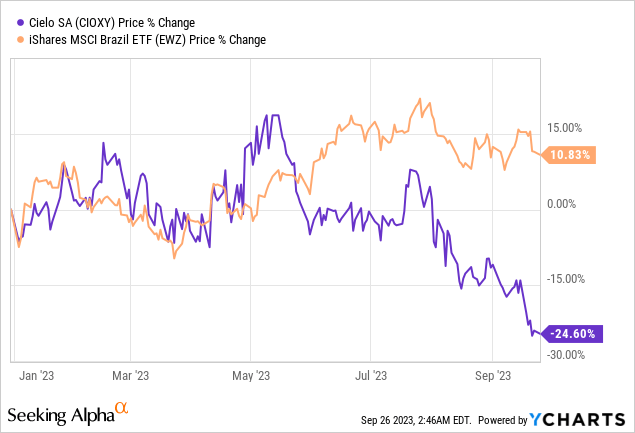

Because the announcement of its Q2 outcomes, the market has been unforgiving with Cielo’s shares, which have already dropped by a considerable 28%. This decline will be attributed to a mix of things, together with considerations in regards to the monetary quantity traded (TPV) and a slowdown within the Brazilian equities bull market in August. This slowdown outcomes from extra adversarial macroeconomic and microeconomic circumstances than these encountered within the first half of 2023.

Web Revenue and Margins: The Fairly Facet

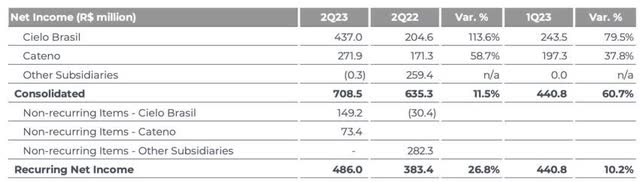

Within the second quarter, the Brazilian cost companies firm Cielo reported comparatively favorable and reasonably constructive outcomes. Notably, Cielo achieved its eighth consecutive quarter of web revenue growth, reaching R$486 million, representing a ten.2% enhance in comparison with the primary quarter and a 26% enhance in comparison with the identical interval final 12 months.

Cielo’s IR

Whereas Cielo has been emphasizing its dedication to sustaining profitability, it faces stress from rivals keen to function with decrease and even loss-making margins, in line with statements from firm executives.

Estanislau Bassols, Cielo’s Govt Director and CEO, acknowledged throughout the firm’s earnings name:

“Within the first half of the 12 months, we applied worth changes, contemplating macroeconomic components, prices, and the added worth of our merchandise. We consider these changes exhibit a excessive degree of rationality, and we stay dedicated to this strategy.”

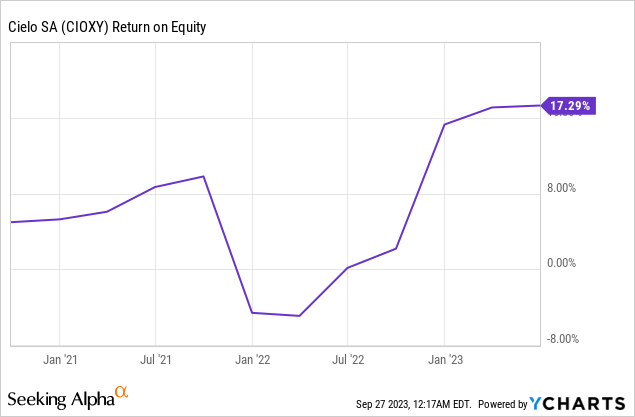

Cielo achieved a Return on Fairness (ROE) of 17%, representing a 1.1 proportion level enhance in comparison with the primary quarter and a 2.2 proportion level enhance in comparison with the earlier 12 months’s second quarter. The online revenue additionally benefited from a rare service tax (ISS) impression of R$223 million.

Notably, Cielo exhibited vital margin enchancment, pushed by an enhanced take charge of operations, which reached 1.16%. This displays a 0.06 proportion level enhance in comparison with the primary quarter and a 0.24 proportion level enhance year-over-year. This enchancment is partly attributed to product repricing and implementing the brand new interchange rule for pay as you go transactions, which grew to become efficient within the second quarter of 2023.

The expansion in web revenue may also be attributed to Cielo’s Q2 revenues. The corporate reported web income of R$2.6 billion, reflecting a 2.8% enhance quarter-over-quarter and a 4.0% enhance year-over-year. This progress was pushed by a 13 foundation level enhance in income yield at Cielo Brasil, reaching 0.83%, its highest degree because the first quarter of 2019. Moreover, increased quantity and yield at Cateno contributed to this progress. The income comparability grew to become extra recurring from this quarter onward since Service provider-e Options was excluded from consolidation within the first quarter of 2022.

Whole bills within the quarter skilled a major lower, reaching R$1.4 billion, a 20.3% lower quarter-over-quarter and a 9.7% lower year-over-year. This discount was primarily pushed by a rare reversal of the Companies Tax (ISS), which will likely be elaborated on in a separate part. Contemplating whole normalized bills, excluding the outstanding occasion, the quantity was R$1.38 billion, reflecting a 3.8% enhance quarter-over-quarter and a 3.3% enhance year-over-year.

Now, let’s take a more in-depth take a look at the outcomes categorized by enterprise models:

Cielo’s IR

Cielo Brasil

The phase reported web income of R$1.6 billion, representing a 3.6% enhance quarter-over-quarter and a 4.3% enhance year-over-year. This progress was influenced by the rise in income yield of 0.12 proportion factors to 0.83%.

The brand new prepaid interchange rule and a slight worth enhance on the finish of the primary quarter 2023 contributed to this enchancment. A mixture of product combine and worth will increase boosted yield by 0.08 proportion factors, whereas the brand new interchange rule and decreased taxes contributed a further 0.04 proportion factors.

Relating to bills, whole bills (excluding extraordinary objects) amounted to R$780.7 million, reflecting a 5.1% enhance quarter-over-quarter and an 11.2% enhance year-over-year. This enhance was primarily pushed by the hiring of the business workforce and a labor settlement that occurred on the finish of 2022.

Cateno

The three way partnership shaped by Banco do Brasil (OTCPK:BDORY) and Cielo, liable for Cielo’s credit score and debit card administration enterprise) reported web revenues of R$1.0 billion. This represents a 1.5% enhance quarter-over-quarter and a 3.6% enhance year-over-year, pushed by improved yield as a result of a extra favorable combine and quantity growth. Contemplating revenues from time period merchandise, Cielo achieved a take charge of 1.16%, reflecting a 0.06 proportion level enhance quarter-over-quarter and a 0.24 proportion level enhance year-over-year. That is the very best degree because the first quarter of 2019.

Whole bills (excluding extraordinary objects) amounted to R$603.3 million, reflecting a 2.0% enhance quarter-over-quarter and a 5.5% lower year-over-year. The rise was impacted by the expansion in personnel bills and bills associated to operational enchancment initiatives.

Cielo’s monetary consequence (excluding prepayment) was negatively affected, amounting to R$682 million, reflecting a 2.3% lower quarter-over-quarter and a 20.1% enhance year-over-year. This destructive stress is primarily attributed to the excessive Brazilian rate of interest (Selic), which at present stands at 12.75%, impacting the monetary expense line.

Monetary Quantity and Consumer Base: The Ugly Facet

Whereas the corporate made progress on each the highest and backside strains, there are regarding tendencies within the monetary quantity traded (TPV) and the consumer base, which warrant consideration.

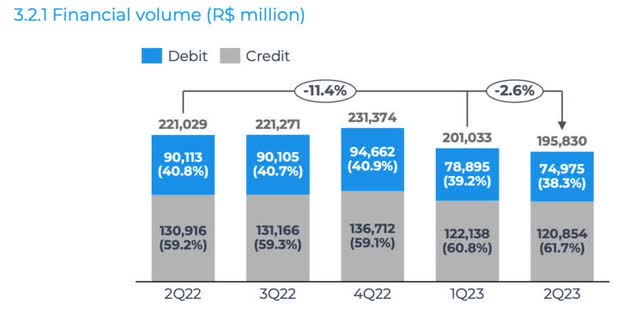

TPV amounted to R$195.8 billion, which displays a 2.6% year-over-year lower and an 11.4% lower in comparison with the earlier 12 months. This decline is primarily attributed to decreased monetary volumes for credit score and debit playing cards, which decreased by 7.7% and 16.8% year-over-year, respectively.

Cielo’s IR

The shrinking lively buyer base contributes to this decline, with a complete of 958,000 prospects, marking a 5.6% year-over-year lower and a 13.6% lower in comparison with the earlier 12 months. This drop within the buyer base can also be mirrored within the TPV for the quarter.

Cielo’s Energetic Consumer Base (1000’s) (Cielo’s IR)

Cielo has continued to face challenges within the phase it prioritizes essentially the most, the retail and small-business phase, which noticed a decline of 1.5% year-over-year and a 12.3% lower in comparison with the earlier 12 months, leading to a quantity of R$64 billion for the quarter. To handle this decline, Cielo plans to rent a further 400 to 1,000 new business brokers, constructing on the 400 gross sales hunters employed originally of the 12 months, to reverse these losses.

In distinction, the big accounts phase skilled a extra pronounced contraction within the quarterly comparability, declining by 2.9%. This isn’t stunning, as the corporate determined to surrender its sponsored share on this phase.

Regardless of the numerous drop in TPV, there was an enchancment within the combine between credit score and debit playing cards. Bank cards, which yield higher outcomes, noticed an growth of 1 proportion level quarter-over-quarter and a couple of.5 proportion factors year-over-year within the combine (credit score/debit), reaching 61.7%. Moreover, whole transactions didn’t observe the identical downward development as TPV, with a lower of two.1% year-over-year and eight.8% in comparison with the earlier 12 months.

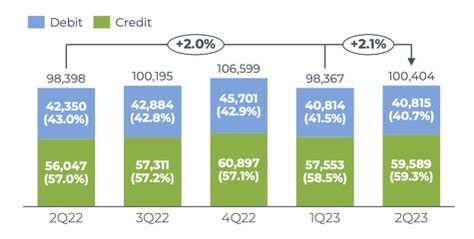

It is usually value noting that Cateno’s monetary quantity skilled comparatively weak progress, growing by 2.1% year-over-year and a couple of.0% in comparison with the earlier 12 months. Nonetheless, this efficiency is best than the contraction seen in Cielo Brasil. Cateno’s TPV reached R$100 billion, with a mixture of credit score and debit playing cards remaining comparatively steady at 59.3% and 40.7%, respectively.

Cielo’s IR

Engaging Yield Unchanged For 2023 and 2024

Cielo additionally introduced the cost of R$196.97 million in curiosity on shareholder fairness (JCP). This observe, particular to the Brazilian tax system and company finance, revolves round corporations paying curiosity to their shareholders on the fairness invested within the firm, carrying distinct tax implications in Brazil. In contrast to dividends, JCP is accounted for as an “expense” for corporations, decreasing taxable web revenue.

The corporate at present gives a dividend yield of 8.63%, which is 63% increased than its historic common. Cielo is anticipated to proceed to ship substantial dividends within the upcoming 12 months, probably attaining a yield exceeding 9% by 2024.

Presently, Cielo is distributing 34% of its earnings, roughly 33% under its historic ten-year common payout.

Searching for Alpha

Brazilian Cost Companies Market and Cielo’s Valuation

Cielo maintains its place because the market chief in cost companies in Brazil, holding a 23.9% market share, in line with BTG Pactual. It’s adopted by Itaú Unibanco’s (ITUB) Rede at 23.3%, Santander Brasil’s (BSBR) GetNet at 15.1%, StoneCo (STNE) at 11.3%, and PagSeguro (PAGS) at 10.8%. Nonetheless, the continued dominance of Cielo’s market place at present raises some considerations.

The second quarter for Cielo was marred by a destructive development within the monetary quantity transacted (TPV), additional emphasizing considerations about consumer attrition throughout this era and the persistently difficult macroeconomic surroundings. According to the corporate’s administration, Cielo has confronted competitors from different gamers working with unprofitable fashions previously, in the end resulting in market share losses, however prospects have traditionally returned.

Regardless of vital progress in pricing and the adoption of prepayment merchandise, TPV remained fragile, casting doubt on the potential for a strong restoration this 12 months, particularly if competitors escalates within the profitable mid-tier buyer phase via a worth conflict. Cateno additionally reported weak monetary volumes, leading to a slowdown in revenue growth from 34% year-over-year within the first quarter of 2023 to fifteen.9% year-over-year within the second quarter of 2023.

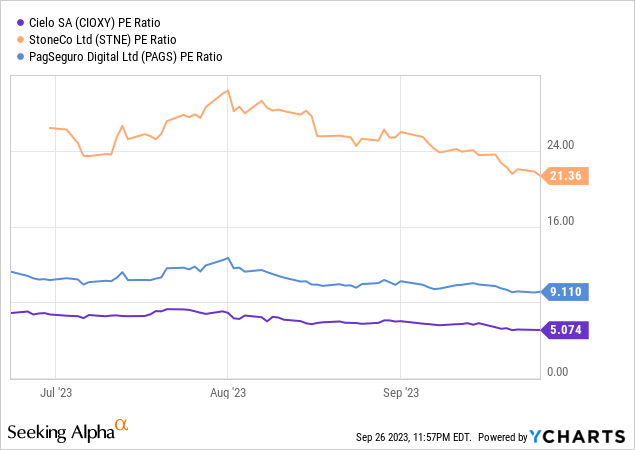

Regardless of the pessimistic sentiment mirrored in Cielo’s market worth, its valuation seems engaging. The corporate is at present buying and selling at an interesting 4.30x P/E ratio for 2023E and 4.53x P/E ratio for 2024E. Nonetheless, the absence of short-term catalysts and persistently weak volumes increase considerations that competitors from different gamers like StoneCo and PagSeguro may intensify, though Cielo is buying and selling at a relative low cost in comparison with its major friends.

In Conclusion

In abstract, I want to emphasize that, regardless of the substantial decline in Cielo’s share worth, which has additional discounted its valuation, the indications of decreased progress within the cost companies trade and elevated competitors, leading to weak operational efficiency, counsel {that a} impartial stance on Cielo is perhaps advisable.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.