By John Cheng, Bloomberg Markets Dwell reporter and strategist

Chinese language markets are set to reopen after the Golden Week holidays towards an unsure world market backdrop, which can mood optimism from the spending increase at dwelling.

Rather a lot has occurred abroad whereas mainland markets have been shut. Threat belongings have been hammered as renewed concern about higher-for-longer US rates of interest spurred a Treasuries selloff that rippled by world markets, whereas the shock assault on Israel by the Palestinian group Hamas added a contemporary layer of uncertainty. On the home entrance, nevertheless, tourism income from the vacations surged year-on-year, including to bets that China’s financial system has doubtless bottomed.

The conflicting alerts set the stage for a uneven begin for mainland equities on Monday. A gauge of Chinese language shares listed in Hong Kong rose on Friday, serving to trim its losses since Sept. 28 — when onshore markets final traded — to 0.3%. In the meantime, an index of the nation’s US-listed shares has gained 0.3% within the interval. The offshore yuan has weakened about 0.2% towards the greenback.

“The Golden Week consumption information ought to give extra confidence to markets that demand is stabilizing, which can assist increase sentiment for shopper and repair sectors,” mentioned Marvin Chen, a strategist with Bloomberg Intelligence. “However easing home worries include rising exterior headwinds from markets adjusting to higher-for-longer Fed charges.”

Merchants had been pinning their hopes on a vacation consumption increase to offer a brand new catalyst for the sluggish market. Journey and spending surged in contrast with lockdown-hit 2022, with 826 million vacationers representing a 71% improve from final yr. Spending leaping almost 130%. Different key units of information launched throughout the break additionally confirmed the broader financial system is on the mend, although removed from roaring again.

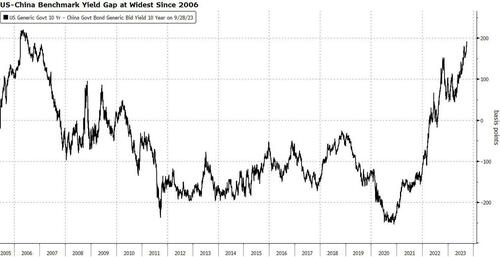

Buyers will weigh these modest enhancements towards issues about tighter Federal Reserve coverage following a hotter-than-expected US jobs report. China is seen at explicit threat as a wider interest-rate hole with the US can improve strain on the yuan and speed up a capital flight.

The CSI 300 Index, a benchmark of onshore Chinese language shares, was down 4.7% for the yr earlier than heading into the break. An additional 4.9% decline will see it erase all its beneficial properties from the reopening rally that took off in October 2022. Reaching that grim milestone might embolden China skeptics, who proceed to shun the market attributable to deepening property-sector woes and geopolitical issues.

The housing market hunch stays a significant overhang, with the disaster embroiling debt-ridden developer China Evergrande Group and different key builders displaying little indicators of abating. House gross sales continued to submit double-digit declines from a yr earlier in September, a historically busy season for builders, underscoring weak purchaser confidence regardless of a current slew of property easing measures.

Some traders, nevertheless, say this yr’s relentless selloff has created some shopping for alternatives. There are additionally hopes that the upcoming third plenum of the twentieth Social gathering Congress, a gathering of prime leaders to debate main financial and reform points, will supply hints of additional stimulus. The assembly, to be held towards the tip of October and early November, might act as a constructive catalyst, mentioned Chen of Bloomberg Intelligence.

“We will count on a restoration towards the tip of the yr or early subsequent yr with the financial system coming towards the tip of the de-stocking cycle, and as we see extra coordinated coverage efforts to sort out the weak financial system,” mentioned Elizabeth Kwik, funding director of Asian equities at abrdn Plc.

For now, successful again overseas traders is proving to be arduous. World funds offered Chinese language shares on a internet foundation for a second consecutive month in September, trimming their publicity to the lowest stage since 2020. Pessimism is such that “quick China equities” emerged as one of many largest convictions amongst cash managers within the newest Financial institution of America Corp. month-to-month survey.

“Now we have financial information displaying enchancment in order that’s a superb begin, however markets are skeptical given how confidence was badly broken,” mentioned Christopher Wong, FX strategist at Oversea-Chinese language Banking Corp. in Singapore. It is going to take time for Chinese language markets to get better, he added, as “sentiment must get better and confidence must be repaired.”

Loading…