European asset managers are following their US counterparts in “pulling again” on a public present of local weather motion whereas nonetheless quietly assessing dangers and new laws, fund managers, legal professionals and consultants instructed the FT.

When a gaggle of traders met this month to debate placing stress on Shell at an upcoming annual assembly over its oil and gasoline development technique, there was a notable absence of the asset managers who had joined in submitting local weather resolutions previously, these current stated.

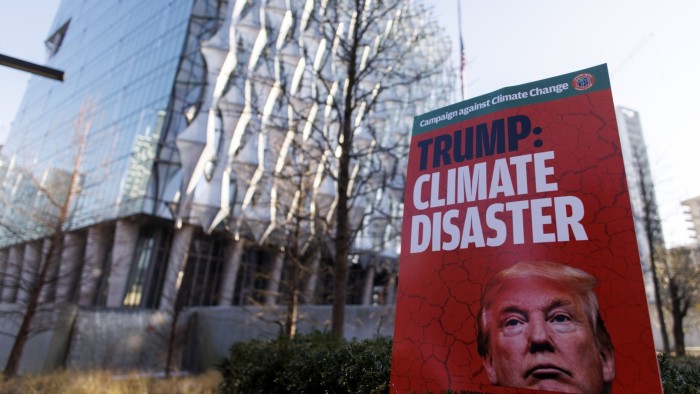

Throughout Europe, main managers have been taking cautious strategy and “tiptoeing” round socially accountable investing issues, following Donald Trump’s election as president and right-wing campaigns towards so-called environmental, social and governance investing over the previous 12 months.

Natasha Landell-Mills, head of stewardship at Sarasin & Companions, a UK asset supervisor, stated: “The chilling impact from the growing politicisation of local weather change within the US is actually spreading to Europe and past.

“The hazard is that we find yourself harming ourselves and future generations by pulling again.”

Monetary establishments in Europe have largely gone additional and sooner than their friends throughout the Atlantic on local weather pledges and transparency on socially accountable investing.

This implies they’re now grappling with the problem of placing into observe commitments to chop greenhouse gasoline emissions throughout their stability sheets, funds or dealbooks, as the broader economic system is slower to wean itself off fossil fuels than was anticipated when the targets have been set a number of years in the past.

In 2025, some EU monetary establishments should meet onerous local weather and biodiversity reporting necessities, which may require them to reveal progress made towards voluntary targets.

This ups the ante on their decarbonisation guarantees, made based mostly on methodologies for carbon monetary accounting which are nonetheless comparatively new.

Commitments to “align” investments with the Paris settlement goal to restrict world warming to not more than 1.5C above pre-industrial ranges now appear unrealistic to some. “It’s a bit demotivating to be set an extremely powerful objective with ineffective methods of getting there” stated one Paris-based financier, in reference to the EU’s perceived choice for inexperienced regulation over subsidies that would help the vitality transition.

Most of the internet zero ambitions have been set at a time when the trade was “not scrutinised like we at the moment are and the stability of threat wasn’t what it’s now”, a senior asset administration govt stated. Inner legal professionals had turn out to be more likely to push again towards sustainability targets and pledges that executives could be challenged about, they added.

A number of European asset managers stated that they had obtained letters from Republican states threatening authorized challenges to their give attention to ESG points together with any potential exclusion of fossil gasoline investments.

The trade’s Web Zero Asset Administration voluntary group on local weather motion this month suspended its public actions after litigation towards US counterparts comparable to BlackRock pressured their withdrawal from the coalition.

ExxonMobil’s determination to sue Arjuna Capital, a US funding adviser, and Comply with This, an activist group, final 12 months over a climate-related decision that they had filed on the oil firm’s annual assembly was a watershed second, sparking worry throughout the sector — even in Europe.

European traders have been no longer solely reluctant to talk out about US firms however have been additionally “being extra cautious about European firms”, the senior govt added.

They’re additionally much less prepared to again local weather resolutions at annual conferences. Assist for such proposals globally amongst Europe’s largest asset managers fell from 84 per cent in 2022 to 69 per cent in 2024, in line with information from FTI, the consultancy.

But a number of prime European asset managers say a give attention to local weather will proceed to be a precedence, as they attempt to stability the conflicting local weather backlash within the US with institutional consumer demand for threat management and tighter laws in Europe.

These asset managers have been “not adjusting their funding technique to a four-year political cycle”, one chief funding officer of a number one European fund supervisor stated, however as a substitute have been taking steps to “shield themselves from open criticism” by not placing a highlight on their actions.

Behind the scenes, some main asset managers proceed to push for motion to cut back local weather threat on the firms they put money into, they added.

Stephen Beer, head of accountable funding strategic relationships and integration technique at Authorized and Common Funding Administration, the UK’s largest asset supervisor, stated interactions with firms over local weather change have been now “more durable edged”.

“We’re speaking about enterprise methods, progress in direction of transition, selections that firms need to make” he stated. “And that’s precisely the place we wish to be in conversations with firms, as a result of we would like them to be worthwhile and sustainable.”

On the similar time, European pension funds have been doubling down on their local weather efforts, stated Jon Johnson, chief govt of PKA, the massive Danish pension fund, leaving asset managers who retreated prone to dropping shoppers.

“We as asset house owners should take the lead proper now [on driving action on climate from the finance sector] . . . If we carry on pushing for the inexperienced transformation, I’m positive from a enterprise perspective, [asset managers] will wish to preserve that development.”

He added: “Loads of asset managers, each within the US and Europe, are tiptoeing round how to do that proper.”

Such calls from asset house owners — and extra supportive politics in Europe — meant the continent’s asset administration trade would proceed to give attention to local weather change, stated Sonja Laud, chief funding officer at LGIM.

“Local weather is a financially materials side in understanding an organization’s future success and we are going to proceed to incorporate it in our funding course of. To establish the proper funding alternatives for our shoppers, local weather threat needs to be an integral a part of the evaluation,” she added.

Landell-Mills at Sarasin stated the trade couldn’t ignore local weather change, regardless of the political pressures and regulatory burden.

“Finally, the basics haven’t modified. Local weather change remains to be occurring. Ignoring the dangers doesn’t make them go away. Nevertheless it delays motion to sort out them,” she stated. “Local weather change goes to have huge financial affect, an enormous geopolitical affect — and that may have an effect on returns.”

Local weather Capital

The place local weather change meets enterprise, markets and politics. Discover the FT’s protection right here.

Are you interested in the FT’s environmental sustainability commitments? Find out more about our science-based targets here