- The correlation coefficients respectively point out practically parallel market actions.

- On-chain information prompt that holders ought to anticipate additional features sooner or later.

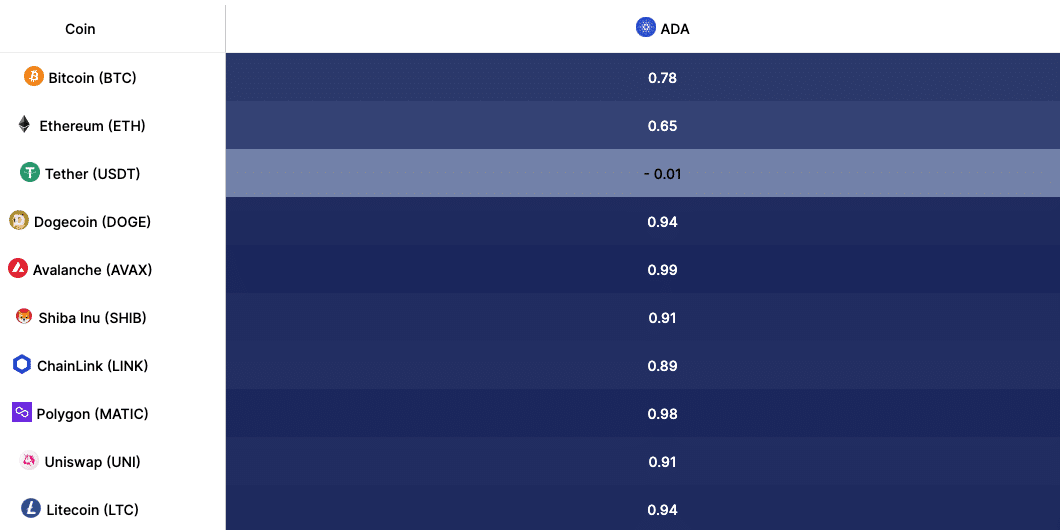

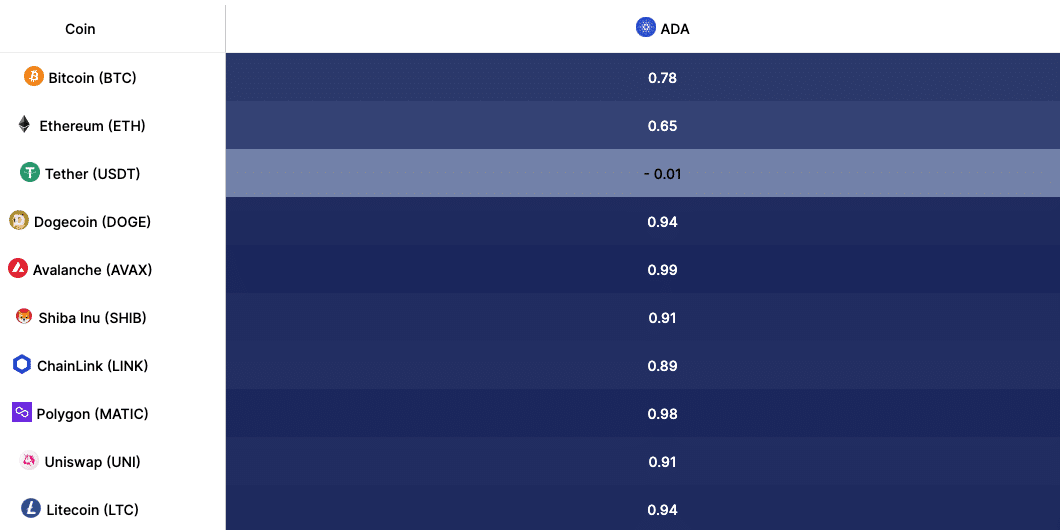

In keeping with IntoTheBlock, Cardano [ADA] has a stronger correlation with Avalanche [AVAX] and Polygon [MATIC] than another prime cryptocurrencies.

At press time, the correlation between ADA and AVAX was 0.99. For MATIC, it was 0.98 on a 60-day foundation. Values of the correlation coefficient vary from -1 to +1 the place the previous implies important divergence.

Alternatively, a reading near +1 suggests sturdy course motion which was the case with Cardano and the opposite two. As of this writing, ADA’s worth was $0.45, which was a 26.40% lower on a Yr-To-Date (YTD) foundation.

Supply: IntoTheBlock

A trio in deep waters

For AVAX, its worth was $36.94— a 11.73% lower inside the identical interval. Lastly, MATIC modified arms at $0.71, marking a 29.21% slide.

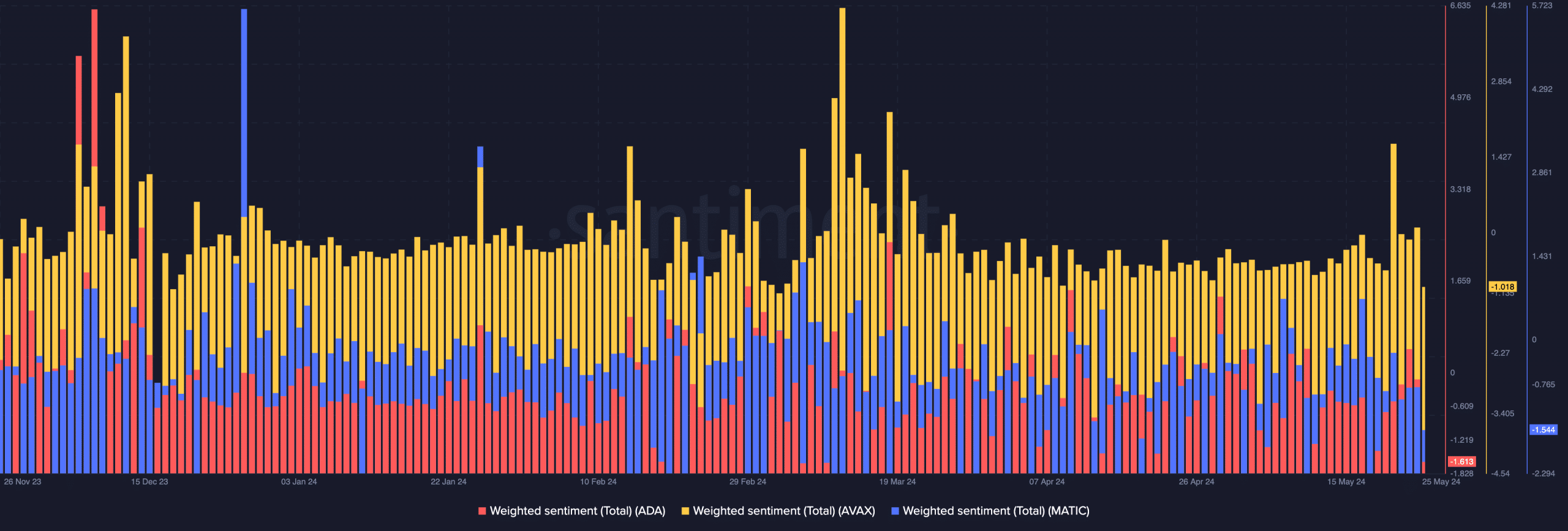

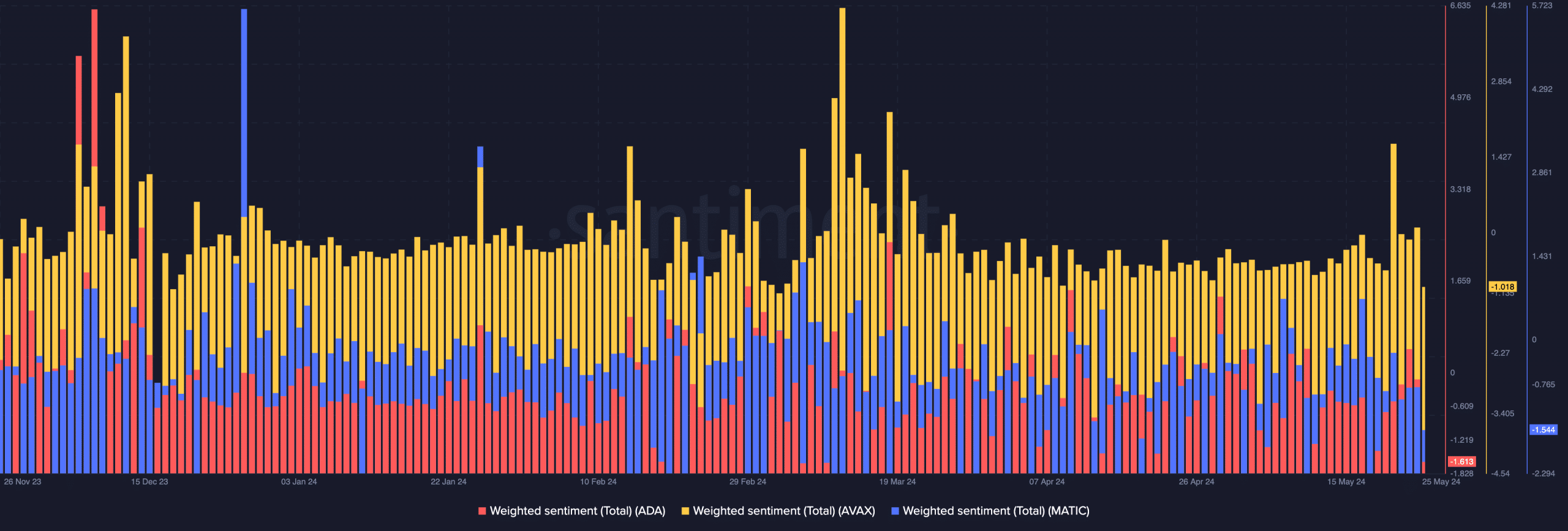

To determine if Cardano would proceed to observe in the identical course as AVAX and MATIC, AMBCrypto appeared on the sentiment across the initiatives.

A have a look at the Weighted Sentiment metric supplied by Santiment that the studying was -1.613 for ADA. In AVAX’s case, the studying was -1.018 whereas MATIC’s was -1.544.

Weighted Sentiment shows the distinctive social quantity, measured by feedback about an asset. If the metric is optimistic, it implies that market members are bullish, and demand for the property concerned may improve.

Nevertheless, for the reason that studying was adverse for all three, it signifies low confidence within the potential. With this development, there’s a likelihood that ADA, AVAX, and MATIC costs may lower once more.

Supply: Santiment

On the identical time, a extremely adverse sentiment of this nature might point out interval to build up earlier than a serious surge seems.

The tokens could quickly get again to the bull part

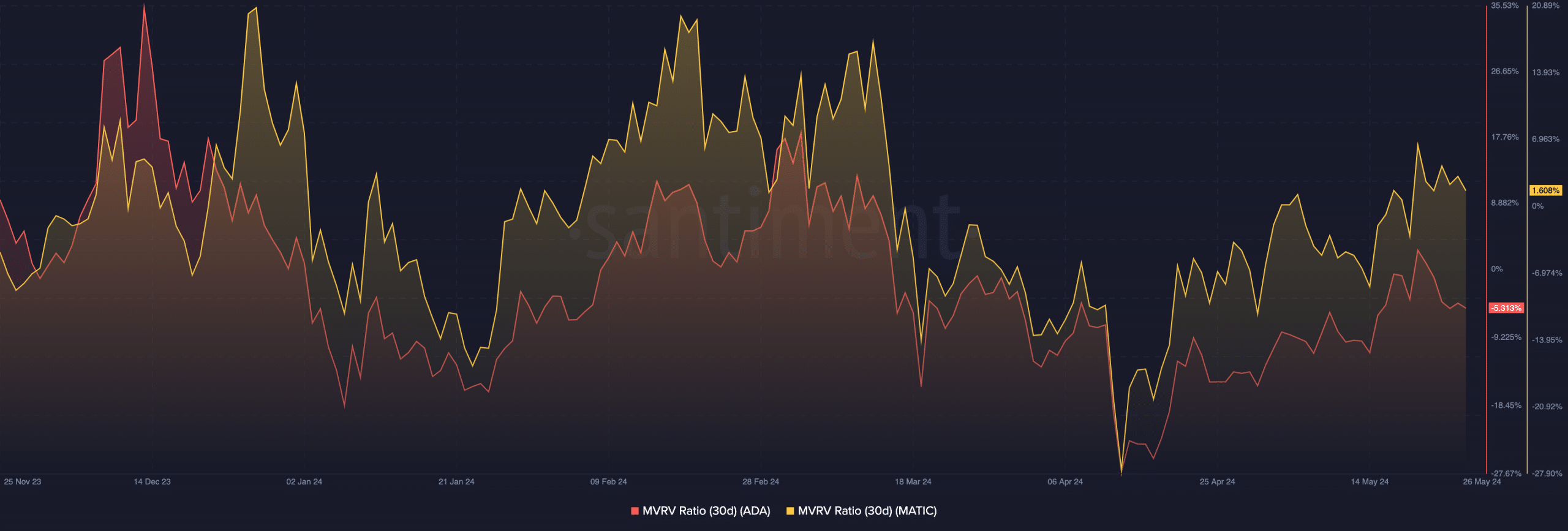

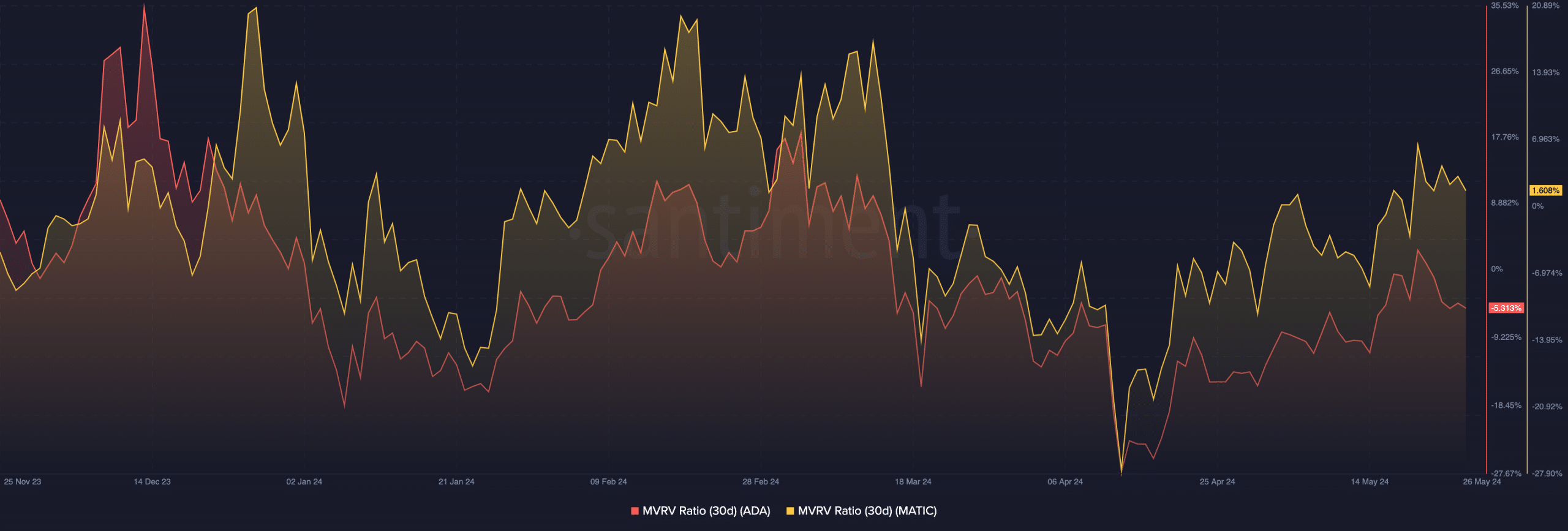

However to verify that, we have to analyze the Market Worth to Notice Worth (MVRV) ratio. This metric tells if a cryptocurrency is undervalued or in any other case.

The extra the MVRV ratio will increase, the extra earnings holders have, and the extra they’re keen to promote. Alternatively, a decrease within the metric means that extra holders are shifting into unrealized losses.

On this case, most will resolve to HODL. At press time, Cardano’s 30-day MVRV ratio was -5.313%. Which means if each ADA holder who accrued inside the final 30 days bought, they’d be making an unrealized loss.

In MATIC’s case, the metric was 1.608%. However one factor AMBCrypto seen was that the ratios decreased. Due to this fact, one can assume that the tokens have been undervalued within the context of the bull market.

Supply: Santiment

Reasonable or not, right here’s AVAX’s market cap in ADA phrases

Ought to the costs start to recuperate, ADA might rally again to $0.67. If it’s the identical for AVAX, the token might make a transfer to $50.35.

As well as, a bounce for MATIC might ship the value within the $1.06 course.