Eoneren

Crown Holdings, Inc. (NYSE:CCK) didn’t solely announce a brand new acquisition in Europe, and is making vital transformation efforts. The corporate advantages from a market that’s rising globally, and just lately made the net-zero carbon commitments. There are dangers from the overall quantity of debt, dependence on a small group of purchasers, and potential dangers from failed restructuring efforts. With that, I imagine that CCK might commerce at larger inventory worth marks.

Crown Holdings

Crown Holdings, Inc. is a Pennsylvania-based company that operates globally as a number one producer of inflexible packaging merchandise for client advertising firms and offers protecting and transit packaging options in numerous finish markets. The corporate focuses on the beverage, meals, residence and private care industries, producing aluminum and metal cans for the patron.

Moreover, it provides metal and plastic tools and consumables, protecting paper packaging and plastic movie merchandise to industries corresponding to metals, meals, beverage, building and agriculture.

The corporate’s enterprise mannequin relies on serving main international producers and entrepreneurs of client packaged merchandise. Consolidation within the beverage business has concentrated its buyer base. The highest ten international clients accounted for 49% of 2022 internet gross sales. Moreover, the corporate collaborates intently with clients, planning manufacturing primarily based on offered estimates, and seeks to broaden contract durations.

The corporate’s technique focuses on increasing international beverage can manufacturing capability to fulfill rising demand within the alcoholic and non-alcoholic beverage classes. These cans are extremely sustainable and recyclable, gaining market share within the launch of latest merchandise. As well as, it seeks to distinguish manufacturers by providing a wide range of particular can dimension, from skinny and chic to bigger sizes. The corporate additionally invests in printing and ornament capabilities, in addition to value-added providers that help clients all through the manufacturing cycle, from consulting to high quality management.

The Firm Studies A Important Quantity Of Money, And A Lot Of Goodwill

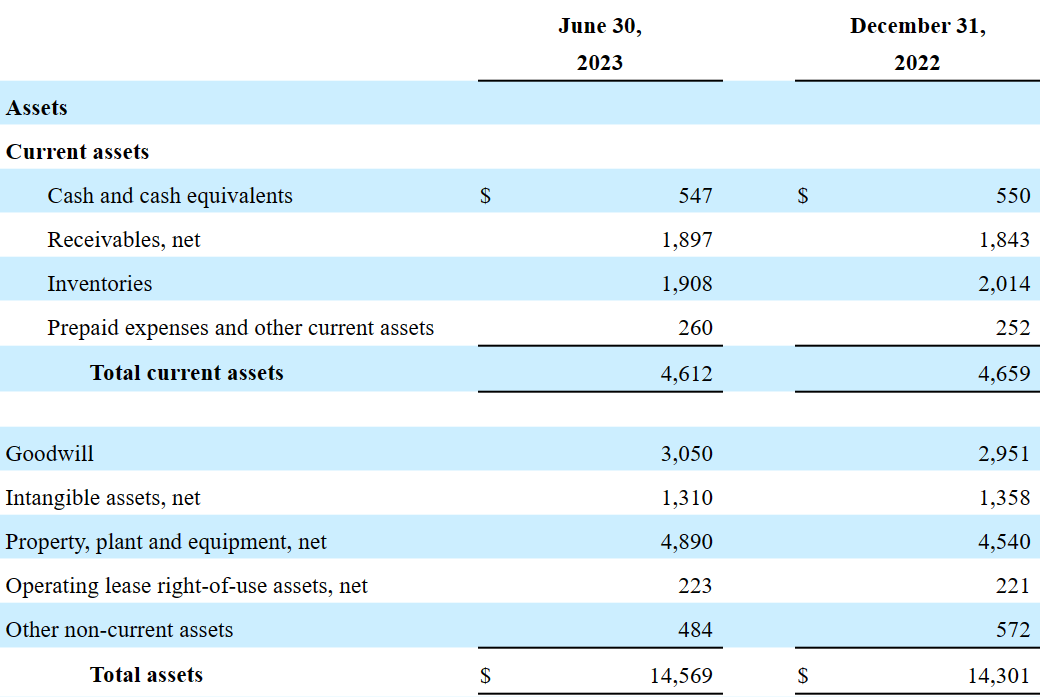

As of June 30, 2023, the corporate reported money of near $547 million, with receivables price $1.897 billion, inventories near $1.908 billion, and goodwill development of $3.050 billion. Contemplating the overall amount of money in hand, I’d count on new acquisitions each in the USA or in different jurisdictions.

With complete property of about $14.569 billion, a present ratio near 1x, and an asset/legal responsibility ratio of greater than 1x, Crown doesn’t report liquidity dangers, and the balance sheet stands in a good position.

Supply: 10-Q

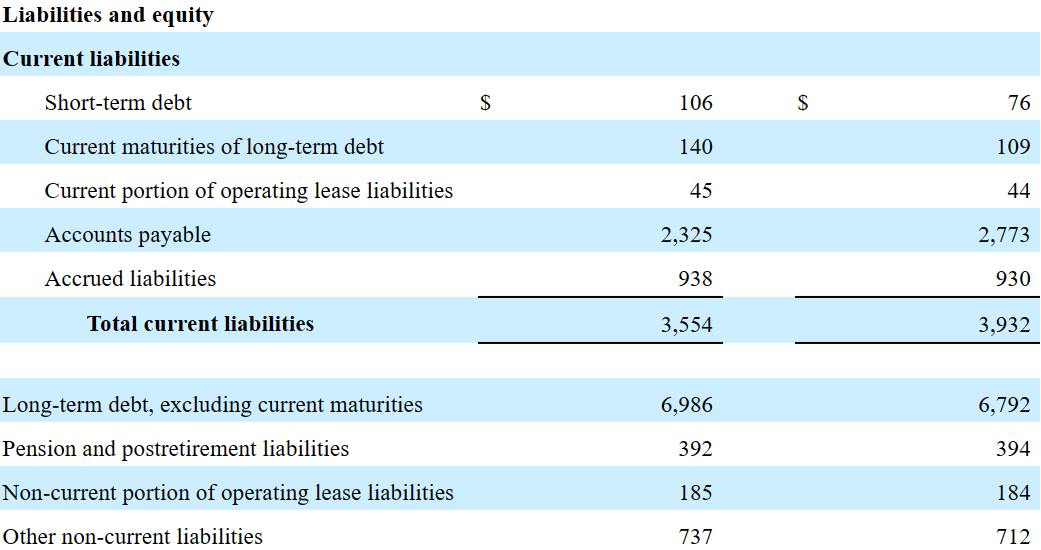

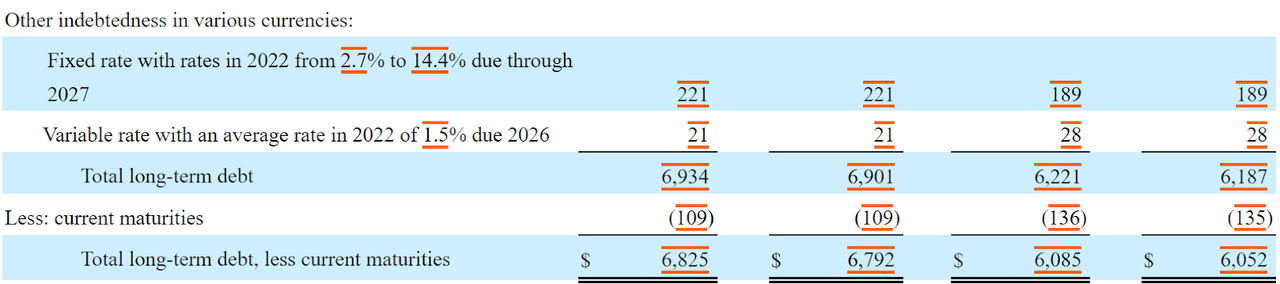

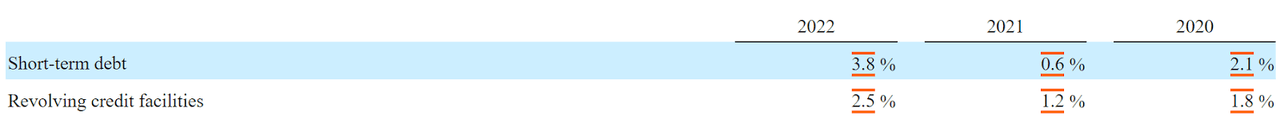

Considering that Crown runs a enterprise mannequin with little FCF volatility, I’d not be afraid of the overall quantity of debt. With that being stated, long run debt doesn’t appear small. The corporate reported short-term debt near $106 million, with present maturities of long-term debt of $140 million, accounts payable of $2.325 million, and long-term debt near $6.986 billion. Lastly, with pension and postretirement liabilities of about $392 million, non-current portion of working lease liabilities stands at $185 million.

Supply: 10-Q

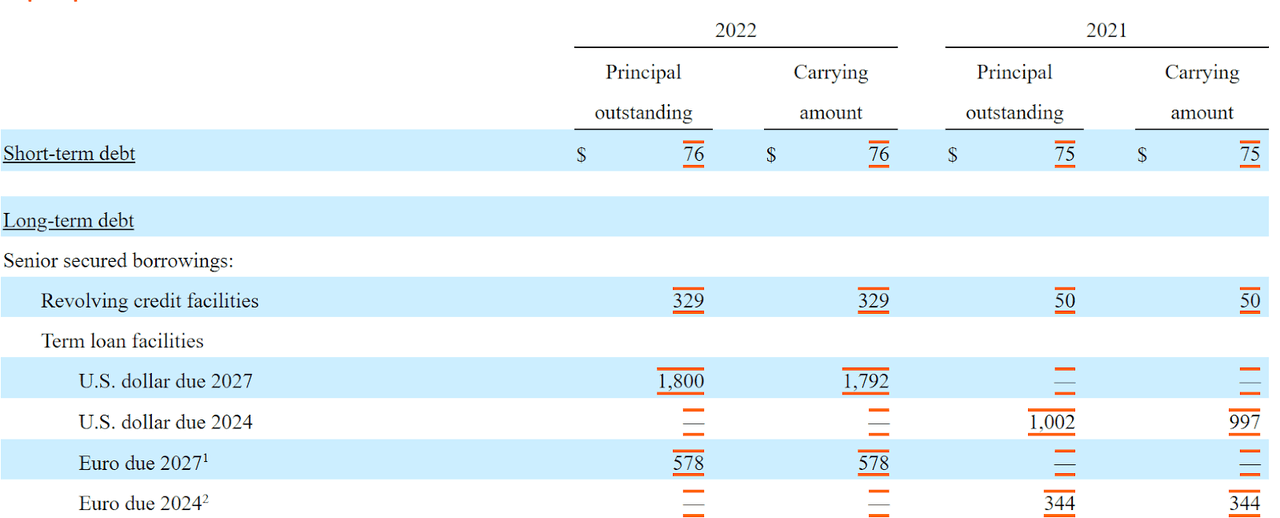

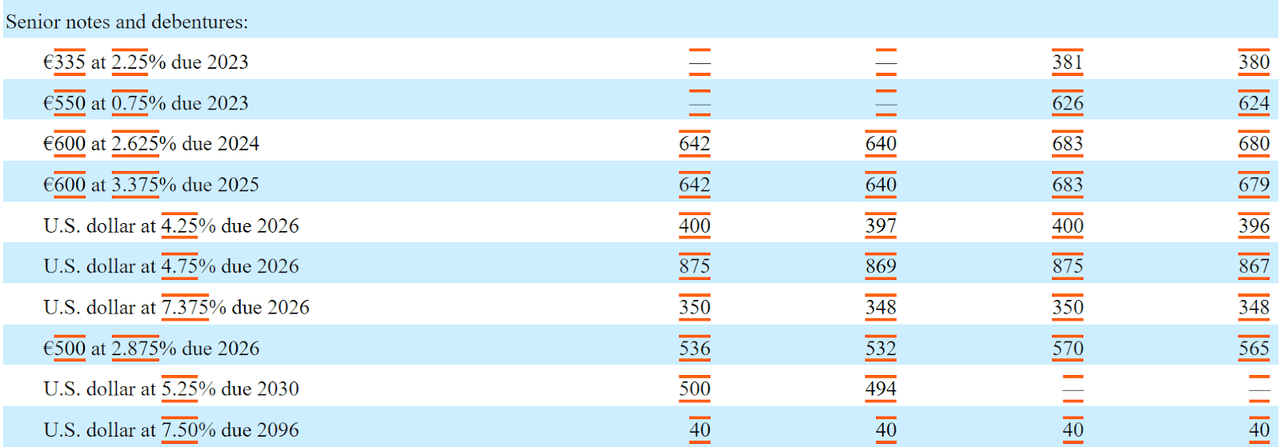

I revised the contractual obligations as the overall quantity of debt could also be studied intimately by traders. In March 2022, the corporate issued $500 million of senior unsecured notes due 2030. In August 2022, it prolonged and elevated its commitments underneath senior secured credit score services, which embody numerous varieties of commitments denominated in US {dollars}, Canadian {dollars} and euros. The revolving credit score services have provisions for letters of credit score and are topic to curiosity margins primarily based on the corporate’s leverage. The senior notes included curiosity between approximately 2% and 7%.

Supply: 10-k Supply: 10-k Supply: 10-k Supply: 10-k

I Assumed That New Acquisitions In Europe, And In Different Areas Are Doubtless

I believe that we may even see additional acquisitions within the coming years. Given the overall quantity of goodwill, Crown seems to have a substantial quantity of experience within the M&A markets. Apart from, with loads of debt, I think that the overall amount of money in hand standing within the steadiness sheet could serve for buying new targets. If that is not the case, I imagine that administration would attempt to scale back its complete quantity of debt. Additionally it is price noting the latest acquisition of latest property in Germany, which we may even see included within the steadiness sheet by the top of 2023. Because of this, we may even see a rise within the complete quantity of property. On this regard, administration gave the next clarification.

The transaction is topic to approval by German anti-trust authorities and is anticipated to be accomplished by the top of 2023. The Saarlouis plant will stay operational all through the assessment interval. Whereas phrases of the settlement are confidential, the impression to the Firm’s internet leverage is negligible. Supply: Crown Expands Beverage Can Footprint Into Germany With Acquisition of Helvetia Packaging

Additional Reorganization, And Sale Of Property Might Lead To Additional Money In Hand, And Inventory Worth Will increase

The corporate just lately made vital restructuring fees in Europe, and likewise offered some property. I believe that additional efforts could deliver much more money in hand, which can improve the leverage ratio. Because of this, I imagine that we might see additional curiosity from extra traders.

For the three and 6 months ended June 30, 2023, restructuring and different, internet fees of $6 and $17, respectively, primarily included enterprise reorganization actions within the Firm’s European Beverage section. The Firm continues to assessment its prices construction and should report further restructuring fees sooner or later. Supply: 10-Q

For the three and 6 months ended June 30, 2022, restructuring and different internet positive factors of $73 and $74, respectively, primarily included a $113 acquire from the sale of the Transit Packaging section’s Kiwiplan enterprise. Supply: 10-Q

The Firm Might Profit From Additional Enhance Of The International Beverage Cans Market

Underneath my DCF mannequin, I additionally assumed that Crown will most definitely profit from additional enhance within the international beverage cans market, which grows at shut to five.6% CAGR. Crown is already nicely positioned in Asia, Mexico, North America, and different areas, so I believe that internet gross sales development could possibly be shut to five%-6%.

The worldwide beverage cans market is anticipated to develop at a compound annual development fee of 5.6% from 2021 to 2026. Supply: Beverage Cans Market Size

For a number of years, international business demand for beverage cans has been rising. In North America, beverage can development has accelerated lately primarily as a result of outsized portion of latest beverage merchandise being launched in cans versus different packaging codecs. As well as, markets corresponding to Brazil, Europe, Mexico and Southeast Asia have additionally skilled larger volumes and market growth. Supply: 10-Q

Twentyby30, And The Web-zero Carbon Dedication Might Speed up Investments From Buyers In Sustainability Markets

The corporate famous many initiatives to achieve environmental targets, and expects to report net-zero carbon throughout enterprise operations by 2040. Because of this, I imagine that demand from traders seeking to put money into sustainable enterprise fashions. The worldwide sustainable finance market is anticipated to develop at shut to twenty% CAGR from 2023 to 2032.

The Firm debuted Twentyby30, a strong program that outlines twenty measurable, science primarily based, environmental, social and governance targets to be accomplished by 2030 or sooner. The Firm joined The Local weather Pledge, a dedication to be net-zero carbon throughout enterprise operations by 2040. Supply: 10-Q

The worldwide sustainable finance market dimension accounted for USD 4,562.85 billion in 2022 and it’s anticipated to hit round USD 29,111.04 billion by 2032, rising at a CAGR of 20.36% through the forecast interval from 2023 to 2032.Sustainable Finance Market Size, Growth, Report By 2032.

Decreases In The Leverage Ratio As a result of The Covenant Requiring Ratio Lowers Might Curiosity Buyers, And Might Speed up The Demand For The Inventory

Not too long ago, the corporate famous a discount within the required internet complete leverage ratio. Because of this, I imagine that Crown could scale back its degree of debt, which can be helpful for shareholders. The ratio lowered from 5x to 4.5x in December 2023.

The Firm’s complete internet leverage ratio of three.8 to 1.0 at June 30, 2023 was in compliance with the covenant requiring a ratio no better than 5.0 to 1.0. The ratio is calculated on the finish of every quarter utilizing debt and money balances as of the top of the quarter and Consolidated EBITDA for the latest twelve months. Supply: 10-Q

The required internet complete leverage ratio underneath the settlement reduces to 4.5 to 1.0 at December 31, 2023. Supply: 10-Q

Valuation

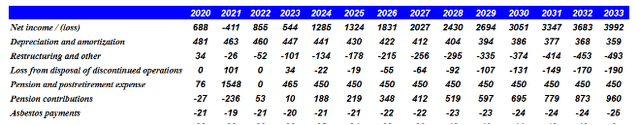

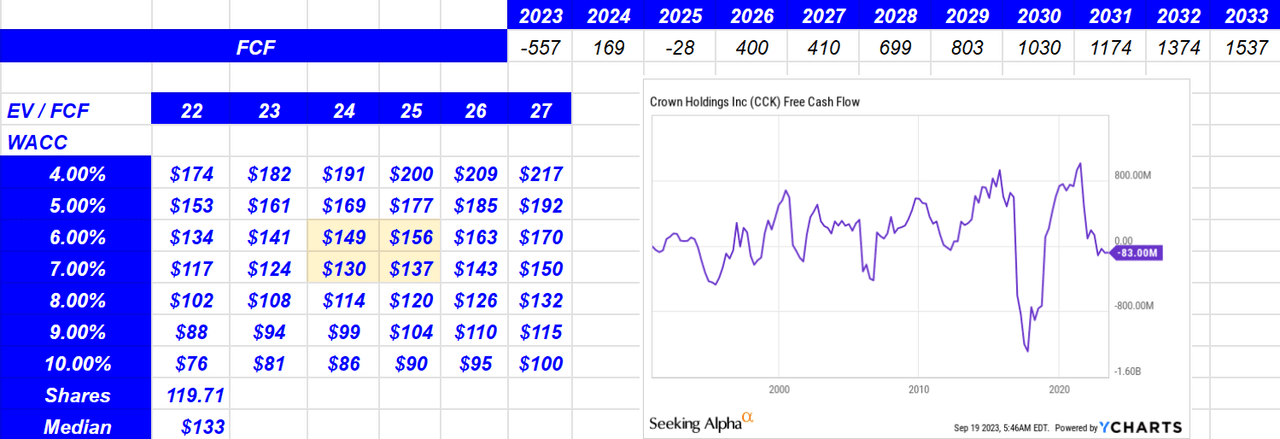

I forecasted 2033 internet revenue of about $3.9 billion, with 2033 depreciation and amortization of $359, restructuring price -$493 million, pension and postretirement bills of lower than $450 million.

Supply: Money Movement Assertion

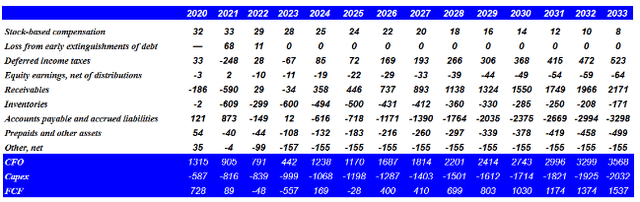

Moreover, bearing in mind 2033 stock-based compensation of $8 million, no loss from early extinguishment of money owed, modifications in receivables of about $2.1 billion, and modifications in inventories of -$171 million, 2033 CFO can be $3.5 billion. Lastly, with 2033 capex of solely -$2.03 billion, 2033 FCF can be near $1.53 billion.

Supply: Money Movement Assertion

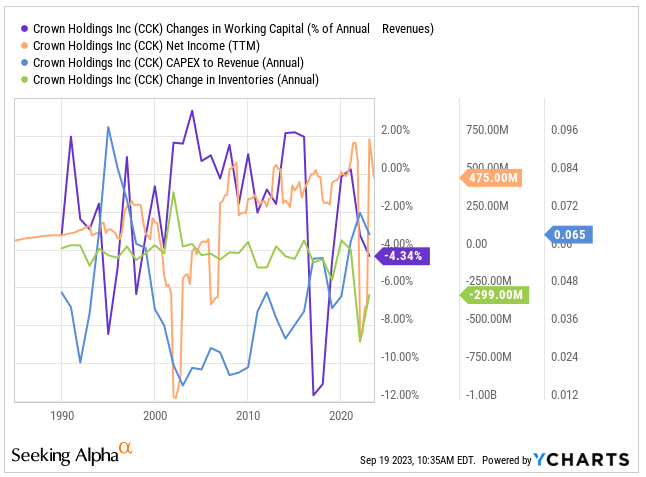

I used some monetary ratio noticed previously, and my earlier assumptions. Take a look at earlier figures within the chart beneath.

Supply: Ycharts

Investment analysts on the market expect the next financial ratio for the year 2025. The capitalization / Income would stand at 0.8x with EV / Income of 1.23x, EV / EBITDA of near 7.89x, and EV / FCF near 16.5x. I imagine that these figures are fairly related for assessing the potential EV/terminal FCF in my DCF mannequin.

If we assume a WACC between 4% and 10%, and a EV/2033 FCF between 22x and 27x the implied valuation can be between $174 and $76. The median end result would stand at about $119, however in any case, I imagine that Crown seems considerably undervalued.

Supply: Valuation Mannequin

Dangers, And Competitors

The corporate faces vital dangers as a result of standardization of merchandise corresponding to beverage and meals cans, which may result in overcapacity and worth competitors if provide exceeds demand. Moreover, competitors from various packaging like glass, paper, or versatile plastic is intense.

Modifications in client preferences and modifications in buyer packaging can have an effect on gross sales. Fluctuations within the costs of supplies corresponding to aluminum, metal and plastic can even have a detrimental impression. Excessive fastened prices can strain margins in durations of low total demand or extra capability within the business. For my part, the corporate faces sturdy competitors in its client items packaging and transit packaging segments. Within the client items market, competitors relies on worth, high quality, service and efficiency, competing with packaging producers, fillers and meals processors.

Then again, within the area of transit packaging, it competes with quite a few regional and native rivals, differentiating itself by its international attain, assorted product portfolio and stable model fame, competing to a sure extent with different packaging supplies corresponding to paper, plastic, wooden and numerous metals.

My Takeaway

Crown Holdings, Inc. is making vital efforts, but in addition increasing the enterprise mannequin with new acquisitions in Europe. I imagine that the enterprise may gain advantage considerably from the expansion of the beverage cans market, and additional communication concerning the Twentyby30, and the net-zero carbon commitments. The corporate additionally faces a aggressive market which poses dangers of overcapacity and pricing pressures. Its dependence on a small group of main purchasers within the beverage business implies vulnerability to modifications of their preferences and market consolidation. For my part, additional prudent debt administration and compliance with covenants will most definitely assist. In any case, I imagine that the inventory worth could possibly be extra expensive.