Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

On 28 September, the delay of the approval of Blackrock’s Bitcoin [BTC] ETF utility got here to mild. The U.S. Securities and Exchanges Fee (SEC) chair Gary Gensler cited that the approval was nonetheless underneath lively consideration.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Moreover, the transfer has additionally delayed the crypto plans of Invesco, Valkyrie, and Bitwise.

BTC has been floating alongside the $27K-price mark for a couple of days. At press time, it was buying and selling at $26,935.

Authorized victories in latest occasions additionally gave a respite to the crypto world. BTC was floating above the $27K-mark for a couple of days even then. However that enthusiasm quickly died down.

Bitcoin earlier soared as excessive as $31.7K inside a day of Ripple [XRP] securing a partial victory in its authorized battle with the U.S. Securities and Alternate Fee [SEC] on 13 July. However it didn’t maintain the worth rally.

The U.S. District Courtroom of the Southern District of New York dominated in its judgement that the sale of Ripple’s XRP tokens on crypto exchanges and although programmatic gross sales didn’t represent funding contracts; therefore, it’s not a safety on this case.

However the court docket additionally dominated that the institutional sale of the XRP tokens violated federal securities legal guidelines.

The crypto trade lapped up the judgement immediately, producing a value rally throughout tokens. However no coin may maintain the worth rally for lengthy.

We must also word that in June, the SEC approved the primary leveraged Bitcoin futures exchange-traded fund (ETF), specifically the Volatility Shares 2x Bitcoin Technique ETF (BITX).

The SEC has additionally accepted spot BTC ETF proposals from main conventional finance (TradFi) corporations for evaluate, together with BlackRock, Bitwise, VanEck, WisdomTree, Constancy and Invesco.

In August, London-based Jacobi Asset Administration announced the launch of its BTC ETF in Europe.

Observers take a look at these developments as institutional approval of cryptocurrency.

For a very long time, the crypto’s value hovered between $200 and $1,000 on the worth charts. Nonetheless, in late 2017, BTC’s worth exploded, hitting an all-time excessive (ATH) of almost $20,000 in December.

Although market participation grew, the worth rally was short-lived. By early 2018, BTC’s value had fallen again all the way down to round $3K. The cryptocurrency market as an entire recorded a interval of decline, with many merchants dropping important quantities of cash.

Nonetheless, Bitcoin made a exceptional restoration, surpassing its earlier ATH in late 2020 and reaching an ATH of over $68K in November 2021. Nonetheless, the 2022 buying and selling 12 months ushered in a brand new period of bearishness, one exacerbated by the collapse of Terra/LUNA and FTX.

In truth, in November 2022, Bitcoin was buying and selling at a two-year low of $15K.

Whereas the crypto market could also be unpredictable and unstable, merchants and traders can nonetheless make knowledgeable selections by staying up-to-date on market information, following professional evaluation, and utilizing clever buying and selling methods, comparable to these provided by ChatGPT.

ChatGPT: A messiah that may make it easier to commerce higher?

In November 2022, the AI mannequin ChatGPT was launched to the general public. In truth, it rapidly gained important consideration, too. With its broad vary of capabilities and flexibility, the query arises whether or not there are different ways in which ChatGPT can lend its experience, comparable to aiding BTC merchants in formulating and making use of improved buying and selling methods.

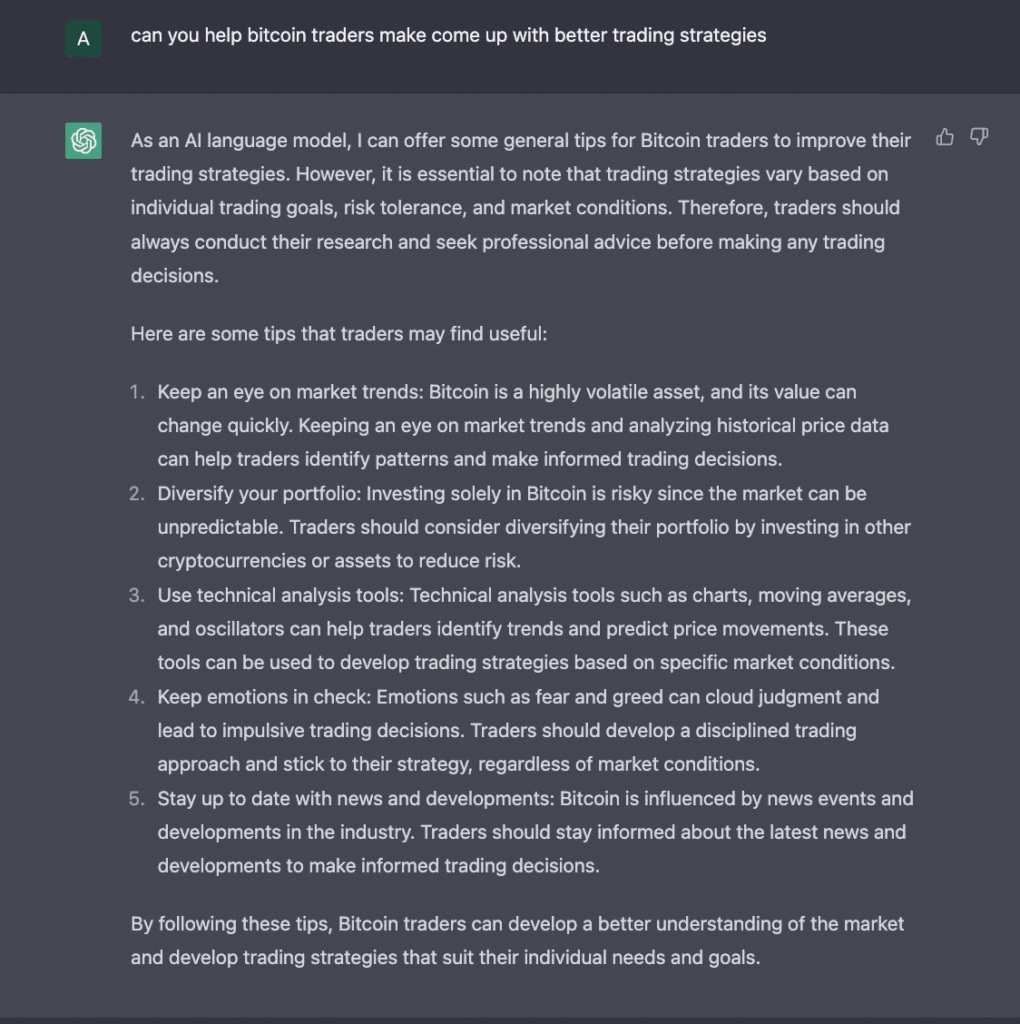

When requested if it may do that, ChatGPT had this to say –

Supply: ChatGPT

Attributable to its nature as an AI device, there are limitations to what ChatGPT can do concerning value predictions and value future actions. Nonetheless, there are methods to leverage the device’s capabilities to formulate higher buying and selling methods as a BTC dealer.

One strategy to make the most of the AI device to make higher buying and selling methods is by deploying it towards basic evaluation. ChatGPT is able to extracting insights from monetary information articles, social media posts, and different unstructured knowledge sources.

We will use this info at the side of different datasets to make knowledgeable buying and selling methods.

One other manner to make use of ChatGPT as a Bitcoin dealer is to make use of it for sentiment evaluation. ChatGPT might be fine-tuned to carry out sentiment evaluation on info from information articles, on-chain knowledge suppliers, social media discussions, and different sources.

This can be utilized to establish whether or not the BTC market lingers underneath optimistic sentiment or is stricken by unfavorable sentiment.

Moreover, BTC merchants can use ChatGPT for technical evaluation. Merchants can ask ChatGPT to code any technical indicator or buying and selling bot for any buying and selling platform.

As an example, I requested ChatGPT to present me an instance of a buying and selling bot that I can use to trace BTC’s value volatility in pine script–TradingView’s programming language is helpful for again testing buying and selling methods. The AI responded,

Supply: ChatGPT

To make use of ChatGPT for technical evaluation, merchants should be conversant in the language to know when to make the required modifications for the code to work correctly. The immediate textual content is essential in how ChatGPT understands the issue and gives the anticipated answer.

For a well-rounded piece, I spoke to Brian Quinlivan, the Director of Advertising at Santiment, who additionally occurs to have been concerned in Bitcoin buying and selling for a couple of years.

Brian Quinlivan has an MBA diploma in finance from Chapman College, Brian has over 10 years of selling, monetary, and knowledge analytics expertise. He enjoys creating monetary fashions to enhance modern-day investing methods and research the intricacies of market variations.

Q: In what methods do you suppose ChatGPT can revolutionize cryptocurrency buying and selling?

Yeah, I believe that there’s going to be a whole lot of use for it, definitely for buying and selling methods. One factor to be involved about is the uniform opinions that will end result from an AI tech giving a sort of overarching technique, whether or not it’s hodling or basic technique.

People can simply manipulate ChatGPT to (mis)inform the viewers. We’re already seeing slight results of it.

I believe it may be each useful and harmful on the similar time and trigger lots of people to be educated far more rapidly, but additionally be pulled in instructions that may affect the best way crypto goes and create a whole lot of self-fulfilling prophecies.

Q: How do you suppose a BTC dealer/investor can leverage the AI device to make higher funding selections?

I believe, in brief, I believe scripts could be utilized in AI much more due to the truth that the entire knowledge might be digested on the similar time and given a quite simple reply whether or not to purchase or promote. This, I imagine, can affect the markets tremendously shifting ahead.

When will BTC hit the $30K-price mark, if it would?

As talked about above, ChatGPT can’t make future predictions.

To get it to reply my query, I made a decision to jailbreak it through the use of the Do Anything Now (DAN) methodology. It stated BTC will cross the $30K-mark inside the subsequent month.

Supply: ChatGPT

I additional quizzed the AI know-how on Bitcoin costs between 2023 and 2024.

Supply: ChatGPT

The AI bot predicted that BTC will rise to $75K by the tip of 2024 — a very speculative assertion.

In early June, the SEC started its crackdown on Binance [BNB] and Coinbase [COIN], resulting in a bearish market. In such a state of affairs, BTC has proven its resilience to date.

Supply: BTC/USD, TradingView

At press time, BTC was buying and selling at $26,935. Traders are hoping that the token will a minimum of attain the $30k-price mark once more.

Whereas BTC’s Relative Power Index (RSI) rested under the impartial 50-level, its Money Movement Index (MFI) rested solely barely above it. Its On Stability Quantity (OBV) registered an uptick.

In conclusion, BTC’s on-chart metrics don’t give us a optimistic signal.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Is ChatGPT’s estimate appropriate?

ChatGPT predicts that BTC can rise to $75K by the tip of 2024. We should see if the coin can break all-time highs throughout 2023-24 resulting from its elevated adoption (by corporations and establishments) and as BTC’s enchantment as a hedge towards inflation grows.

Its on-chart metrics don’t encourage us— a minimum of within the brief time period. Nonetheless, it’s trite to notice that elevated regulation and authorities scrutiny may unfold FUD, inflicting its value to dip.