- LINK’s value has jumped to correspond to the uptick in its whale and social exercise

- Nonetheless, key metrics counsel {that a} value backside would possibly nonetheless be in

The worth of LINK, the token that powers main oracle community Chainlink, has surged by double digits within the final 24 hours. Valued at $15.81 at press time, LINK is now buying and selling at its highest degree since March, based on CoinMarketCap.

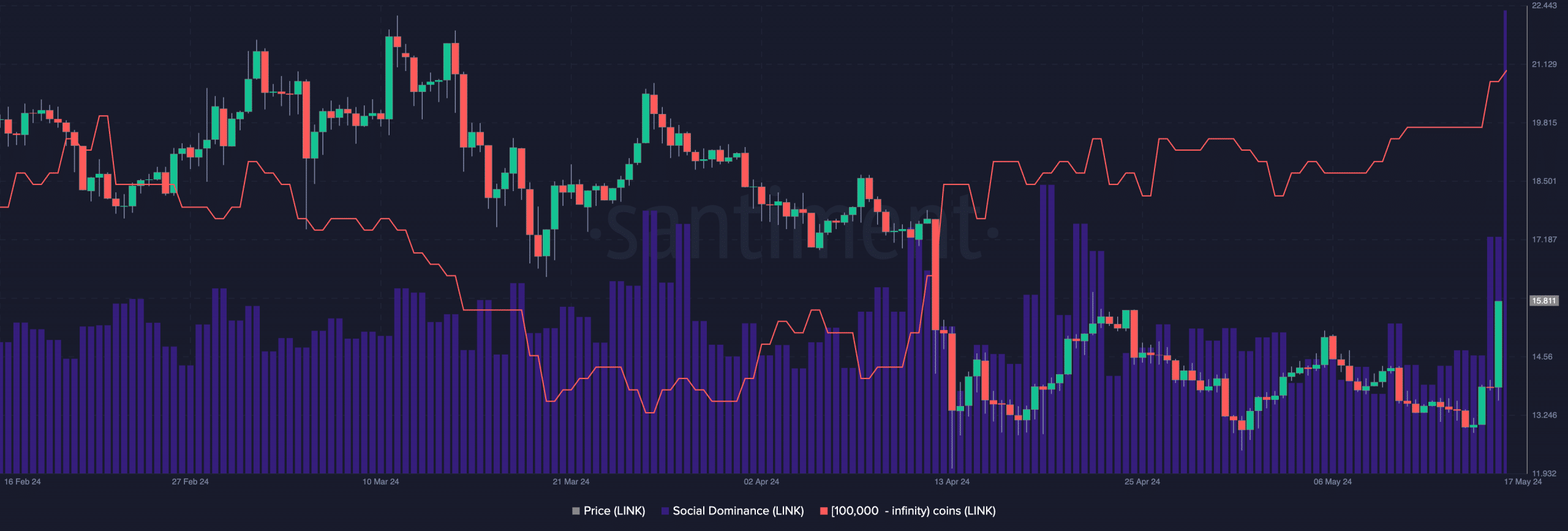

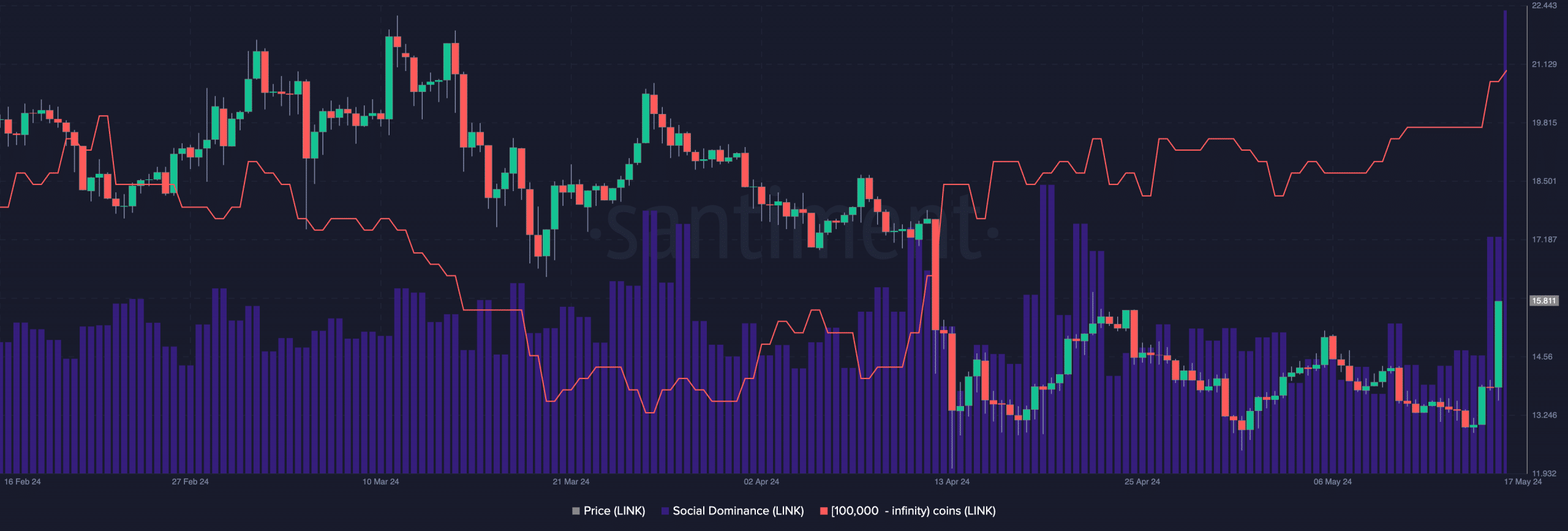

In a post on X (previously Twitter), on-chain information supplier Santiment revealed that LINK’s current rally has been because of the uptick in its whale exercise and social exercise.

On the time of writing, 565 LINK whales held over 100,000 tokens – The very best quantity since October 2023. The depend of this investor cohort has rallied steadily because the starting of Might, mountaineering by 2% within the final 16 days. Over the past month alone, this has grown by 5% too, based on Santiment.

So far as the token’s social exercise is worried, its social dominance presently sits at its highest degree in seven months.

This metric tracks social discussions about an asset, in comparison with the general dialogue in regards to the prime 100 cryptocurrencies by market capitalization. With a studying of 1.8% at press time, LINK recorded its highest market share of social discussions since November 2023.

Supply: Santiment

LINK enjoys consideration

A leap in an asset’s whale and social exercise are notable indicators of sustained bullish presence. LINK’s weighted sentiment, which returned a constructive worth of 1.808 at press time, confirmed this.

Signaling elevated demand for the altcoin, its key momentum indicators assessed on a 1-day chart trended upwards at press time too. Additionally, LINK’s Relative Energy Index (RSI) was 60.67, whereas its Cash Stream Index (MFI) was 62.99.

At these values, these indicators instructed that LINK accumulation exceeded sell-offs amongst market individuals.

Additional confirming the bullish pattern, LINK’s value closed above its 20-day Exponential Shifting Common (EMA) on 16 Might. In actual fact, it was buying and selling above that key degree, on the time of writing.

Supply: LINK/USDT on TradingView

This can be a bullish sign as a result of it reveals that LINK’s value has grown previous its common value of the previous 20 days. Market individuals interpret the crossover as a shift in momentum from bearish to bullish.

Worth backside is probably not in but

Whereas the present rally marks a shift in market sentiment in the direction of LINK, there isn’t any affirmation on-chain {that a} value backside has been reached but.

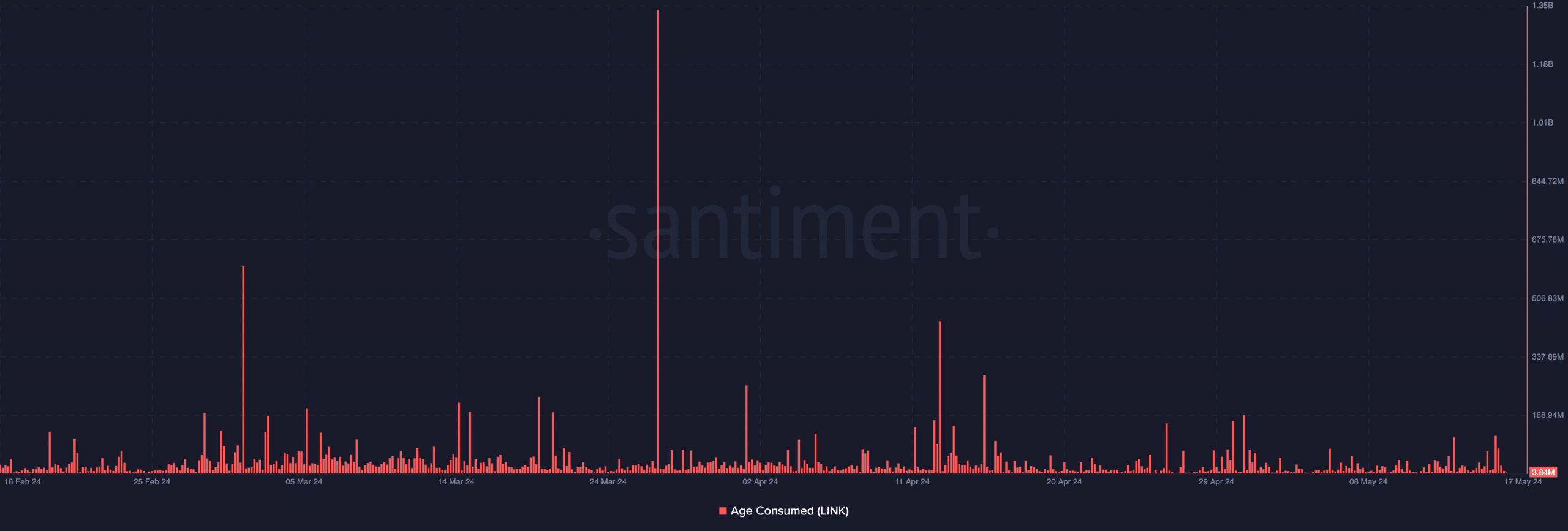

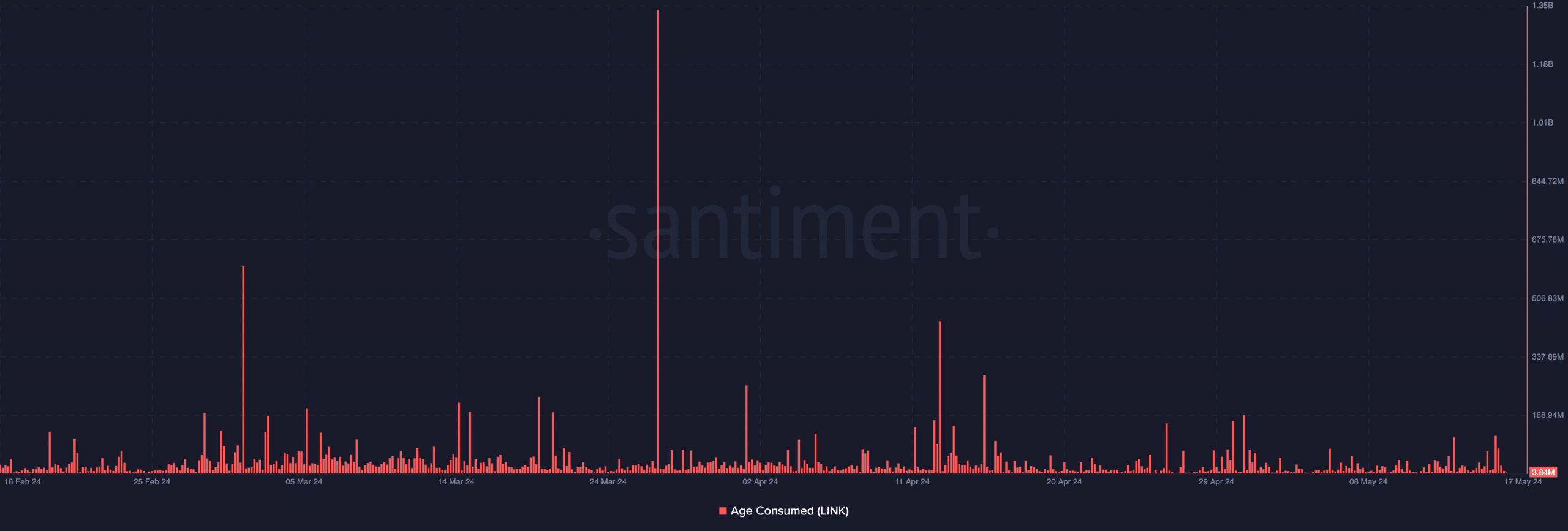

A great metric to evaluate that is the token’s Age Consumed, which tracks the motion of dormant LINK tokens.

The metric is vital as a result of it gives insights into the behavioral patterns of the token’s long-term holders. This class of traders hardly ever strikes their tokens round. Due to this fact, after they do, it usually ends in a shift in market developments.

Is your portfolio inexperienced? Try the LINK Revenue Calculator

When LINK’s Age Consumed metric spikes, it signifies that many tokens which were left idle for a very long time are altering arms. However, when it falls, it signifies that idle cash are left unmoved.

Because the starting of Might, LINK’s Age Consumed has returned comparatively low values – An indication that its long-term holders have barely moved their tokens round.

Supply: Santiment

Therefore, there was no vital shift in LINK’s market developments, particularly in relation to the token’s long-term holders.