Chainlink (LINK) skilled modest progress of merely 1% over the earlier month, presenting a definite divergence from the broader market’s development, which noticed unprecedented peaks in the identical timeframe. Alarmingly, a major discount in Dormant Circulation Provide coupled with an all-time low in Weighted Sentiment has make clear the prevailing market sentiment and hints at attainable future instructions.

Inside this text, we completely discover the ramifications of those crucial metrics, scrutinize the prevailing value assist ranges and resistance boundaries, and supply a well-reasoned forecast relating to the long run value path of Chainlink.

How the 180-Day Dormant Provide Drop Can Impression the Chainlink Worth

Between February 6 and March 3, the Dormant Circulation Provide for Chainlink (LINK), over a 180-day interval, witnessed a considerable improve from 257,000 to 714,000. This vital progress alerts a powerful interval of accumulation or a constant holding sample amongst buyers, implying a collective anticipation of future value appreciation or an illustration of religion within the long-term worth of LINK.

The habits instructed by this metric throughout this timeframe factors in direction of bullish sentiment, with buyers displaying a transparent desire for holding onto their belongings fairly than promoting them off, anticipating potential positive aspects, or believing within the underlying fundamentals of Chainlink.

Nonetheless, the narrative took a dramatic activate March 6, when the Dormant Circulation Provide skilled a stark discount, plummeting from 570,000 to 70,200, translating to an 87.68% lower.

This precipitous fall signifies {that a} substantial portion of LINK that had been inactive, not collaborating in any transactions for over six months, was immediately mobilized. Activating a big quantity of beforehand dormant LINK may indicate a major shift in investor sentiment or strategic actions inside the market.

Learn Extra: The way to Purchase Chainlink (LINK) With a Credit score Card: A Step-By-Step Information

The idea of Dormant Circulation Provide, particularly when noticed over a interval of 180 days, presents profound insights into the habits of long-term holders inside the cryptocurrency ecosystem. Nonetheless, the sudden and vital drop on March 6 could result in elevated promoting stress out there.

Since Chainlink’s progress is approach beneath that of different cryptocurrencies, longtime holders – represented by Dormant Provide (180d)- could possibly be promoting their LINK to have sufficient liquidity to pursue higher alternatives out there.

Chainlink Sentiment Hits a New Low

The Weighted Sentiment metric for Chainlink has reached a startling low level, diving all the way down to -1.265. The chart beneath represents essentially the most substantial bearish sentiment the Chainlink neighborhood has seen since July 2023.

Weighted Sentiment is an combination measure that evaluates the final temper inside the market discourse regarding Chainlink, factoring within the relative dimension of optimistic versus destructive discussions and the frequency of those mentions throughout social media platforms.

A rating within the destructive area, particularly one as little as -1.265, signifies a dominant bearish overtone in market conversations, with a bigger quantity of destructive commentary, presumably fueled by uncertainties or crucial views relating to Chainlink’s prospects.

The importance of the Weighted Sentiment metric extends past mere hypothesis; it serves as an early warning system for buyers and market individuals, typically presaging shifts in market dynamics. When sentiment sours to the diploma proven on this scale, it usually alerts a contraction in investor enthusiasm, which might translate into diminished shopping for stress and, in flip, exert a downward pressure on Chainlink’s value.

The presence of such destructive sentiment concurrently with a notable downtick within the Dormant Circulation Provide paints a bearish to impartial image for LINK.

LINK Worth Prediction: Is $22 Doable Anytime Quickly?

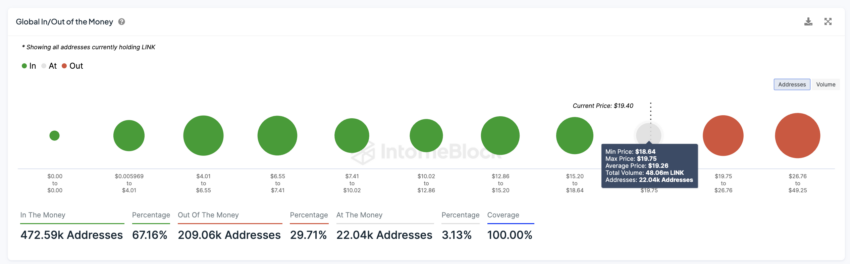

Based mostly on the “World In/Out of the Cash” chart for Chainlink value, we will analyze the present sentiment and potential future value actions with a lean in direction of a bearish to impartial outlook. The chart signifies that a lot of addresses are “Within the Cash” (worthwhile), representing 67.16% of the full addresses holding LINK, whereas a smaller fraction, 29.71%, is “Out of the Cash” (unprofitable), and a minuscule 3.13% are “On the Cash” (at break-even).

Learn Extra: Chainlink (LINK) Worth Prediction 2024/2025/2030

Notably, LINK has established a sturdy assist zone between $15 to $18.50, the place many addresses could doubtlessly have acquired their tokens. The presence of this assist signifies that ought to LINK’s value dip into this vary, shopping for exercise may improve, as holders is perhaps inclined to buy extra to common their entry value, or new buyers may even see it as a sexy entry level.

Conversely, a formidable resistance zone ranges from $19.75 to $26.75. This implies that as LINK value ascends in direction of these ranges, it’s prone to encounter a sell-off as holders in revenue may begin to offload their holdings, consequently exerting downward stress on the value.

This creates a difficult ceiling for LINK to interrupt by way of, particularly if the broader market sentiment doesn’t present a powerful sufficient tailwind to assist an upward breakthrough.

For a reversal of the present bearish to a impartial stance and for LINK to attain $22 once more, it could want to keep up its stance above the assist ranges, regularly constructing momentum to sort out the acknowledged resistance.

A shift out there by way of persistently optimistic weighted sentiment and even the approval of a Chainlink ETF, typically, may present the required impetus for LINK to interrupt by way of the resistance.

The publish Chainlink (LINK) Worth Stagnates – Can it Break and Maintain Above $20? appeared first on BeInCrypto.