Chainlink has just lately skilled a major worth enhance, leaping from $13 to $17.

This evaluation delves into the components driving this spectacular rise. Specializing in the spike in on-chain exercise and Bitcoin’s concurrent rally.

Chainlink Bullish Outlook Backed by Key Ranges

On the each day timeframe, Chainlink has examined the higher boundary of the Ichimoku cloud, which is at the moment across the $17.41 mark. This take a look at suggests a powerful resistance degree. A profitable break above this boundary might point out additional bullish momentum.

The Ichimoku Cloud is a device utilized in technical evaluation to assist establish developments out there. Right here’s a easy breakdown:

Cloud: The shaded space on the chart reveals potential assist and resistance ranges.

When the worth is above the cloud, it suggests an upward development (bullish). When the worth is beneath the cloud, it suggests a downward development (bearish).

Strains: There are a number of traces within the Ichimoku Cloud:

Conversion Line (Tenkan): Reveals the common worth over the past 9 durations (candles).

Base Line (Kijun): Reveals the common worth over the past 26 durations (candles).

Main Span A and B: These type the cloud and undertaking future assist and resistance ranges.

Learn Extra: How To Purchase Chainlink (LINK) and All the things You Want To Know

Chainlink has retraced to the Fibonacci ranges, with vital assist noticed at $16.41 (0.236), $15.525 (0.382 degree), and $14.09 (0.618 degree). Holding above these ranges, particularly the $15.525 assist, will preserve the bullish outlook.

Chainlink vs Bitcoin: LINK Value Anticipated to Climb Towards BTC

Moreover, LINK/BTC on the each day timeframe has simply entered the Ichimoku cloud, signaling a possible upward trajectory. The entry into the cloud is commonly a precursor to a worth enhance, suggesting that LINK might see additional beneficial properties in opposition to Bitcoin.

On the 4-hour timeframe, LINK is buying and selling above the Ichimoku cloud in opposition to Bitcoin and is at the moment testing its higher boundary. If LINK can preserve this place, it helps the bullish outlook. Nevertheless, if LINK fails to carry above this degree and breaks downward, it might change the market sentiment.

The bullish situation turns into extra favorable contemplating Bitcoin’s potential rise to $73,000. If Bitcoin continues its upward development, LINK might probably commerce again at $19 within the mid-term.

General, the technical indicators and key assist/resistance ranges counsel a powerful bullish potential for Chainlink, offered it will possibly maintain above vital ranges and capitalize on Bitcoin’s upward momentum.

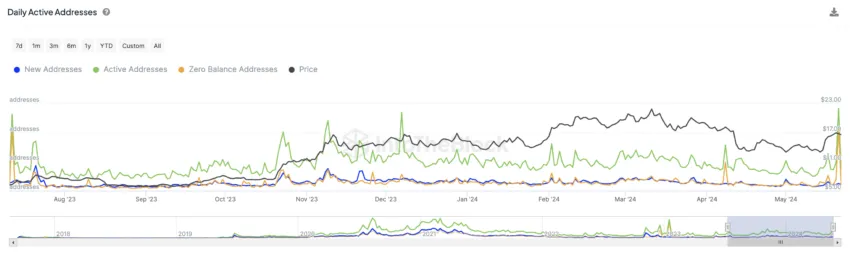

The current spike in on-chain exercise for Chainlink has helped propel its worth from $13 to $17. This surge in exercise is obvious within the sharp enhance in each day lively addresses, as proven within the chart.

The inexperienced line representing lively addresses has notably spiked, indicating heightened community utilization and engagement.

Learn Extra: Chainlink (LINK) Value Prediction 2024/2025/2030

Moreover, Bitcoin’s concurrent rise to $72,000 has offered a good macro surroundings for Chainlink’s worth enhance. The bullish momentum within the broader cryptocurrency market, led by Bitcoin, has doubtless contributed to the constructive worth motion noticed in Chainlink.

Strategic Suggestions

Bullish Outlook:

Key ranges to observe are $16.41 (the higher boundary of the Ichimoku cloud), $15.52 (the 0.382 Fibonacci degree), and $14.09 (the 0.618 Fibonacci degree). These indicators will help you optimize your buying and selling technique.

Whereas LINK reveals robust potential, diversify your portfolio with different high-potential property to mitigate threat.

Keep knowledgeable about Chainlink’s developments and take part in community discussions to realize insights into upcoming tasks.

Disclaimer

Consistent with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.