- LINK has climbed to its highest worth stage in six weeks.

- Most LINK transactions proceed to return revenue.

Chainlink [LINK] leads the altcoin rally following its worth rise to a six-week excessive, information from Santiment has proven.

In accordance with the on-chain information supplier, in the course of the intraday buying and selling session on twenty third Could, the altcoin briefly exchanged arms at $17.53 earlier than witnessing a slight retraction. A

s of this writing, LINK exchanged arms at $17, in keeping with CoinMarketCap’s information.

LINK holders in positive aspects

The current surge in LINK’s worth has brought about it to be a considerably worthwhile funding for its holders.

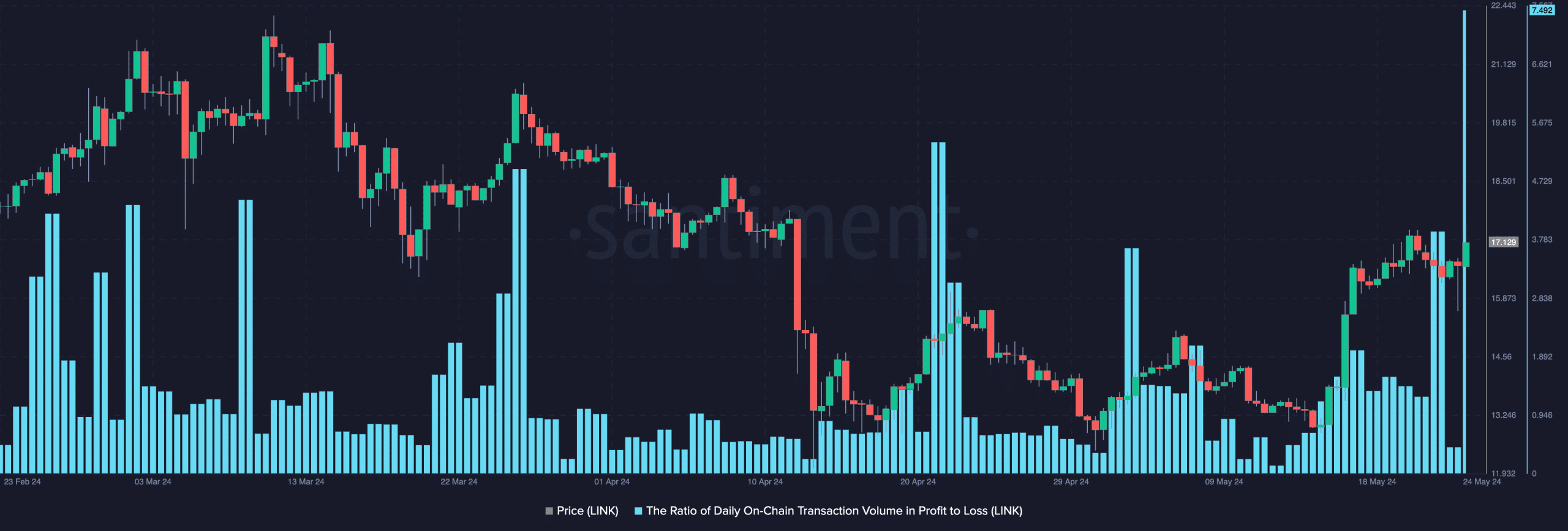

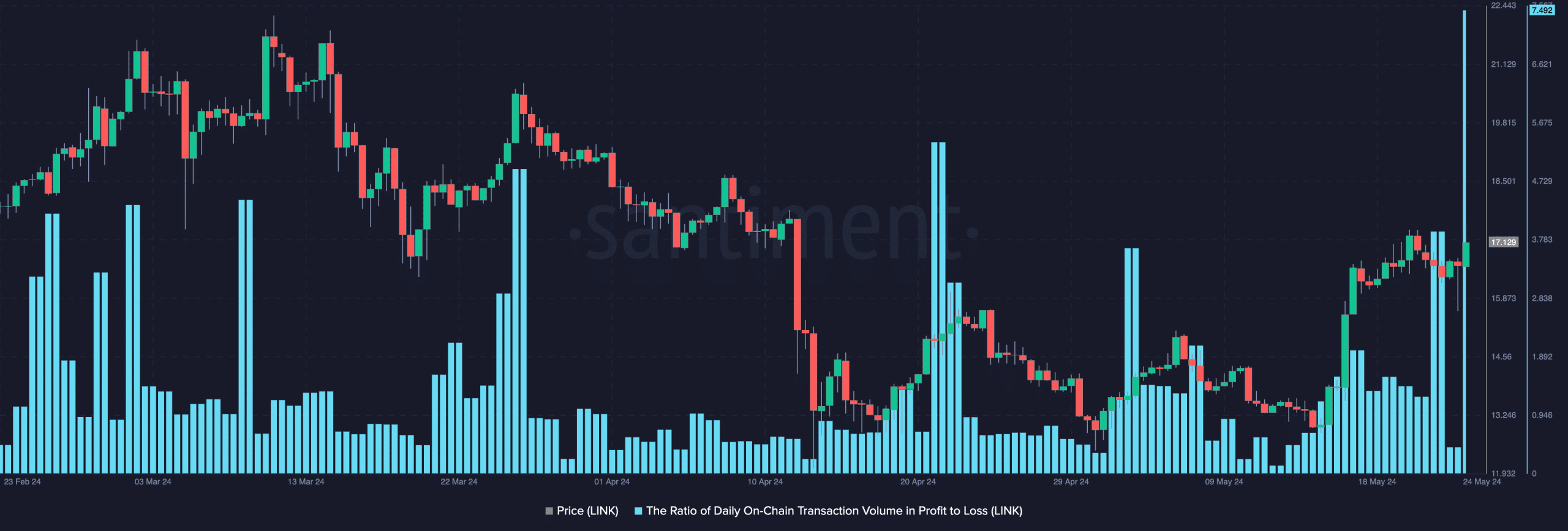

AMBCrypto assessed the ratio of LINK’s day by day transaction quantity in revenue to loss and located that it was 11 on twenty third Could. This signaled that for each LINK transaction that led to a loss throughout that buying and selling interval, 11 transactions returned a revenue.

As of this writing, this metric’s worth was 7.49, suggesting that worthwhile transactions remained excessive.

Supply: Santiment

Additional, the token’s Market Worth to Realized Worth (MVRV) ratio was 71.56%. This urged that LINK’s market worth was considerably increased than the typical acquisition worth throughout all holders.

Though it signaled that the token was overvalued, it additionally meant that LINK holders had been assured a revenue in the event that they bought.

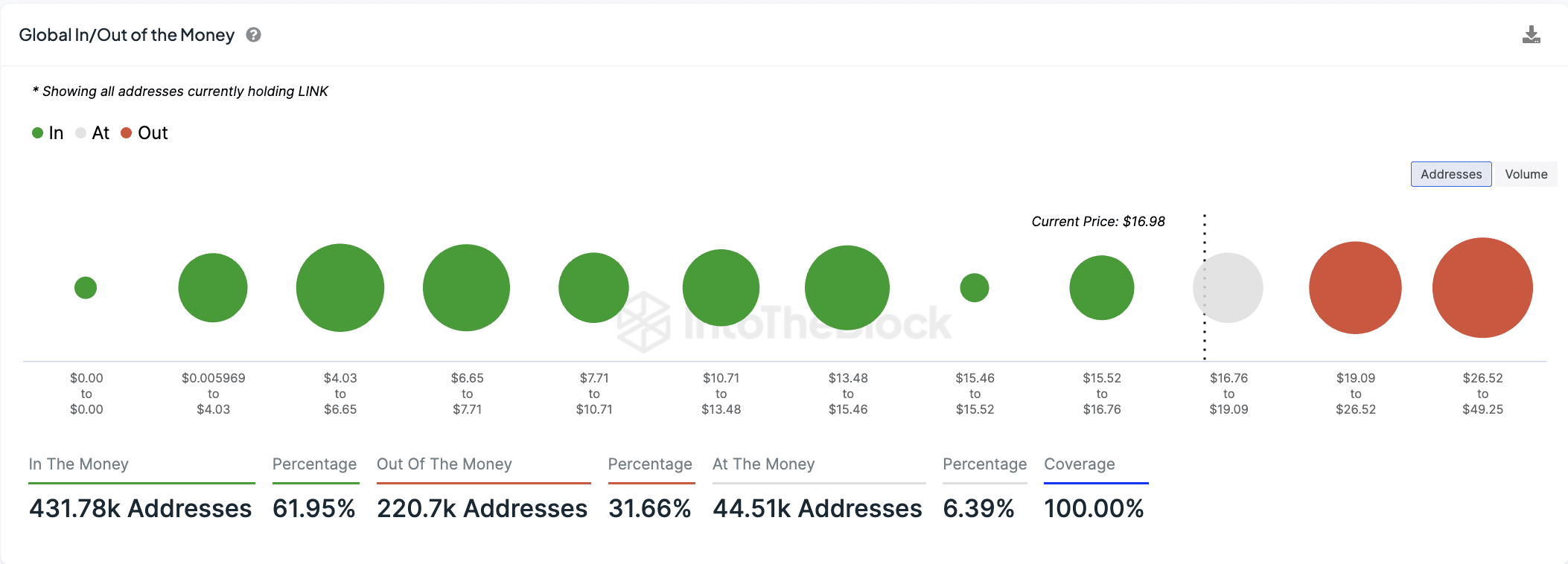

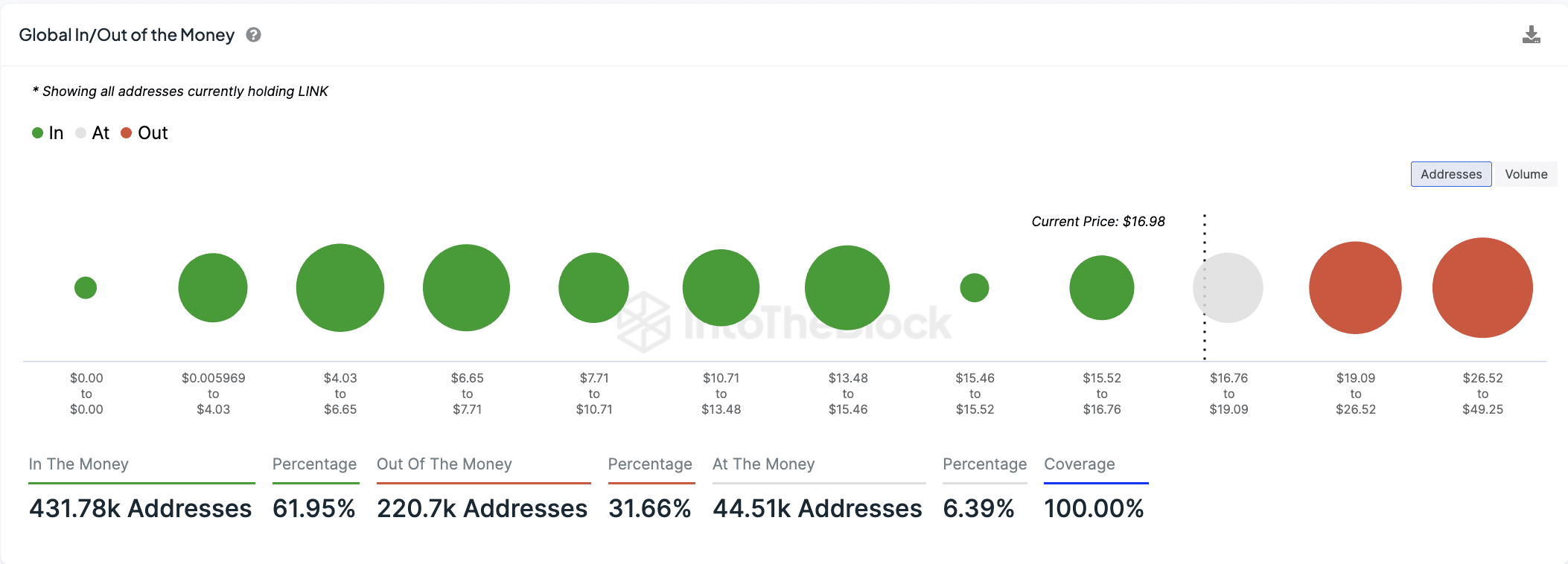

At present, 432,000 pockets addresses, which make up 62% of all LINK holders, are “within the cash,” in keeping with IntoTheBlock. These are traders who maintain the altcoin at a revenue.

Conversely, 221,000 addresses, representing 32% of all LINK holders, are “out of the cash,” holding their tokens at a loss.

Supply: IntoTheBlock

Don’t get carried away

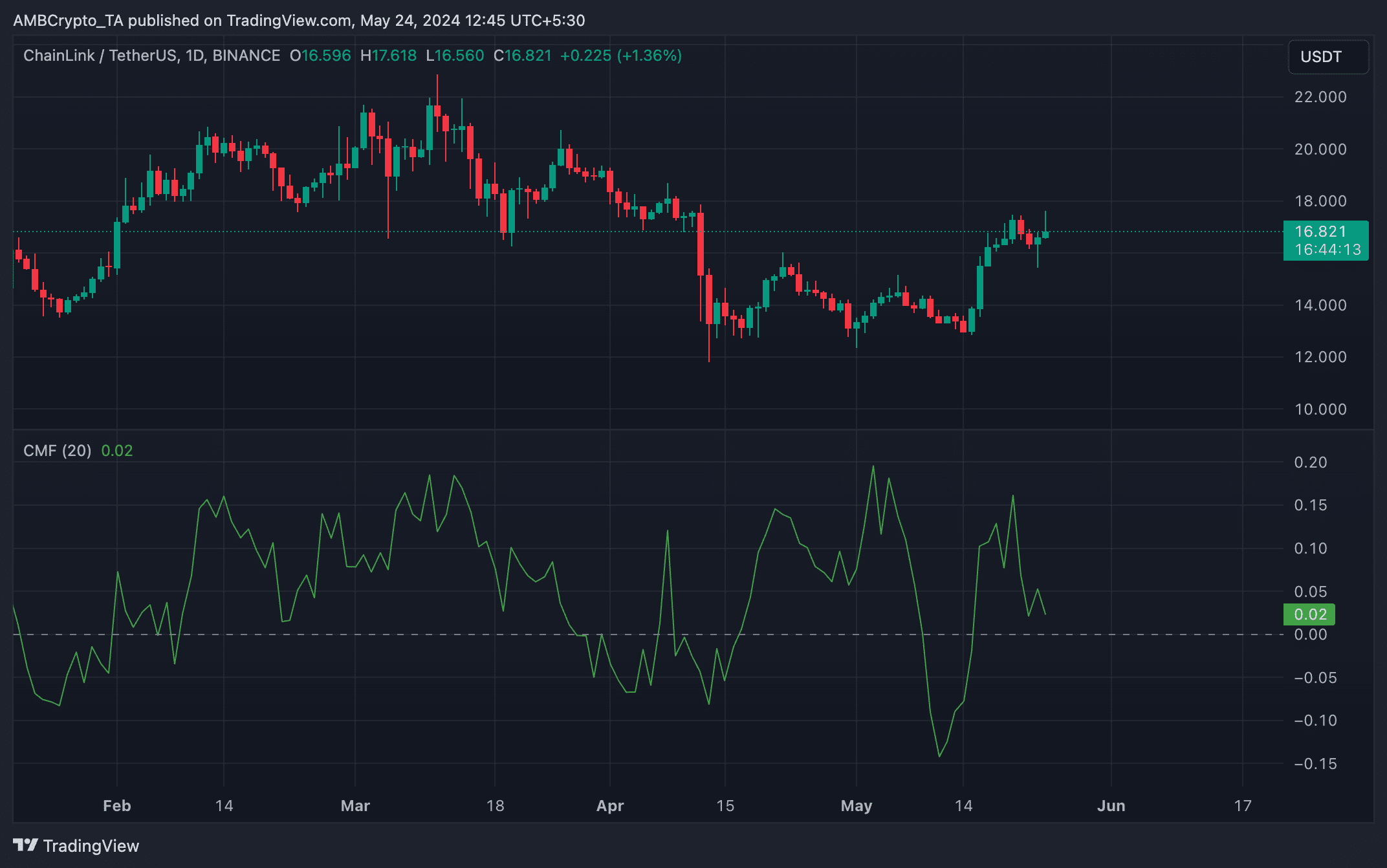

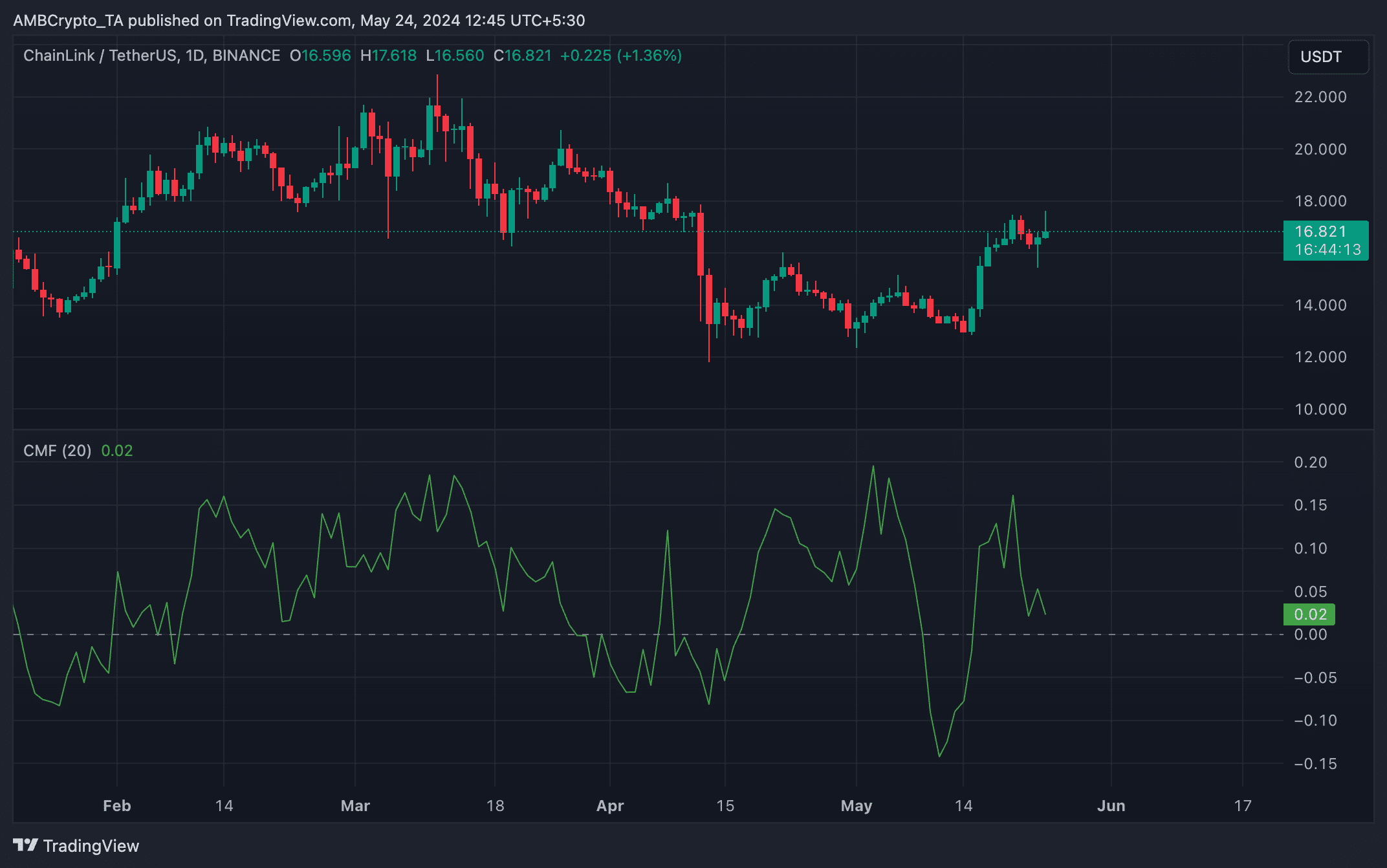

Regardless of LINK’s worth rally within the final week, a key technical indicator has trended downward, forming a bearish divergence.

Readings from LINK’s day by day chart revealed that its Chaikin Cash Circulation (CMF) declined at the same time as its worth surged over the previous seven days. This indicator measures cash flowing into and out of LINK’s market. At press time, LINK’s CMF was close to nits zero line at 0.02.

Supply: LINK/USDT on TradingView

Is your portfolio inexperienced? Take a look at the LINK Revenue Calculator

A bearish divergence is fashioned when an asset’s worth rallies whereas its CMF traits downward. This implies the shopping for quantity just isn’t as robust as anticipated although the asset’s worth is growing.

It suggests to market individuals that the value rally will not be sustainable.