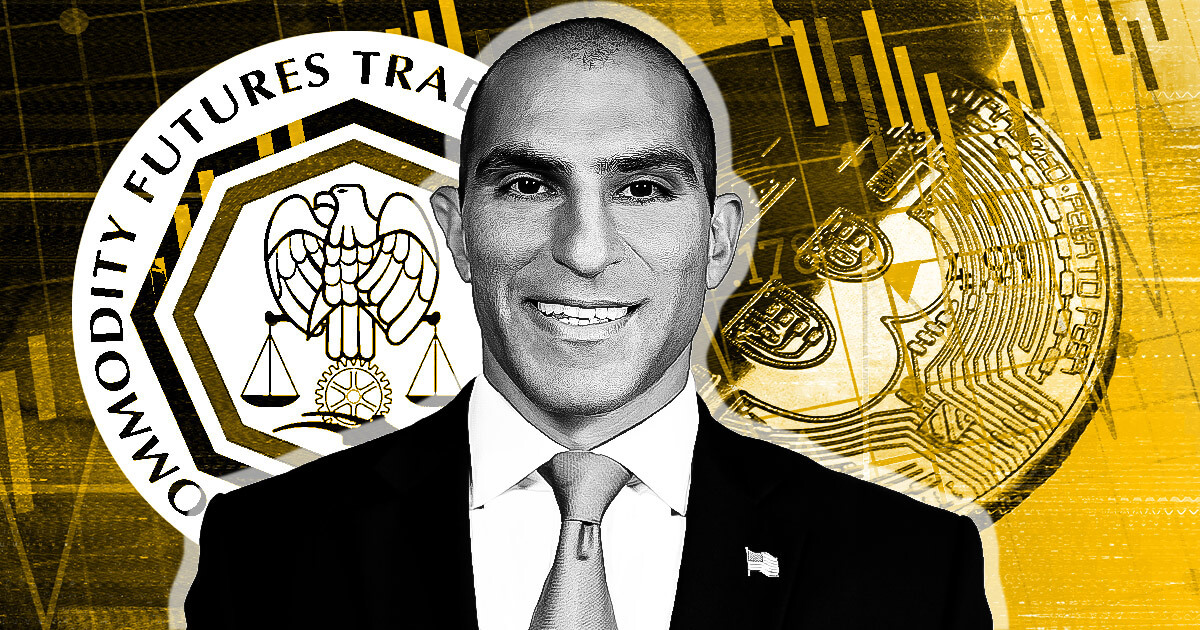

CFTC chair Rostin Behnam mentioned the company is open to serving as a major regulator for crypto throughout a Senate Agriculture Committee listening to on digital commodities oversight.

The listening to, held on July 10, broadly involved the CFTC’s request for extra regulatory authority.

Senator Roger Marshall requested Behnam whether or not it might be “less complicated” to make the CFTC a major regulator for digital belongings whereas leaving a small variety of “offshoots” for the SEC to deal with.

Behnam responded:

“I communicate for myself, [we] can be pleased to try this. I feel we’ve got the capability to try this the experience and the expertise.”

Nevertheless, Behnam mentioned adjustments to definitions of securities and commodities can be vital if the CFTC assumes major authority.

Cooperation with SEC helpful

Earlier, Marshall requested Behnam whether or not he helps the SEC being able to determine which belongings fall beneath the CFTC’s jurisdiction.

Behnam mentioned he doesn’t help the SEC making such selections alone however added that the 2 businesses have labored collectively to outline belongings in gray areas for about 50 years.

Marshall additionally requested whether or not the CFTC is anxious it could face lawsuits over conflicting asset designations. Behnam mentioned he “can’t say that it’s not going to occur,” however cooperation between the SEC and CFTC will assist tackle novel authorized questions.

Behnam acknowledged Marshall’s considerations that lawmakers might allow such lawsuits however pressured the necessity for a contract itemizing system that matches the CFTC’s current powers and permits cooperation with the SEC. Behnam mentioned:

“I feel there’s a technique to construct a system of itemizing contracts that doesn’t delay or delay the itemizing of contracts in a regulated market.”

Behnam mentioned the CFTC needs to introduce tokens and contracts to regulated markets “as quickly as doable” to cut back or get rid of investor dangers.

Most

Behnam believes that a good portion of the crypto market ought to fall beneath the CFTC’s purview because it can’t be categorised as securities. Through the listening to, Behnam mentioned that greater than 70% to 80% of the crypto market doesn’t fall beneath the class of securities, leaving the realm with no direct federal oversight.

He mentioned the CFTC wants at the least $30 million within the first yr and at the least $50 within the second yr to ascertain a regulatory regime. The funding would go towards staffing, administration, and IT spending. Person charges submitted by registrants would offset requested funds.

Behnam additionally affirmed Senator Cory Booker’s considerations round urgency, stating that if the CFTC doesn’t acquire authority, fraud and manipulation will proceed to influence people throughout the US.