New knowledge reveals that the general buying and selling quantity of centralized crypto exchanges (CEXs) plummeted in April after six consecutive months of good points.

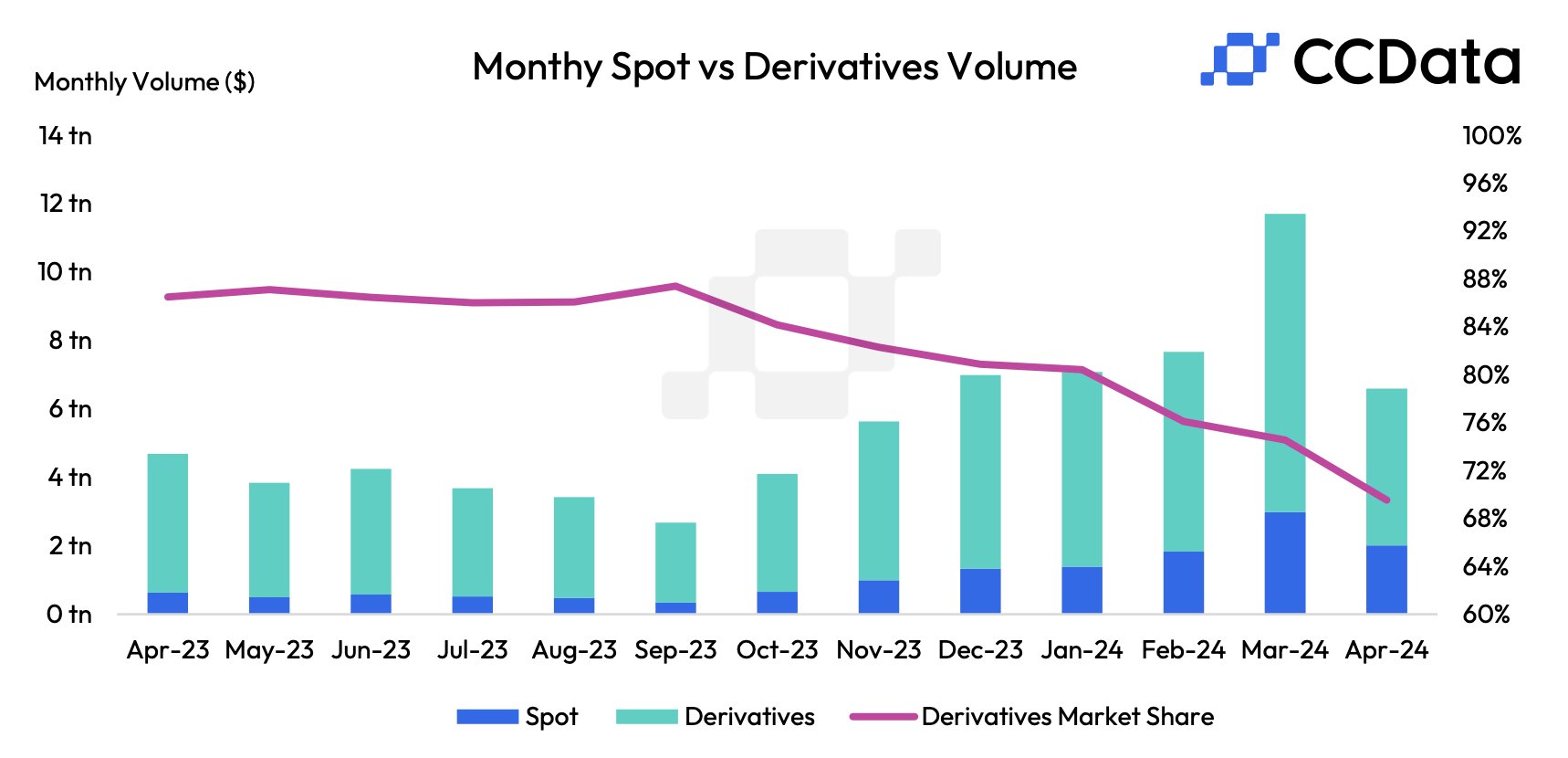

In response to blockchain tracker CCData, the mixed quantity of spot market and derivatives trading on centralized change platforms fell by a staggering 43.8% to $6.58 trillion.

The agency’s charts point out that in March, the mixed quantity was about $11 trillion and in February, it was roughly $8 trillion. Nonetheless, the chart additionally reveals that the general quantity in April 2024 remains to be larger than it was throughout any month in 2023 aside from December.

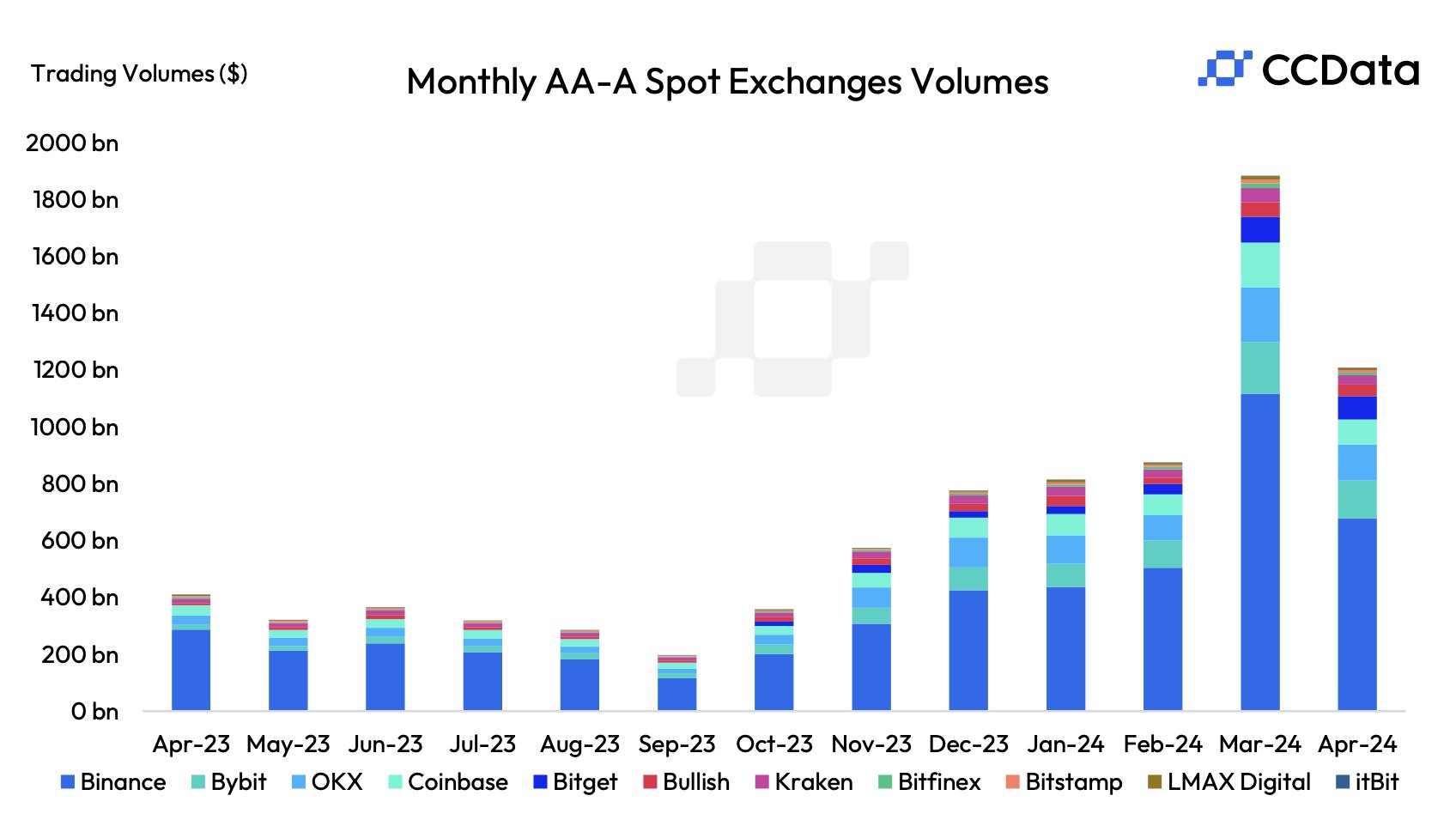

CCData goes on to notice the crypto exchanges that noticed essentially the most fall in quantity. In response to the agency, Bybit, OKX and Binance, the world’s largest crypto change by quantity, have been hit the toughest.

“Contemplating particular person exchanges, Binance (Grade A) was the biggest Prime-Tier spot change amongst AA-A graded exchanges by quantity in April, buying and selling $679 trillion (down 39.2%). Adopted by Bybit (Grade AA) buying and selling $133 billion (down 26.9%) and OKX (Grade A) buying and selling $126 billion (down 34.8%).”

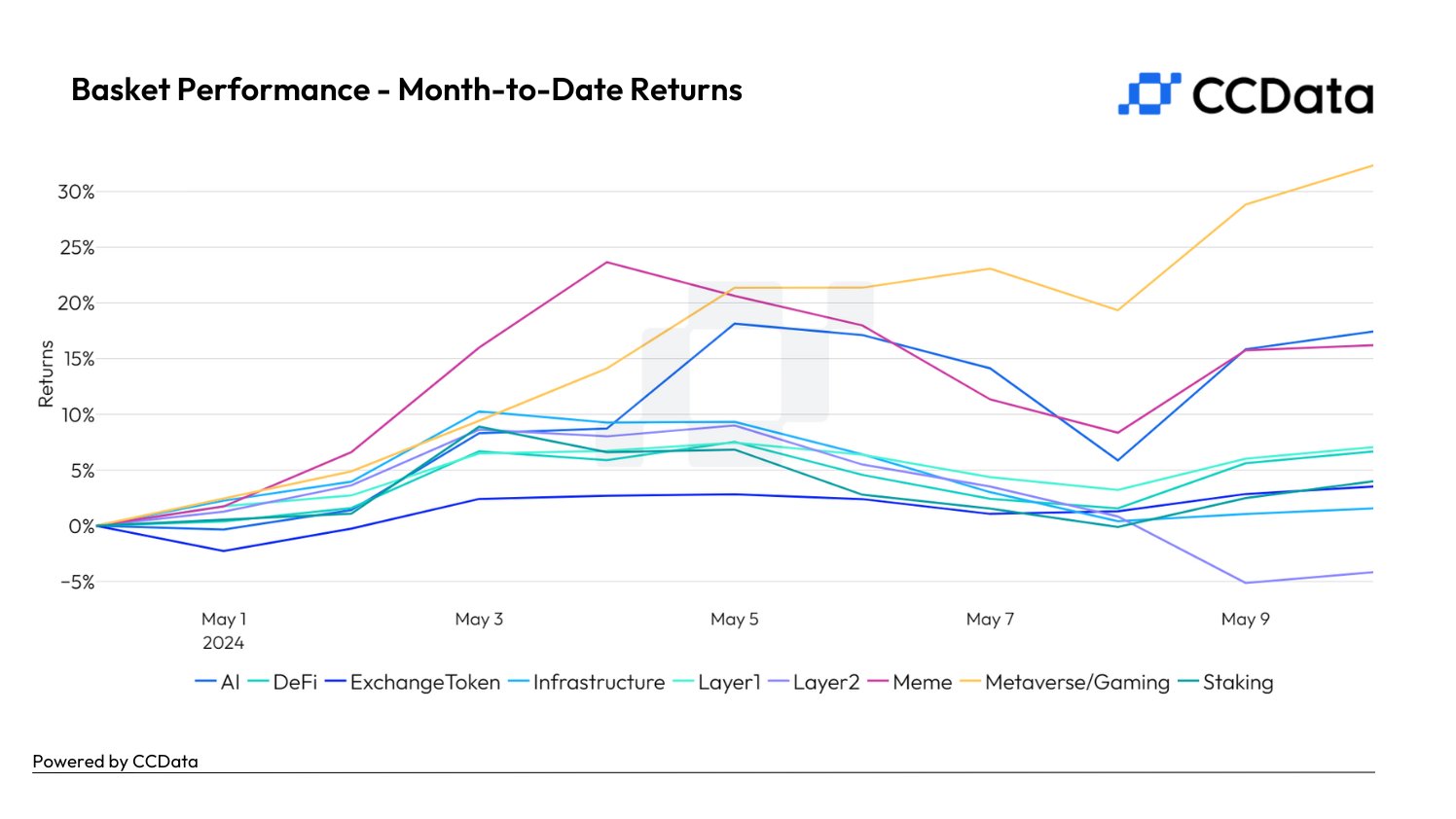

The info-aggregating agency additionally says that metaverse gaming, synthetic intelligence (AI) and meme tokens have seen double-digit returns month-to-date whereas layer-2 scaling options are within the negatives. The most important rise was within the metaverse/gaming sector, which noticed a 32.4% climb in returns from final month.

“Basket Efficiency Returns Month-to-Date:

Metaverse/Gaming: 32.4%

Meme: 16.2%

AI: 17.4%

Layer-1: 7.1%

DeFi: 6.7%

Staking: 4.0%

ExchangeToken: 3.5%

Infrastructure: 1.6%

Layer-2: -4.2%

As of Could tenth.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on X, Facebook and Telegram

Surf The Each day Hodl Combine

Generated Picture: Midjourney