Torsten Asmus

Welcome to a different installment of our CEF Market Weekly Overview, the place we focus on closed-end fund (“CEF”) market exercise from each the bottom-up – highlighting particular person fund information and occasions – in addition to the top-down – offering an outline of the broader market. We additionally attempt to present some historic context in addition to the related themes that look to be driving markets or that buyers must be aware of.

This replace covers the interval by means of the third week of December. Make sure you take a look at our different weekly updates masking the enterprise improvement firm (“BDC”) in addition to the preferreds/child bond markets for views throughout the broader revenue area.

Market Motion

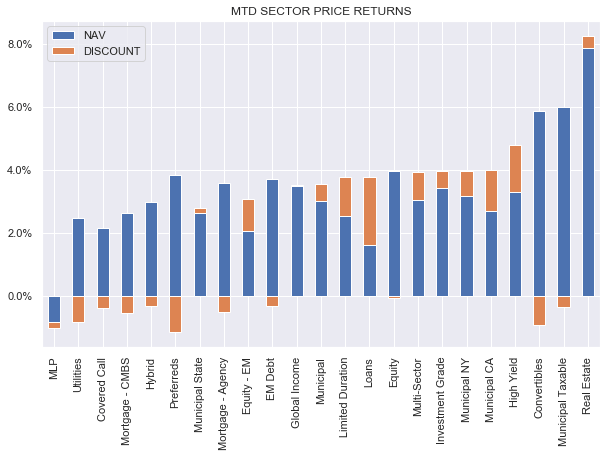

CEFs had a powerful week with a complete return above 2%. Month-to-date, all sectors however MLPs are within the inexperienced with whole returns between 2-8%.

Systematic Revenue

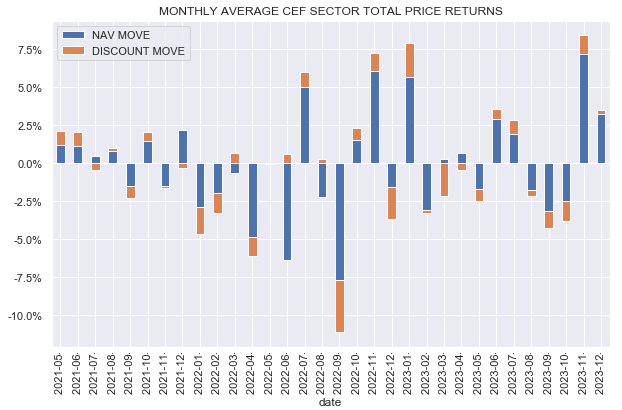

The December Santa Claus rally appears fairly good and follows a stellar November.

Systematic Revenue

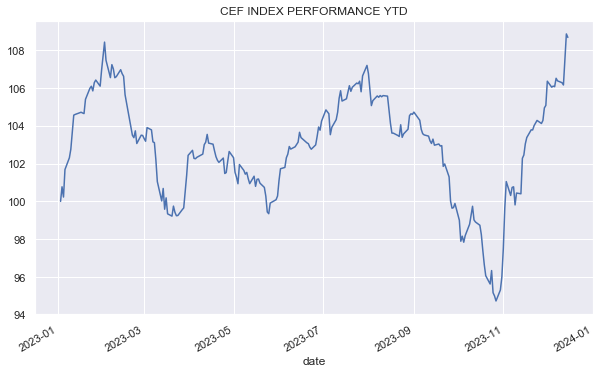

CEFs are at their peak whole return for the 12 months of round 8%.

Systematic Revenue

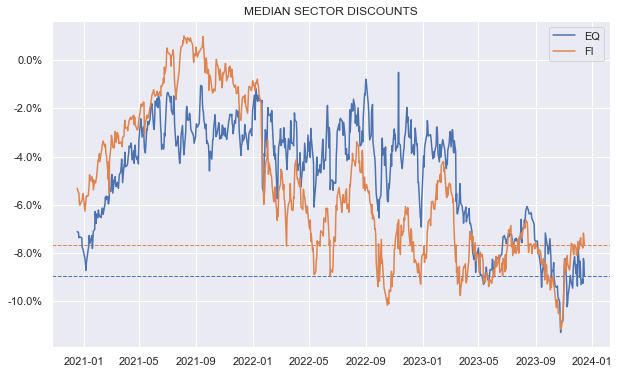

Whereas fixed-income CEF sector reductions have tightened properly, fairness CEF sector reductions stay depressed.

Systematic Revenue

Market Themes

We’re sometimes requested on the service whether or not coated name CEFs are simply kind of equities at a reduction. The attraction of coated name CEFs could be very apparent – you get to personal a portfolio of shares that you could possibly purchase out there straight however with two fundamental benefits. One, the coated name CEF offers you a a lot larger distribution price than the portfolio of particular person shares, and two, the shares throughout the CEF are provided at a reduction (as a result of, usually, the CEF trades at a reduction) whereas the shares purchased straight out there don’t have any low cost. Each of those beliefs are incorrect – we check out them individually on this part.

First, though coated name CEFs maintain equities they don’t seem to be actually equities funds – they’re coated name funds. It is because, whereas coated name funds do maintain shares (particular person or by way of ETFs), additionally they promote calls on their holdings.

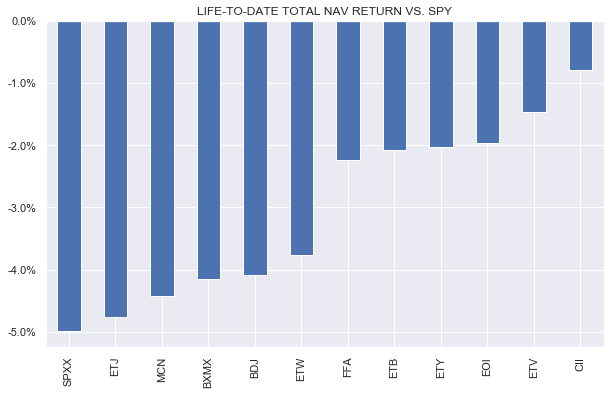

Aside from that necessary structural ingredient, one more reason why coated name CEFs aren’t “equities” is as a result of they underperform equities. For instance, all of the SPX-benchmarked coated name CEFs have underperformed the S&P 500 since their inception, starting from round 1% to five% each year.

Systematic Revenue

A few of that underperformance is because of charges and doubtless damaging alpha, nevertheless, one other is as a result of dynamic of coated name funds. Intuitively it would look like promoting calls on shares ensures {that a} coated name fund will underperform the underlying fairness index as a coated name fund offers away the upside in an atmosphere of rising inventory costs (which the market has loved for the reason that inception of all of the funds above). Nevertheless, that’s solely true if the compensation the coated name funds obtain for the calls is lower than what the market truly delivers.

Because of this it is necessary for buyers in coated name funds to have a way of whether or not at this time’s market atmosphere favors name promoting i.e. whether or not the volatility danger premium is engaging. This volatility danger premium is, roughly, the distinction between implied and realized inventory market volatility. The upper the implied volatility is relative to realized volatility, the upper is the volatility danger premium that decision promoting enjoys.

Coated name funds have tended to considerably underperform their inventory benchmarks as a result of the volatility premium has not been excessive sufficient. And, arguably, it has not been excessive sufficient due to the very reputation of coated name funds. The extra sellers of name choices there are, the decrease is the volatility danger premium. This leads to coated name holders not being sufficiently compensated for the technique.

One other necessary level is that, intuitively it would look like in a interval of flat inventory returns, coated name funds ought to outperform as they get the extra return from name premiums. Nevertheless, that is additionally not essentially true for two causes. Fund charges, once more. And the truth that a flat return interval isn’t one the place the shares are exactly flat every day, relatively it’s a interval when shares transfer up and down and return to roughly the identical level. This zig-zagging of returns is mostly not good for coated name funds.

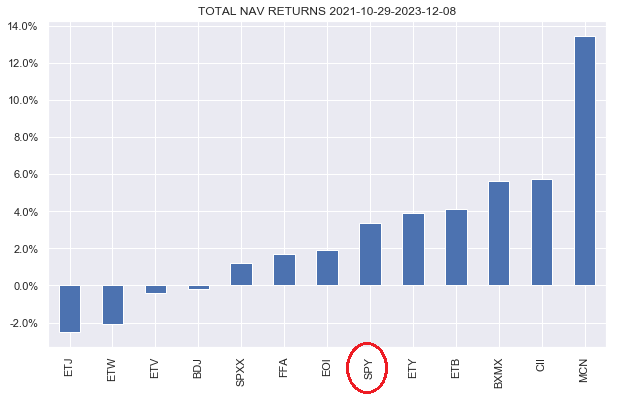

For instance, for the return interval of 29-Oct-21 to 8-Dec-23, a interval over which SPY was flat (in value phrases), which ought to be an absolute lay-up for coated name funds, nearly all of SPX-benchmarked coated name CEFs underperformed SPY as the next chart reveals.

Systematic Revenue

In brief, coated name CEFs aren’t “equities” for the straightforward motive that, other than the brief name place, they’ve tended to considerably underperform their underlying fairness benchmarks over the long run. This isn’t to say that particular person coated name funds cannot outperform their fairness benchmarks or that coated name funds will not outperform in a down market, however a market atmosphere just like what now we have seen up to now doesn’t favor these funds. This may occasionally change sooner or later however it could require the volatility danger premium to reset larger from historic ranges.

Turning to the low cost ingredient of the “coated name funds are equities at a reduction”, that is incorrect as nicely. A coated name CEF owns a basket of shares, nevertheless, not like the basket of shares, the fund costs buyers a large payment which may be prevented by means of direct inventory possession or an affordable fund tracker. The low cost that almost all coated name CEFs (and, the truth is, most CEFs) have isn’t a coincidence – it’s a reflection that there’s a payment levied on the portfolio of property which might typically be acquired at decrease price straight.

Total, buyers must watch out in considering of coated name funds as “equities at a reduction” for the essential motive that they do not ship equity-like efficiency and that the low cost is there for fair-value causes.

Market Commentary

CLO Fairness CEF, Carlyle Credit score Revenue Fund (CCIF) NAV got here in at $8.04 in November, a drop of round 2% from the earlier month. That is sudden given the power in broader credit score markets. That mentioned, different CLO Fairness fund NAV adjustments had been blended – OXLC NAV was up whereas ECC NAV was down. CLO Fairness strikes don’t all the time align with broader credit score markets as they’re extra akin to a buying and selling technique than a static credit score portfolio.

CCIF continues to construct out its portfolio so there may have been some buying and selling slippage prices in addition to a possible price to unwind its final legacy place. We should always get a greater sense of its NAV trajectory and efficiency relative to different CLO Fairness funds over the subsequent 12 months. The low cost primarily based on this NAV is 3.5% which is wider than the 3-5% premiums of OXLC, ECC, and EIC, making it a beautiful choice in its area of interest sector.

Stance And Takeaways

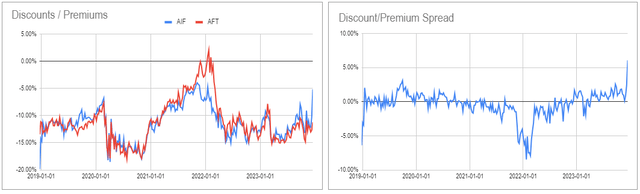

The mortgage CEF Apollo Tactical Revenue Fund (AIF) rose round 9% during the last week, making it pretty costly general in addition to relative to its sister CEF AFT. The 2 funds’ reductions have tended to commerce in lockstep with one another however have diverged most not too long ago. Because of this, we moved part of our allocation to its sister fund AFT which stays at a beautiful low cost.

Systematic Revenue CEF Device

Editor’s Be aware: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.