Scott Olson

Introduction

Cboe World Markets, Inc. (BATS:CBOE) is likely one of the world’s largest alternate operators. On this article, I will delve deeper into the corporate’s quarterly outcomes and clarify the expansion drivers and aggressive benefits I see that help the corporate being a nice long-term funding.

Firm Overview

Cboe World Markets is an alternate operator that gives its constituents a market to commerce numerous monetary belongings resembling equities, international alternate, digital belongings, in addition to derivatives and choices on these securities. Based in 1973, CBOE was formerly referred to as the Chicago Board Choices Trade, and was the preliminary alternate that allowed buyers to make use of alternate listed choices. As time progressed, it expanded the variety of securities it allowed choices buying and selling on and in addition launched its personal futures alternate. Quickly after, it acquired a number of corporations and expanded its presence to develop into the third largest alternate within the U.S. At present, it controls a 3rd of the market in listed choices as the biggest choices alternate within the U.S. and the biggest inventory alternate in Europe.

Latest Outcomes

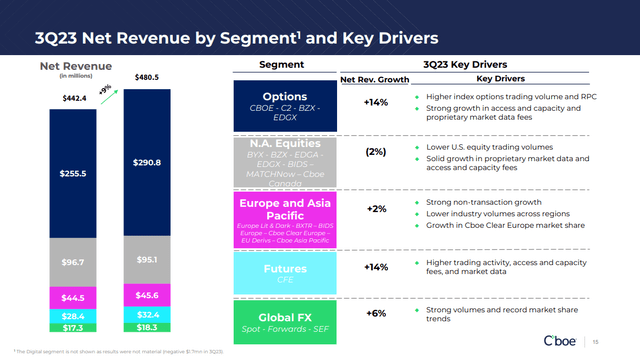

We are able to consider CBOE by way of the six totally different segments it operates: Choices, North American Equities, European and Asia Pacific Equities, Futures, World FX, and Digital. Under, I will focus on how every section carried out for Q3 outcomes introduced in November:

- Choices: For the third quarter, choices income made up 60% of total internet income and was up 14% 12 months over 12 months coming in at $291 million. Greater transaction volumes and clearing charges have been the first drivers however we additionally noticed first rate progress in market information charges.

- North American Equities: Internet revenues clocked in at $95 million (20% of complete internet revenues) and better revenues from the Canadian working section have been offset by decrease transaction and clearing charges.

- European and Asia Pacific Equities: Internet revenues got here in at $46 million (9% of complete internet revenues) and have been primarily pushed by larger market information charges (up 2% 12 months over 12 months).

- Futures: Internet revenues have been $32 million (7% of complete internet revenues), and have been up 14%. This was pushed by larger internet transaction and clearing charges, but additionally market information which was up 16%.

- World FX: Internet revenues got here in at $18.3 million (4% of complete internet revenues), 6% larger on the again of 5% progress in transaction charges and eight% progress in common day by day notional quantity. Market share elevated from 17.8% to twenty.2%

- Digital: For the quarter, this section reported a lack of $1.7 million.

For the quarter, administration additionally revised income steering upwards, forecasting complete natural internet income progress of between 7% and 9%. The corporate additionally now expects EPS for the total 12 months of 2023 EPS estimate of $7.66 (beforehand $7.41) and 2024 EPS of $7.97 (beforehand $7.67).

Q3 Highlights (Investor Presentation)

Total, I might think about CBOE’s outcomes to be relatively spectacular for the quarter. CBOE makes cash when there’s market volatility, and on condition that the VIX dropped 17.7% for the total 12 months 2023, these outcomes do not appear unhealthy in any respect with a document Q3 earnings variety of $2.06, up 18% 12 months on 12 months.

The notable standouts by way of segments listed below are the Choices and Futures segments. For Choices, this 14% progress is significant on condition that it makes up over 60% of the corporate’s complete revenues and is a progress engine for the enterprise. We’re beginning to see extra buyers and merchants use shorter length choices like zero days to expiration (0 DTE) which led to a good combine on SPX volumes, making up 48% of total SPX volumes. Common day by day quantity on these merchandise was up 33% 12 months on 12 months for the third quarter.

These merchandise appear to be standard each amongst individuals who wish to speculate on short-term buying and selling in addition to merchants who use these choices for extra precision in danger administration for actions like hedging, earnings era or expressing a directional view on markets. The shift to shorter length choices like 0 DTE additionally implies that revenues for Cboe is changing into extra reoccurring, which ends up in extra steady and predictable money flows. It additionally has the benefit of being much less cyclical, since buyers will use 0 DTE choices no matter the place the VIX is buying and selling or the place the market is at. On the earnings name administration famous the next:

These choices opened up an entire new danger premium for buyers to seize particularly intraday danger. And it’s unsure to extend is relating to the long run macro image, curiosity in capturing shorter time period traits and dislocations have led to the next share going to zero DT choices, now, comprising round 48% of all SPX volumes within the third quarter.

Nonetheless, it is essential to notice that whereas the zero DT choices are making up an even bigger a part of the pie, the pie itself is rising, as effectively. Different expiries are additionally seeing excessive quantity together with our customary month-to-month SPX choices contracts that expires within the third Friday of each month. We consider that bonus are getting used much less as we diversify our fairness danger and buyers are more and more turning to choices to assist hedge their portfolios.

So it might appear that given administration’s feedback, they’re optimistic on the developments and future outlook for the take up in 0 DTE choices. With common day by day buying and selling volumes throughout these merchandise up 60% 12 months on 12 months, I consider this additionally helps to clarify why revenues have been robust this quarter regardless of the VIX not shifting a lot.

Funding Thesis

One of many greatest elements defending Cboe’s aggressive place is an settlement signed between the corporate and S&P World (SPGI) which basically gave Cboe unique entry to supply alternate listed choices on S&P merchandise (S&P 500 Index, the S&P 100 Index, the S&P 500 ESG Index, and the S&P Choose Sector Indices) for the following ten years till December 31, 2033. It additionally has comparable agreements with MSCI and FTSE Russell lasting till April 1, 2030 and December 31, 2031, respectively.

For my part, this provides Cboe a leg up on the competitors being one of many solely suppliers of S&P choices except for its competitor the CME Group (CME). It is a supply of aggressive benefit that is protected by long-term contracts; contracts that may generate excessive margin revenues for the corporate.

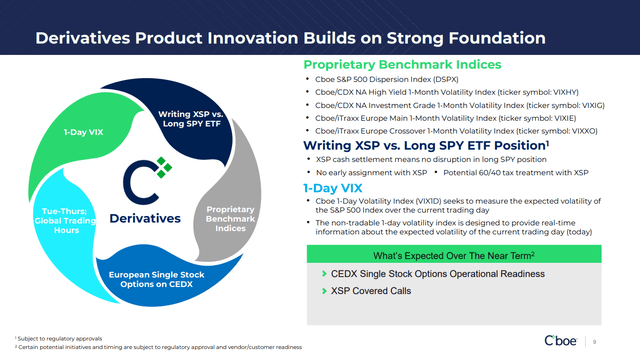

One other level that makes me bullish on the corporate’s outlook is the event of XSP choices, which simply acquired authorized by FINRA final 12 months. XSP choices have been rising in reputation with buyers as a result of they’re typically smaller than the usual SPX possibility contract at about 10% the dimensions and let’s merchants have extra flexibility in managing danger on the portfolio degree.

Provided that the money settlement for writing an XSP possibility has no bearing on lengthy SPY positions and that there isn’t a early task with XSP choices, I consider that is enticing for merchants. Extra favorable tax code therapy to XSP versus the choice is one more reason why many merchants are making the change. I view that is vital as a result of it solves a buyer want out there and contributes to the broader enchantment and adoption of XSP choices out there – all issues that bode effectively for Cboe.

XSP Choices (Investor Presentation)

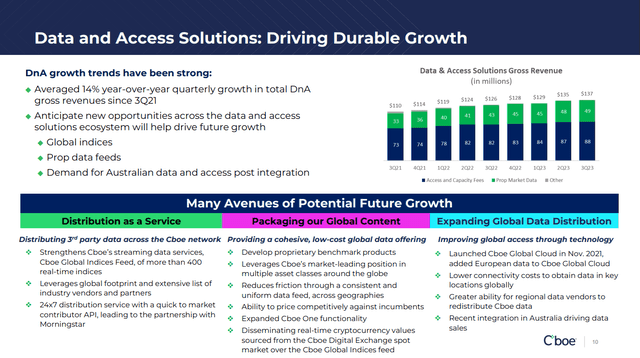

Lastly, the final main catalyst I see is within the firm’s Information and Entry Options enterprise which is rising quarter to quarter, regardless of market volatility. It is a steady a part of the corporate’s income that’s nonetheless placing up good progress of 14% 12 months over 12 months. As buying and selling turns into more and more extra environment friendly and aggressive, the info that Cboe sells turns into all of the extra helpful to massive institutional merchants, so this can be a long run avenue for progress for Cboe.

With indications from administration experiencing stronger demand within the APAC area, particularly within the Australian marketplace for this information, I consider there’s seemingly a world alternative to supply this information as a service to these outdoors the USA. I would not be shocked to see this enterprise section double or triple in dimension within the subsequent 5 years ought to that be the case, together with natural progress from the prevailing home revenues.

Information and Entry Options Enterprise (Investor Presentation)

Valuation

Primarily based on the 12 fairness analysis analysts with one 12 months goal costs on Cboe’s inventory, the typical goal worth is $179.82, with a excessive estimate of $204.00 and a low estimate of $138.00. From the typical this means upside of about 1.9%, suggesting shares are pretty valued. Remember the fact that fairness markets have risen since Q3 outcomes have been introduced in November, rising the share costs of many shares together with Cboe as charges have dropped, so the inventory hasn’t climbed in isolation.

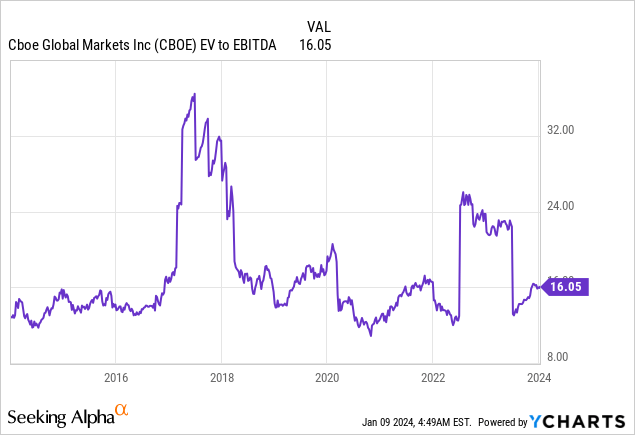

When wanting on the valuation for Cboe, the corporate trades at a reasonably cheap valuation of 16.0x EV/EBITDA or at about 24.6x P/E (15.1x ahead EV/EBITDA and 21.7x ahead P/E). When wanting on the historic EV/EBITDA vary, the corporate appears to be buying and selling in step with its historic valuation vary. The big spikes in 2017 and 2022 are a mirrored image of low buying and selling volumes which resulted in decrease EBITDA (therefore a spike within the EV/EBITDA a number of).

At 16.0x EV/EBITDA and 24.6x P/E, CBOE is available in at a barely higher valuation than its peer group of CME Group, Nasdaq (NDAQ), and Intercontinental Trade (ICE) at 18.7x, 17.4x, 16.4x EV/EBITDA and 23.9x, 25.4x, 29.8x P/E, respectively. So on common, the corporate is buying and selling about 1 flip cheaper on an EV/EBITDA foundation and a pair of turns cheaper on a P/E foundation, which means that the corporate is barely undervalued on a relative foundation. With consensus estimates of 10.2% progress in 2023 and seven.1% progress in 2024, 16.0x EBITDA looks as if a good a number of to pay for a top quality enterprise with minimal disruption danger.

Dangers

By way of the dangers to the funding thesis right here, just a few notes are price mentioning. Firstly, there’s been just a few adjustments in key management on the administration degree. Final 12 months in September, Edward Tilly resigned and was changed by Frederic Tomczyk. Edward Tilly was pressured to resign over failing to reveal earlier private relationships on the firm and was on the firm for over a decade. He performed an instrumental role in diversifying the enterprise away from simply choices into different areas of fintech and monetary markets. One among his biggest accomplishments on the firm was his function within the contract with S&P, which basically lets Cboe have a monopoly on a number of S&P merchandise. Another notable administration adjustments embrace David Howson changing into the corporate’s president in Could 2022 and the previous CFO Brian Schell leaving to pursue outdoors alternatives. He was replaced by Jill Griebenow, who was promoted inside the corporate. Whereas I do not assume these administration adjustments will steer the corporate in a brand new path, it is price mentioning to watch how administration executes over time. Within the case of Frederic Tomczyk, I believe he is fit for the job coming from TD Ameritrade and having been sitting on Cboe’s board since 2019.

Secondly, and maybe crucial danger for my part, is the chance of decrease market volatility. As revenues for Cboe are inclined to climb in intervals of market volatility with extra fairness and choices buying and selling, the corporate might see margins decline as nearly all of the corporate’s prices are mounted. Proper now, the VIX is presently sitting at about 13, beneath the long-run average of about 21. So it might appear that the chance can be to the upside right here. If volatility have been to spike out there, this could be good for Cboe as we are inclined to see buying and selling exercise enhance, which implies extra excessive margin clearing charges and different service associated revenues to Cboe.

Lastly, the final danger right here is fierce competitors from different exchanges, specifically the Members Trade and IEX. Concerning competitors, we will infer that competitors is one thing that administration views as extremely essential to watch on condition that they share market share for every of their segments and positive factors or losses quarter to quarter. For the latest quarter, we noticed market share positive factors in equities for Europe, Australia, Canada, and international FX, however we did see a decline in U.S. equities market share. It is arduous to get a pulse level in market share and know how you can interpret it quarter to quarter however Cboe’s market share in its enterprise segments have been regular over time. To keep up and develop its market share, Cboe invests closely into new and progressive applied sciences to keep up a aggressive market place.

Conclusion

In abstract, Cboe is increasing its choices and market presence and has maintained its dominance within the alternate enterprise. Its current quarterly efficiency highlights this effectively, demonstrating first rate progress throughout numerous segments, notably in choices and futures, contributing considerably to the corporate’s earnings. The event and rising reputation of XSP choices, coupled with unique agreements for providing exchange-listed choices on distinguished indices, current promising alternatives for income progress and sustained aggressive benefit. Within the Information and Entry Options enterprise, I would not be shocked to see worldwide enlargement 2x or 3x the section’s revenues within the subsequent 5 years, because the section places up 14% progress 12 months on 12 months, with revenues rising each quarter. At a pretty valuation, it trades at a slight low cost to its friends and its in step with its historic a number of so I consider buyers as we speak are paying a good worth for the expansion right here going ahead.