- ADA fell by 13% within the final 24 hours

- Technical indicators pointed to an additional value decline within the making

Cardano [ADA] is within the information at the moment after it revealed its March growth highlights. Nonetheless, that’s not the one cause it grabbed headlines. In reality, it additionally did so for all of the incorrect causes after ADA noticed crimson on the charts and dropped by 13% because of the market crash.

Cardano doing effectively on dev entrance

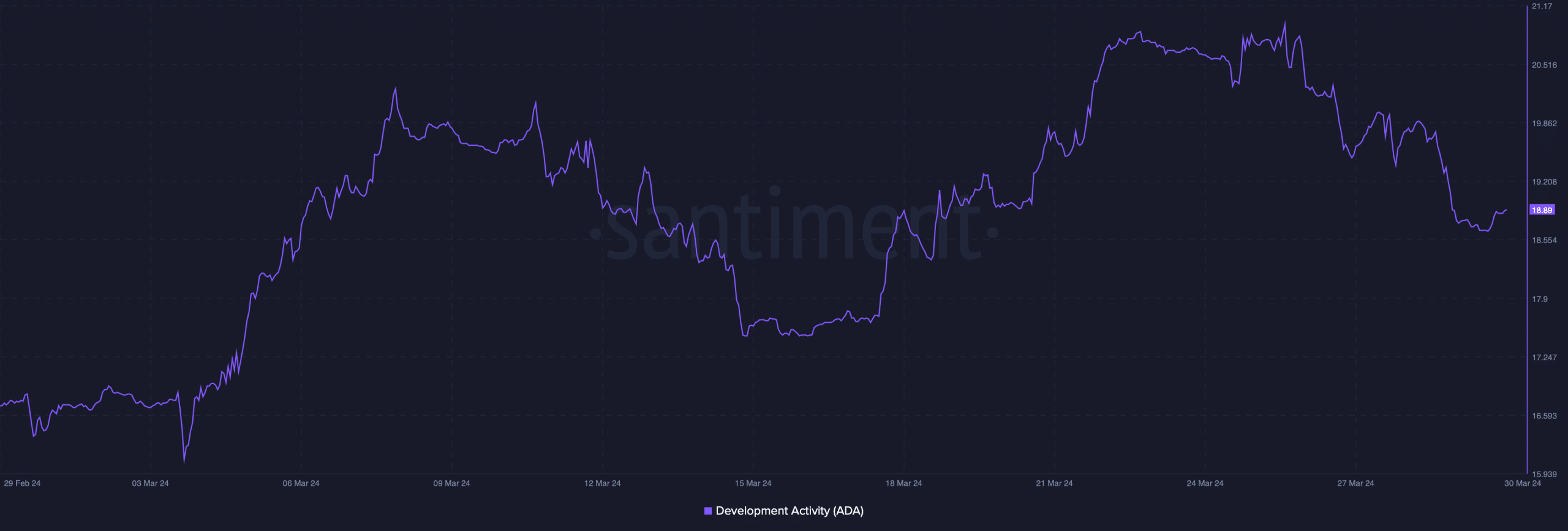

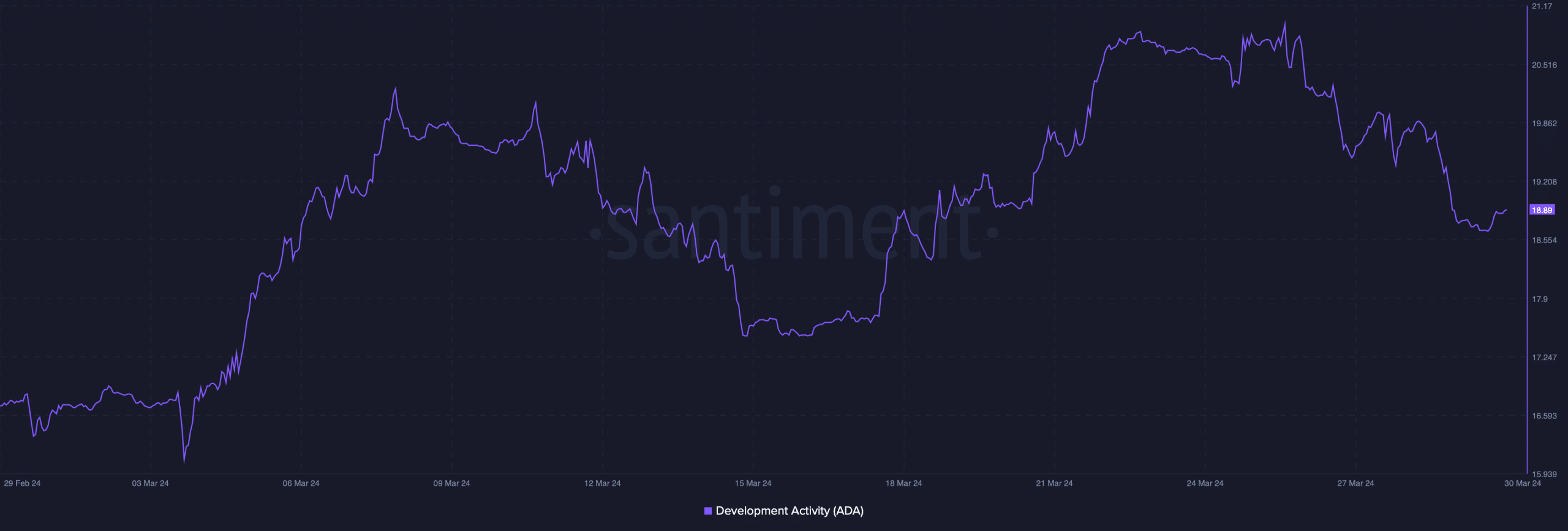

AMBCrypto’s evaluation of Santiment’s information revealed that growth work round Cardano has remained excessive. This was evidenced by its dev exercise chart, with the identical remaining steadily excessive in March.

Supply: Santiment

Enter Output, the developer of Cardano posted an X thread sharing the efforts made by builders over the past month of Q1. As per the identical, the groups launched Cardano node v.8.9.0, which launched Genesis Lite bootstrap friends, re-certifying a bug to enhance total efficiency.

As a way to enhance scalability, the Mithril crew additionally launched Mithril distribution 2408.0, which included stake distribution enhancements and others. Aside from this, the report additionally talked about that ADA’s whole variety of transactions elevated by 2.3 million over the month. Moreover, three new tasks had been launched in March on the Cardano blockchain.

Cardano is going through bears’ wrath

Cardano exited March with a slight decline in its value, in comparison with the start of the month, as its value fell to $0.64. April didn’t carry excellent news for traders both because the token’s value dropped by practically 13% in 24 hours.

Based on CoinMarketCap, on the time of writing, ADA was buying and selling at $0.5071 with a market capitalization of over $18 billion, making it the tenth largest crypto. The potential of ADA’s value going additional down in April appeared probably, as most metrics flashed bearish indicators.

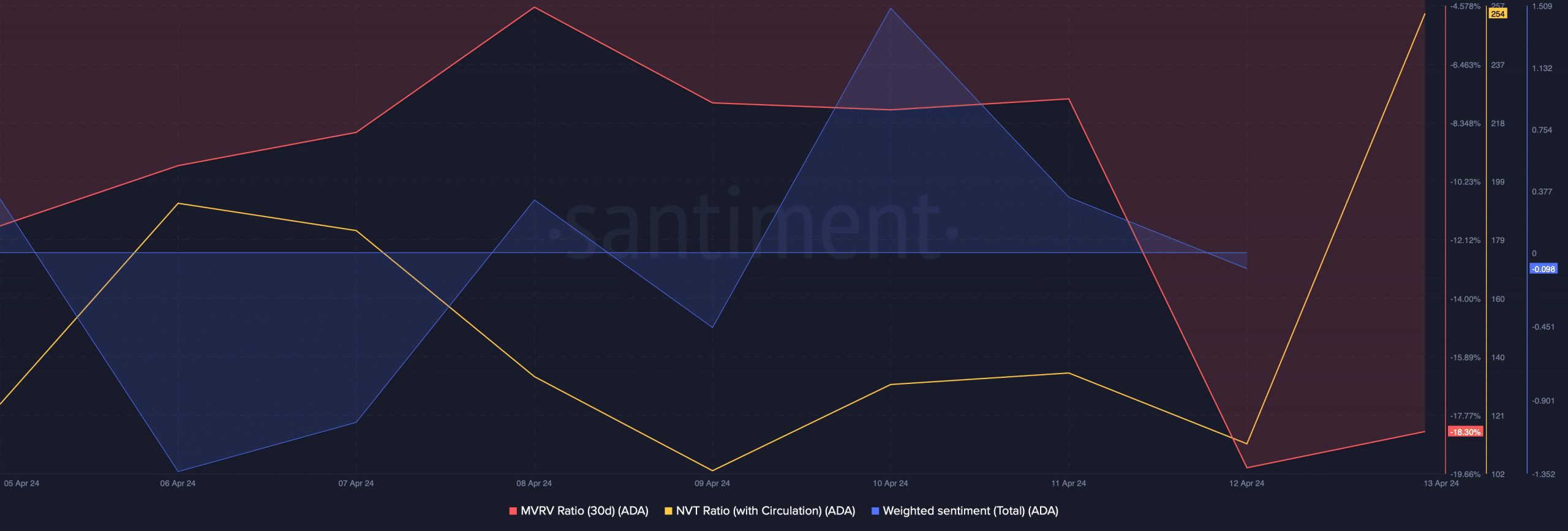

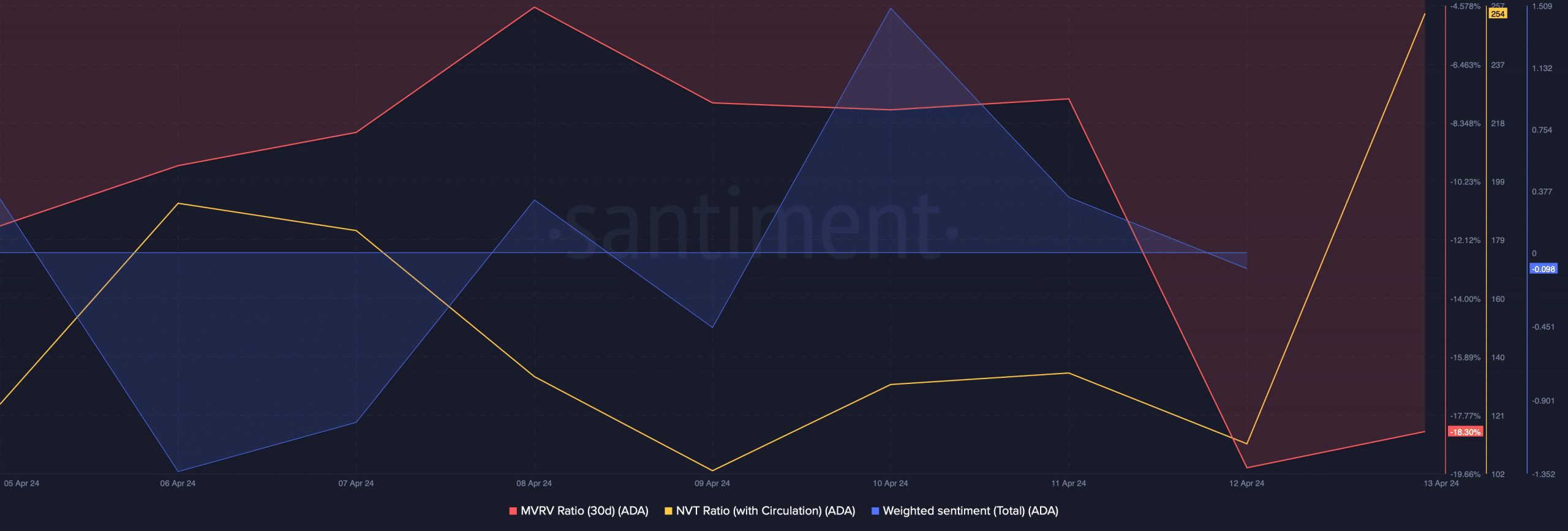

Our evaluation of Santiment’s information revealed that Cardano’s MVRV ratio dropped sharply. At press time, it had a worth of -18%. Sentiment round ADA additionally turned bearish, as is obvious from the drop in its weighted sentiment on 12 April. Furthermore, the token’s NVT ratio spiked sharply. An increase within the metric means that an asset is overvalued, hinting at an additional value drop within the coming days.

Supply: Santiment

Learn Cardano’s [ADA] Value Prediction 2024-25

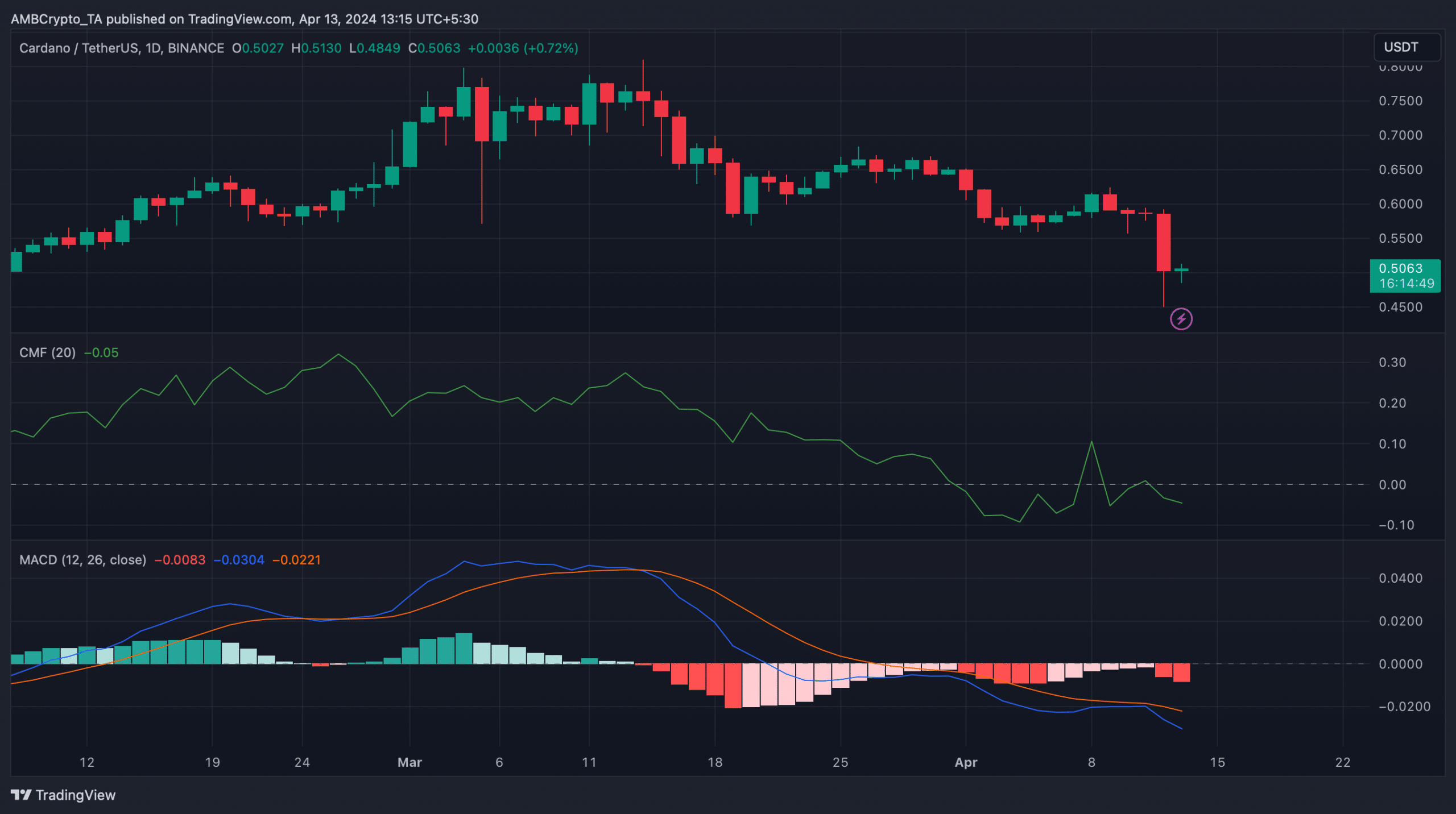

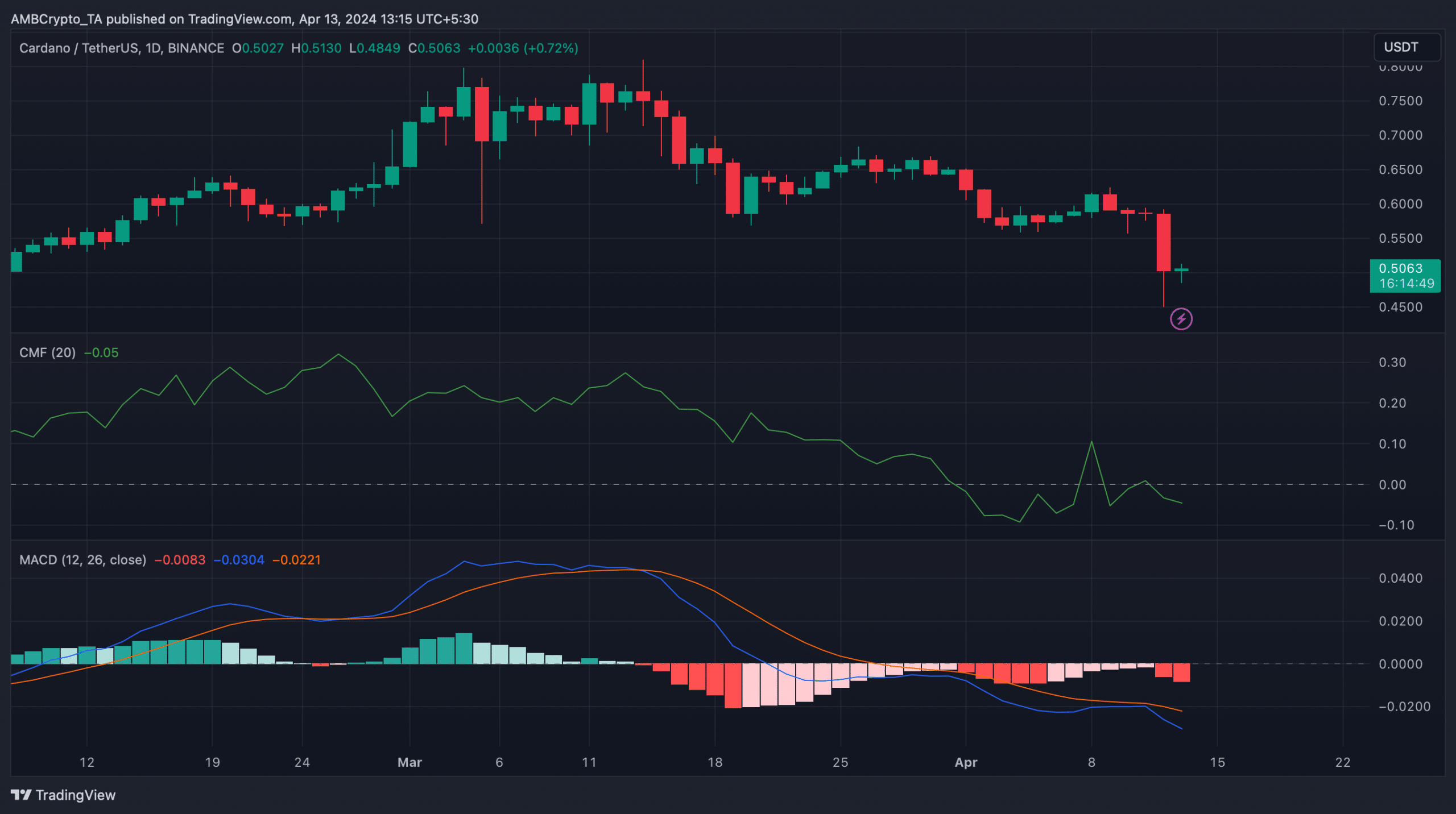

We then analyzed Cardano’s every day chart to see whether or not indicators additionally hinted at an additional value decline. ADA’s MACD displayed a transparent bearish higher hand out there.

Moreover, the Chaikin Cash Circulate (CMF) registered a pointy downtick on 12 April. Each of those technical indicators supported the sellers and indicated that traders may witness ADA’s worth drop within the coming days.

Supply: TradingView