- ADA was down by greater than 23% during the last seven days.

- Most metrics and indicators supported the opportunity of ADA testing the bull sample.

Much like most cryptos, Cardano [ADA] bears have been main the market because the token’s worth charts remained pink. Nevertheless, there have been adjustments of a pattern reversal as a bull sample fashioned on ADA’s chart.

Will this enable ADA to show its charts inexperienced whereas Bitcoin [BTC] undergoes its subsequent halving on the nineteenth of April?

Cardano bulls are waking up

The final week was disastrous for ADA buyers because the token’s worth declined by a whopping 23%. In response to CoinMarketCap, within the final 24 hours, ADA dropped by over 2.5%.

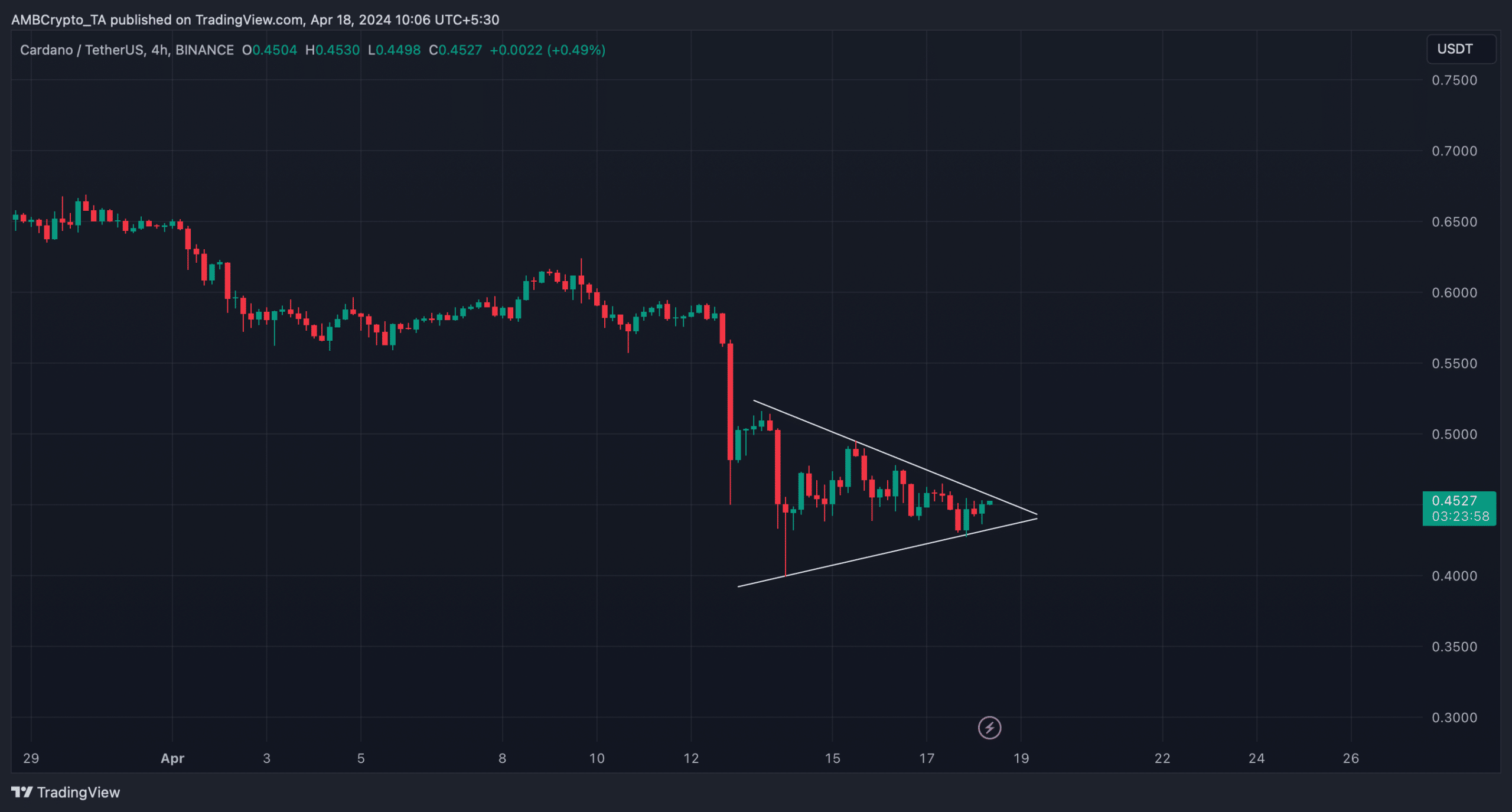

However there was extra to the story, as ADA’s worth was consolidating inside a bullish symmetrical triangle sample at press time, which hinted at a bull rally.

Supply: TradingView

AMBCrypto’s evaluation of ADA’s 4-hour chart revealed that if the token’s worth breaks above the $0.454 resistance degree, then it would witness a robust bull rally as BTC undergoes its fourth halving course of.

The potential of ADA testing the sample appeared excessive, because the token’s worth had elevated by 1.15% within the final 60 minutes.

At press time, it was buying and selling at $0.4498 with a market capitalization of over $16 billion, making it the tenth largest crypto.

ADA heading in the right direction

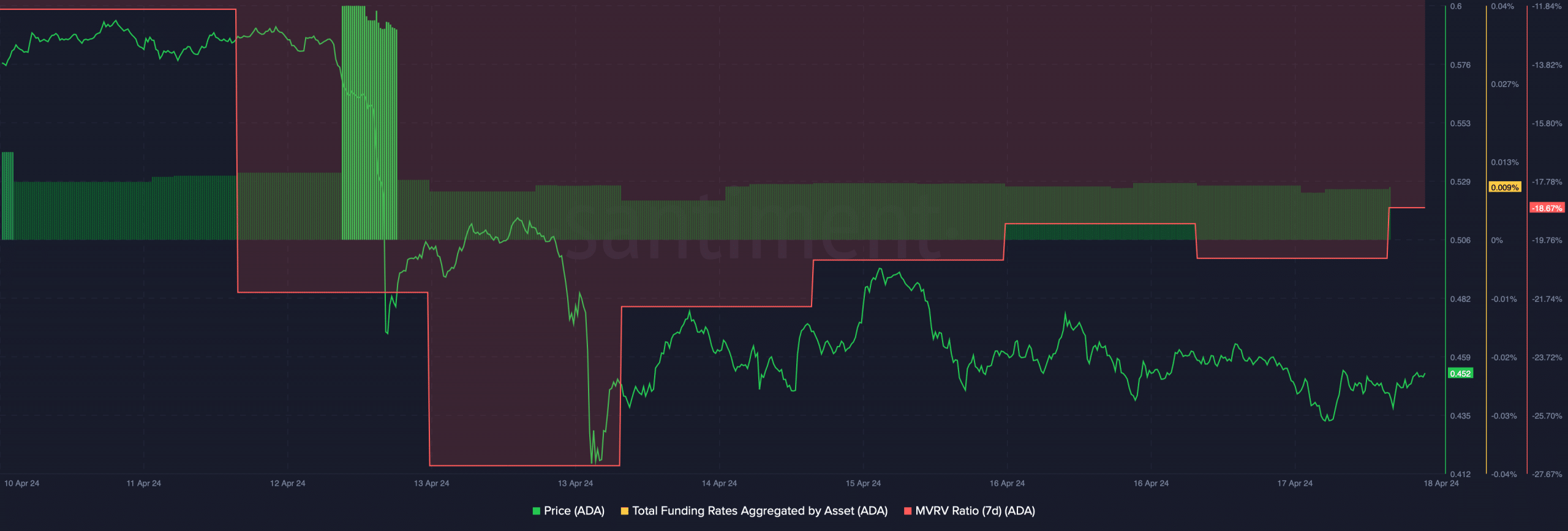

Aside from worth motion, a number of of the metrics additionally seemed bullish. AMBCrypto’s test on Santiment’s knowledge identified that ADA’s 7-day MVRV ratio improved over the previous couple of days.

Its Funding Fee had additionally dropped. Since costs have a tendency to maneuver the opposite approach than the funding price, there was a risk of ADA registering a worth uptick quickly.

Supply: Santiment

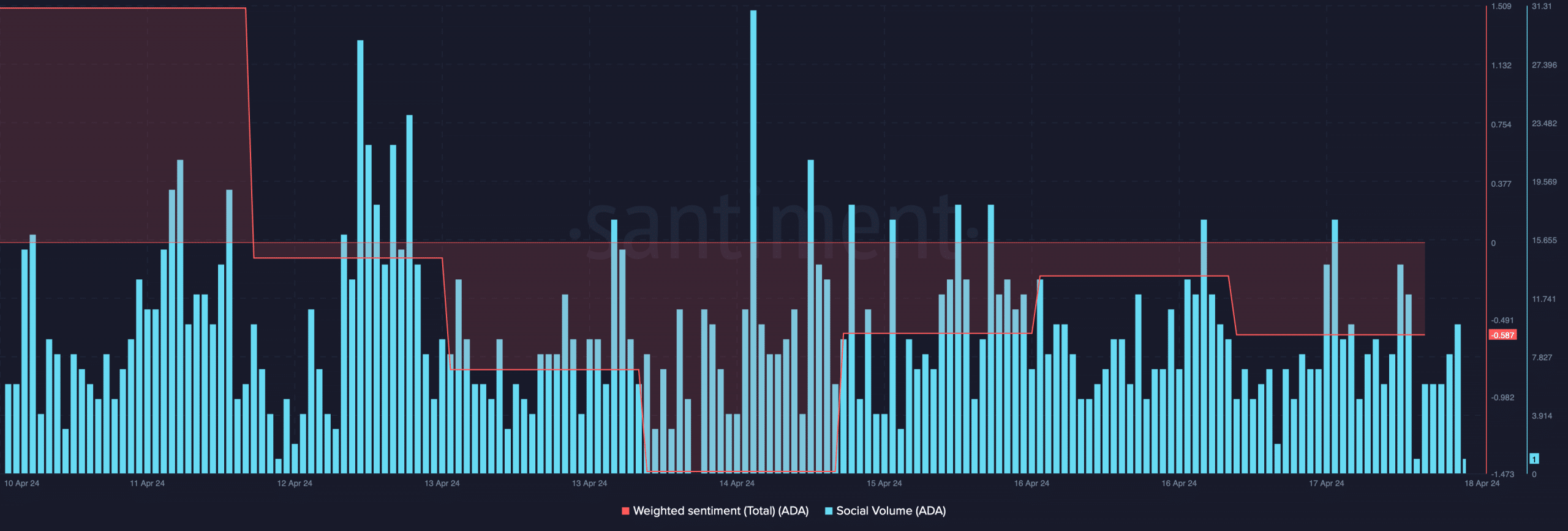

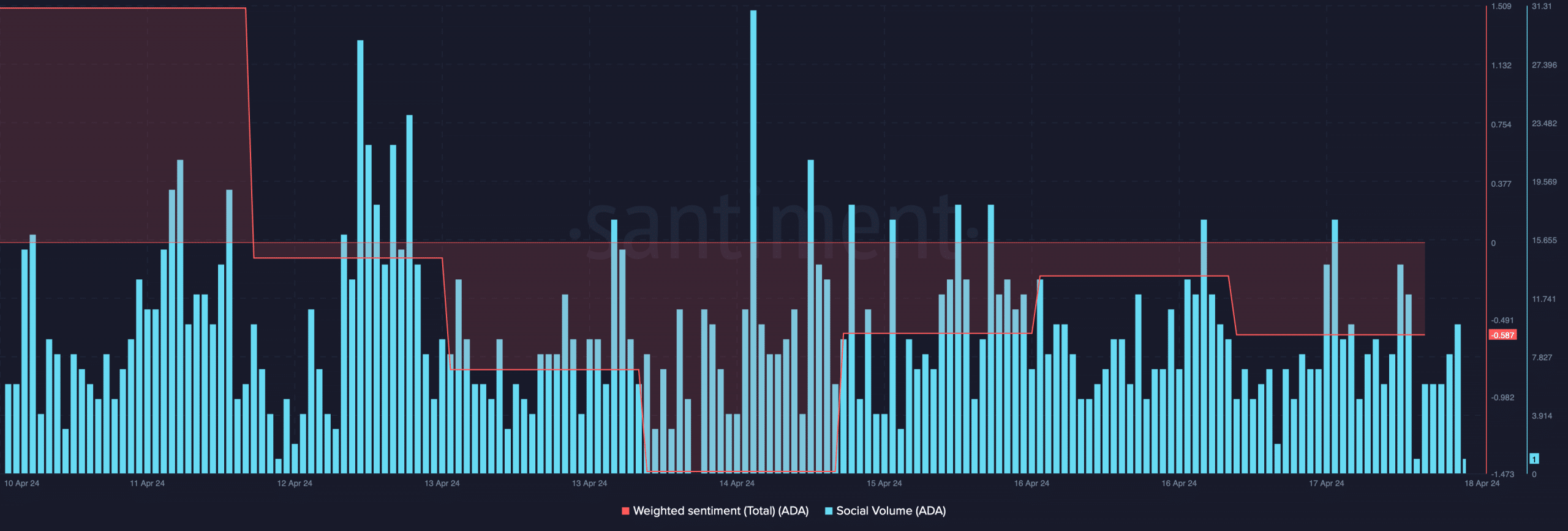

The token’s social quantity remained comparatively excessive all through the final week, with a considerable spike on the 14th of April. The rise in social quantity clearly mirrored Cardano’s reputation within the crypto house.

Furthermore, its Weighted Sentiment rose final week after dropping on the 14th of April, suggesting that bearish sentiment across the token began to say no.

Supply: Santiment

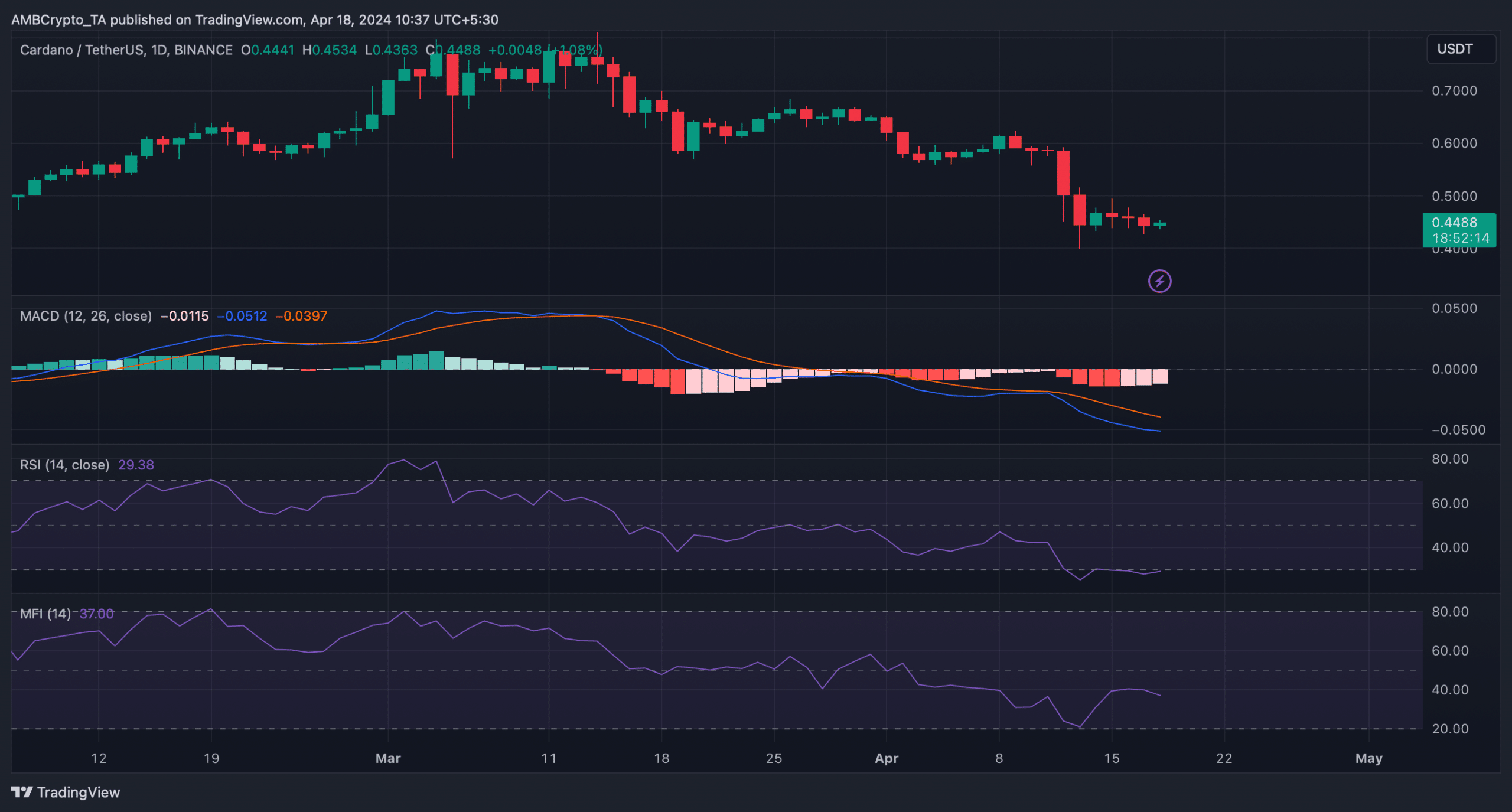

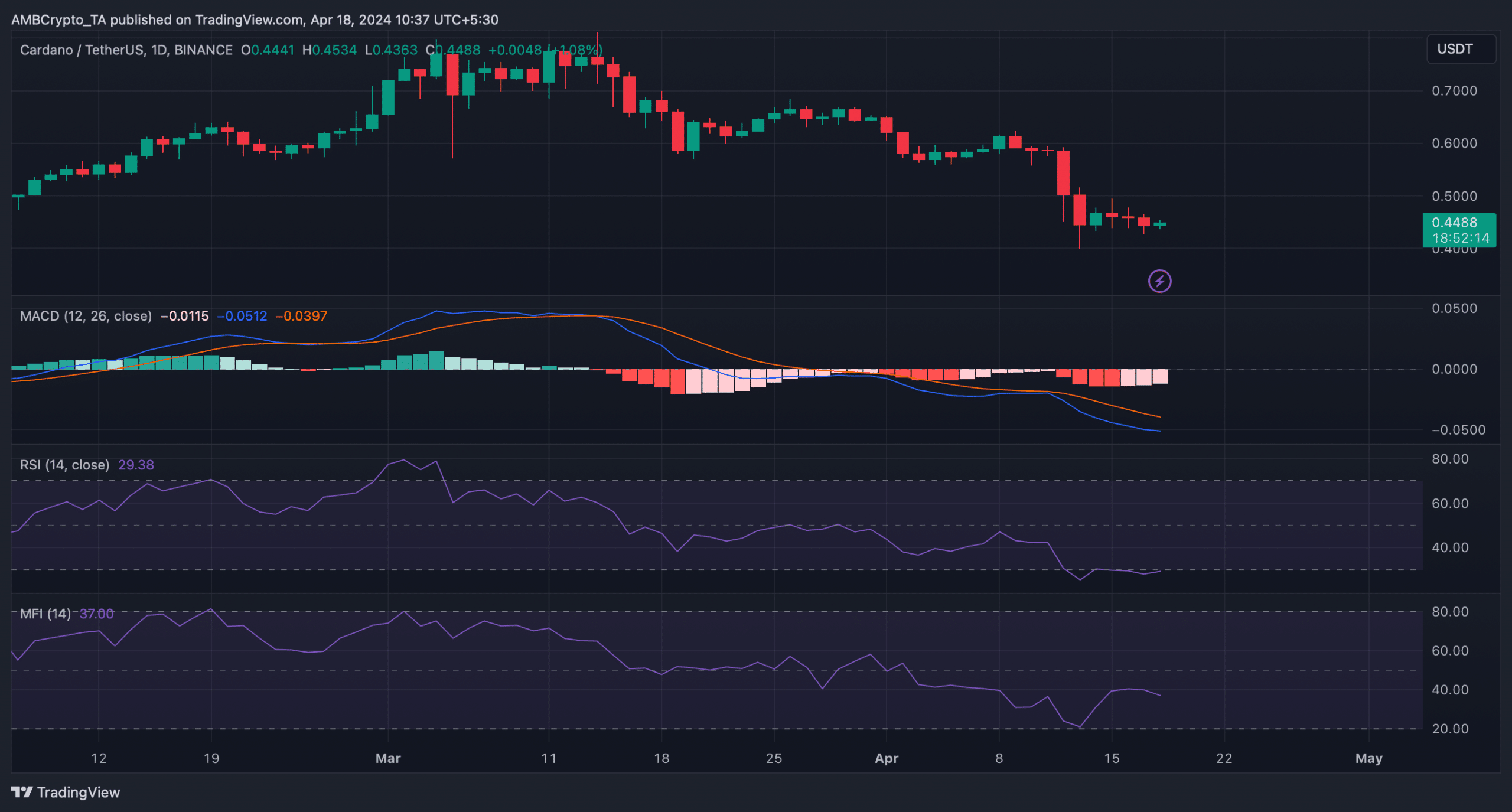

To higher perceive whether or not ADA will handle to go above the $0.454 resistance degree, we then took a take a look at its every day chart. We discovered that Cardano’s Relative Power Index (RSI) was within the oversold zone.

Learn Cardano’s [ADA] Value Prediction 2024-25

This indicated that purchasing strain on the token may enhance quickly, leading to a worth enhance. Nevertheless, the MACD displayed a bearish benefit available in the market.

The Cash Circulate Index (MFI) additionally declined, which hinted that ADA may take extra time to show bullish.

Supply: TradingView