- ADA’s MVRV ratio has flashed a purchase sign.

- Its present holders are coping with vital losses.

Cardano’s [ADA] 6% value decline up to now seven days has introduced a shopping for alternative for these seeking to commerce towards the market.

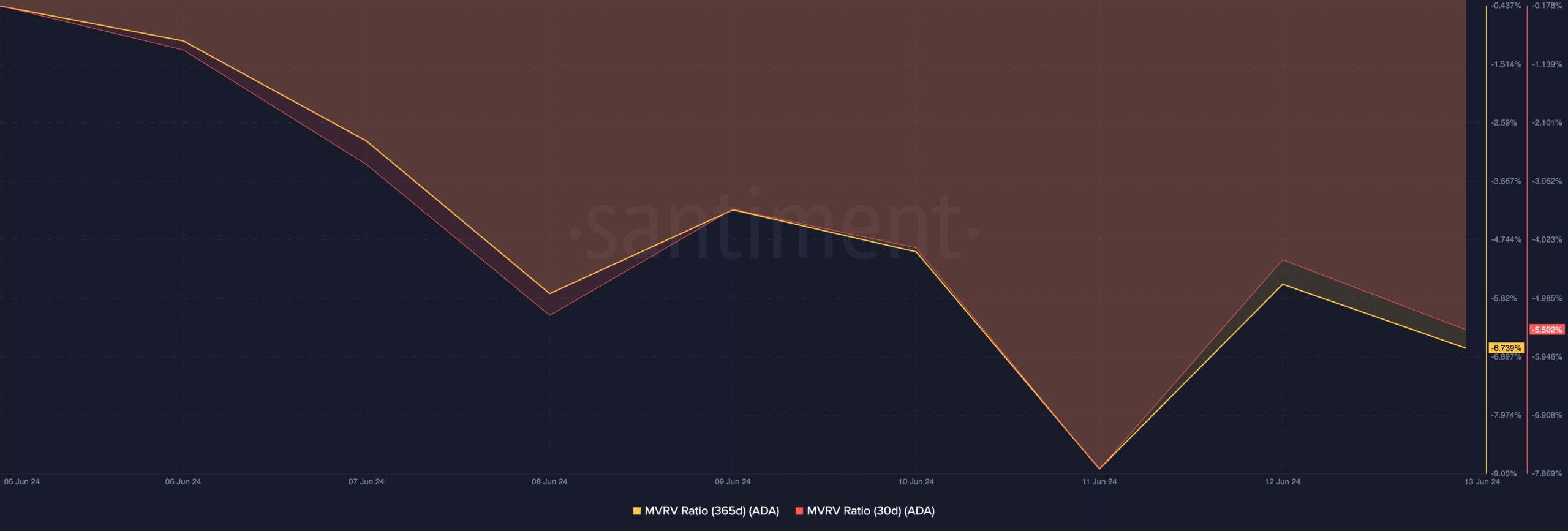

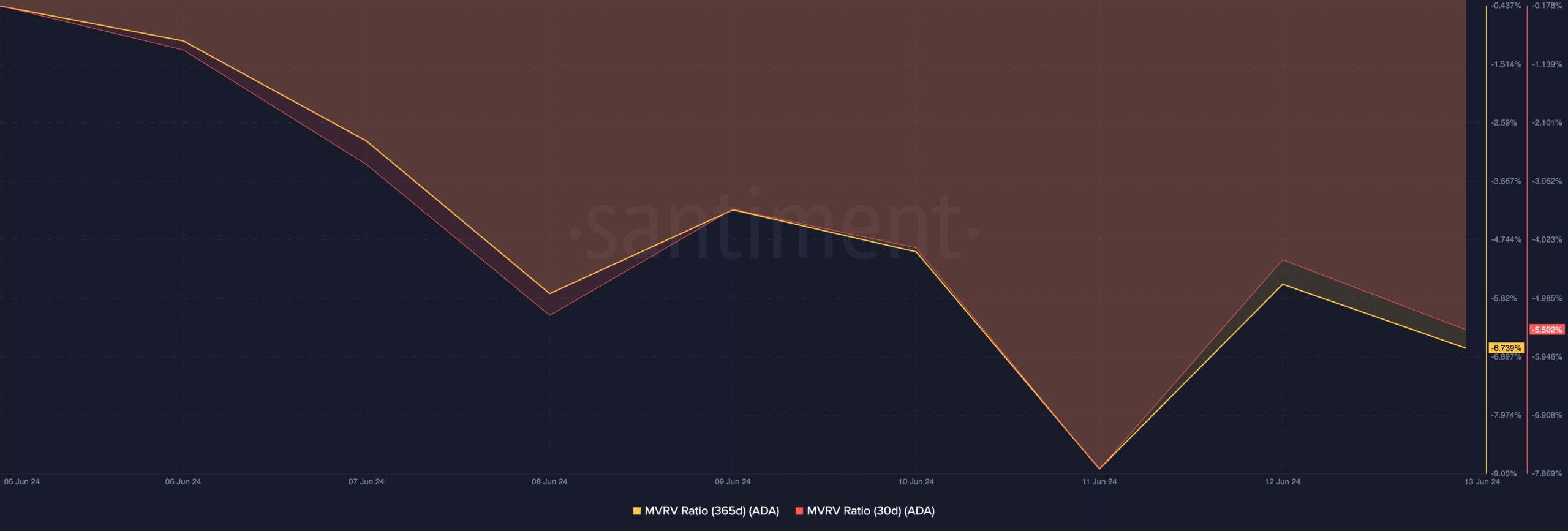

In accordance with Santiment’s knowledge, the altcoin’s Market Worth to Realized Worth (MVRV) ratio assessed over totally different shifting averages returned detrimental values, thereby flashing a purchase sign.

ADA’s MVRV ratios on the 30-day and 365-day shifting averages had been -5.44% and -6.72%, respectively, on the time of writing.

Supply: Santiment

This metric tracks the ratio between an asset’s present worth and the typical value at which every of its cash or tokens was acquired.

When its worth is above one and in an uptrend, the asset trades considerably greater than the worth at which most buyers acquired their holdings.

It’s thought of overvalued and due for a correction as merchants unload their cash to e book earnings.

Conversely, a detrimental MVRV worth signifies an undervalued asset. It means that the market worth of the asset in query is under the typical buy value of all its tokens which are in circulation.

Destructive MVRV ratios usually current a shopping for alternative as a result of they sign that the asset trades at a reduction relative to its historic value foundation.

ADA holders take care of losses

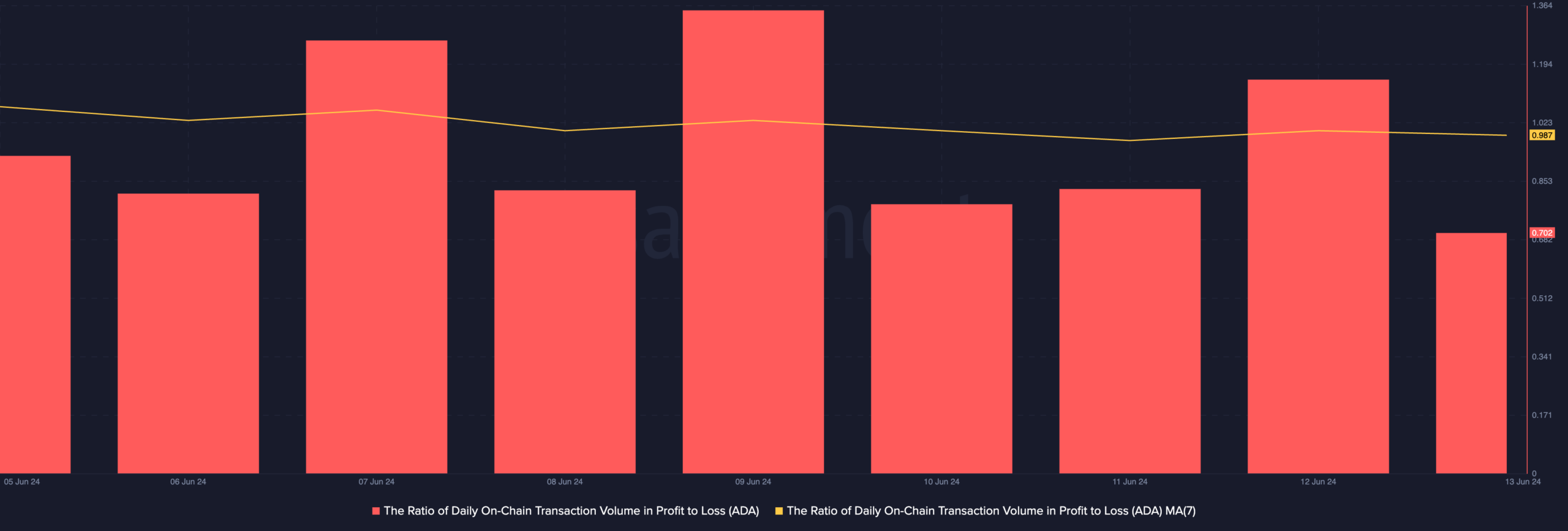

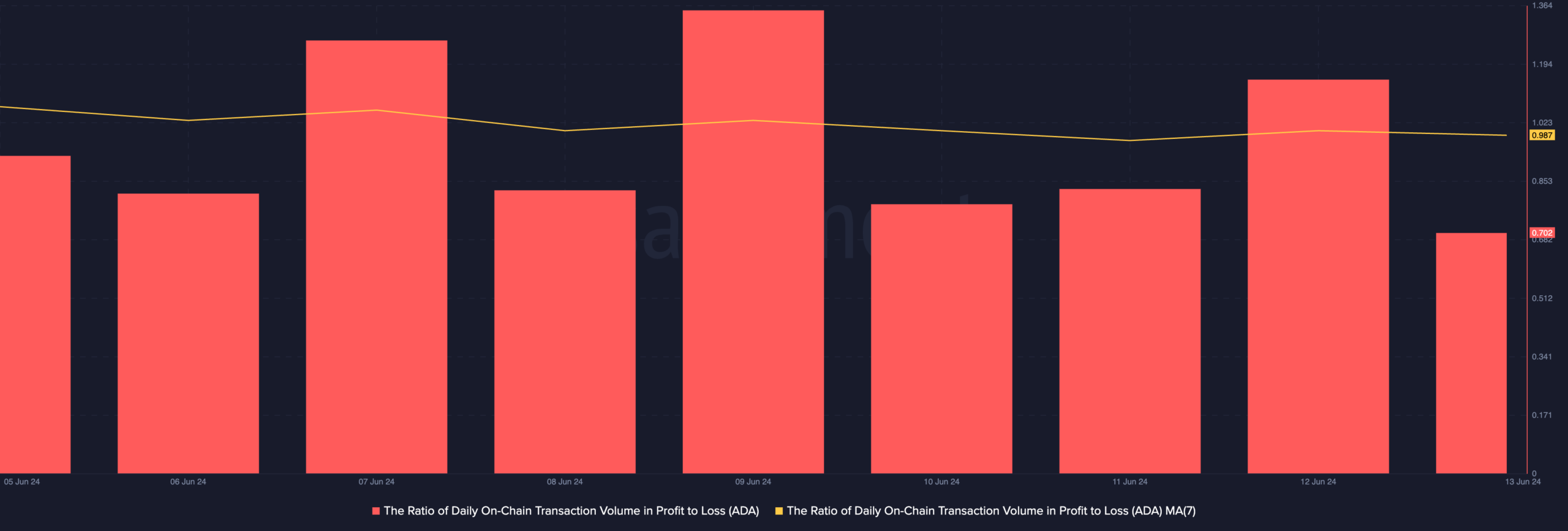

ADA’s value decline this previous week has made it a much less worthwhile funding for holders. A take a look at the coin’s each day ratio of transaction quantity in revenue to loss confirmed this.

Assessed utilizing a seven-day shifting common, the worth of this metric was 0.98 as of this writing.

This confirmed that for each transaction that led to a loss throughout the interval below evaluation, solely 0.98 transactions returned a revenue. This implies that extra ADA transactions have resulted in losses than earnings.

Supply: Santiment

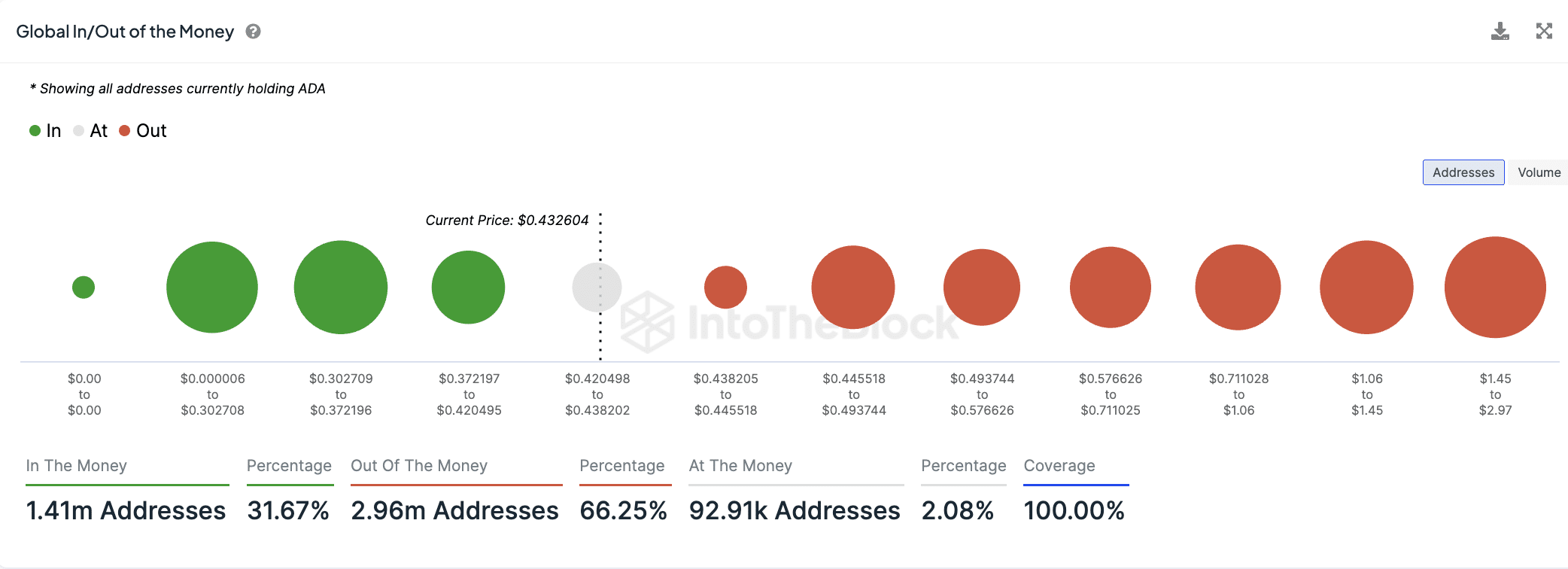

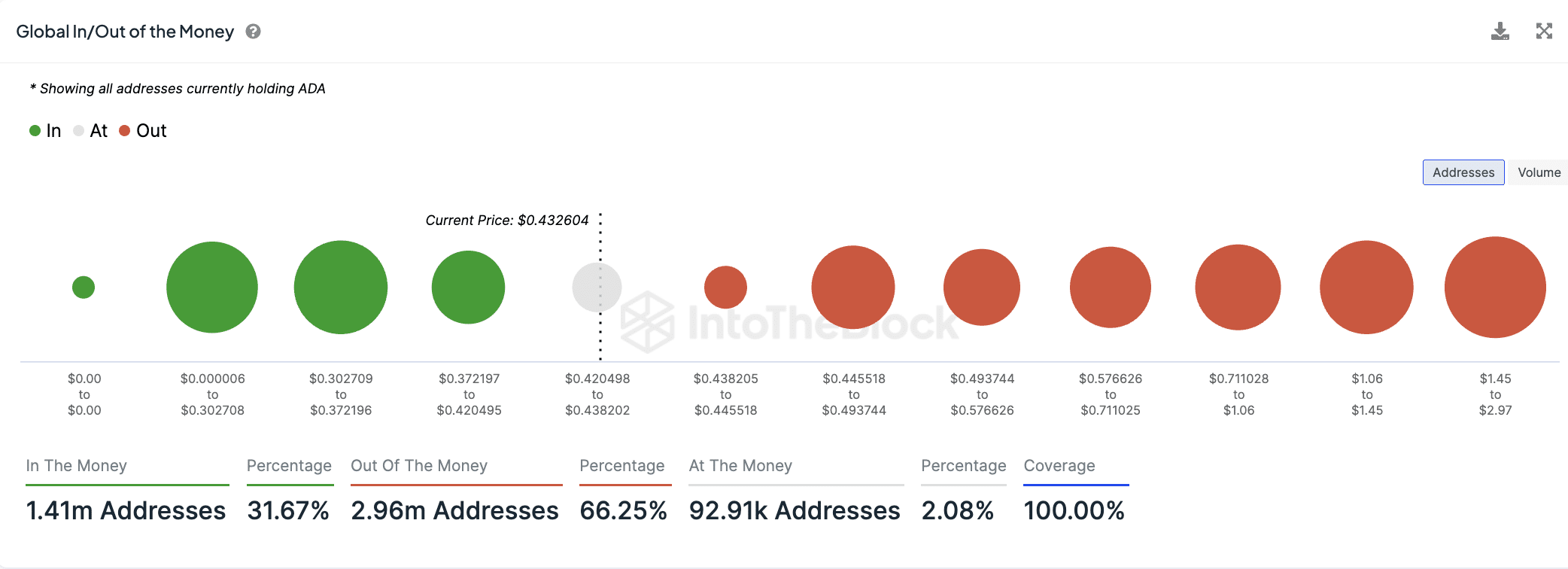

In accordance with IntoTheBlock, 2.96 million ADA addresses, which symbolize 66.25% of all holders, are “out of the cash.”

Is your portfolio inexperienced? Try the ADA Revenue Calculator

An tackle is “out of the cash” if the typical value at which it acquired its holdings is greater than the asset’s present market value. Put merely, virtually 3 million ADA addresses maintain the coin at a loss.

Supply: IntoTheBlock

Conversely, only one.41 million addresses, which comprise 31.67% of all ADA holders, are in revenue or “within the cash.”