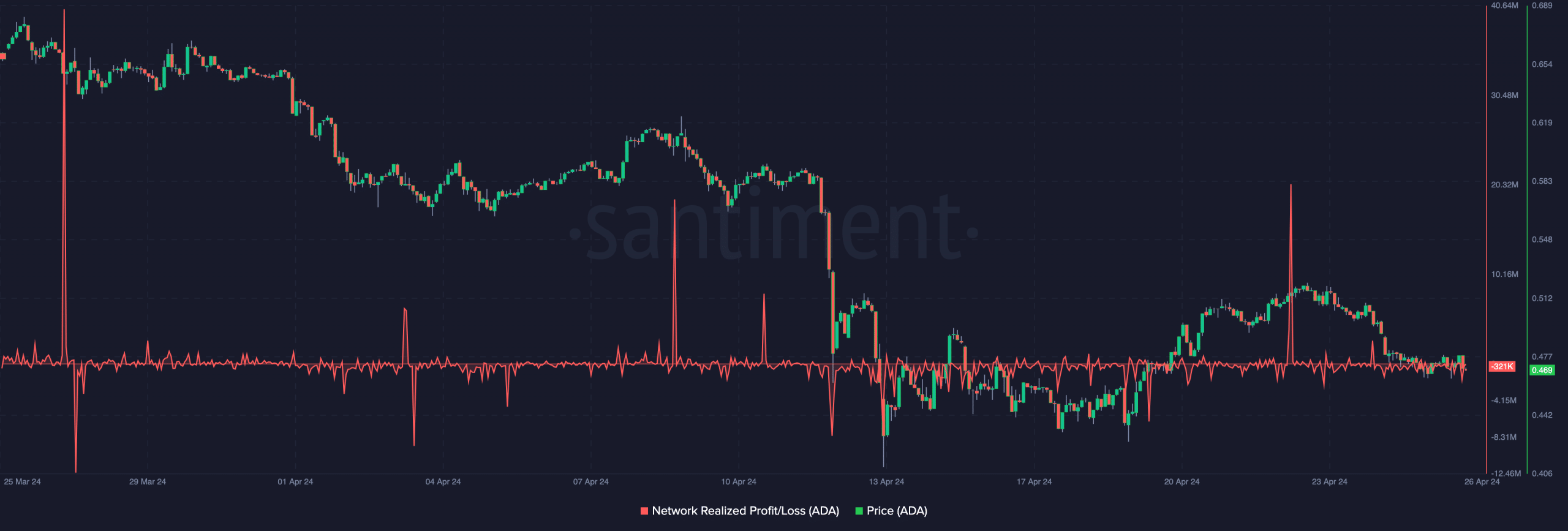

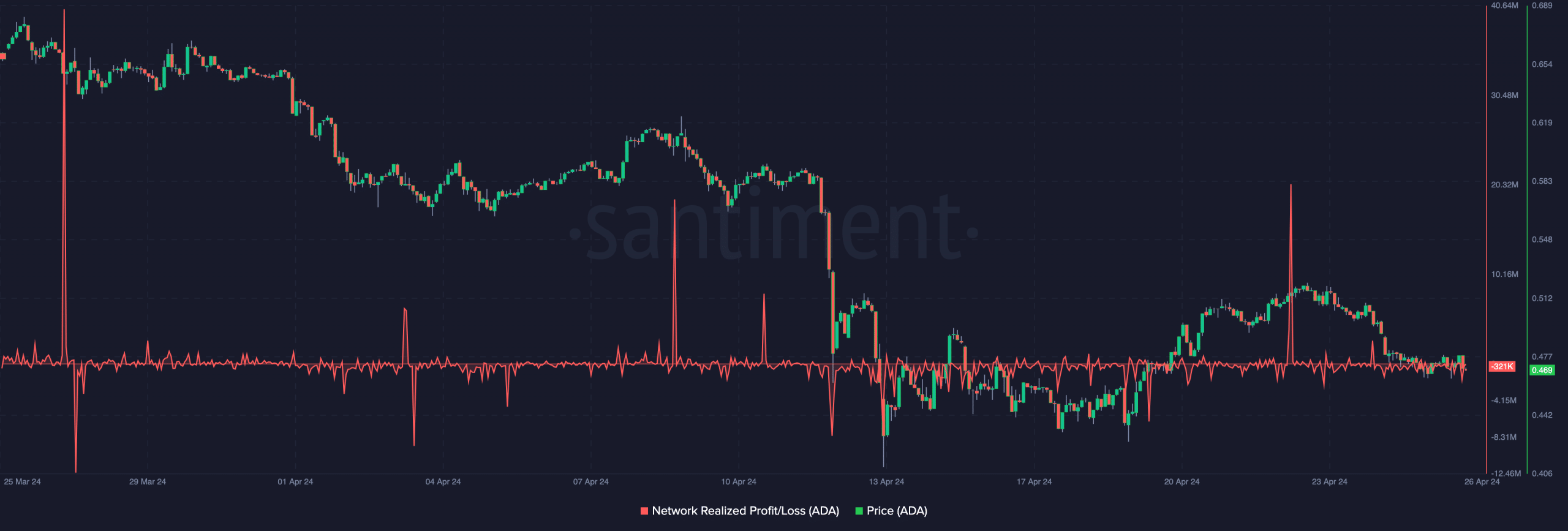

- Almost all ADA transactions have been realized losses since twenty second April.

- Entries for the cryptocurrencies stood between $0.40 and $0.44.

This week, nearly all Cardano [ADA] transactions ended up with contributors realizing losses, AMBCrypto confirmed. Earlier than this conclusion, we appeared on the Community Realized Revenue/Loss.

This metric measures the USD worth of transactions in features or in any other case inside a particular interval. From our evaluation, the final time ADA made contributors amount of cash was on twenty second April. At the moment, $19.78 million value of the token didn’t must be offered at a loss.

However as of this writing, ADA tokens, valued at $321,000, had realized losses inside the final month. This motion was a mirrored image of the cryptocurrency’s worth motion.

Supply: Santiment

No cash for now

5 days in the past, Cardano’s worth was $0.52. At press time, that worth had decreased to $0.46, indicating that it was difficult to make earnings off spot buying and selling the token.

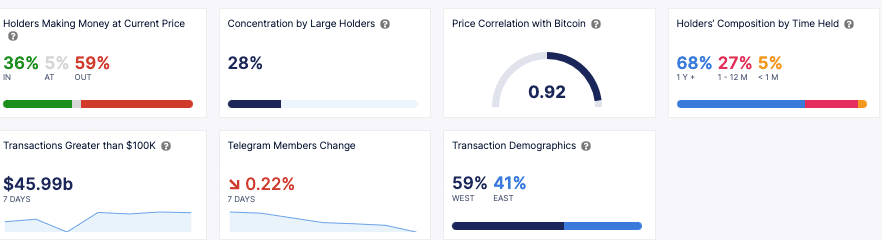

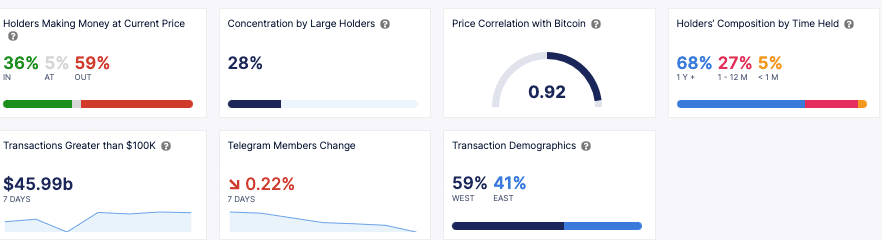

Nevertheless, short-term holders aren’t the one ones affected by ADA’s motion. Just a few weeks in the past, lower than 50% of holders have been at a loss. Based on press time data from IntoTheBlock, 59% of the full holders have been out of the cash.

On the broader spectrum, this might counsel a shopping for alternative contemplating that many holders may not need to liquidate their holdings with none revenue.

If that is so, extra accumulation would possibly happen, and this would possibly depart Cardano with a possible upside. Then again, if part of the holders determine to forfeit what was left, ADA’s worth would possibly fall to $0.44.

Supply: IntoTheBlock

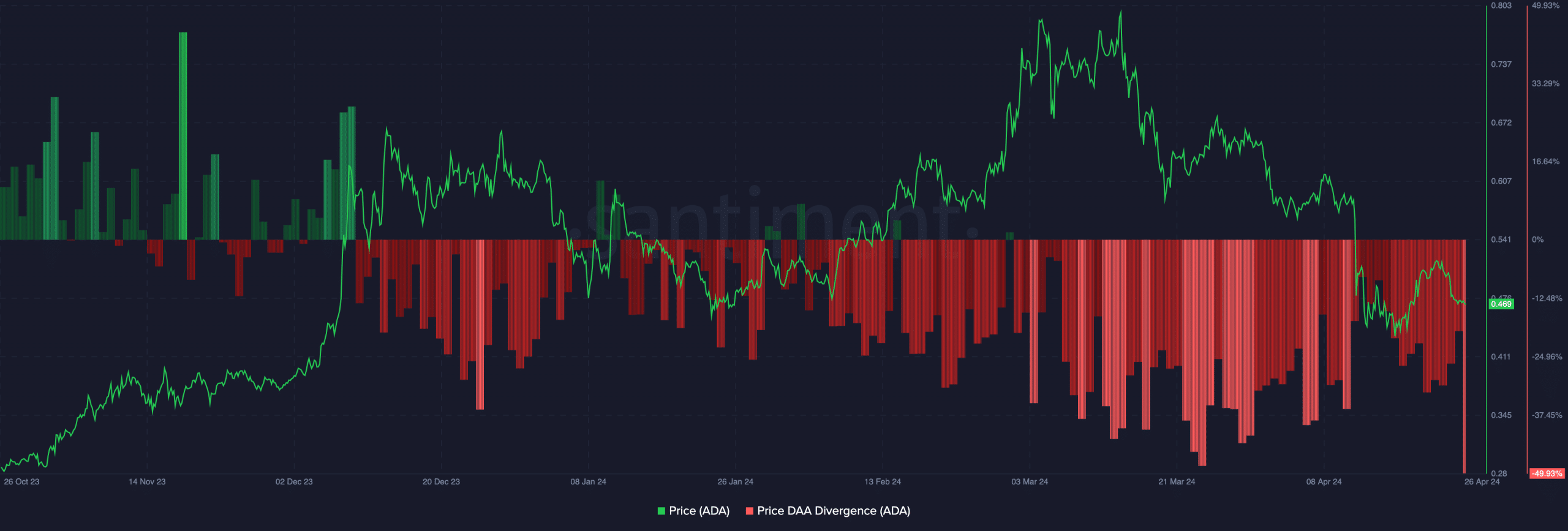

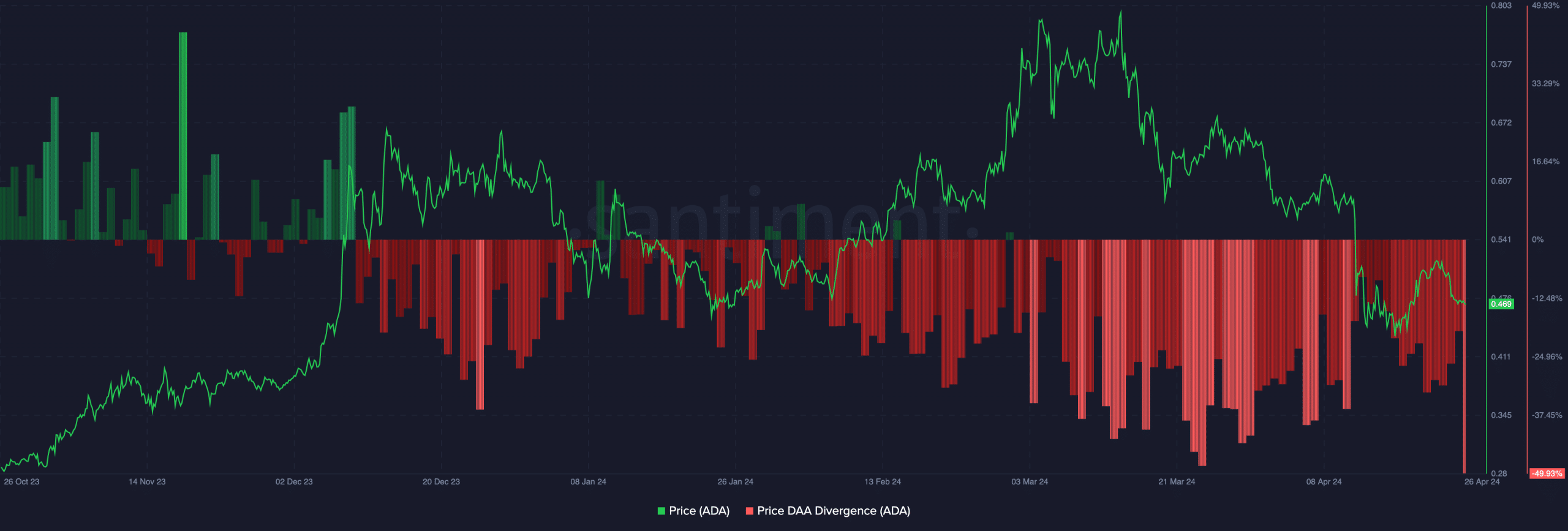

However is that this time to contemplate shopping for ADA? Properly, AMBCrypto’s evaluation of the price-DAA divergence offers an concept of that. For the unfamiliar, DAA is an acronym for Day by day Lively Addresses. It exhibits the each day stage of person exercise on a blockchain.

Sign screams: Put together for an additional exit!

Utilizing Santiment’s knowledge, we noticed that the price-DAA divergence was -49.99%. With the metric, merchants can develop a buying and selling technique that has confirmed to be legitimate traditionally.

In previous cycles, if the worth grows greater than the DAA, it means it’s time to purchase. Then again, a powerful exit signal seems if the worth declines greater than the DAA.

One factor we seen was that Cardano’s DAA jumped inside the previous few days ADA’s worth decreased. Subsequently, one can conclude {that a} strong shopping for alternative has not appeared but.

Supply: Santiment

Regarding the worth, ADA would possibly drop beneath the $0.45 psychological assist within the quick time period. Ought to this be the case, market contributors would possibly want to search out different entry spots between $0.40 and $0.44.

Is your portfolio inexperienced? Test the Cardano Revenue Calculator

Regardless of the potential drawdown, Cardano’s rebound would possibly nonetheless be doable within the mid-term. However that may depend upon altcoin’s efficiency.

Ought to the costs of the cryptocurrencies bounce across the similar interval, ADA would possibly rise and break $0.60 yet another time.