The Associated Press has realized the US Drug Enforcement Administration is transferring to reclassify marijuana to a much less harmful drug class. Shares of cannabis-related firms erupted on the information.

Here is extra from AP information:

The DEA’s proposal, which nonetheless should be reviewed by the White Home Workplace of Administration and Price range, would acknowledge the medical makes use of of hashish and acknowledge it has much less potential for abuse than a few of the nation’s most harmful medicine. Nonetheless, it might not legalize marijuana outright for leisure use.

The company’s transfer, confirmed to the AP on Tuesday by 5 individuals accustomed to the matter who spoke on the situation of anonymity to debate the delicate regulatory evaluate, clears the final important regulatory hurdle earlier than the company’s greatest coverage change in additional than 50 years can take impact.

As soon as OMB indicators off, the DEA will take public touch upon the plan to maneuver marijuana from its present classification as a Schedule I drug, alongside heroin and LSD. It strikes pot to Schedule III, alongside ketamine and a few anabolic steroids, following a suggestion from the federal Well being and Human Companies Division. After the public-comment interval the company would publish the ultimate rule.

Following the information, Tilray Manufacturers Inc. shares jumped 22%, whereas Cover Progress Corp shares are up 26%.

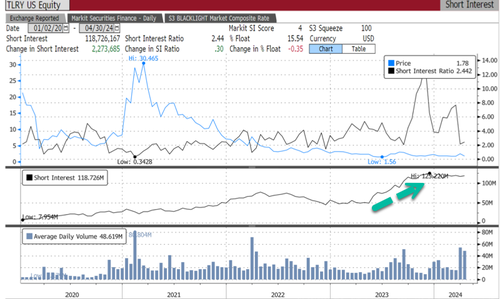

Tilray’s float is about 15% brief, equal to about 118 million shares brief.

Cover’s float is 12% brief, equal to 9 million shares brief.

In the meantime, AdvisorShares Pure US Hashish ETF and Amplify Various Harvest ETF are broadly larger and look like rounding a multi-year backside.

It is an election 12 months, and the Biden administration is getting determined.

Loading…