The Financial institution of Canada printed a workers word on decentralized finance (DeFi) on October 17, assessing the improvements which have made it in style and the challenges and dangers related to utilizing it.

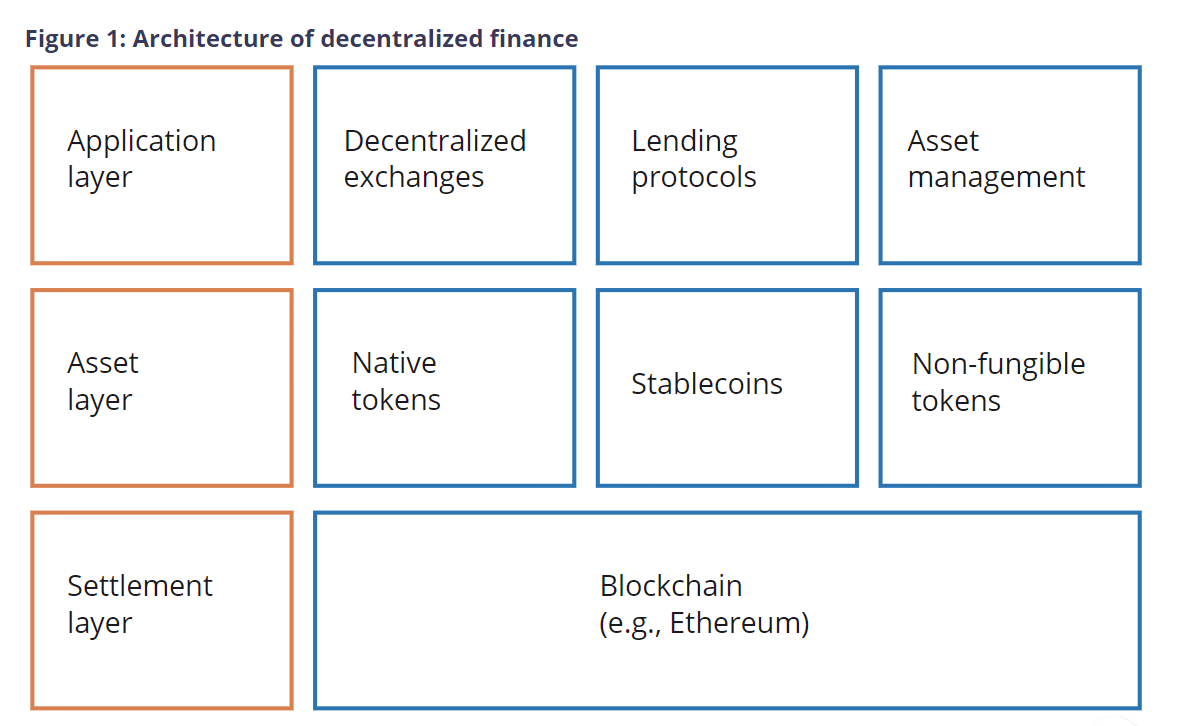

The workers word describes DeFi as a multi-layered construction, with the Ethereum blockchain serving as the underside layer (or settlement layer). Builders are constructing quite a lot of instruments and companies on high of the primary blockchain, together with tokenization, lending and borrowing companies, and far more.

DeFi structure. Supply: Financial institution of Canada

The workers word sheds mild on the rising reputation of the DeFi ecosystem from 2020 and the way it grew to become an integral a part of the crypto financial system, reaching billions in quantity within the coming years. The ecosystem’s reputation declined beginning in 2022 with the collapse of a number of main crypto platforms with important DeFi publicity, together with Terra.

Talking about the important thing options of the decentralized ecosystem, the contributors praised the “composability” of DeFi, which permits the apps and companies within the ecosystem to be related. The Financial institution of Canada word highlights three of the important thing areas the place DeFi can rework the monetary system:

- A frictionless monetary service providing: A decentralized ledger-based system reduces the frictions skilled within the current system and expands the scope of economic companies presently provided.

- Open competitors: The DeFi ecosystem is open for anybody to construct and entry, given its open-source nature; thus, it makes means for extra competitors and presents higher choices for the top consumer.

- Transparency: Utilizing programmable sensible contracts eliminates middlemen and will increase transparency within the system, as every part is accessible to folks analyzing it.

Along with highlighting key DeFi improvements that would rework the standard monetary system, the workers word additionally addressed the challenges and dangers related to the DeFi ecosystem, claiming that “regardless of its improvements and capabilities, the general financial advantages of DeFi stay restricted.”

Associated: Financial institution of Canada emphasizes the necessity for stablecoin regulation as laws is tabled

The word lists three key challenges dealing with the DeFi system at present: the dearth of tokenization in the actual world, the upper focus of interconnections inside, and its dependence on the unregulated centralized monetary ecosystem.

The word additionally highlighted the regulatory challenges posed by the DeFi ecosystem and the rise in vulnerabilities within the ecosystem, which have led to a number of hacks and exploits. The word claimed that “the nameless and borderless nature of public blockchains complicates regulatory oversight.”

Journal: US regulation enforcement businesses are stepping up the battle in opposition to crypto-related crime