- SOL has witnessed a drop in shopping for momentum prior to now few days.

- This indicators the re-emergence of SOL bears.

Solana [SOL] is poised to fall beneath its 20-day exponential transferring common (EMA), signaling a decline in shopping for strain.

This comes per week after the coin traded above the important thing transferring common. SOL’s 20-day EMA represents its common worth over the previous 20 days.

When its worth falls beneath this stage, the coin trades at a stage decrease than its common worth prior to now 20 days. It indicators a decline in shopping for strain and a rally in coin sell-offs.

SOL sees rising bearish exercise

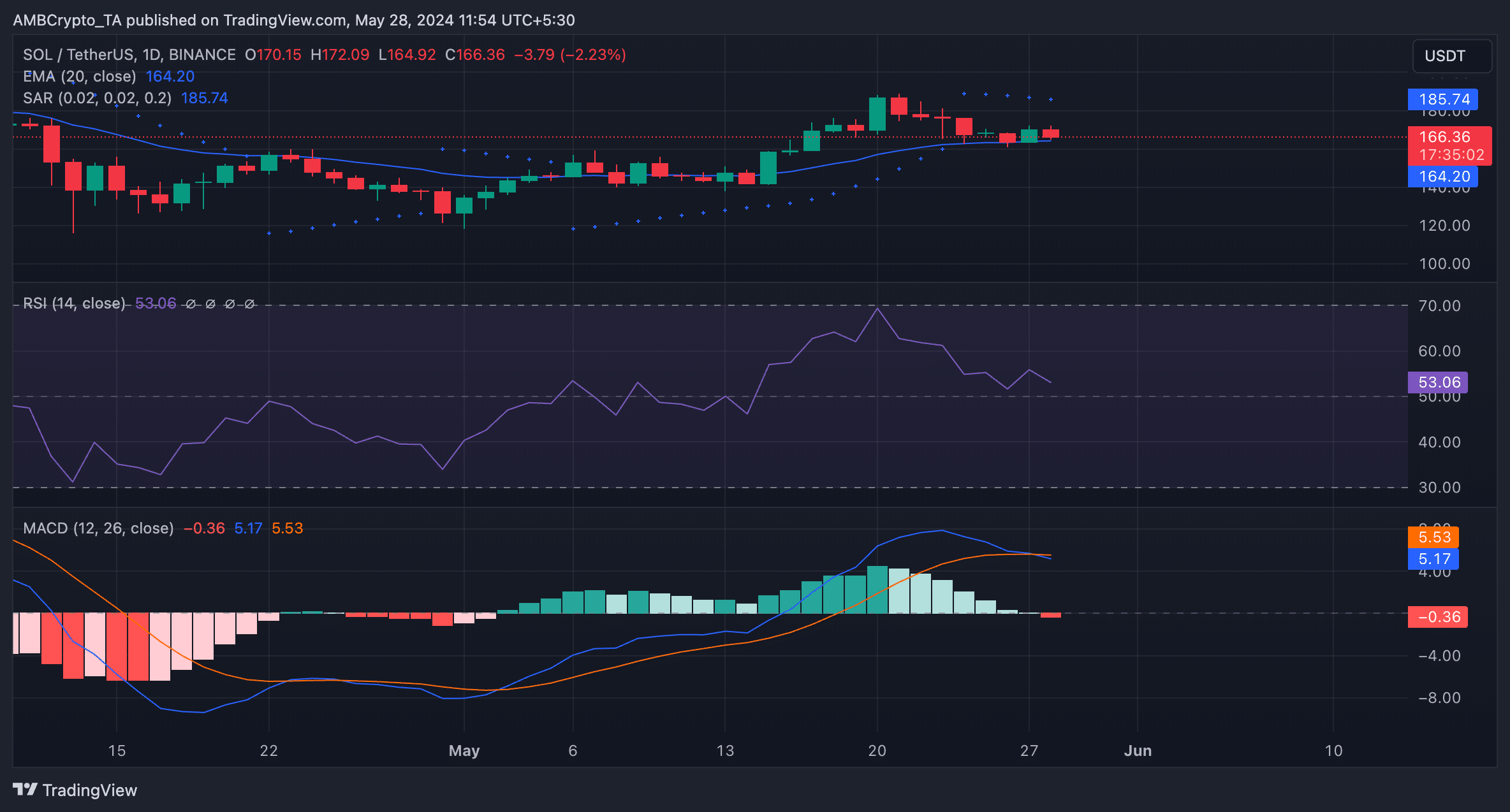

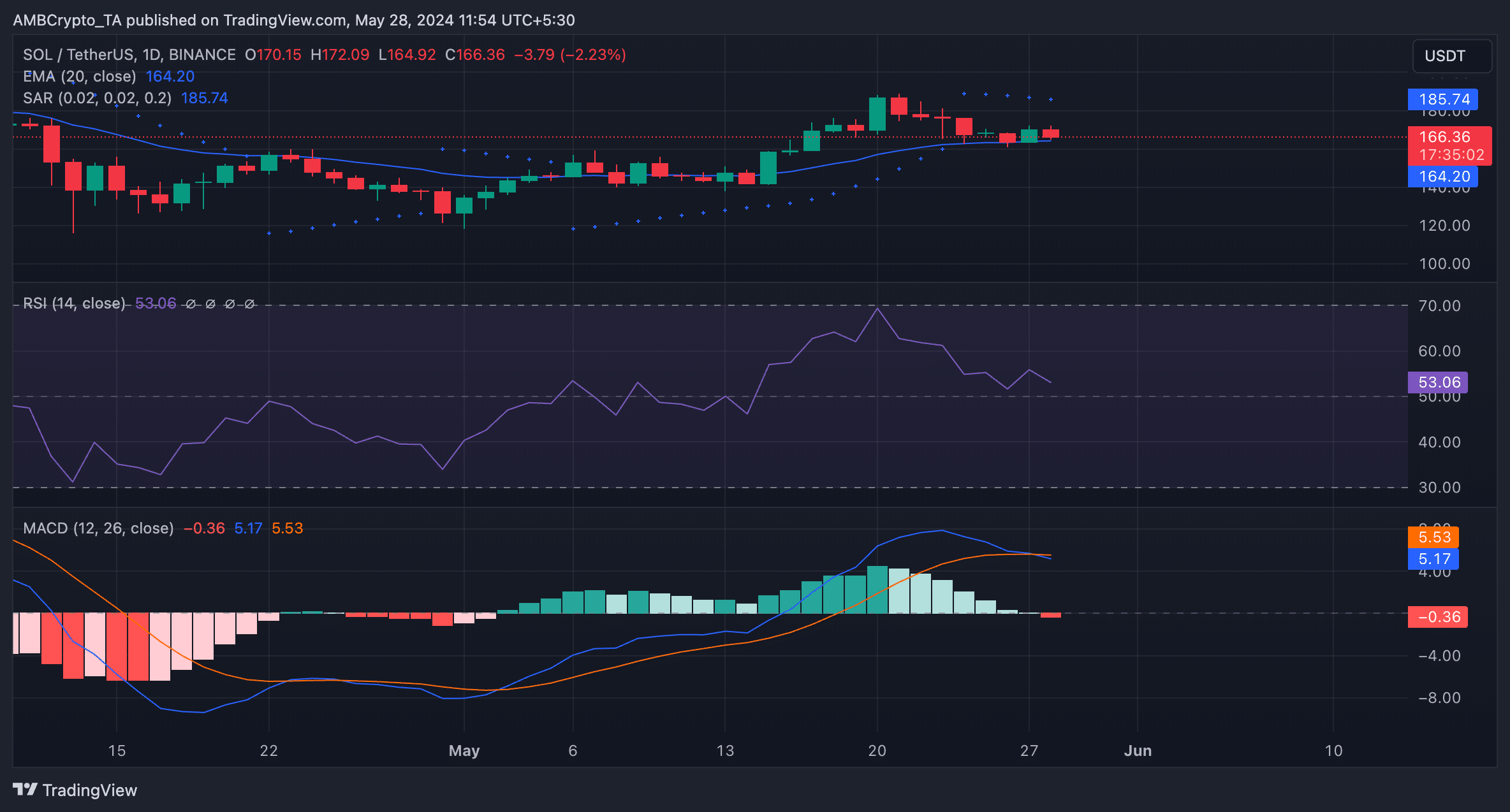

AMBCrypto’s evaluation of SOL’s actions on a 1-day chart confirmed the regular decline in bullish exercise within the coin’s market.

For instance, readings from SOL’s Shifting Common Convergence Divergence (MACD) indicator revealed a downward intersection of the MACD line (blue) with the sign line (orange) at press time.

When an asset’s MACD line crosses beneath the sign line, it’s known as a bearish crossover. It indicators that the accent’s current worth rally is perhaps dropping momentum, and a possible worth decline may happen.

Merchants usually interpret this crossover as a sign to promote or open quick and exit lengthy positions.

Additional, the dots of SOL’s Parabolic SAR indicator have been atop its worth as of this writing. These dots have been positioned this manner since 24 Might, AMBCrypto discovered.

This indicator identifies potential pattern route and reversals. When its dotted traces are positioned above an asset’s worth, the market is claimed to be in a decline. It means that the asset’s worth has been falling and will proceed.

Additionally, the worth of SOL’s Relative Energy Index (RSI) hinted on the declining demand for the altcoin. At 53.47, and in a downtrend at press time, the indicator prompt that promoting strain was starting to surge.

Supply: SOL/USDT on TradingView

Not the top of the highway for Solana

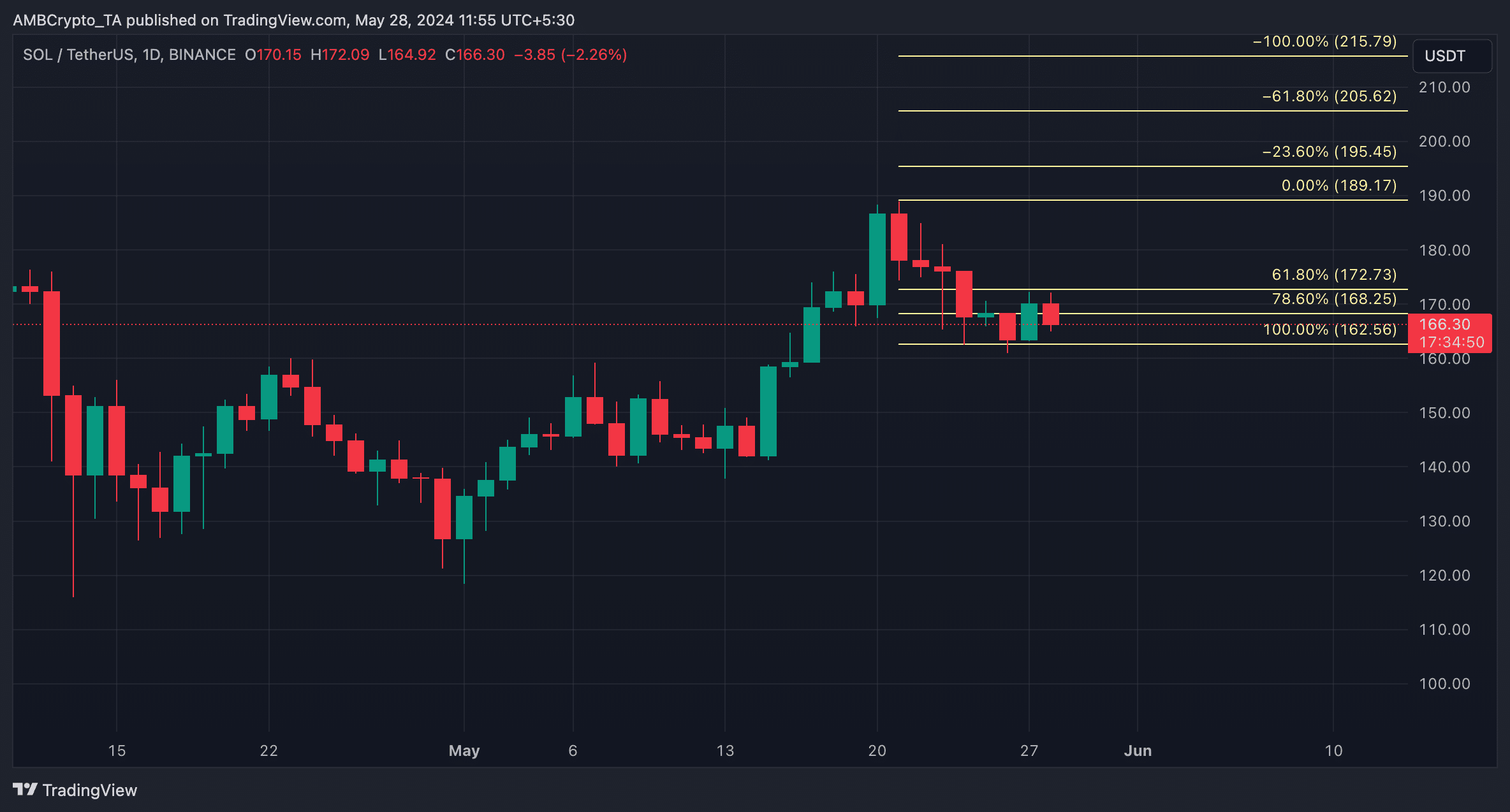

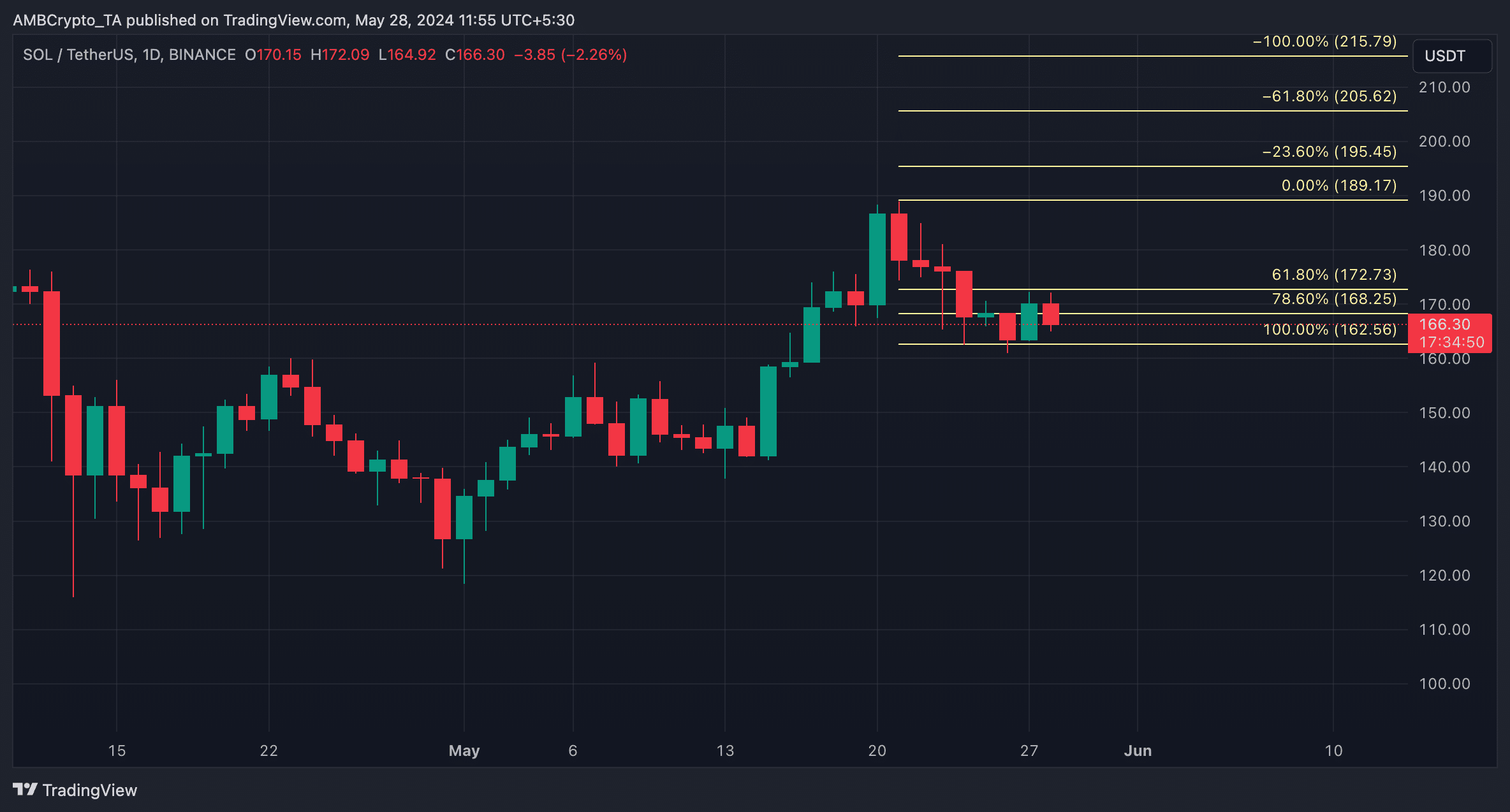

If SOL’s shopping for momentum plummets additional, the coin’s worth may fall towards $162.56.

Nevertheless, if this bearish projection is invalidated and the bulls regain market management, the altcoin could rally to trade arms above $170 at $172.73.

Supply: SOL/USDT on TradingView

The potential of this occurring within the quick time period is probably going as SOL’s funding price in its futures market stays constructive regardless of its current headwinds.

Learn Solana’s [SOL] Value Prediction 2024-25

Funding charges are utilized in perpetual futures contracts to make sure the contract worth stays near the spot worth.

When an asset’s funding price is constructive, it suggests a powerful demand for lengthy positions. In accordance with Coinglass’ information, SOL’s funding price was 0.0147% at press time.