To say that opinions on personal fairness’s sustainability document are divided could be a wild understatement. After we polled FT Ethical Cash readers, respondents supplied all the pieces from the view that personal fairness has “all the time achieved ‘ESG’ as a result of it’s merely good investing” to a characterisation of corporations as “parasites on the residing physique of democratic capitalism”.

Because the latter remark signifies, the sector has, to place it mildly, one thing of a reputational problem. With a typical annual administration price of two per cent of managed funds — plus 20 per cent of funding features — the personal fairness moneymaking mannequin has created a military of billionaires.

However detractors blame corporations for sins from working nursing properties into the bottom to snapping up the soiled belongings of oil and gasoline majors as they divest from fossil fuels. Others fear that the trade’s huge portfolios of firms give it an unhealthy maintain over society and the economic system.

Non-public fairness definitely wields financial clout. The sector has trillions of {dollars} invested in industries from actual property and healthcare to power and manufacturing. Within the US, firms owned by personal fairness made up about 6.5 per cent of gross home product in 2022, based on the American Funding Council, a personal fairness foyer group.

Ethical Cash Discussion board

Nevertheless, some argue that its longer-term method and mannequin of worth creation based mostly on development capital — supporting the growth of firms which have outgrown enterprise capital funding — makes the sector what Saïd Enterprise College professor Robert Eccles has referred to as a “transformation engine” for progress in the direction of a extra sustainable economic system.

Whereas this engine has taken time to shift gears, giant personal fairness corporations are actually working laborious to place themselves as sustainability leaders.

That is partly a response to the calls for of their restricted companions — the hedge funds, pension funds and different institutional traders on which they rely for funding.

Some are seeing alternatives, too. “The lesson we’ve discovered from the previous 15 years is that an method to ESG and sustainability that’s centered on points materials to an organization’s backside line might be extremely accretive from a price creation and worth safety perspective,” says Ken Mehlman, co-head of the worldwide influence fund at KKR, which launched its “inexperienced portfolio program” in 2008.

Sustainability methods may also serve to handle danger. “There’s a recognition that the necessity to deal with issues like local weather change is inescapable,” says Michael Moore, chief government of the BVCA, the UK personal fairness trade affiliation. “The proof is there in entrance of individuals’s eyes.”

For outsiders, the trade’s opaque nature prompts questions in regards to the seriousness of corporations’ pledges on sustainable enterprise practices. “It’s laborious to know precisely what personal fairness is doing with their firms as a result of by default they’re personal,” says Bruce Usher, a Columbia Enterprise College professor and creator of Investing within the Period of Local weather Change.

Nevertheless, he argues that the sector’s pragmatic method comes with benefits. “Non-public fairness could be very centered on growing the effectivity and profitability of companies,” he says. “In the event you can align that with issues like lowered power use, that’s not greenwashing.”

So, many years on from the heady days of Nineteen Eighties leveraged buyouts, has the leopard actually modified its spots? And what may deliver to personal capital the transparency and accountability wanted to make sure it’s genuinely contributing to a extra sustainable economic system?

Harnessing the value-creation mannequin

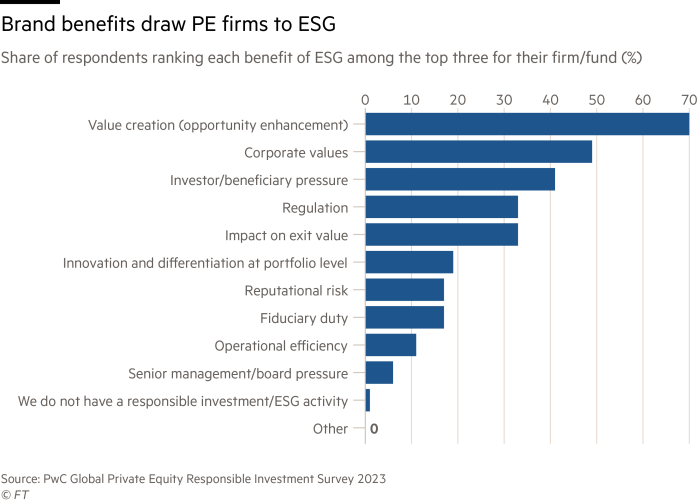

When requested to determine the largest driver of personal fairness corporations’ elevated curiosity in ESG methods, most FT Ethical Cash readers pointed to the potential for aggressive benefit.

Moore agrees that this can be a essential motivation for BVCA members. “They’ll all see that discovering options to local weather change or serving to the economic system adapt to decarbonisation is a vastly important space of alternative,” he says.

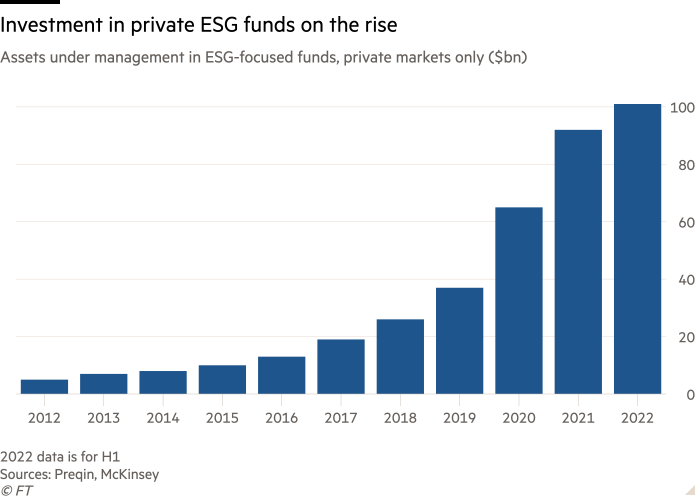

Non-public cash is definitely flowing into one sector that’s important to the transition to a low-carbon economic system. In 2022, personal fairness funding in renewable power and cleantech within the US alone stood at greater than $26bn, up from about $16bn in 2021, based on the AIC.

The local weather disaster can also be prompting corporations to make new sorts of investments, comparable to Blackstone’s 2021 acquisition for $1.4bn of information administration firm Sphera, which helps shoppers determine and mitigate ESG danger.

Neither is the local weather the one space of focus. Variety and social fairness are rising up the agenda. KKR, for instance, has a programme by way of which it helps its portfolio firms in introducing worker engagement measures comparable to giving employees shares along with salaries, which will increase retention, improves productiveness and enhances profitability.

In the meantime, a structural shift within the trade has given it higher incentive to take sustainability significantly. Within the days when corporations have been recognized primarily as buyout kings, they have been in a position to reap the advantages of effectivity features by way of inside restructuring.

“Loads of that low-hanging fruit has been picked,” says Eccles, who chairs KKR’s Sustainability Knowledgeable Advisory Council. At this time, development capital is the dominant mannequin, which he says must transcend effectivity to deal with all the pieces from local weather change to office range. “These are issues we weren’t serious about within the 60s and 70s.”

The expansion capital mannequin helps a lot of this. As a result of they take giant stakes within the firms of their portfolios, corporations can use board illustration and ongoing dialogue with administration to push firms to implement extra formidable sustainability methods.

“You don’t want to fret about shareholder resolutions — you simply name the chief government,” says Andrew Howell, senior director of sustainable finance at US advocacy group Environmental Protection Fund. “That places GPs [general partners] in an incredible place to drive actual implementation of what must be achieved for the transition.”

Provided that their portfolios encompass firms which might be usually smaller than their listed counterparts, GPs — that’s, the corporations that handle personal fairness funds — even have extra room for manoeuvre than public markets traders. And since they aren’t topic to quarterly earnings reporting, they will set their very own agendas.

“Whenever you measure success over years versus quarter to quarter, you’re extra more likely to obtain your aims,” says Mehlman.

Jamal Hagler, the AIC’s vice-president of analysis, cites investments in new power or power transition infrastructure. “Applied sciences which have upfront prices, however long-term returns, is usually a bit harder to do within the public markets,” he says. “Sure issues should be exterior the public-market glare to scale up and develop.”

GPs may also supply the businesses of their portfolio entry to information and experience constructed up by way of their investments. “They’ll deliver assets to bear {that a} small to medium-sized firm won’t have alone,” says Sarah Keohane Williamson, chief government of FCLTGlobal, a Boston think-tank that champions long-term investing.

One instance of that is at EQT. The Swedish personal fairness group helps all the businesses in its portfolio to set science-based targets (which align with efforts to maintain world warming to 1.5C above pre-industrial ranges) and to have them validated by way of the Science Based mostly Targets initiative.

“As we scale this throughout the portfolio, we deliver learnings from the primary spherical to the second spherical,” says Bahare Haghshenas, EQT’s world head of sustainable transformation. “Scalability on the subject of sustainability is a vital a part of the personal fairness mannequin.”

For firms struggling to combine sustainability into their operations, the mixture of development capital and experience might be interesting. Ethical Cash survey respondents who recognized their organisation as a personal fairness portfolio firm cited help from their administration groups as crucial think about shaping their sustainability methods.

“In the event you’re a small firm, life is difficult sufficient as it’s, with all of the altering expectations and rules,” says Eccles. “For a portfolio firm, what’s to not like?”

With investments in hundreds of firms, bigger corporations have a possibility to scale up their sustainability methods by transferring expertise and knowhow throughout the portfolio. “That’s why there’s some hope that they could be a constructive pressure,” says Williamson.

How TPG’s Rise Fund tackles the influence measurement problem

Within the personal fairness trade, approaches to sustainability are likely to contain implementing internet zero, range or different methods within the operations of firms. Nevertheless, in one other mannequin, investments are directed into teams or start-ups with social influence as their core goal. This was the target of personal fairness agency TPG in creating the Rise Fund, which it launched in 2016 with its first fund which raised $2.1bn.

On the time, influence investing was largely going down by way of enterprise capital, however in comparatively small investments. “That was not ample to make the change we wanted to make on the earth,” says Maya Chorengel, co-managing accomplice. “To scale, we needed to develop the trade past enterprise capital and into development fairness and later-stage capital.”

Utilizing the UN’s Sustainable Improvement Targets as an funding information, the fund invests in firms that present all the pieces from renewable power to digital training, world illness intelligence, plant-based meals and low-cost healthcare. “We selected sectors that TPG has familiarity with,” Chorengel explains. “And we used the SDGs because the north star for figuring out the outcomes we wished to realize.”

The purpose was additionally to make sure that influence was measured as rigorously as monetary returns and that the impact of the fund’s portfolio firms was “extra” — that’s, over and above the influence that may occur with out the corporate.

This led TPG to develop Y Analytics, which makes use of information, proof and third-party analysis in its influence assessments. Utilizing the Y Analytics methodology, the Rise Fund estimates that by 2022 it had generated constructive outcomes value virtually $9bn throughout its funds since its inception.

“For any at-scale influence enterprise, we don’t have time or capital to waste,” says Maryanne Hancock, Y Analytics chief government. “So when the fund was created, the problem was to be as efficient as potential with the {dollars} we had.”

Good, unhealthy or ugly?

To some the concept corporations historically recognized for a “purchase, strip and flip” mannequin of capitalism are claiming to steer on sustainability is laughable. Detractors embrace Elizabeth Warren, the Democratic senator from Massachusetts, who has been unequivocal in her characterisation of the sector.

“Non-public fairness corporations get wealthy off of stripping belongings from firms, loading them up with a bunch of debt, after which leaving employees, shoppers, and entire communities within the mud,” she stated in 2021 on reintroducing laws that may, amongst different issues, make it tougher for corporations to load firms with debt to finance acquisitions. The invoice’s title says all of it: the Cease Wall Road Looting Act.

Scrutiny of personal fairness is intensifying additional as antitrust regulators dwelling in on the anti-competitive behaviour of a sector that now owns giant chunks of the economic system.

Some regulators have pointed to the detrimental social results of this possession. In a 2022 interview with the Monetary Occasions, US Federal Commerce Fee chair Lina Khan talked of the “life and demise penalties” of personal fairness acquisitions, citing analysis exhibiting a rise in mortality charges after nursing properties have been bought by these corporations.

One other concern is that as massive power firms work to wash up their carbon footprint by promoting off their dirtiest belongings, these belongings are ending up within the fingers of householders backed by personal fairness that may be topic to much less scrutiny on the subject of their environmental commitments.

There isn’t any scarcity of detrimental information on personal fairness as watchdogs search to test the sector’s local weather credentials.

The Non-public Fairness Stakeholder Challenge, an advocacy group, produces common reviews on the social and environmental influence of personal fairness corporations. In September, for instance, it highlighted the growth of investments into fossil fuels by KKR, together with three liquefied pure gasoline tasks, two of which it says have been cited for environmental violations.

“Non-public fairness is quietly shopping for up fairly in depth typical power belongings, in addition to increasing them, and there’s no accounting for it,” says Alyssa Giachino, PESP’s local weather director.

One other organisation protecting tabs on personal fairness’s footprint is the Anthropocene Mounted Revenue Institute, a climate-focused non-profit based by former bond portfolio supervisor Ulf Erlandsson. He argues that due to the shortage of constant local weather and nature reporting on the supervisor and portfolio firm stage, traders might unwittingly be placing their cash into funds containing belongings that run opposite to their ESG commitments.

After all, whether or not or not you suppose personal fairness possession of fossil gasoline belongings is a foul factor comes all the way down to which aspect you soak up a well-recognized argument: whether or not engagement or divestment is one of the best ways to wash up soiled firms.

At Carlyle, Megan Starr, the agency’s world head of influence, argues that proudly owning and decarbonising these belongings is a simpler technique. The agency has been buying conventional power belongings, comparable to Spain’s Cepsa, one in all Europe’s largest oil and gasoline firms, with which it has developed an power transition plan that features a concentrate on sustainable mobility, biofuels and inexperienced hydrogen produced from renewable sources.

“The biggest decarbonisation potential is in essentially the most carbon-intensive companies,” says Starr. “If we don’t spend money on these companies, our portfolio appears to be like ‘clear’ on paper however that doesn’t change the quantity of carbon within the environment.”

Different corporations have made comparable arguments. Nevertheless, if the personal fairness sector is to persuade the remainder of the world of the deserves of this technique, elevated transparency will probably be important.

“One of many points with personal fairness structuring is it’s opaque so it’s tougher to observe,” says Erlandsson. “An investor ought to be capable of perceive the local weather influence of the supervisor and of every asset, however the personal sphere tends to cherry-pick the information it shares.”

One other aspect to the revenue coin

If some see trade revenue motives as a part of the issue, Eccles takes a contrasting view. He argues that the revenue motive might assist to offer assurance that corporations are genuinely dedicated to sustainability.

Non-public fairness corporations, he says, are solely more likely to spend money on implementing sustainability methods throughout their portfolios in the event that they imagine they are going to bolster long-term profitability. “There could be no cause for giant corporations to concentrate to sustainability if it wasn’t linked to worth creation,” he says. “As a result of that’s how they receives a commission.”

As a relative newcomer to the sector, Haghshenas (who earlier than becoming a member of EQT was a Deloitte accomplice) sees the potential to strengthen this hyperlink and assist portfolio firms transfer away from treating sustainability as primarily a matter of reporting and compliance. “Connecting sustainability to efficiency and worth creation is how we see this coming to life,” she says. “That’s undoubtedly the chance now we have forward of us.”

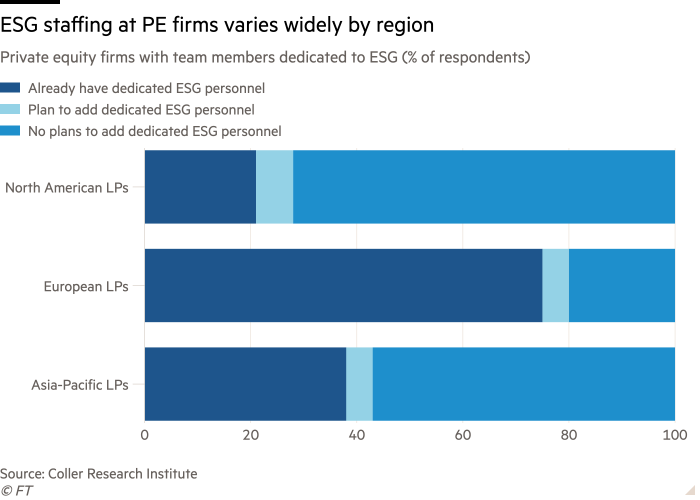

As well as, personal fairness corporations are being nudged in the direction of sustainability methods by one other pressure: their traders. To satisfy their very own sustainability mandates, LPs are pushing the GPs they spend money on to work in the direction of all the pieces from carbon discount to worker range.

In a 2023 Edelman Smithfield survey, 30 per cent of LPs stated that ESG was extra vital than funding returns when it got here to allocating funds to personal fairness corporations, whereas 60 per cent wished to know a agency’s ESG-linked monetary incentives earlier than deciding to speculate.

FT Ethical Cash readers have famous this pattern. When requested to determine essentially the most highly effective driver behind personal fairness’s embrace of ESG methods, the second-largest group (after these citing need to reap aggressive benefits) pointed to strain from traders.

Claudia Zeisberger, professor of entrepreneurship at Insead, goes additional. “Proper now, there’s not a personal fairness fund on the market that may elevate cash with out having one thing to say about environmental and social points and governance,” says Zeisberger, who additionally based the enterprise faculty’s World Non-public Fairness Initiative. “It’s the LPs that decision the photographs, and for all of them this has develop into an vital a part of how they deploy their funding.”

Growing the strain for GPs is the truth that the times when traders have been lining as much as get in on the personal fairness act are over — for the second, at the least. “Loads of personal fairness corporations try to lift cash and having a tougher time doing so,” says FCLTGlobal’s Williamson. “So the LPs have extra leverage as we speak than they’ve usually had.”

Questions over questionnaires

One of many issues LPs are searching for is best disclosure on ESG efficiency. And lots of have stepped up their due diligence on sustainability, based on BVCA’s Moore. “It’s off the dimensions,” he says. “The questionnaires have big sections on ESG. They benchmark the investments and search for information to feed again to pension schemes and different LPs.”

This doesn’t imply the sector’s ESG measurement and disclosure questions have been resolved — removed from it. Actually, if there may be one factor that everybody from activists to LPs and GPs can agree on it’s that higher information is a precedence.

FT Ethical Cash readers ranked transparency second (after higher regulation) amongst measures that may improve personal fairness’s potential to contribute to a sustainable economic system. But once we requested GP respondents how they monitor progress on the sustainability of the businesses of their portfolio firms, their solutions revealed the sector’s greatest information problem: lack of consistency.

FT Ethical Cash readers stated they used strategies starting from annual questionnaires and discussions at board conferences to steady evaluation, common monitoring and reporting, hiring of out of doors advisers, collaboration with deal groups, inside operations groups and ESG groups — and a combination of the entire above.

At PESP, Giachino says that equally heterogeneous approaches prevail within the information GPs provide to their traders. “As a result of there’s no standardised disclosure, every agency tells the story it needs to inform.” She says PESP has developed an investor questionnaire on areas comparable to fossil gasoline danger exposures, power transition methods and local weather lobbying.

As ever, nevertheless, the controversy over whether or not ESG information ought to be one-size-fits-all, or particular to firms and sectors, divides opinion. “It might be simpler for GPs to work instantly with the LPs for the knowledge they want,” says AIC’s Hagler. “Broad information units don’t essentially fulfill that want.”

He argues that the sustainability components materials to, say, an oil and gasoline firm and a software-as-a-service enterprise could also be very totally different. “We need to make sure that there’s sufficient flexibility in order that GPs and LPs can entry the knowledge that’s greatest for them.”

Debates over particular versus generalised information will little question proceed. However one factor appears clear: various approaches to personal fairness information are creating more and more heavy workloads.

Suzanne Lupton, director of co-investment at Maven Capital Companions, says that “disparate and competing reporting requirements throughout the trade” could make data gathering and reporting “extra onerous than it’d in any other case be”.

Starr agrees. “We’re getting north of 300 ESG information requests at Carlyle yearly and so they’re all in barely totally different codecs with barely totally different definitions,” she says.

In 2021, with volumes of bespoke information requests rising, a gaggle of personal fairness corporations and traders led by Carlyle and Calpers, the Californian pension fund, launched the ESG Information Convergence Initiative.

The goal is to offer consistency in measurement and reporting of sustainability efficiency within the personal fairness sector. “We would have liked to converge on a smaller set of information factors so we may see what was taking place,” says Starr.

In October of the identical 12 months, traders together with the Ford Basis, S&P World, personal markets adviser Hamilton Lane and Omidyar Community launched Novata, a US-based public profit company whose platform is designed to make it simpler for personal markets to gather, analyse and report on sustainability information.

A part of the impetus behind the creation of Novata was to deliver personal market disclosure according to developments on measurement and disclosure which have taken place in public markets lately.

“You couldn’t have ever extra stringent necessities in public markets and never anticipate traders with diversified asset allocation throughout private and non-private markets to ask comparable questions on the personal market aspect,” says Margot Brandenburg, Ford Basis’s senior programme officer for mission investments.

Extra broadly, she sees information as important if the sector is to play a much bigger position within the transition to a sustainable economic system. “The potential is there for personal fairness firms to punch above their weight on sustainable improvement points which might be vital for everybody on the planet,” Brandenburg says. “However there must be actual information, infrastructure and intention for that to play out.”

Some use current instruments and requirements which have been developed for public markets, comparable to SASB, which can also be relevant to personal fairness portfolios on the subject of assessing social and environmental points which might be materials to worth creation. “Utilizing these third-party frameworks and advisers is vital,” says KKR’s Mehlman. “That helps us be smarter.”

Out of the shadows

Whereas transparency inside the sector is enhancing, it’s obtainable largely to trade insiders. Because the proliferation of important media tales and damning reviews from advocacy teams suggests, this frustrates these wanting in on the sector from exterior.

“Cash drives all the pieces,” says Hugh Brown, world head of monetary providers at BSR, a company social accountability advisory group. “So for people who make investments, there’s going to be relative transparency obtainable. For outsiders, that stage of transparency goes to be troublesome to acquire.”

Mehlman argues that it is very important discuss to detractors. “We’ve all the time had an open door to people who find themselves sincerely serious about participating,” he says, citing former union chief Andrew Stern, an erstwhile fierce critic of KKR who’s now a member of the agency’s Sustainability Knowledgeable Advisory Council.

Brandenburg believes accountability wants to increase past the partitions of the sector. “It’s a big and rising slice of the worldwide capital markets so it’s related it doesn’t matter what,” she says. “Nevertheless it’s additionally comparatively opaque and ailing understood by stakeholders who ought to know, as a result of their lives are being impacted.”

Given the sums of capital it could possibly wield, personal fairness could possibly be important to financing all the pieces from clear power infrastructure to workforce improvement. And with loads of instruments at their disposal, corporations are setting formidable objectives for methods that, if realised, may contribute to a cleaner, extra equitable economic system.

But it’s struggling to shake off its picture as a rapacious sector with a slash-and-burn enterprise mannequin. If personal fairness is to be credited for assembly its sustainability aims, it might must set yet one more purpose: to deliver itself out from the shadows.