- Jupiter has introduced the launch of its native DAO.

- Solana has seen a decline in person exercise within the final month.

Solana-based decentralized trade Jupiter [JUP] has introduced the launch of its native decentralized autonomous group (DAO), which is funded by 10 million USD Coin [USDC] and 100 million JUP tokens value round $132 million.

We’ve formally funded 10M USDC and 100M JUP right into a DAO pockets.

This operational funds gives the DAO the potential to fund the concepts with USDC and have the JUP allocation for long run incentive alignment with J.U.P Catributors.

Moreover LFG choice, the DAO may also…

— Jupiter 🪐 (@JupiterExchange) March 27, 2024

In keeping with the twenty seventh March announcement, the DEX acknowledged that the DAO can fund its concepts with USDC and might distribute JUP tokens to J.U.P Catributors as an incentive for a long-term alignment.

In keeping with Jupiter, the funds might be topped up yearly to make sure that the DAO is ready to execute its targets in the long run.

State of Solana

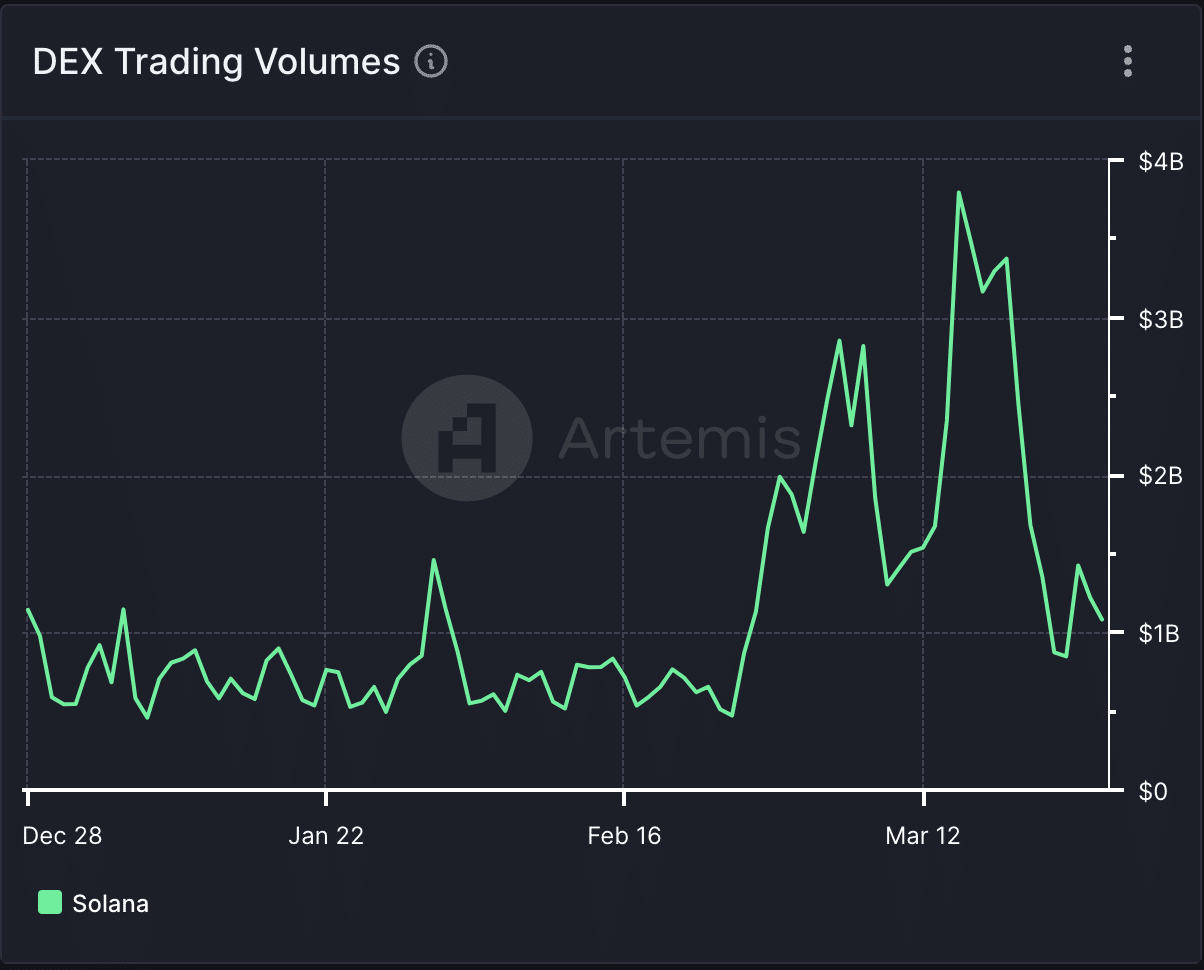

Regardless of this month’s meme coin frenzy, the amount of day by day transactions accomplished on the DEXes housed inside Solana started to drop on fifteenth March. In keeping with Artemis’ information, this has since plunged by 71%. As of twenty seventh March, Solana’s DEX quantity totaled $1.1 billion.

Supply: Artemis

The decline in Solana’s DEX quantity is because of the common decline in person exercise on the community. Per Artemis’ information, the day by day rely of distinctive energetic addresses has plummeted by 40% since 18th March.

Because of the low person exercise on the community, the quantity generated within the type of protocol charges and revenues has additionally dwindled. Knowledge from DefiLlama confirmed that whole transaction charges acquired by Solana have trended downward since nineteenth March. Previously eight days, this has dropped by 60%.

Likewise, income derived from the charges has witnessed a corresponding decline. The community’s income totaled $1.4 million on twenty seventh March, having declined by 44% within the final week.

SOL just isn’t missing on this regard

SOL’s value has risen by 70% within the final month. Regardless of the latest common market pullback, demand for SOL persists amongst spot market contributors.

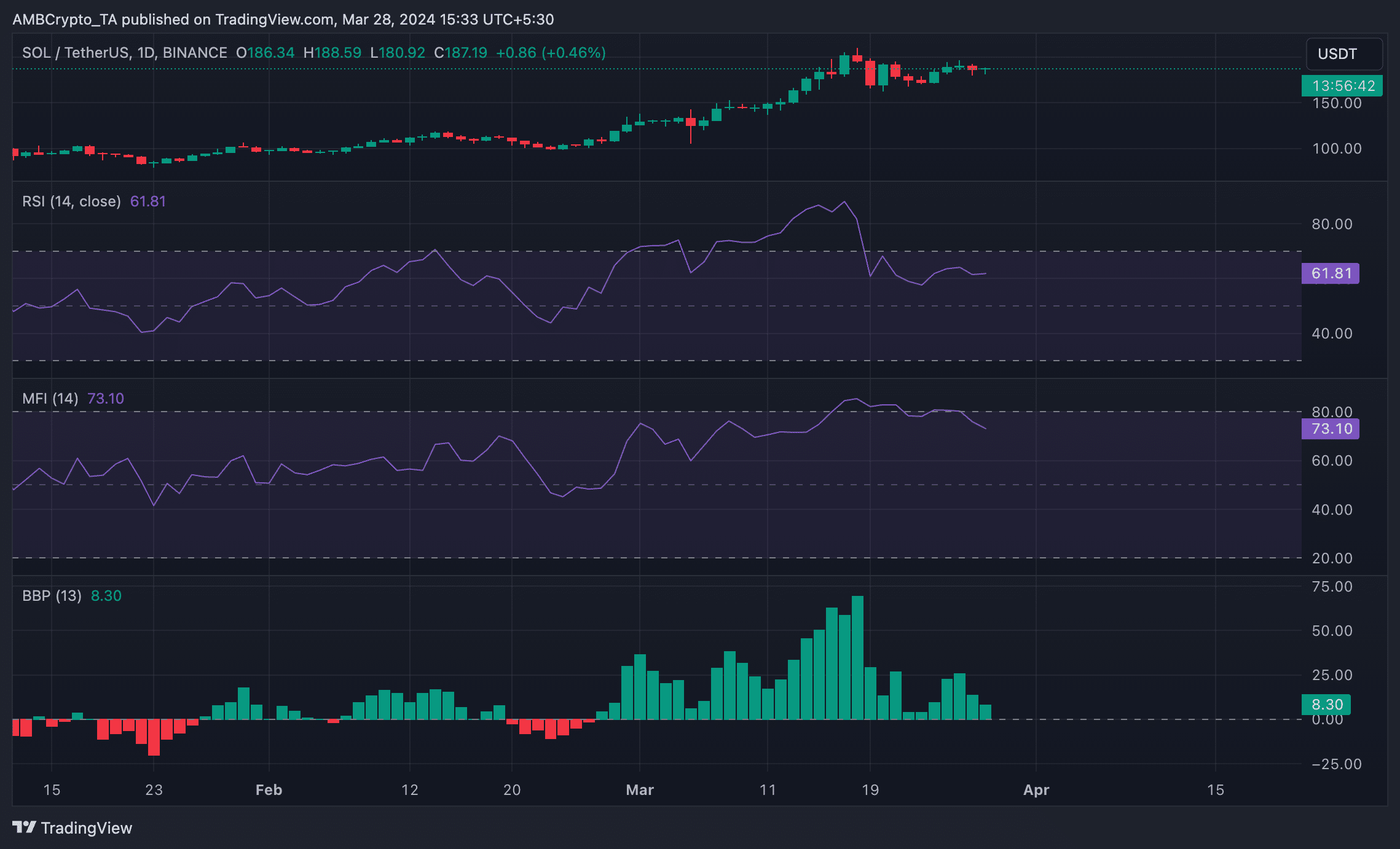

Supply: SOL/USDT on TradingView

The coin’s key momentum indicators point out that purchasing exercise continues to outpace promoting stress. For instance, its Relative Power Index (RSI) was 61.81, whereas its Cash Stream Index (MFI) was 73.10.

Learn Solana [SOL] Value Prediction 2024-25

At these values, these indicators confirmed that merchants have continued SOL accumulation regardless of the rise in profit-taking exercise.

Confirming the bullish development, its Elder-Ray Index, which estimates the connection between the energy of patrons and sellers out there, was constructive at press time. A constructive Elder-Ray Index worth is a bullish sign, depicting an uptick in shopping for exercise.