Welcome to FT Asset Administration, our weekly e-newsletter on the movers and shakers behind a multitrillion-dollar world trade. This text is an on-site model of the e-newsletter. Sign up here to get it despatched straight to your inbox each Monday.

Does the format, content material and tone be just right for you? Let me know: harriet.agnew@ft.com

One scoop to start out: Invoice Ackman, the billionaire founding father of hedge fund supervisor Pershing Sq. Capital Administration, made a revenue of about $200mn from his high-profile guess towards US 30-year Treasury bonds, after exiting a brief place he first introduced in August.

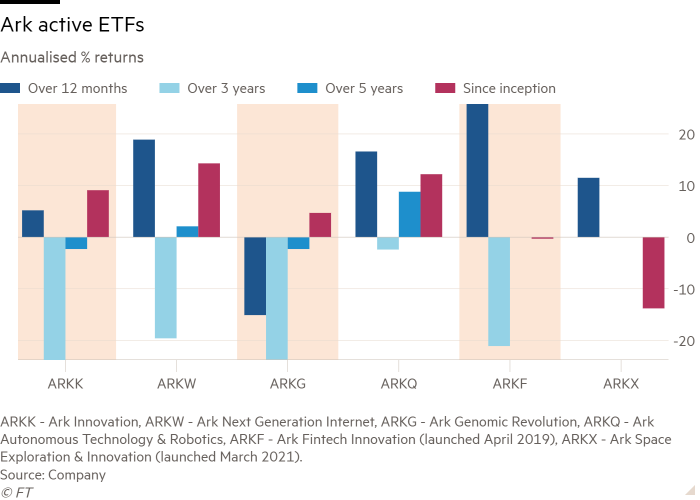

Cathie Wooden faces ‘robust nut to crack’ as Ark units sights on Europe

Armed with messianic conviction and social media savvy, Cathie Wooden has constructed a profitable profession pitching disruptive firms to US retail traders, write Chris Flood and Emma Boyde in London.

However even the 67-year-old acknowledges that her quest to convey Ark Funding Management, the Florida-based agency she arrange in 2014, to Europe is a frightening one.

Europe is a “robust nut to crack,” Wooden informed the Monetary Instances. “We knew, as an American firm, that Europe and the UK is probably the most sophisticated area on the planet. We would have liked native expertise and native management.”

Wooden has lengthy harboured ambitions to interrupt into the $1.5tn European alternate traded fund market, nevertheless it was solely final month that Ark took its first step with the acquisition of London-based Rize ETF, which manages greater than $450mn.

The choice by Martin Gilbert’s AssetCo to promote Rize barely two years after buying it factors to the obstacles in breaking the dominance of the ten gamers — amongst them BlackRock, Amundi and DWS — who management greater than 90 per cent of the ETF market in Europe.

Alongside Ark’s poor efficiency and questions over whether or not her evangelism may misfire in Europe, Wooden and Ark might want to overcome a number of hurdles.

In lots of European international locations, asset managers pays monetary advisers a fee to suggest an actively managed mutual fund. ETF suppliers don’t pay any comparable incentives, which has slowed their adoption by monetary advisers in Europe.

ETF buying and selling in Europe is performed throughout a number of exchanges, dividing liquidity and growing transaction prices. In the meantime, distribution channels for promoting ETFs additionally range throughout the continent, which would require Ark’s salesforce to win orders from a mixture of fund supermarkets, banks, brokers, wealth managers and monetary advisers, alongside particular person retail traders. And in contrast to within the US, ETFs don’t provide tax benefits in Europe.

Amin Rajan, chief govt of the consultancy Create Analysis, cautioned that nearly each small ETF supervisor had failed to realize vital mass in Europe, earlier than including that “if there may be anybody that may, then it’s Cathie Wooden”. Learn the complete story right here

How traders misplaced their love for UK property funds

Buyers in UK property funds have had their ups and downs because the Brexit vote. Now they’re dropping endurance, writes my colleague Sally Hickey in London.

Earlier this month, fund supervisor M&G introduced plans to shut its £565mn property fund and return money to shoppers, citing declining curiosity from retail traders, and St James’s Place suspended buying and selling in its £829.5mn property unit belief after a surge in redemption requests.

A 3rd property fund, run by Canada Life Asset Administration, at the start of the month introduced plans to shut for a similar cause.

It isn’t the primary time UK traders have had this expertise. Property funds have lived via rushes for the exit and short-term closures on and off since 2016.

However rising rates of interest have induced a marked shift in funding away from these funds, which include worries about rising debt prices and empty post-pandemic places of work, and in the direction of fastened earnings and money merchandise which look extra enticing and safer.

Max Nimmo, an actual property analyst at stockbroker Numis, identified the actual issues for “open-ended” property funds, which permit each day dealing when the underlying asset is inherently illiquid.

“After a number of fund gatings in recent times, confidence within the open-ended automobiles has continued to dwindle,” he stated. “We’re stunned it has taken this lengthy for the market to just accept this.”

Redemptions from UK property funds have been constantly excessive over the previous 12 months, with between £50mn and £190mn taken out on a internet foundation every month, in accordance with Morningstar. The market has shrunk to £10.4bn on the finish of September, from a peak of £35bn in April 2016.

Learn the complete story right here

Chart of the week

When UK regulators probe what non-public property are actually price, they’re prone to discover a mixture of rigour, guesswork and wishful pondering, write my colleagues Laura Noonan, Josephine Cumbo and Arjun Neil Alim in London.

The Monetary Conduct Authority is anticipated to start its evaluate this 12 months — a vital second of scrutiny for a sprawling asset class that pension funds and different traders piled into as they hunted for returns through the lengthy period of low rates of interest.

Regulators have three causes to be apprehensive. Non-public property greater than doubled between 2017 and mid-2022, accounting for a report share of world monetary property, resulting in fears that an upset there may ricochet throughout broader markets.

Rising rates of interest and slowing financial development characterize a hazard to some non-public fairness fashions, as highlighted by regulators together with Iosco, which lately warned about difficulties in refinancing property and potential fireplace gross sales.

The strategy for valuing the property is a gray space. Homeowners are required to carry property at “honest worth” beneath accounting guidelines. Usually, non-public fairness corporations will use the valuations of comparable public firms as a information for audits and traders. How correct these are will solely be decided when the asset is bought.

Judgment carries dangers, particularly when managers are incentivised to current a rosy image for so long as they will, significantly if they’re looking for to lift cash from traders. It typically additionally fits traders resembling pension funds to cling on to upbeat, however stale, valuations.

Valuation gaps are most obvious in listed non-public fairness trusts, which commerce on inventory exchanges and will commerce near the worth of their property.

UK non-public fairness belief internet asset values are presently about 30 per cent above share value valuations, knowledge from the Affiliation of Funding Firms exhibits. That hole is near a historic excessive, suggesting that share costs are low-cost or asset valuations far in extra of what might be achieved in a sale tomorrow.

Nick Britton of the AIC stated the non-public fairness managers are “all saying the identical factor: the valuations at which they’re holding investments on their stability sheets they imagine are conservative and the proof they’re presenting is that after they’ve exited investments within the final decade, it’s constantly been at an uplift to their valuation”.

Whereas listed non-public fairness has traded at a reduction because the monetary disaster, “they’re struggling to know how excessive it’s in the meanwhile”, he added.

5 unmissable tales this week

Buyers together with Pimco, Janus Henderson, Vanguard and BlackRock are snapping up US authorities bonds with longer maturities, betting the ache within the Treasury market is sort of over and an elusive slowdown within the US financial system could also be on the horizon.

The pension fund taking care of the retirement financial savings of Britain’s MPs and ministers has given the chilly shoulder to UK firms, despite efforts by chancellor Jeremy Hunt to funnel extra cash into home funding.

Brookfield and the Qatar Funding Authority, the homeowners of Canary Wharf Group, will inject £400mn of contemporary capital into the London workplace district, which has suffered the departure of key tenants as firms in the reduction of workplace house in response to hybrid working.

A New York jury has convicted Neil Phillips, the high-profile supervisor of a London-based hedge fund beforehand backed by George Soros, over an alleged scheme to control the US greenback to South African rand alternate fee as a part of a ploy to set off a $20mn choices fee.

Buyers are punishing firms that report disappointing earnings or outlooks with unusually harsh share value declines, in an illustration of the more durable angle rising within the excessive rates of interest setting.

And eventually

Swiss multimedia artist Rolf Sachs brings a retrospective spanning twenty years to Sotheby’s, from now till November 6. Accompanying the exhibition is a jewelry and design pop up, St. Moritz Pops Up At Sotheby’s. St Moritz is the place Sachs transformed the Olympic stadium used within the 1928 and 1948 Winter Olympics right into a family residence. The placing pavilion housed rooms for officers and umpires and nonetheless has the Olympic flame on its tower.

FT Reside occasion: Way forward for Asset Administration Europe

Hosted by the Monetary Instances, in collaboration with Ignites Europe, Way forward for Asset Administration Europe is happening on 14-15 November on the Carlton Tower Jumeirah in London. The 2 day occasion will convey collectively senior leaders from Europe’s main asset and wealth administration corporations, together with BlackRock, Authorized & Normal and Federated Hermes. For a restricted time, save as much as 20 per cent off in your in-person or digital move. Register now

Thanks for studying. When you have pals or colleagues who may get pleasure from this article, please ahead it to them. Sign up here

We’d love to listen to your suggestions and feedback about this article. E mail me at harriet.agnew@ft.com