Posted:

- There have been expectations of elevated flows on crypto exchanges put up the approval.

- Bitcoin was well-placed to make a powerful begin to 2024.

Crypto market was eagerly wanting ahead to the potential approval of spot Bitcoin [BTC] exchange-traded fund (ETF) purposes, seen as a extra handy method for TradFi buyers to achieve publicity to cryptocurrencies.

With the ultimate deadline of a number of purposes due in January 2024, the query, nonetheless, in everybody’s thoughts was – will ETFs reach restoring crypto liquidity to ranges seen earlier than the FTX collapse?

Spot ETFs could flip it round for the market

A latest report by crypto market information supplier Kaiko referred to ETFs because the “single largest catalyst” in reviving the 2 measures of liquidity – market depth and buying and selling volumes.

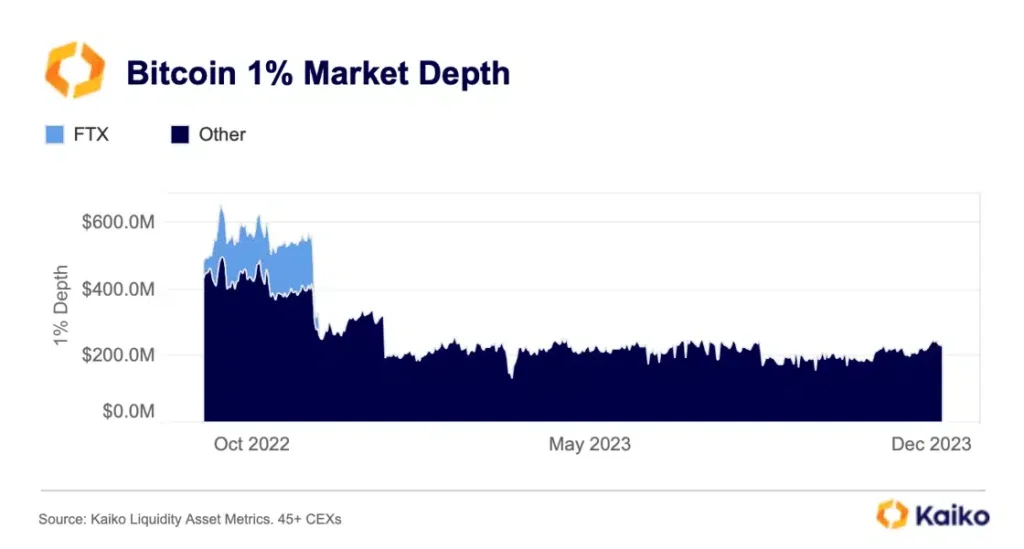

As seen from the graph under, market depth was hammered within the aftermath of FTX implosion and stayed suppressed for a lot of 2023. Even the continuing market rally did not carry a couple of significant restoration.

Supply: Kaiko

Nevertheless, spot ETFs would require shopping for Bitcoins in enormous amount from licensed crypto exchanges or different holders. Sometimes, they may even be promoting cash to rebalance their holdings. This might enhance buying and selling exercise on exchanges.

Moreover, spot ETFs are anticipated to imitate the precise worth of underlying Bitcoins. To keep up this, arbitrageurs would repeatedly purchase and promote relying on whether or not ETF shares are buying and selling at a premium or low cost to Bitcoin’s worth.

Therefore, there was the next chance of enhanced liquidity available in the market as soon as spot ETFs are green-lighted, Kaiko famous.

Circumstances favorable for Bitcoin?

AMBCrypto had earlier reported capital inflows of $155 billion into the Bitcoin market upon clearance of the ETFs, with Bitcoin’s spot worth zooming to someplace between $50,000 and $73,000 consequently.

This was one more sturdy instance of spot ETFs having a good affect available on the market.

As of this writing, BTC held on to its positive aspects above $42,000, AMBCrypto noticed utilizing CoinMarketCap’s information.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Shivam Thakral, CEO of India cryptocurrency trade, famous a constructive market sentiment following the U.S. Federal Reserve’s dovish stance.

He stated,

“We will anticipate and spectacular begin of 2024 for Bitcoin and different belongings as occasions like ETF approvals are lined up for early 2024.”