The Avalanche (AVAX) worth has elevated considerably over the previous 20 days, culminating with a excessive above $40 on February 10.

Avalanche bounced at a long-term horizontal help space however trades inside a shorter-term resistance degree.

Avalanche Clears Lengthy-Time period Resistance

The weekly timeframe technical evaluation exhibits the AVAX worth has elevated since bouncing on January 22. The upward motion validated a important horizontal space as help. Beforehand, the world had supplied resistance since Could 2022.

AVAX created a bullish weekly candlestick (inexperienced icon), catalyzing the present improve. The value didn’t break above the 2023 excessive regardless of the upward motion.

The weekly Relative Power Index (RSI) offers a combined studying. Market merchants use the RSI as a momentum indicator to establish overbought or oversold circumstances and to determine whether or not to build up or promote an asset.

Learn Extra: Purchase Avalanche (AVAX)

Readings above 50 and an upward pattern point out that bulls nonetheless have a bonus, whereas readings beneath 50 counsel the alternative. Whereas the indicator is above 50, it has been falling for the previous two months. Moreover, it crossed beneath overbought territory and has not moved again up since.

AVAX Worth Prediction: Aid Rally or Bullish Development Reversal?

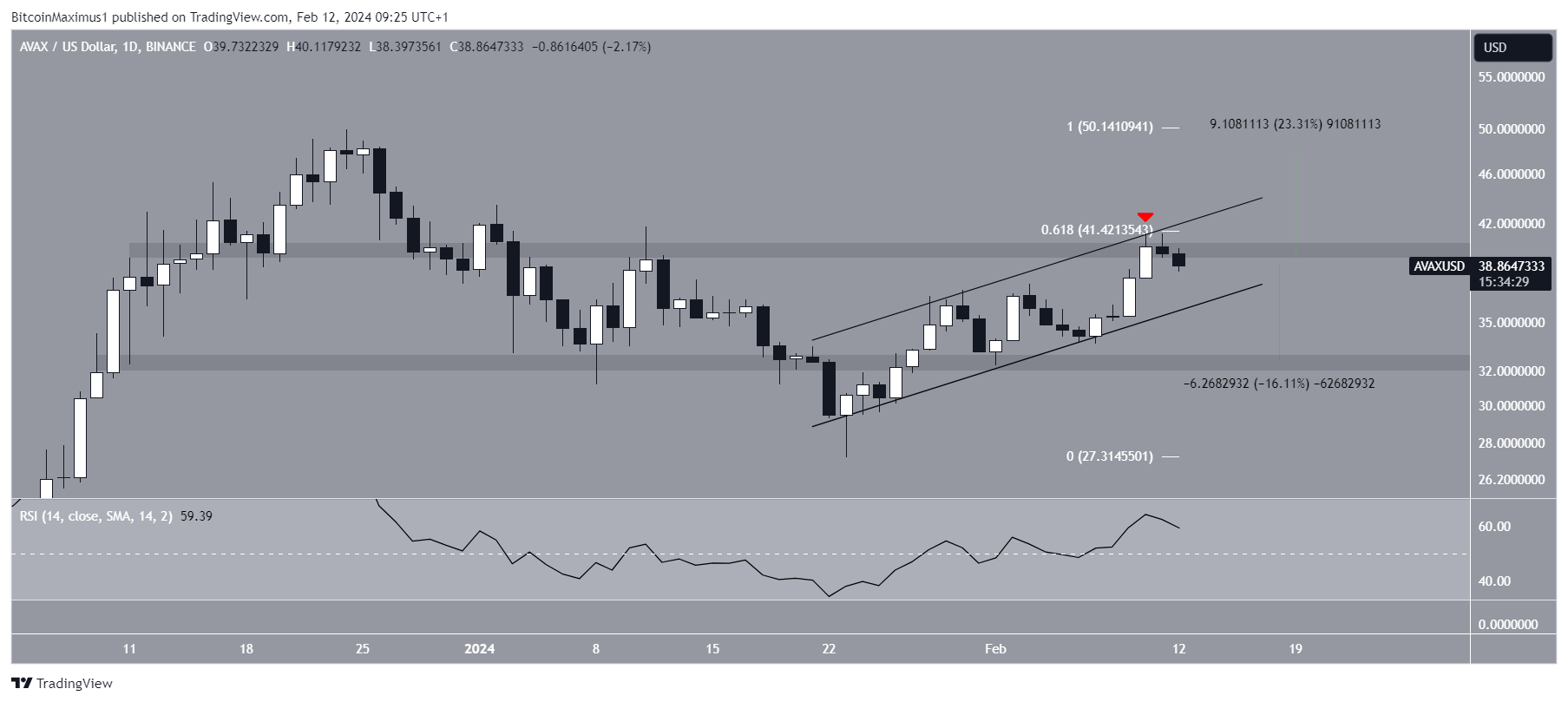

The each day timeframe chart doesn’t verify the long run pattern’s course for AVAX due to the combined worth motion. The each day chart exhibits that the upward motion since January 22 has been contained inside an ascending parallel channel. Such channels often comprise corrective actions.

On February 10, the channel’s resistance pattern line rejected the AVAX worth (pink icon). Moreover, the rejection coincided with the $40 resistance space.

Learn Extra: Purchase Avalanche (AVAX) With a Credit score Card

Regardless of the rejection, the each day RSI offers a bullish studying. The upward motion took the indicator above 50 and into bullish territory. The RSI can also be trending upwards.

Cryptocurrency dealer InmortalCrypto suggests the AVAX worth will comply with SOL if the latter pumps.

“If $SOL pumps, $AVAX will comply with. Muscle reminiscence,” InmortalCrypto tweeted.

On account of these combined readings, the response to the $40 space might be key in figuring out the long run pattern’s course. A profitable breakout can set off a 23% AVAX improve to the 2023 excessive at $50.

Conversely, a rejection from the $40 space and breakdown from the channel can catalyze a 16% AVAX drop to the closest help at $33.

For BeInCrypto‘s newest crypto market evaluation, click on right here.

Disclaimer

Consistent with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.