zhengzaishuru

Funding motion

Primarily based on my present outlook and evaluation of Cactus, Inc. (NYSE:WHD), I like to recommend a maintain ranking for the corporate. My evaluation relies on the expectation that U.S. oil rig counts are unlikely to succeed in historic highs, given the present decline in oil costs in comparison with the degrees noticed following the Russian-Ukraine battle. Moreover, given WHD’s vital market share within the US, its development alternatives in established US segments appear restricted and intently tied to fluctuations within the US oil rig rely.

Fundamental Data

WHD specializes within the design, manufacturing, and sale of wellhead and stress management tools. Its product vary primarily caters to onshore unconventional oil and gasoline wells, taking part in very important roles within the drilling, completion, and manufacturing levels of its prospects’ properly operations. Along with promoting merchandise, the corporate supplies in depth area providers for all its choices, together with rental objects and help in the set up, upkeep, and secure operation of wellhead and stress management tools. Moreover, WHD provides restore and refurbishment providers for these merchandise.

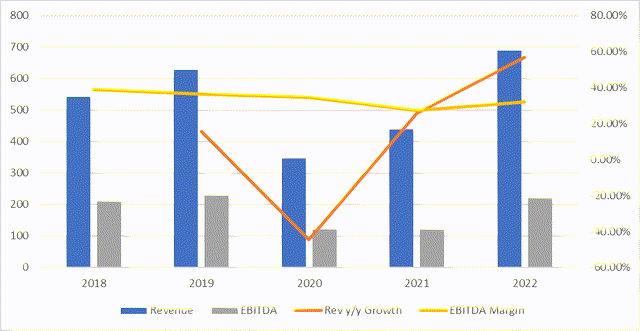

Over the previous 5 years, the corporate has skilled a gradual income restoration to ranges seen previous to the COVID-19 pandemic. In 2022, the corporate’s income reached $688 million, a notable improve in comparison with the $544 million recorded in 2018. Given the influence of the pandemic, it is price inspecting the CAGR, which supplies a clean common annual development price. WHD has achieved a CAGR of 4.81% in income over this era.

Concerning its adjusted EBITDA margin, the corporate has maintained consistency, with a median margin of 34%. Nevertheless, it is necessary to notice that there’s a noticeable declining pattern on this margin over time, because it fell to 32% from 39% in 2018.

WHD holds the highest place within the US market with a powerful market share. Its market dominance has surged, rising from a modest 0.8% in 2011 to a powerful 41.8% by 2021. Furthermore, WHD boasts substantial development prospects by geographic enlargement. Presently, WHD’s tools providers are accessible in simply 24% of the world’s complete geographic expanse, leaving a considerable 76% of untapped potential for enterprise enlargement.

Creator’s work

Overview

WHD holds the coveted place of business chief in US floor tools. The corporate has considerably expanded its presence within the US market, witnessing a powerful climb in its US market share from a mere 0.8% in 2011 to a commanding 41.8% by 2023. This outstanding development might be attributed to WHD’s innovation in wellhead expertise and its agile manufacturing processes, which have discovered favor amongst US shale-oriented Exploration and Manufacturing (E&P) prospects when in comparison with bigger rivals.

Nevertheless, regardless of this substantial market share development, the general US oil rig rely is experiencing a downward trajectory resulting from low oil prices, which have but to recuperate to the degrees seen following Russia’s invasion of Ukraine. For the reason that starting of 2023, the oil rig count has persistently declined from 621 to 513, marking a big 17% lower. The surge in oil rig counts witnessed after the invasion has not been sustained, and with present oil costs nowhere close to the degrees seen throughout the preliminary levels of the battle, a return to historic excessive rig counts is unlikely.

Except for the gross sales of floor tools within the US, WHD’s area service additionally contributes to ~20% of income. Income from area providers is intently linked to the amount of product gross sales and tools leases. The reducing variety of oil rigs within the US, which can have an effect on the gross sales of floor tools, is predicted to even have a downstream influence on area service income, subsequently bringing extra headwinds to WHD’s income development outlook.

Basically, all service gross sales are offered to E&P prospects at the side of a product sale or rental, primarily involving the meeting, upkeep, and restore of on-site tools. The vast majority of service income comes from labor crews, and there have been issues about labor shortages in 2022.

Regardless of these challenges, WHD persistently achieved among the highest margins within the Oilfield Providers [OFS] sector. Over the previous 5 years, the corporate has maintained a powerful common adjusted EBITDA margin of 34%, surpassing rivals like Schlumberger and TechnipFMC, whose margins usually linger round 27%. This sturdy margin is fueled by the distinctive merchandise WHD provides inside every of its classes and contributions from the Spoolable Applied sciences phase, whose area service income is grouped beneath. Contemplating the labor scarcity, I discover it difficult for WHD to realize its 5 years historic median margin of 34%. Subsequently, I count on the margin to remain round its present degree of roughly 32%.

“On a stand-alone foundation, every of Cactus and FlexSteel set data for each quarterly income and adjusted EBITDA. This energy displays the extremely differentiated choices in every of our segments. Adjusted EBITDA margin for the quarter was 37.7% of revenues, a rise from the primary quarter resulting from working leverage and better contribution from the Spoolable Applied sciences phase” 2Q23 name.

Valuation

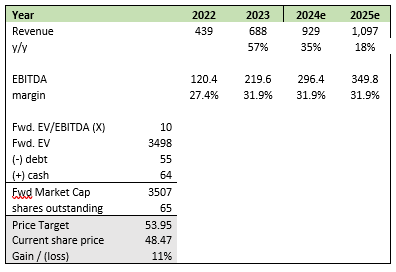

I consider WHD will develop by 18% in FY25 because of the declining variety of oil rigs within the US. Regardless of the rise in its US market share, the full rely of oil rigs within the US has been persistently declining because of the ongoing hunch in oil costs, which haven’t but recovered to the degrees noticed following Russia’s invasion of Ukraine. For the reason that begin of 2023, there was a steady lower within the oil rig rely, amounting to a big 17% decline. The surge in oil rig counts witnessed after the invasion is unlikely to be repeated, given the present oil worth ranges. Consequently, I don’t anticipate the oil rig rely returning to historic highs. With regard to revenue margins, I count on WHD to keep up its present ranges, due to its distinctive choices inside every of its enterprise segments and contributions from the Spoolable Applied sciences phase.

WHD is presently buying and selling at a ahead EV/EBITDA a number of of 9.43x. This valuation is according to its friends, akin to Schlumberger and TechnipFMC, which commerce at a median a number of of 9.43x. I count on the market to assign WHD the next a number of of 10x, aligning it nearer to Schlumberger, which trades at 10.71x provided that WHD boasts larger margins at 34%, in comparison with friends’ medians of roughly 27%. Contemplating these elements, At this a number of, my goal worth for WHD is $53.95, representing a possible 11% upside.

Creator’s work

Threat and last ideas

WHD’s sturdy presence within the U.S. onshore market is a testomony to the corporate’s engineering prowess and its well-established popularity amongst E&P prospects. Nonetheless, larger-cap rivals akin to Schlumberger have entry to larger monetary assets and a extra in depth vary of providers. This benefit may probably lead to a quicker tempo of technological innovation and heightened competitors stemming from bundled service choices. Contemplating WHD’s dominant US market share, its future development prospects in its established US segments seem comparatively constrained and are largely contingent on fluctuations within the U.S. rig rely.

WHD has emerged as a number one participant within the US floor tools business, with its US market share surging from a mere 0.8% in 2011 to a dominant 41.8% by 2023. This spectacular development is attributed to WHD’s modern wellhead expertise and agile manufacturing, favoured by US shale-oriented E&P prospects over bigger rivals.

Nevertheless, regardless of this outstanding market share acquire, the US oil rig rely faces a steady decline resulting from reducing oil costs, which is way from the degrees seen after Russia’s Ukraine invasion. Since early 2023, the rig rely has plummeted by 17%, making a return to historic highs unlikely. Contemplating WHD’s dominant US market share, its future development prospects in its established US segments seem comparatively constrained and are largely contingent on fluctuations within the U.S. rig rely. Subsequently, I like to recommend a “maintain” ranking given headwinds in US oil rig demand.