BlackJack3D

C3.ai, Inc.’s (NYSE:AI) enterprise has proven indicators of life over the previous few quarters, with progress starting to speed up and margins stabilizing. A lot of that is merely the mechanical results of the corporate’s enterprise mannequin transition although. C3.ai has instructed that it’s a chief in AI and years forward of its friends, however the firm is at risk of lacking the generative AI boat. Given the dimensions of the generative AI alternative and the demand that distributors are speculated to be seeing, C3.ai’s efficiency appears fairly weak. The corporate’s valuation implies a big progress acceleration, creating draw back threat if this doesn’t eventuate.

Market

The generative AI market is predicted to be price 200 billion USD to 1.3 trillion USD within the subsequent decade. There is a gigantic quantity of uncertainty related to any estimate although given the nascent state of the know-how. Additionally it is unclear at this stage the place worth will accrue within the business worth chain. Even when generative AI lives as much as expectations in the long term, there’s a important threat of disappointment within the close to time period as corporations attempt to create viable enterprise fashions.

The first affect at this stage stays on the {hardware} layer, with restricted advantages for infrastructure and software software program. Consequently, it’s too early to attract conclusions from C3.ai’s ongoing smooth efficiency. C3.ai noticed gross sales headwinds within the second quarter which the corporate instructed have been extra a results of better scrutiny concerning governance and safety, reasonably than softer demand. This stands in sharp distinction to Palantir Applied sciences Inc. (PLTR), which has instructed that it’s seeing an acceleration of bigger offers and shorter occasions to conversion and growth.

C3.ai

Buyer engagement continues to select up, and C3.ai has instructed that its C3 Generative AI and Enterprise AI functions are gaining traction. The entire variety of buyer engagements was 404, an 81% enhance sequentially. C3.ai closed 62 agreements within the second quarter, together with 36 pilots and trials, 20 of which have been generative AI pilots. The low entry worth level of pilots has made it considerably simpler for C3.ai to land new accounts although, that means these figures want to extend additional to be actually significant. Pilot challenge consumption knowledge is in step with C3.ai’s expectations, suggesting that clients are persevering with the platform and realizing worth. Pilot conversion charges are additionally trending in the direction of C3.ai’s goal of 70%. The corporate has signed a complete of 109 pilots, of which 103 are nonetheless lively (pilots nonetheless underway or transformed to industrial). C3.ai’s federal enterprise is an space of energy in the intervening time, with bookings up 187% YoY.

C3.ai’s no-code generative AI software is now accessible on the AWS market. This product permits non-technical personnel to make the most of C3.ai’s software program. C3’s Generative AI certified pipeline grew 55% sequentially. The extent to which this transfers to significant income stays to be seen although.

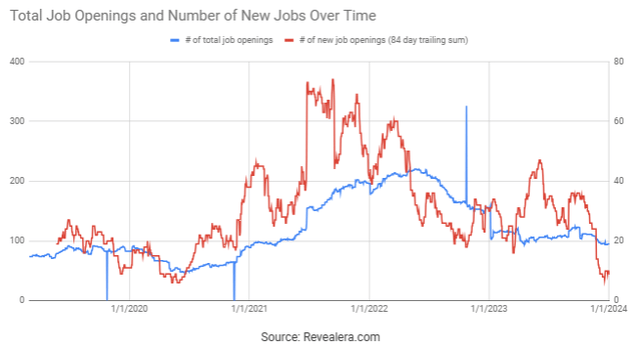

Positives on the pipeline facet have to be weighed in opposition to the truth that C3.ai’s hiring stays anemic, and the corporate reportedly just lately engaged in one other spherical of headcount cuts. Job cuts have been speculated to have occurred throughout a number of departments, partly for efficiency and price saving causes. C3.ai has acknowledged that it continues to put money into the massive market alternative forward of it although, and that any cuts have been efficiency pushed.

Determine 1: C3.ai Job Openings (supply: Revealera.com)

Baker Hughes

C3.ai is making in depth use of companions each to distribute their software program and to increase their platform’s capabilities. They’ve established partnerships with Baker Hughes Firm (BKR) (oil and gasoline market), Constancy Nationwide Data Companies, Inc. (FIS) (monetary companies) and RTX Company (RTX) (US protection and intelligence communities). The alliance program companions work with C3.ai to develop, market, and promote options which are natively constructed on or tightly built-in with the C3 AI Suite.

Baker Hughes C3 AI is a three way partnership that goals to allow digital transformation within the oil and gasoline business. Functions goal use instances like:

- Power administration.

- Stock optimization.

- Course of optimization.

- Manufacturing optimization.

- Course of schedule optimization.

- Reliability.

- Provide Community Danger.

- Effectively Growth Optimization.

Baker Hughes can also be supposed to be using C3.ai functions throughout its enterprise to extend productiveness and effectivity.

Whereas these partnerships probably help software growth and drive distribution, their success is questionable. Buyer focus can also be a problem, with a considerable portion of income coming from associated events, most of which is from Baker Hughes. If this relationship have been to bitter, or C3.ai have been to lose certainly one of its different bigger clients it might have a fabric affect on the enterprise.

Schlumberger

Schlumberger Restricted (SLB) is leveraging AI in areas like drilling automation, digital twins for manufacturing optimization, and carbon seize and storage modeling. These use instances are rather more particular to the oil and gasoline business and require far better area experience. To allow these efforts, Schlumberger has partnered with Dataiku. Schlumberger goals at offering clients with a single end-to-end platform for AI and believes in open knowledge architectures primarily based on frequent requirements.

Dataiku gives an analytics platform that’s aimed toward analytics leaders, knowledge scientists, enterprise analysts and knowledge engineers. Their core product is Information Science Studio, which is targeted on cross-discipline collaboration and ease of use and permits customers to begin machine-learning initiatives quickly. Dataiku is targeted on collaboration and open-source help and has a powerful on-line person group.

Schlumberger expects its digital income to achieve round 3 billion USD by 2025, with new digital know-how choices at present rising roughly 60% yearly. A lot of this is not corresponding to the merchandise supplied by C3.ai however the progress and scale of Schlumberger’s digital options are notable.

Variations within the options supplied by Baker Hughes and Schlumberger, and the relative success of these options, are usually not essentially vital to C3.ai. Whereas finish market energy is a optimistic, what issues right here is that opposite to the claims of C3.ai, there are a number of comparable platforms. Schlumberger is a technically competent group, and its option to accomplice with Dataiku (and the success of its options) demonstrates the viability of competing platforms.

Alteryx Acquisition

The marketplace for analytics software program stays fragmented, with distributors having restricted differentiation. There may be additionally a excessive likelihood that the hyperscalers and firms like Snowflake Inc. (SNOW) and Databricks will seize a lot of the analytics alternative.

Recognizing that C3.ai’s platform is just one of many in a fragmented market; it’s worthwhile contemplating the success and valuation of rivals. Whereas C3.ai is differentiated by its give attention to use case-specific functions and scalable AI, Alteryx has been shifting in the direction of a scalable end-to-end machine studying platform. Alteryx’s current struggles and resolution to promote at a comparatively low valuation are due to this fact instructive. Regardless of having a far bigger enterprise, increased progress fee and higher margins than C3.ai, Alteryx just lately agreed to be acquired by Clearlake Capital Group and Perception Companions for 4.4 billion USD cash.

Monetary Evaluation

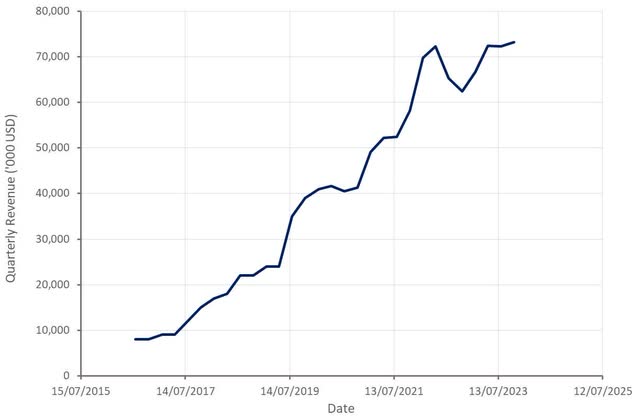

C3.ai’s income elevated 17% YoY within the second quarter to 73.2 million USD. North American income elevated 28% YoY, whereas EMEA income decreased 11% YoY. Q3 income is predicted to be 74-78 million USD, representing 14% progress on the midpoint.

Whereas accelerating progress is a optimistic, that is an anticipated end result of C3.ai’s enterprise mannequin transition. Ignoring the affect of simpler comparable durations, C3.ai’s progress stays smooth although.

Determine 2: C3.ai Income (supply: Created by writer utilizing knowledge from C3.ai)

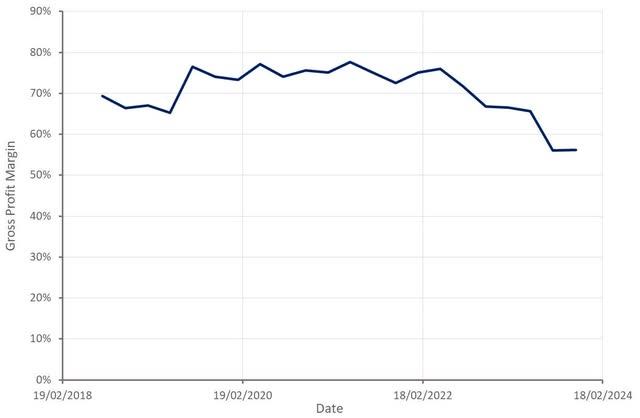

C3.ai’s gross revenue stays depressed as a result of increased mixture of pilots, which carries increased prices. Pilots and a change to consumption pricing imply that C3.ai is investing forward of progress, dragging on margins. This course of is maturing although, which ought to imply that margins stabilize and even enhance within the coming quarters.

C3.ai expects to be money stream optimistic in FY2025. This can be a considerably meaningless metric although given the corporate’s heavy use of stock-based compensation.

Determine 3: C3.ai Gross Revenue Margin (supply: Created by writer utilizing knowledge from C3.ai)

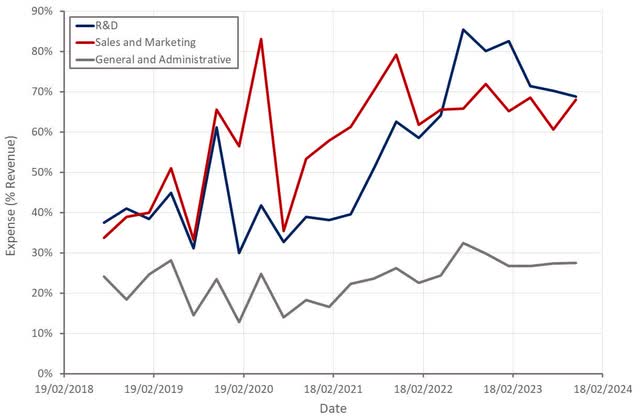

Determine 4: C3.ai Working Bills (supply: Created by writer utilizing knowledge from C3.ai)

Conclusion

C3.ai’s progress ought to proceed to speed up within the coming quarters, largely as a operate of the corporate’s enterprise mannequin transition. This shouldn’t be mistaken for a sudden surge in demand although. The hype round generative AI is probably going a tailwind for C3.ai however the firm’s progress in absolute phrases is low, notably in gentle of the expansion acceleration achieved by corporations like Palantir and UiPath Inc. (PATH).

Expectations of decrease rates of interest and easing macro issues have pushed software program valuations considerably increased. This has notably benefitted smaller, fast-growing and unprofitable corporations. Valuations are starting to look stretched although, notably relative to rates of interest. A major and broad-based acceleration of progress seems to be baked into the valuation of many corporations, C3.ai included. If this progress does not eventuate, or investor sentiment sours, there’s possible a big draw back from present worth ranges.

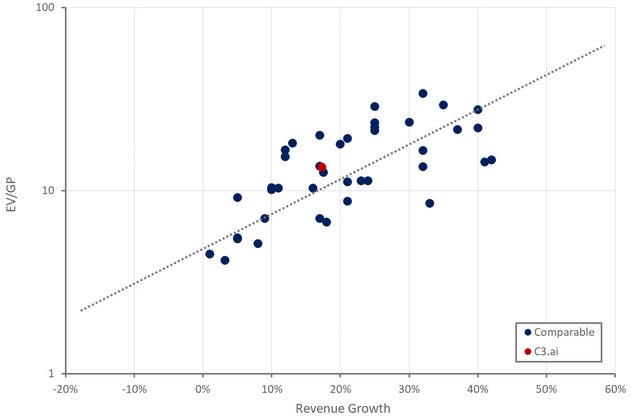

Determine 5: C3.ai Job Openings (supply: Created by writer utilizing knowledge from In search of Alpha)