Emirhan Karamuk/iStock Editorial through Getty Photographs

Introduction

Per my November 2nd article, BYD’s (OTCPK:BYDDY) progress continues. BYD bought extra battery electrical autos (“BEVs”) than anybody in 4Q23. Nevertheless, their autos are at a cheaper price level than Tesla autos and plenty of of BYD’s fashions skew in the direction of smaller batteries such that they are usually pushed fewer miles. Additionally, BYD nonetheless must show their capability to promote numerous autos exterior China. My thesis is that BYD had a formidable quarter for 4Q23 however work stays.

Numbers By 4Q23

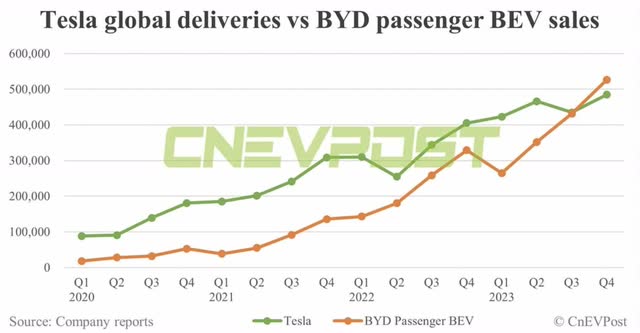

CnEVPost shows how BYD saved closing the BEV hole with Tesla, quarter after quarter till they lastly outsold them in 4Q23:

BYD BEVs (CnEVPost)

Per BYD’s December 2023 gross sales announcement, they bought 911,140 BEVs in 2022 and added one other 663,682 in 2023 for a complete of 1,574,822. This enhance of 663,682 is extra BEVs than everybody besides Tesla bought outright in 2022 per EV-Volumes.

Work Forward

Focusing solely on the overall variety of BEV models is pernicious as a result of worth, vary and markets are essential concerns.

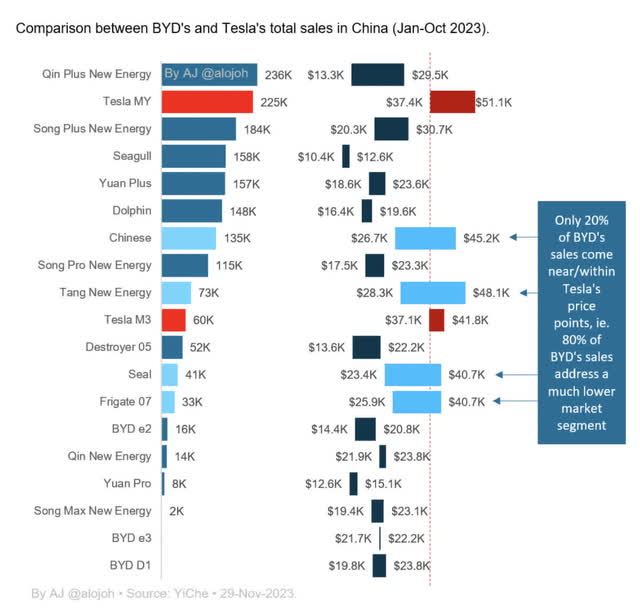

BYD nonetheless has work to do by way of promoting numerous high-value autos. One of many causes we will’t worth BYD on a unit to unit degree with Tesla is as a result of BYD’s BEVs are cheaper. Per a post from @NicklasNilsso14, the typical BYD prices about $24,200 whereas the typical Tesla is round $45,600. @alojoh posted concerning the worth variations in late November. The value level is very notable for the BYD Seagull which is as little as $10,400 per car. Its high pace is simply 80 mph and the battery capability is below 40 kWh. 80% of BYD’s gross sales goal a decrease market phase so BYD and Tesla models aren’t comparable on an apples to apples degree:

BYD costs (@alojoh put up on X/Twitter)

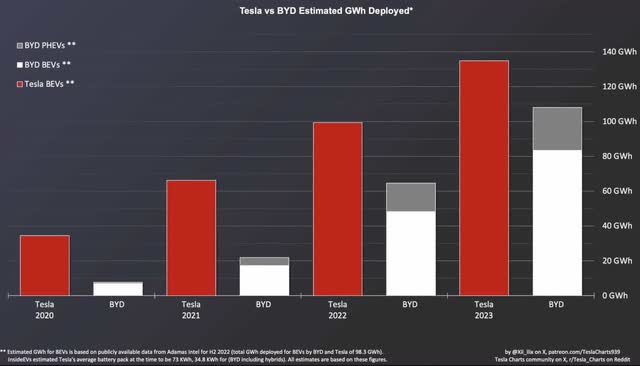

One of many causes BYD BEVs are cheaper than Tesla autos is the battery. BYD’s December 2023 announcement stated the cumulative put in capability for the 12 months was practically 151 GWh however that is complicated as BYD makes batteries for different OEMS similar to among the Tesla models inbuilt China. As for the batteries in BYD’s personal autos, @Xil_llix made a graphic exhibiting deployment of practically 140 GWh from Tesla for 2023 in comparison with a little bit over 80 GWh for BYD BEVs. That is far more of a discrepancy than 2023 BEV models which have been 1,808,581 for Tesla and 1,574,822 for BYD:

BYD GWh (@Xil_llix put up on X/Twitter)

BYD bought 341,043 autos in December together with 190,754 passenger BEVs. Nevertheless, extra progress is required by way of promoting autos exterior China as they solely bought 36,095 abroad models for the month.

Valuation

Berkshire Hathaway (BRK.A) (BRK.B) noticed issues coming with BYD over a decade in the past. Then vice chairman Charlie Munger revealed his thought course of within the Could 2009 annual meeting. First he famous that BYD’s founder, Wang Chuanfu, was solely 43 years previous on the time. He talked about BYD reinventing car manufacturing with vertical integration. It was apparent they’d make nice issues occur with their staff of 17,000 gifted engineers:

I believe they make the whole lot in that automobile besides the glass and the rubber. There could also be a few small exceptions. That’s exceptional. Whoever went into the car enterprise and made each half, and made the car a best-selling factor? This isn’t regular. I imply, that is very uncommon. And I regard it as a privilege to have Berkshire related to an organization that’s making an attempt to take action a lot that’s so essential for humanity, whenever you get proper all the way down to it. As a result of it could be a small firm, however its ambitions are giant. And I don’t need to guess towards 17,000 Chinese language engineers led by Wang Chuanfu, plus 100,000 extra gifted Chinese language in a brand-new space – constructed the way in which they need it. I might be amazed, if nice issues don’t occur right here.

Regardless of the reward above, Berkshire first reported promoting a part of their place of 225,000,000 shares in August 2022. By October 2023, Berkshire had bought 137,386,858 shares or 61% of their authentic place such that they have been down to only 87,613,142 shares. Being a educated shareholder, Berkshire makes me involved about BYD’s valuation given the way in which they’ve reported promoting shares since August 2022. My valuation thought course of hasn’t modified drastically from my November 2nd article. The inventory has gone down a bit since that point however I nonetheless view it as a maintain.

Ahead-looking buyers ought to proceed maintaining a tally of BYD’s abroad models. That they had abroad models of 30,521, 30,629 and 36,095 for October, November and December, respectively.

Disclaimer: Any materials on this article shouldn’t be relied on as a proper funding suggestion. By no means purchase a inventory with out doing your individual thorough analysis.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.