webphotographeer

Butterfly Community, Inc. (NYSE:BFLY) is an fascinating firm that goals to make use of its moveable ultrasound expertise to impression the healthcare sector. They’ve quite a lot of services and products associated to such merchandise. Nonetheless, the corporate’s efficiency has lately seen a pointy income decline, a brand new CEO, and a strategic realignment. Its present price construction seems unsustainable even after workforce reductions and cost-cutting strikes. I estimate the corporate’s money runway to be barely over a 12 months, which is regarding and suggests additional capital raises by means of debt or fairness issuance. From a valuation perspective, I believe the present price ticket appears acceptable. I estimate this by a multiples-based valuation, which initially suggests the shares are undervalued. Nonetheless, after contemplating the potential dilutive dangers and its ongoing structural unprofitability, I believe BFLY deserves a “maintain” score.

Enterprise Overview

Butterfly specializes in moveable ultrasound expertise. BLFY goals to make medical photographs accessible and contribute to world well being fairness. Their whole-body imaging merchandise are moveable ultrasounds, together with Butterfly IQ, Butterfly IQ+, and Butterfly Blueprint. Butterfly IQ is a tool for particular person follow. The IQ+ line is the brand new model with higher capabilities, improved ergonomics, and longer battery life. These ultrasound units function with cell telephones and tablets utilizing software program cloud-connected software program. Butterfly’s Blueprint is a workflow that works with the Caption Well being platform, the world’s first AI interpretation and steerage software program approved by the FDA to assist the sensible software of ultrasound data.

Blueprint supplies hospitals and well being programs with an entire ultrasound answer that integrates with the well being system’s medical and administrative procedures. Butterfly Blueprint is complemented by an intensive set of elective software program and companies, together with Caption Well being’s AI-guided software program. Caption AI permits healthcare professionals with out ultrasound expertise to seize and interpret cardiac ultrasound photographs for earlier illness detection and higher affected person administration. Medicare & Medicaid Companies (CMS) permitted New Expertise Supplemental Funds (NTAP) for Caption Steering, a designation given to new medical applied sciences and companies anticipated to enhance the analysis considerably.

Supply: Butterfly Community Q3 2023 Earnings Presentation

From an ownership perspective, it’s value mentioning that BFLY’s predominant shareholder is Jonathan Rothberg, with 17.81% of the corporate value roughly $38.7 million. Additionally noteworthy is ARK Funding Administration LLC, which holds a barely smaller variety of shares, with a 6.14% stake within the firm value about $13.4 million.

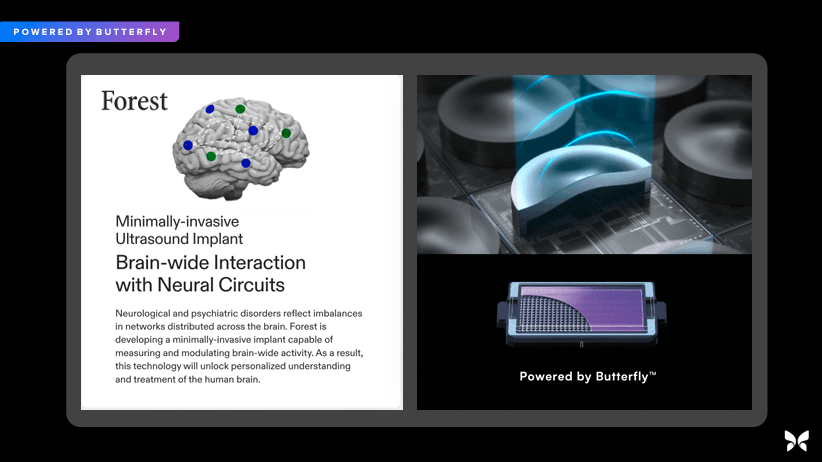

Mind Interfaces and AI Markets

BFLY’s current strategic strikes have been fascinating, lately saying a five-year co-development agreement with Forest Neurotech to create next-generation brain-computer interfaces ((BCIs)) utilizing Butterfly’s Ultrasound-on-Chip expertise. This chip could be the primary whole-brain implanted neural interface, leveraging the BFLY’s ultrasound-on-chip expertise and its Butterfly Backyard program, geared toward growth and innovation in medical expertise. Butterfly Backyard is a platform designed to develop customized AI purposes utilizing the BFLY growth package (SDK) in order that medical gadget corporations, digital care suppliers, and AI builders can program their built-in purposes to ultrasound with augmented actuality, digital actuality, or robotics. Butterfly Backyard Market is meant to host new purposes in order that customers can entry the newest AI capabilities in photographs.

Inside this settlement with Forest Neurotech, BFLY will obtain $20 million as varied growth milestones are met, and BLFY already acquired $3.5 million upon signing the settlement. Moreover, BFLY will receive earnings for every unit offered. Forest Neurotech is a part of the Convergent Analysis and Schmidt Futures Community that focuses on minimally invasive mind imaging and stimulation for medical and scientific use. The collaboration validates Butterfly Community’s initiative, Butterfly Backyard, geared toward co-development and innovation in medical expertise. This partnership is a vital step within the development of medical expertise, significantly within the subject of brain-computer interfaces, and can serve to use ultrasound expertise in revolutionary improvements inside healthcare.

Supply: Butterfly Community Q3 2023 Earnings Presentation

On the 2023 American Faculty of Emergency Physicians Scientific Meeting in Philadelphia, ACEP23 Butterfly Community introduced two ultrasound instructional choices as a strategic effort to drive consciousness and adoption of its expertise. Its function is to coach healthcare professionals in regards to the capabilities and advantages of BFLY ultrasound expertise to extend the visibility of the expertise and facilitate its adoption in medical settings.

Moreover, Butterfly Community has obtained FDA approval for its AI-powered Auto B-line Counter that works with synthetic intelligence. This can be a device designed to guage adults with suspected irregular lung circumstances. This gadget makes use of deep studying expertise to investigate a six-second ultrasound clip and produce a B-line rely. B-lines, or ultrasound lung comets, seem as brilliant vertical traces on an ultrasound, indicating lung dampness related to a illness of the lung airspace. This device provides a extra exact interpretation than a guide rely of B traces. On this method, early detection of cardiovascular illnesses, one of many predominant causes of dying worldwide, may be achieved.

Apparently, Butterfly Community developed and trained its AI algorithms utilizing greater than 3.5 million ultrasound photographs from a number of US websites, overlaying a large and numerous vary of demographics. This FDA approval marks a big development for Butterfly Community, significantly in bettering diagnostic accuracy and effectivity in lung situation assessments utilizing ultrasound expertise.

But, one key occasion that lately occurred and showcases BFLY’s transitional stage is the current appointment of Joseph DeVivo as CEO. This rent intends to spice up the corporate’s mission to innovate and broaden within the point-of-care ultrasound (POCUS) market. DeVivo’s amalgamation of expertise in telemedicine, ultrasound expertise, and synthetic intelligence, alongside together with his management expertise, positions him effectively to steer the expansion and growth of Butterfly Community. His expertise at Teladoc Well being (TDOC), a telemedicine and digital healthcare firm, may very well be significantly invaluable as Butterfly Community seems to be to broaden its digital well being companies. As well as, after working as government president of Caption Well being, the bogus intelligence firm utilized to ultrasound expertise, ensures his expertise in key areas for Butterfly Community.

Disappointing Monetary Efficiency

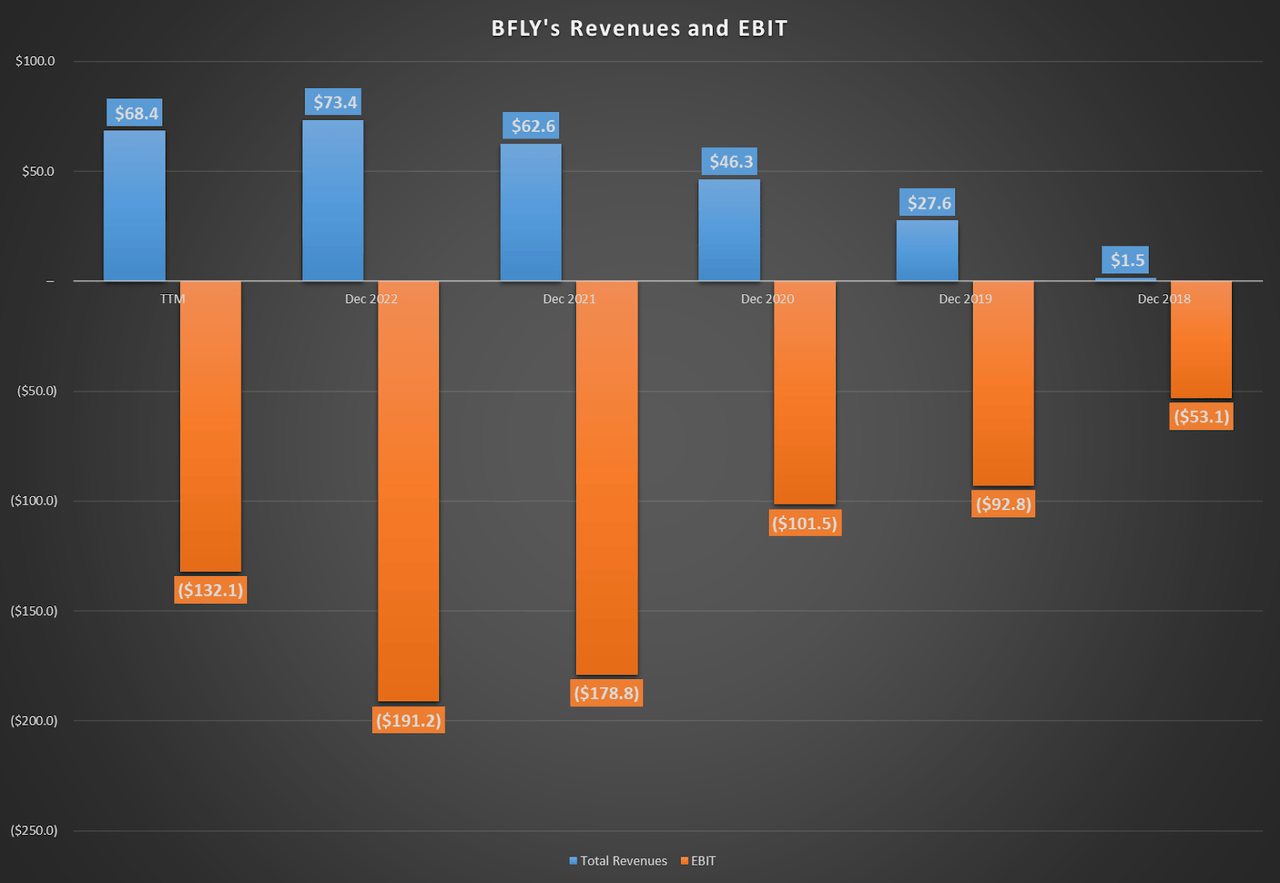

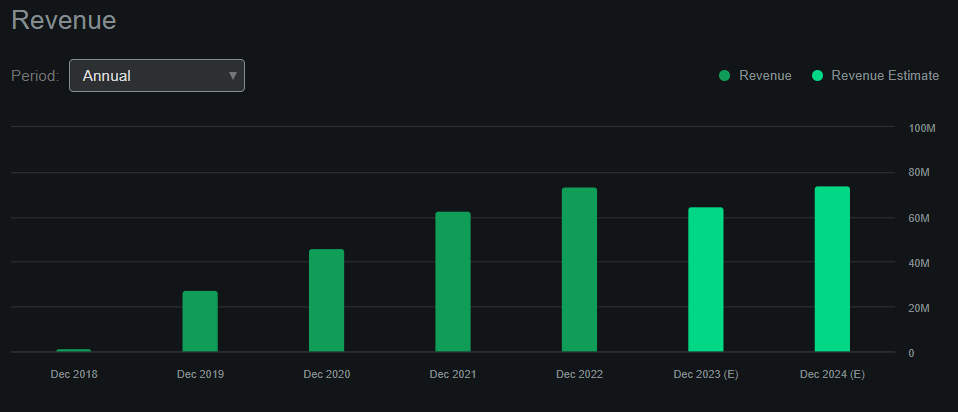

Nonetheless, though the corporate’s expertise seems promising, its financials inform a unique story. BFLY’s revenues are anticipated to drop barely in 2023, primarily attributed to a decline in product income, and make a restoration by 2024. On this context, it’s value noting that product revenues are acknowledged on the level of sale. In distinction, service revenues are acknowledged over time, so these two are inextricably associated, but the timing is inherently totally different. Additionally, the 10-Q implies that BFLY expects the income combine to tilt over time towards service revenues. In any occasion, this kind of paints an image of an organization that has leveled off revenue-wise, though since 2019, the corporate’s revenues have grown at a good CAGR of 25.5%. Nonetheless, the primary concern from a valuation perspective is that the corporate’s EBIT has deteriorated with income progress.

Writer’s elaboration.

Trying nearer at BFLY’s financials reveals that gross margins have improved over time, so the EBIT deterioration comes from working bills, not the price of items offered. This distinction is essential as a result of COGS could be extra immediately associated to inflation pressures, which might be an inexpensive clarification for EBIT deterioration given the continuing inflationary macroeconomic atmosphere. But, gross margins have truly improved from 49.6% in 2021 to 57.0% within the TTM. BFLY’s product COGS is especially manufacturing freight and packaging prices. In distinction, service COGS are cloud internet hosting prices, processing charges, and personnel. So, it’s encouraging that these prices that appear to strike on the coronary heart of BFLY’s enterprise aren’t the issue.

Nonetheless, the image modifications considerably within the working bills like R&D and SG&A. For the 9 months ending in September 2022 and 2023, R&D bills have decreased considerably, dropping 35.5% YoY attributable to workforce reductions and testing and fewer consulting charges paid. That is theoretically encouraging as a result of it exhibits the corporate is making an attempt to remove inefficiencies. Nonetheless, I believe R&D appears key for this sort of firm’s long-term success, so I believe it’s regarding on this context. Likewise, SG&A bills decreased considerably. For context, gross sales and advertising dropped 38.9% YoY, and normal and administrative bills additionally declined 31.1% YoY. Once more, this might usually be encouraging figures, however this might nonetheless go away the EBIT margin worsening unexplained.

BFLY’s inventory has additionally been disappointing. (TradingView.)

It’s key to appreciate that the corporate’s “Different Bills” have skyrocketed to $17.8 million through the 9 months ending in September 2022 and 2023, rising by 365.0% YoY. As talked about earlier, these bills are primarily severance prices and different authorized bills principally associated to the corporate’s workforce reductions. But, theoretically, these bills ought to be one-time gadgets and never recurring. But, even when we exclude these bills from our EBIT calculations, it’d not be sufficient to be EBIT optimistic. For context, throughout the identical interval, EBIT losses had been $98.9 million, so the $17.8 of different bills is vastly overshadowed.

Money Burn and Valuation Evaluation

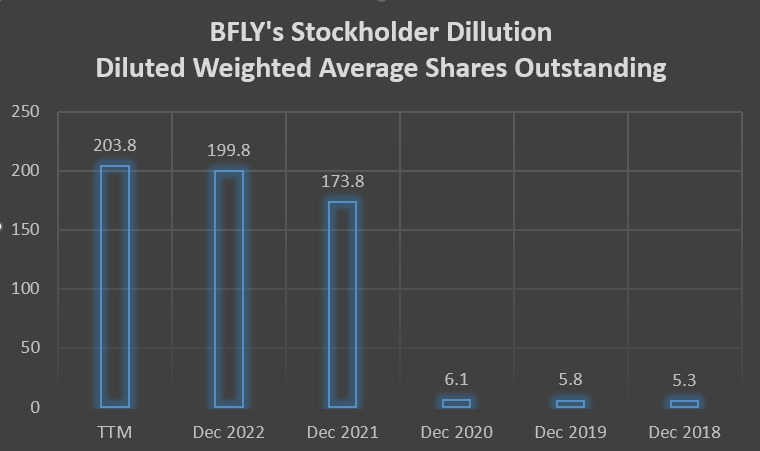

Total, I estimate that with out the “different bills,” BFLY’s OpEx annualized run charge is about $147.2 million. These figures and the corporate’s present gross margins of 57.0% suggest that BFLY’s breakeven revenues in EBIT phrases are $258.25 million per 12 months. But, at present, the 2024 income estimates are $74.08 million, which suggests BFLY will proceed burning by means of its money reserves. Thus, utilizing the corporate’s money from operations and web capex figures, I estimate its money burn to be about $118.6 million yearly. On condition that the corporate at present holds simply $150.0 million in money as of September 2023, the present money runway is simply 1.26 years, which is alarming and means that additional stockholder dilution is imminent. Alternatively, debt may very well be issued, which might even be detrimental for shareholders due to the at present high interest rate atmosphere.

Searching for Alpha. Analyst income estimates for 2023 and 2024.

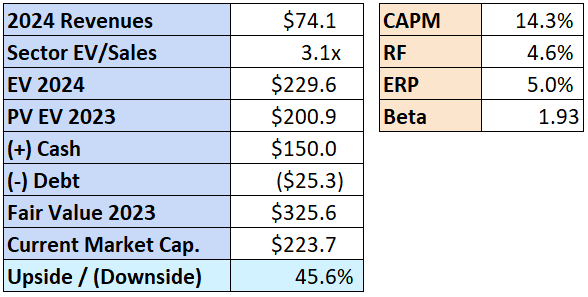

Subsequently, since BFLY continues to be structurally unprofitable, I believe the very best valuation method is multiples-based. On this case, the primary variable is BFLY’s revenues. We are able to assess BFLY’s income potential utilizing its present analyst estimates for 2024 revenues of $74.08 million, coupled with the forecasted sector CAGR of 4.9% till 2028. Then, do not forget that since 2019, BFLY’s income CAGR has been 25.5%, so let’s assume a barely decrease CAGR going ahead however nonetheless outpacing its sector’s CAGR. Let’s say a ten.0% income CAGR by 2028. With that, BFLY’s revenues could be $108.5 million, which, priced on the sector’s EV/Gross sales a number of of three.10, would suggest an enterprise worth of

Writer’s elaboration.

As you may see, this valuation method would counsel the shares are undervalued and have a forty five.6% upside potential. Nonetheless, the caveat is that this ignores the probably fairness dilution, which might restrict this upside to some extent. Furthermore, I don’t assume a structurally unprofitable firm ought to be valued on the identical median EV/Gross sales a number of as the remainder of its sector. As a substitute, it ought to have a reduction due to this. Thus, factoring in these caveats offsets the purely multiples-based valuation upside, main me to a “maintain” score for BFLY.

BFLY has traditionally elevated its shares over time. (Writer’s elaboration.)

Conclusion

Total, BFLY is an fascinating firm and appears promising from a valuation perspective. In actual fact, the present income estimates could be greater than sufficient to justify its present price ticket if it had been worthwhile or no less than had a concrete path towards profitability in the long term. Nonetheless, at the moment, the corporate is evidently in a transition section. It’s unprofitable, burning by means of its money reserves, and beneath a brand new CEO. This, coupled with potential dilutive dangers for present shareholders, makes the shares much less engaging than they initially appear beneath a multiples-based valuation method. Thus, I consider the prudent score is a “maintain” for BFLY.