- BTC has surged by 4.16% over the previous week, with fundamentals indicating optimistic sentiments.

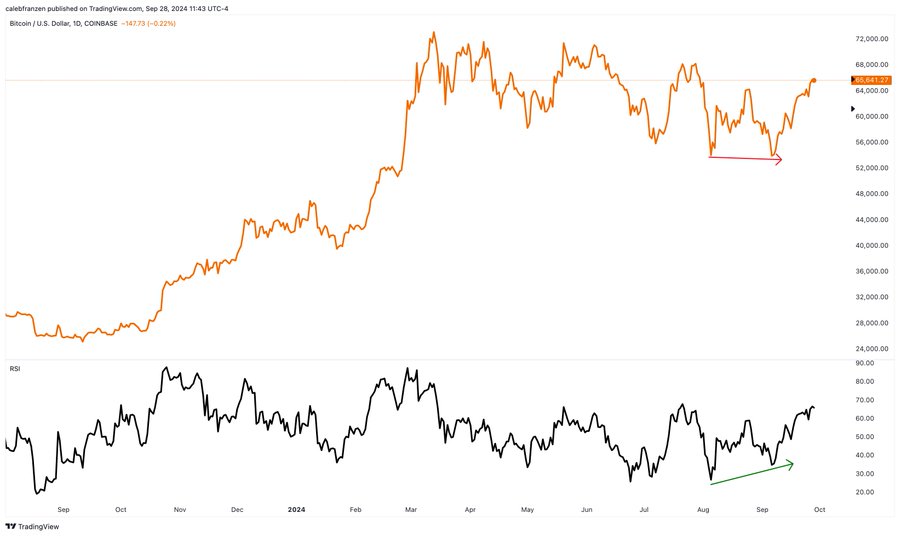

- Regardless of the lows, RSI confirms a bullish pattern with a bullish RSI divergence.

Bitcoin [BTC] has skilled a powerful upward momentum all through the month. Traditionally, September is related to a bearish pattern. Nevertheless, this month has seen a dramatic shift with BTC making greater lows.

Actually, as of this writing, Bitcoin was buying and selling at $65,530. This marked a ten.52% improve on month-to-month charts with the extension of the uptrend by a 4.16% surge over the previous week.

Nevertheless, the final 24 hours have seen a minor correction with Bitcoin declining by 0.46%.

Subsequently, the present market situations have left analysts speaking over Bitcoin’s trajectory. One in all them is the favored crypto analyst Caleb Franzen who recommended {that a} bullish pattern is ready to proceed citing bullish RSI divergence.

What market sentiment says

In his evaluation, Franzen Cited bullish RSI divergence to argue that, the bulls are dominating the market.

Supply: X

In response to the analyst, RSI has not fashioned a bearish RSI divergence on each day charts. Nevertheless, the RSI is constant to verify the bullish pattern off the lows. Subsequently, it has been confirming the bullish RSI divergence.

In context, the truth that there is no such thing as a bearish divergence implies that the worth improve is supported by momentum and there’s no important signal of a reversal presently.

When a bearish RSI divergence happens, it signifies a weakening upward momentum and will counsel {that a} value correction is imminent.

Thus, though BTC may need made decrease lows not too long ago, the RSI is making greater lows indicating that momentum is constructing regardless of decrease costs.

Normally, a bullish RSI divergence means that promoting strain is weakening and shopping for curiosity is rising resulting in an extra upside.

What BTC charts say

As noticed by Frazen, Bitcoin is having fun with favorable market situations. Subsequently, these market situations might set BTC for additional beneficial properties on value charts.

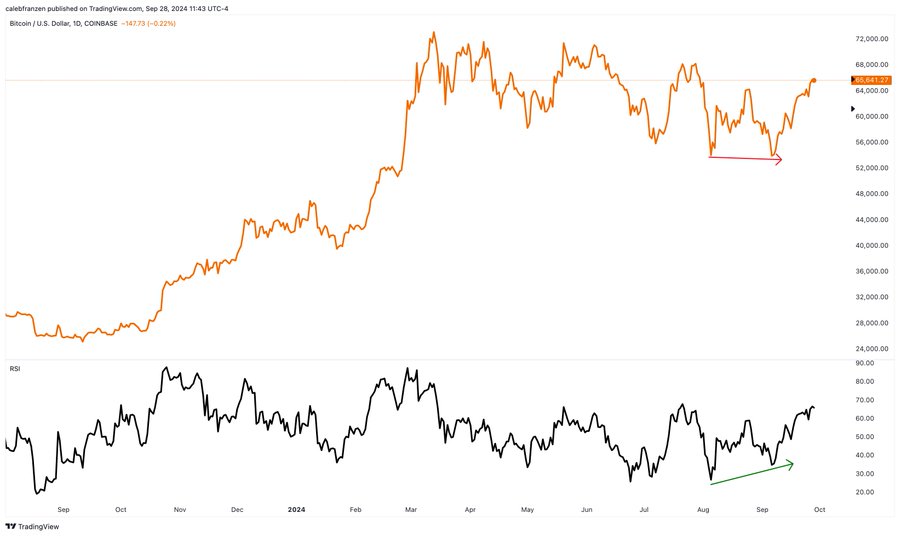

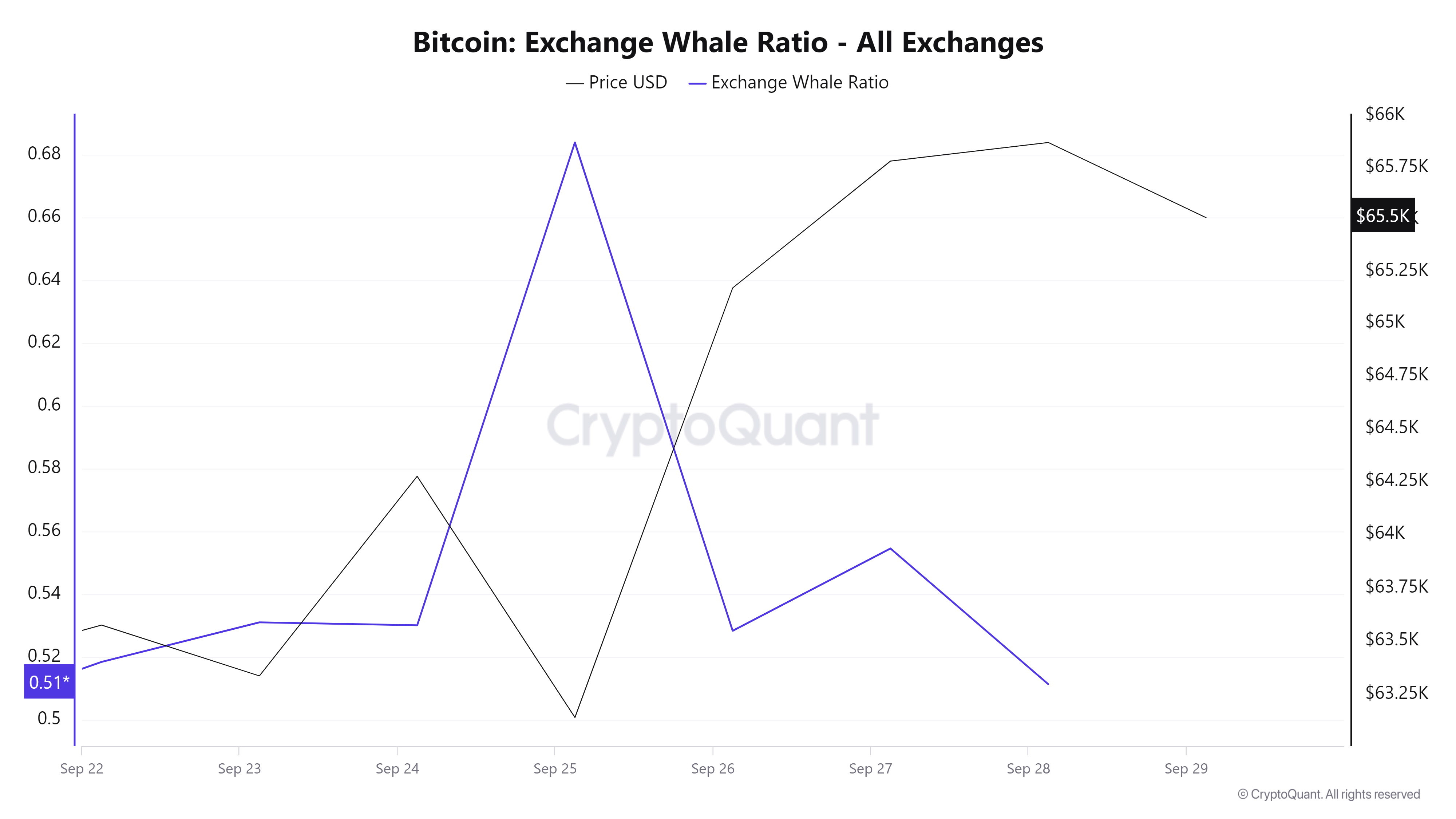

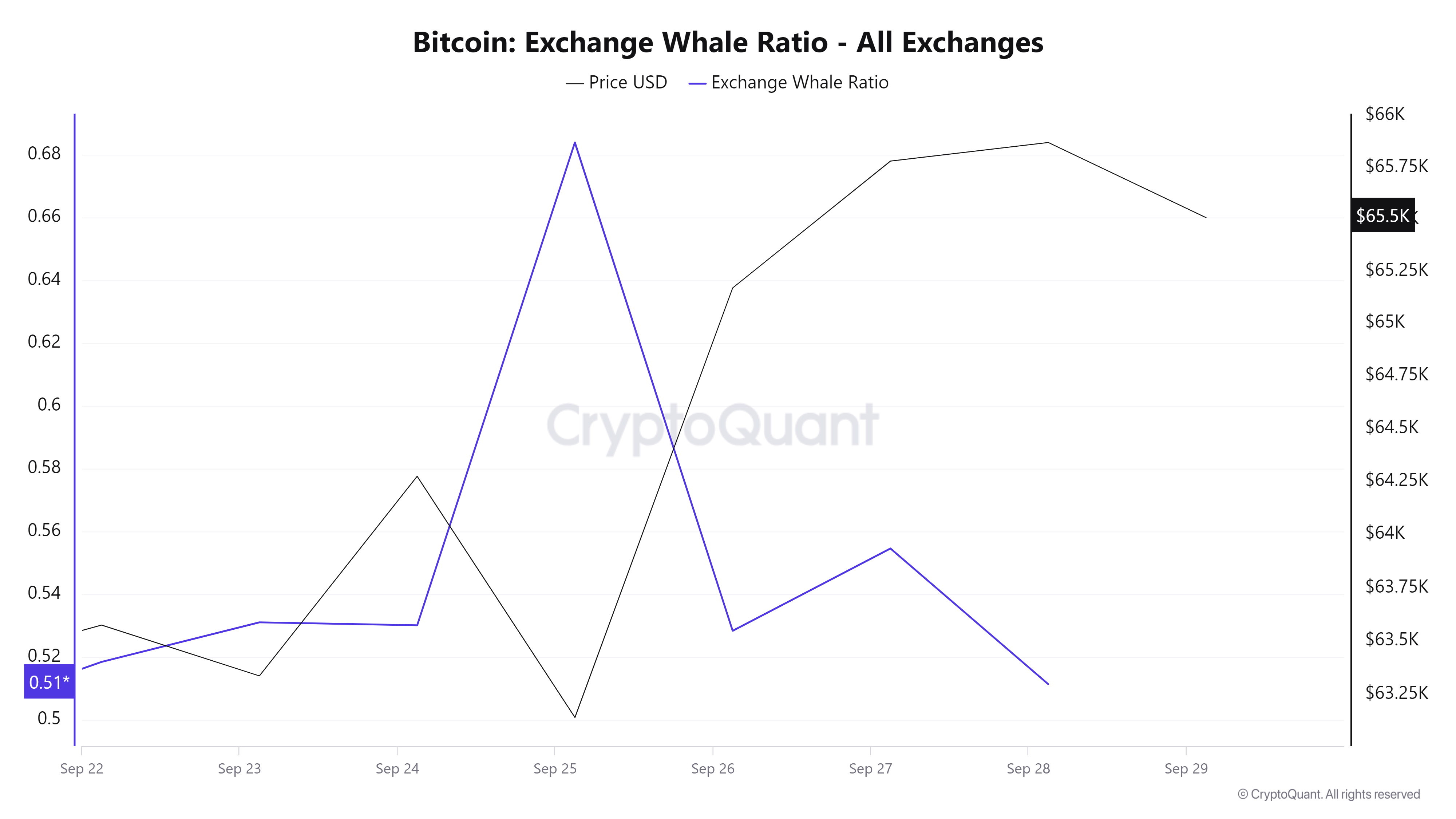

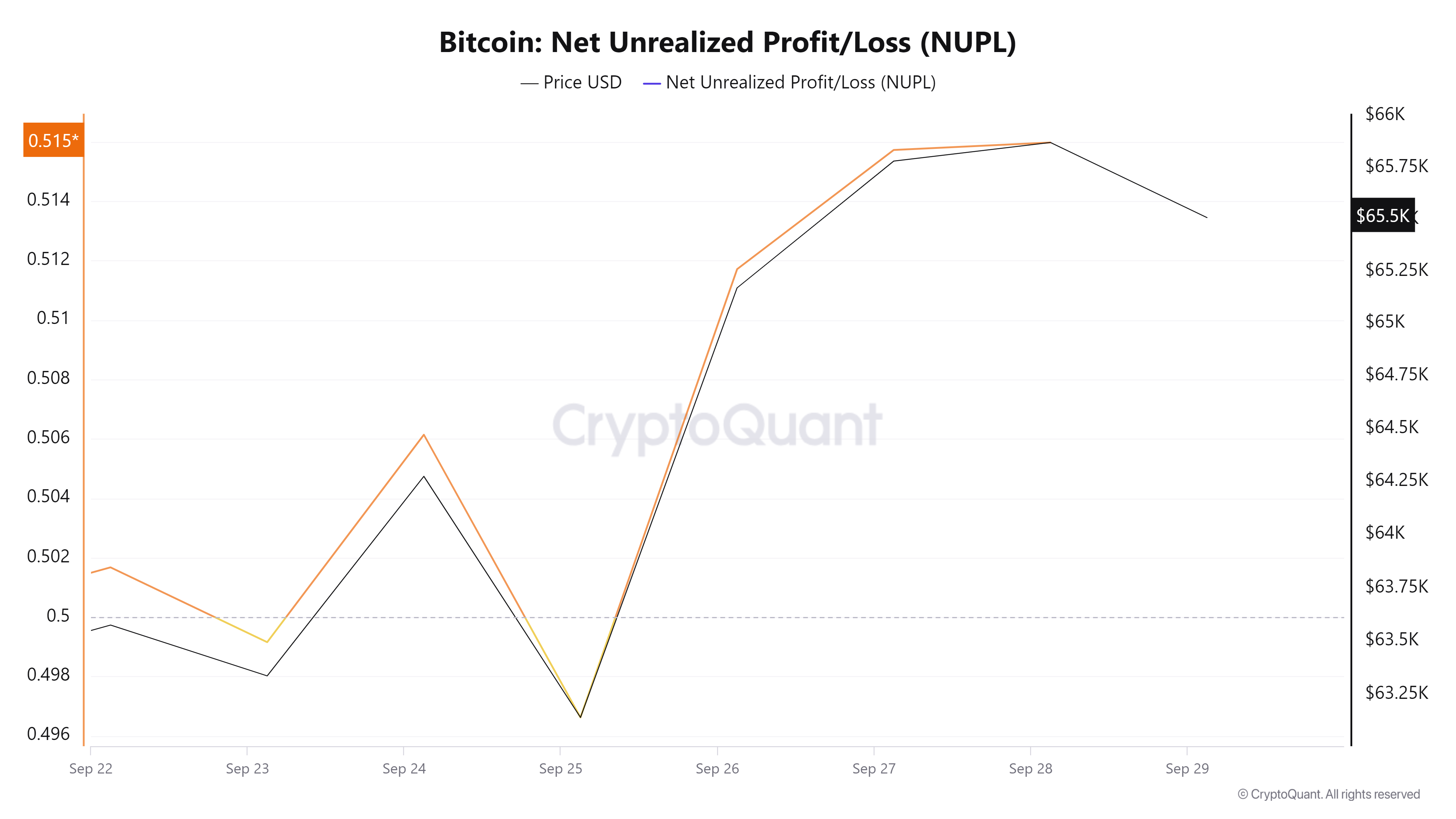

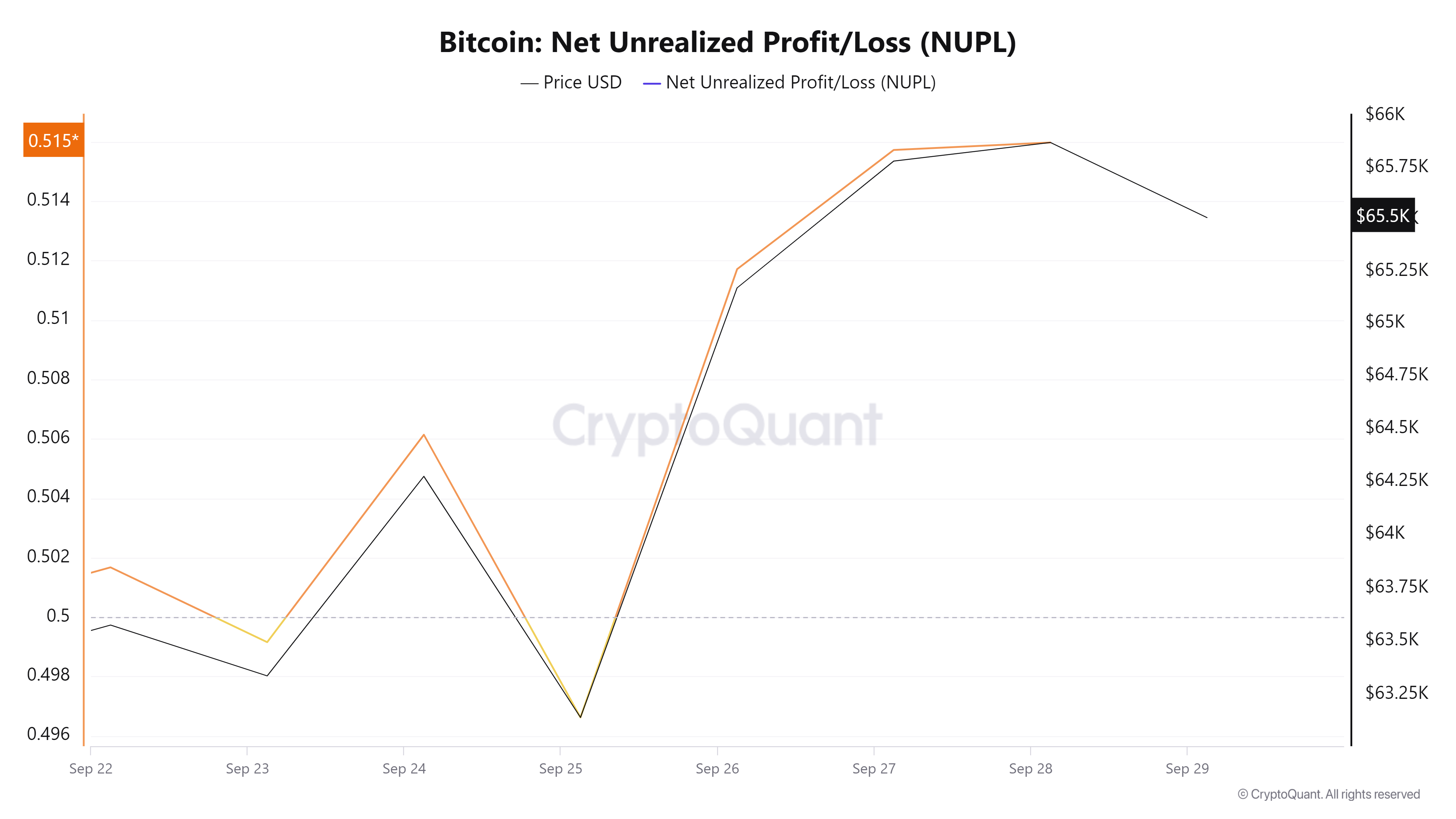

Supply: Cryptoquant

For instance, the Alternate whale ratio has declined from a excessive of 0.68 to 0.511 at press time. This decline means that whales are transferring their BT off exchanges into personal wallets.

Such market habits is a bullish sign indicating that giant holders haven’t any plan to promote within the quick time period.

Supply: Cryptoquant

Moreover, Bitcoin’s Internet Unrealized revenue/loss (NUPL) has risen from a low of 0.4 to 0.51 over the previous week. As NUPL rises, it signifies that buyers are seeing earnings.

This normally happens in the course of the market bullish part as costs improve exceeding the buying worth. Subsequently, it ends in elevated optimism as individuals really feel extra assured available in the market’s future potential, anticipating additional value beneficial properties.

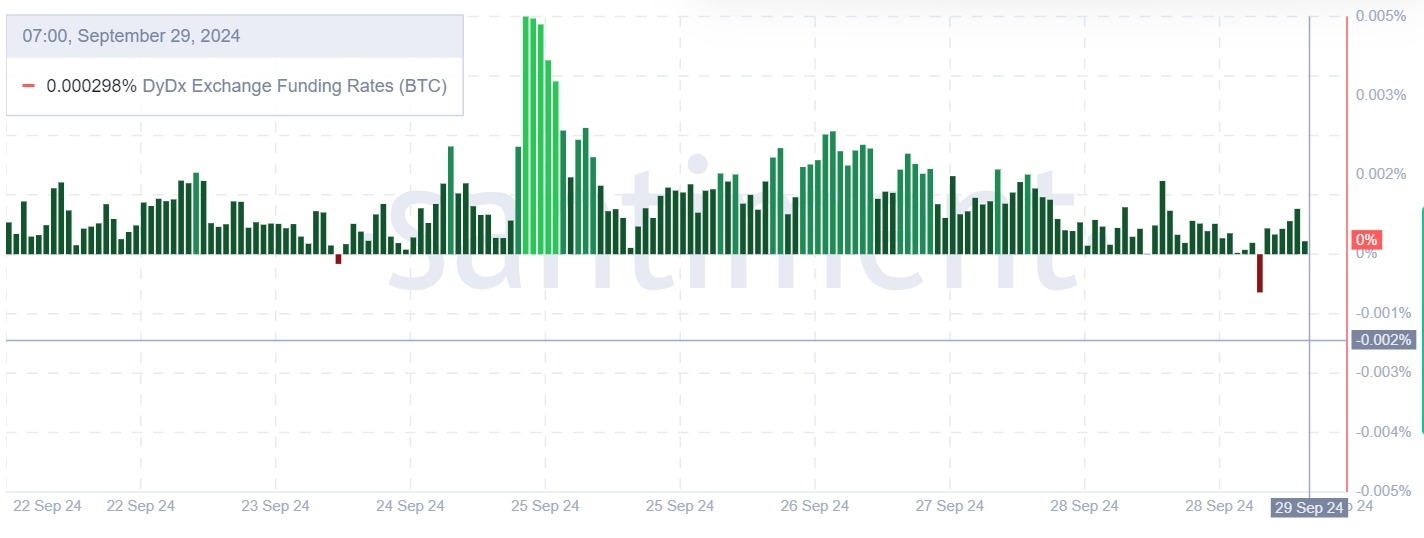

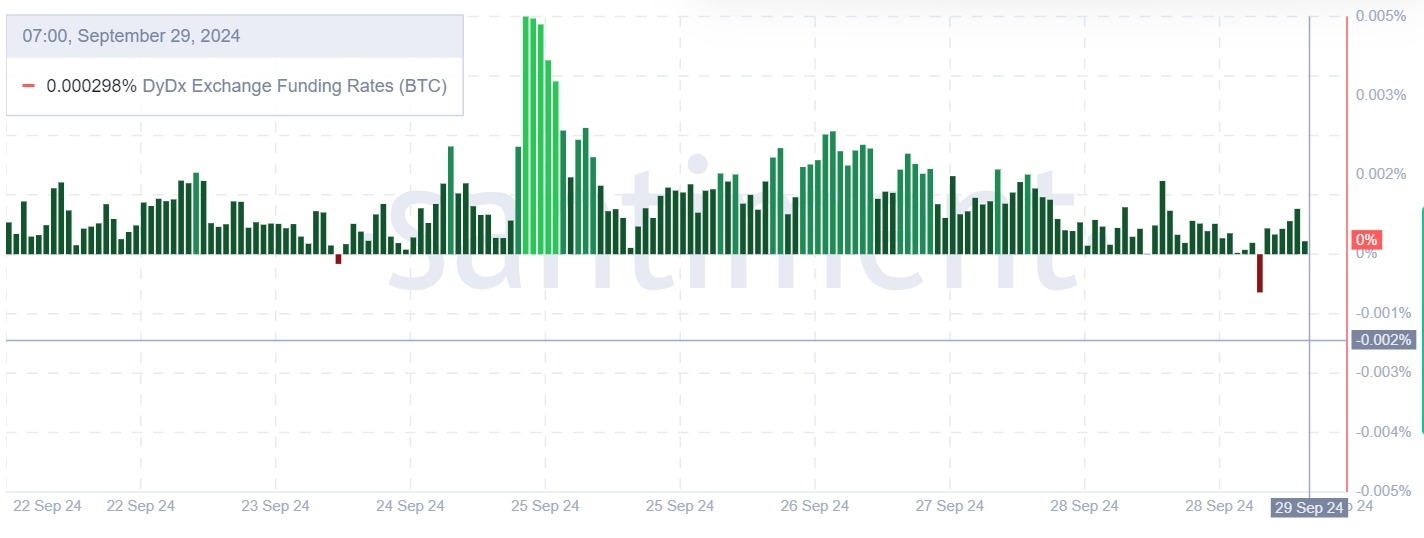

Supply: Santiment

Lastly, Bitcoin’s DyDx change funding charge has remained optimistic over the previous week. A optimistic DyDx change funding charge suggests lengthy place holders are paying these taking shorts to carry their place.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

In such a market state of affairs, buyers are extra inclined to take lengthy positions anticipating costs to rise.

Merely put, Bitcoin is experiencing a powerful upward momentum will bulls dominating the market. Subsequently, in these situations, BTC will make additional beneficial properties on value charts by reclaiming the $66500 resistance stage within the quick time period.