- BTC made important positive aspects up to now day, rising by 2.08%.

- Regardless of the current positive aspects, Bitcoin remained caught in a sustained bear section.

During the last 24 hours, Bitcoin [BTC] has made important positive aspects, rising from a neighborhood low of $55554 to $58038 at press time. This marked a 2.08% improve over the previous day.

These positive aspects are coupled with weekly positive aspects of 1.83% a restoration from a pointy decline to $52546.

These present market situations elevate the query of whether or not BTC will expertise a sustained restoration or a mere correction earlier than additional dip. The market sentiment stays bearish as analysts see a possible dip.

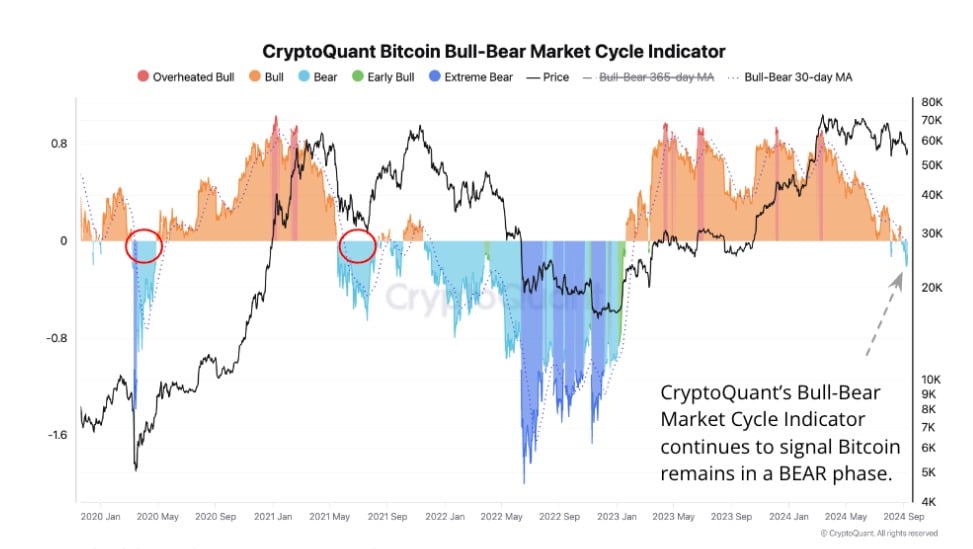

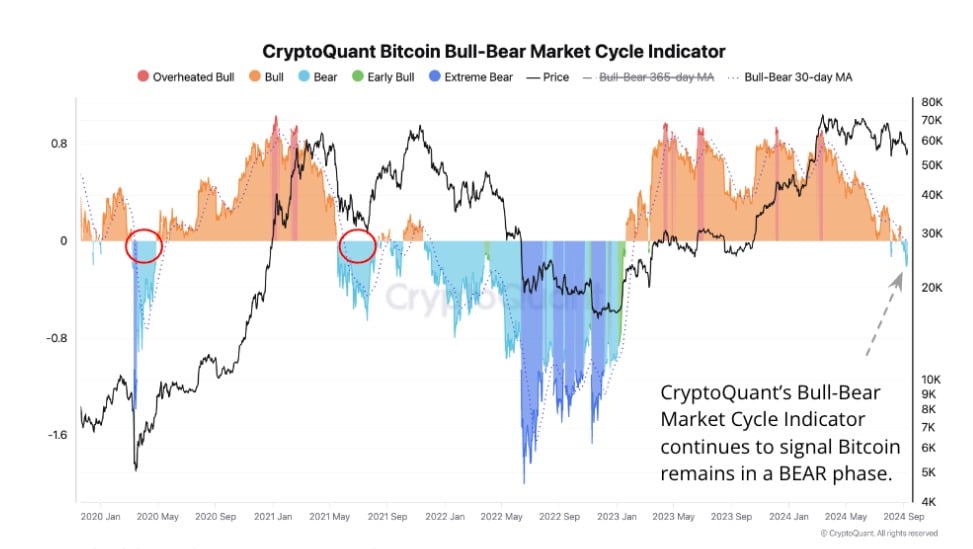

This sentiment is shared by CryptoQuant analysts who posit that BTC is caught in a bear section, citing the 365-day transferring common and MVRV.

BTC caught in bear section

Based on CryptoQuant, the Bull-Bear Market cycle has remained within the bear section over the previous two weeks.

For the reason that final time BTC was buying and selling at $62k, the crypto has remained in a bear section, dropping to a low of $52k on this interval.

So long as it stays on this section, a major rally stays sudden with potential for additional correction.

Supply: CryptoQuant

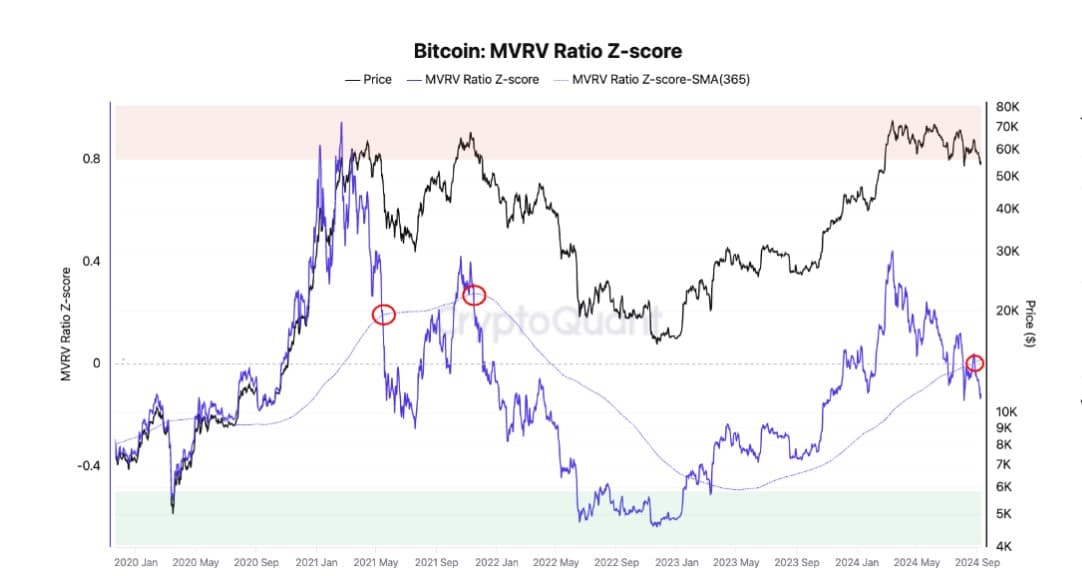

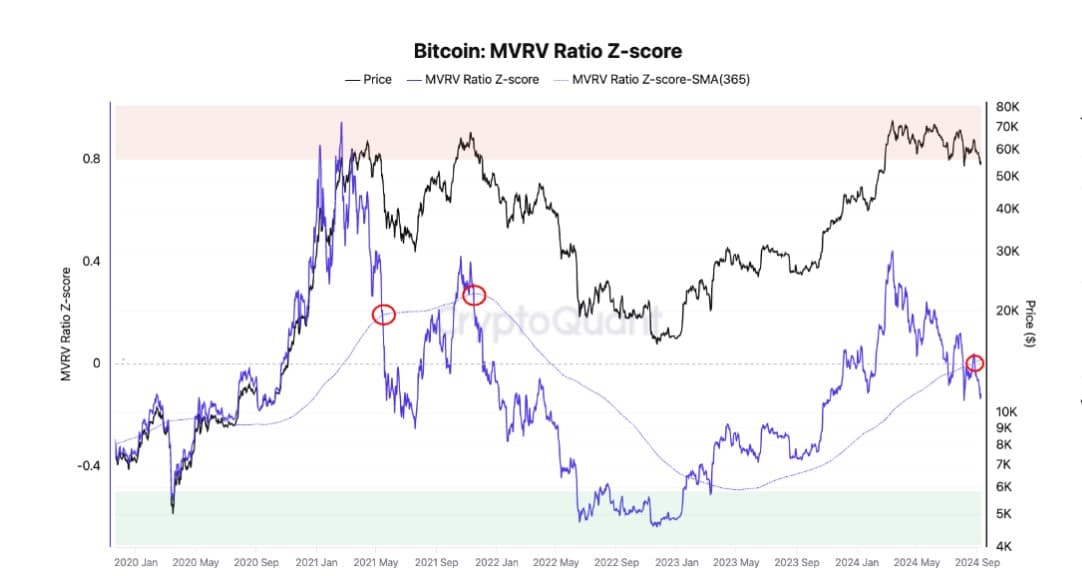

Secondly, the evaluation cited that BTC’s MVRV ratio has remained under its 365-day transferring common for the reason that twenty sixth of August. Such a situation suggests the potential for an additional decline, as was witnessed in Might 2021.

Through the 2021 cycle, BTC declined by 36% in two months — this reoccurred in November 2021.

Supply: CryptoQuant

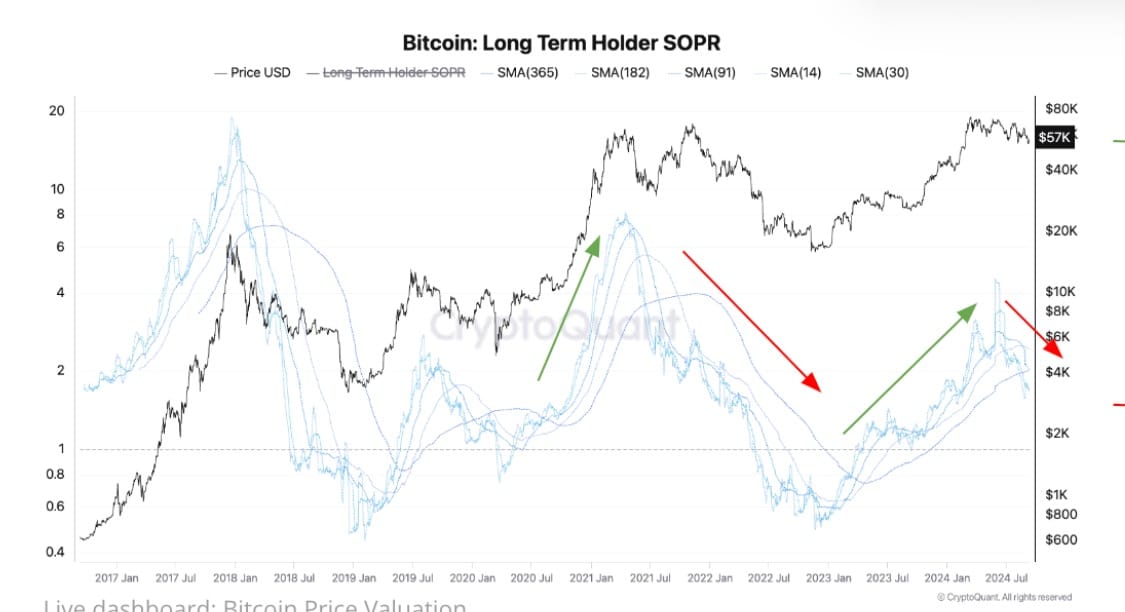

One other market indicator signaling a bearish development is the long-term holders’ SOPR. Based on CryptoQuant, long-term holders’ SOPR has declined since July, with LTH spending at decrease revenue margins.

When LTHs spend at decrease revenue margins, it reveals an absence of latest demand for BTC. Thus, BTC will solely present a shopping for sign when LTH SOPR charts begin an uptrend motion.

Supply: CryptoQuant

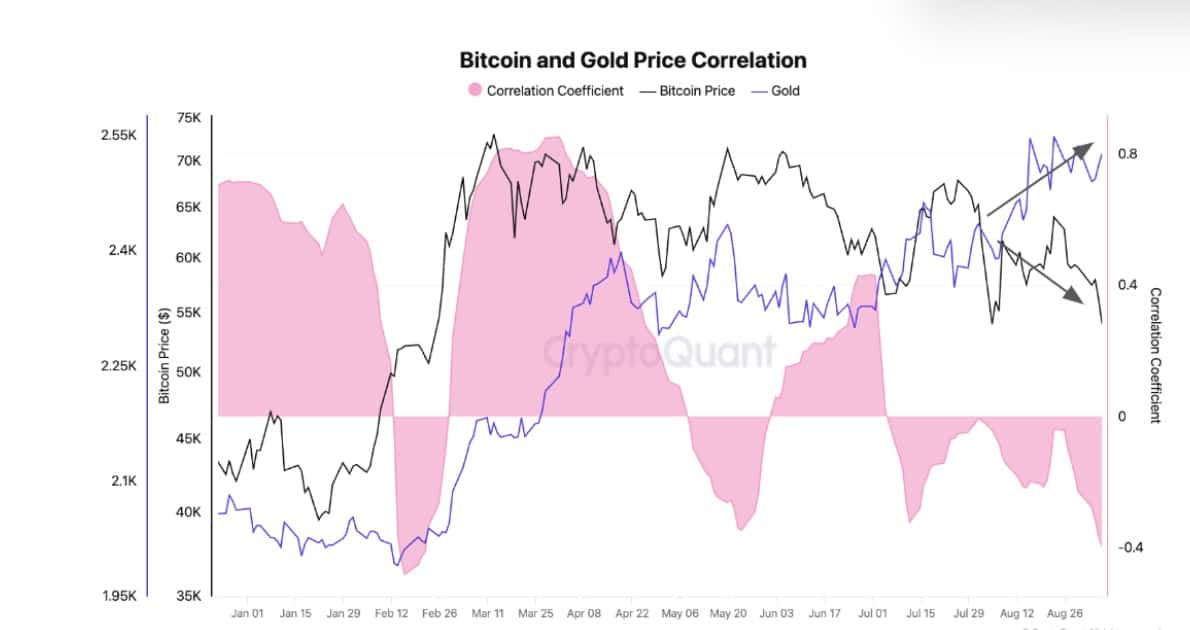

Lastly, BTC has decoupled from gold as its costs have declined whereas gold costs have been hovering, hitting new highs. Thus, the correlation between gold and BTC has turned detrimental, the place gold’s worth elevated as BTC declined.

This urged that buyers have been changing into risk-averse as they turned to conventional belongings as a protected haven, thus avoiding unstable belongings.

Supply: CryptoQuant

What Bitcoin’s charts counsel

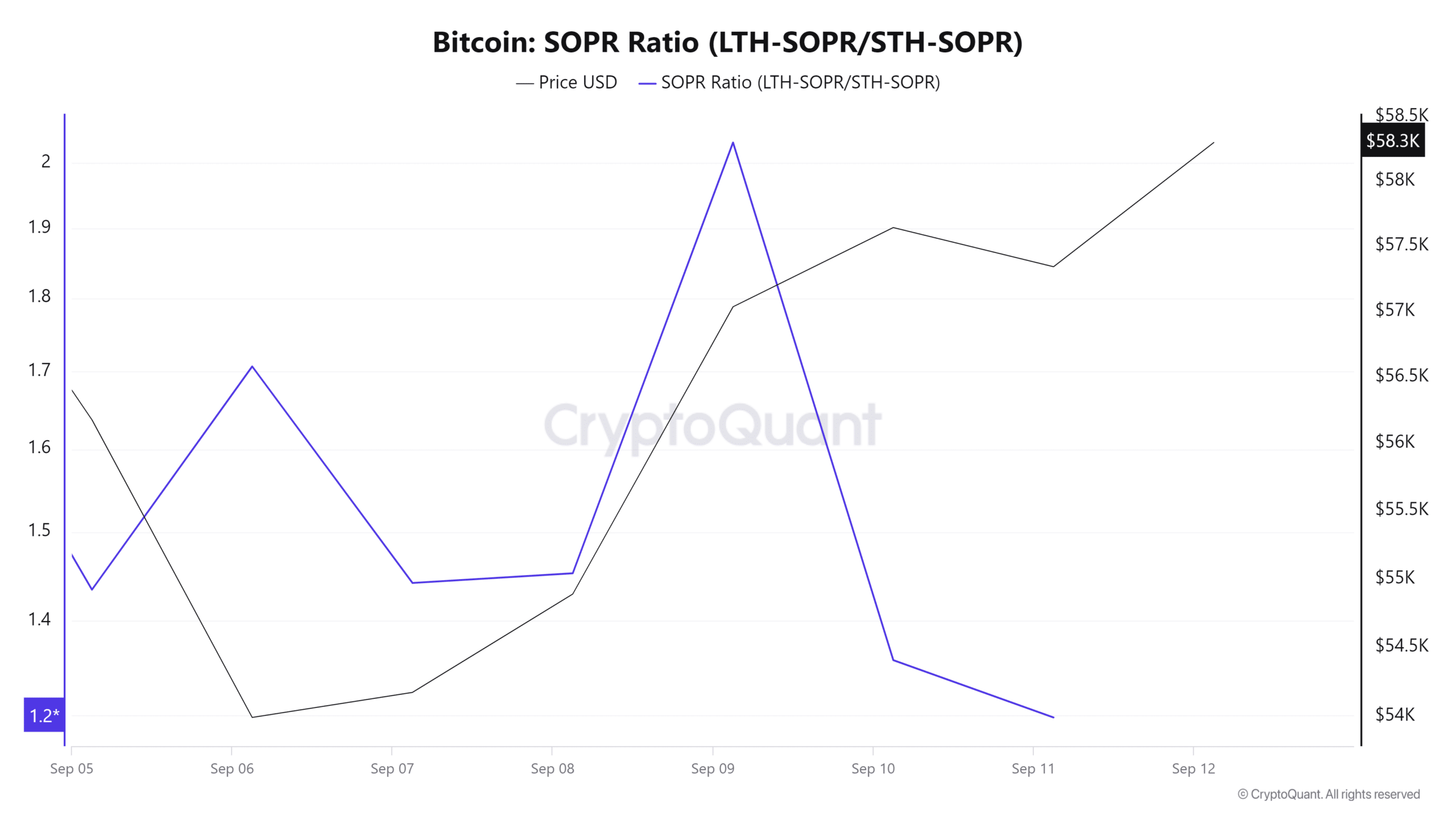

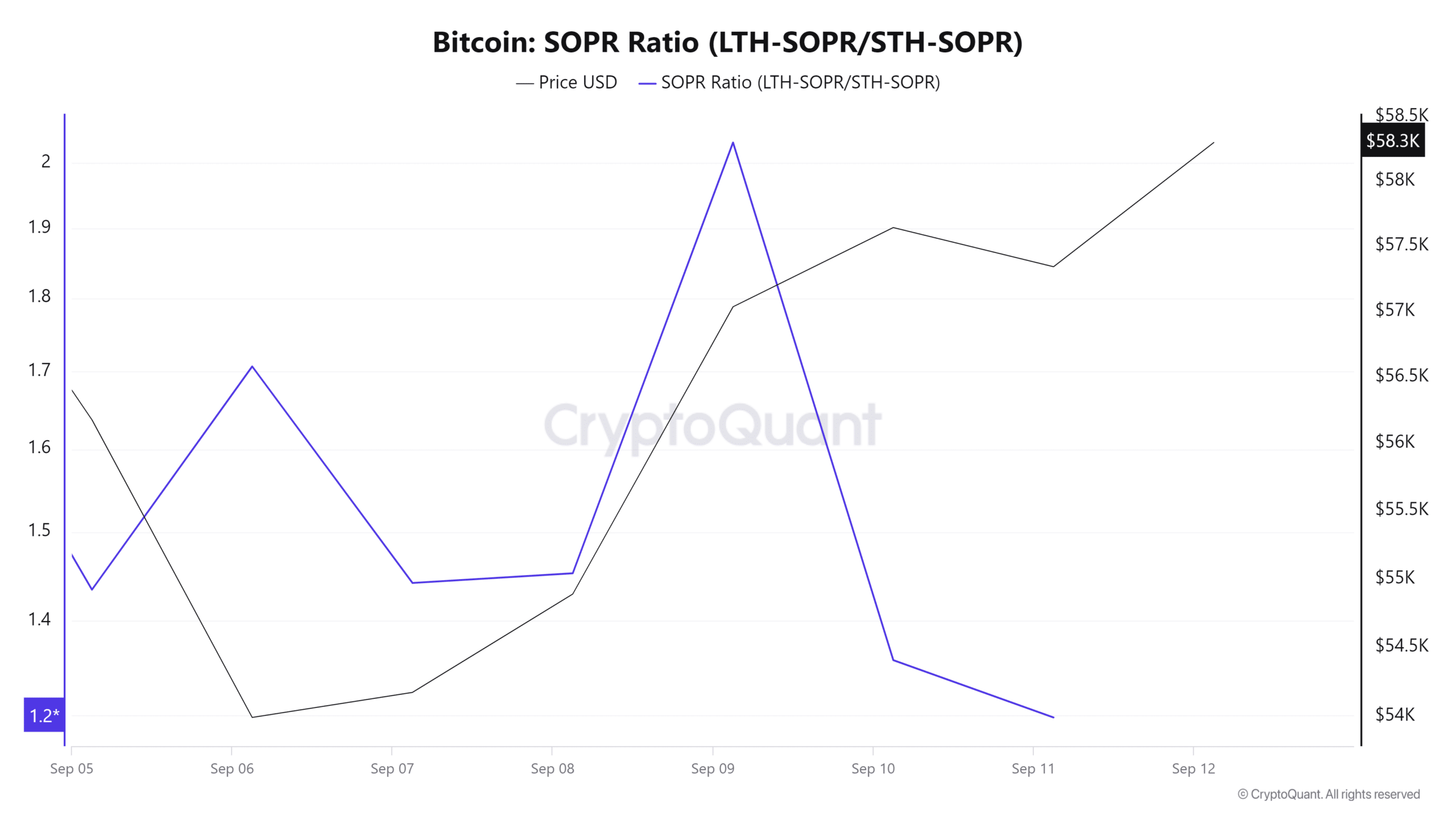

Wanting forward, each Bitcoin’s LTH-SOPR and STH-SOPR declined over the previous week. When the LTH-SOPR declines, it means that long-term holders have been more and more promoting their crypto at a loss.

When the STH-SOPR declines, it signifies that quick short-term holders are additionally promoting at a loss, as a consequence of FUD and worry of additional draw back.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

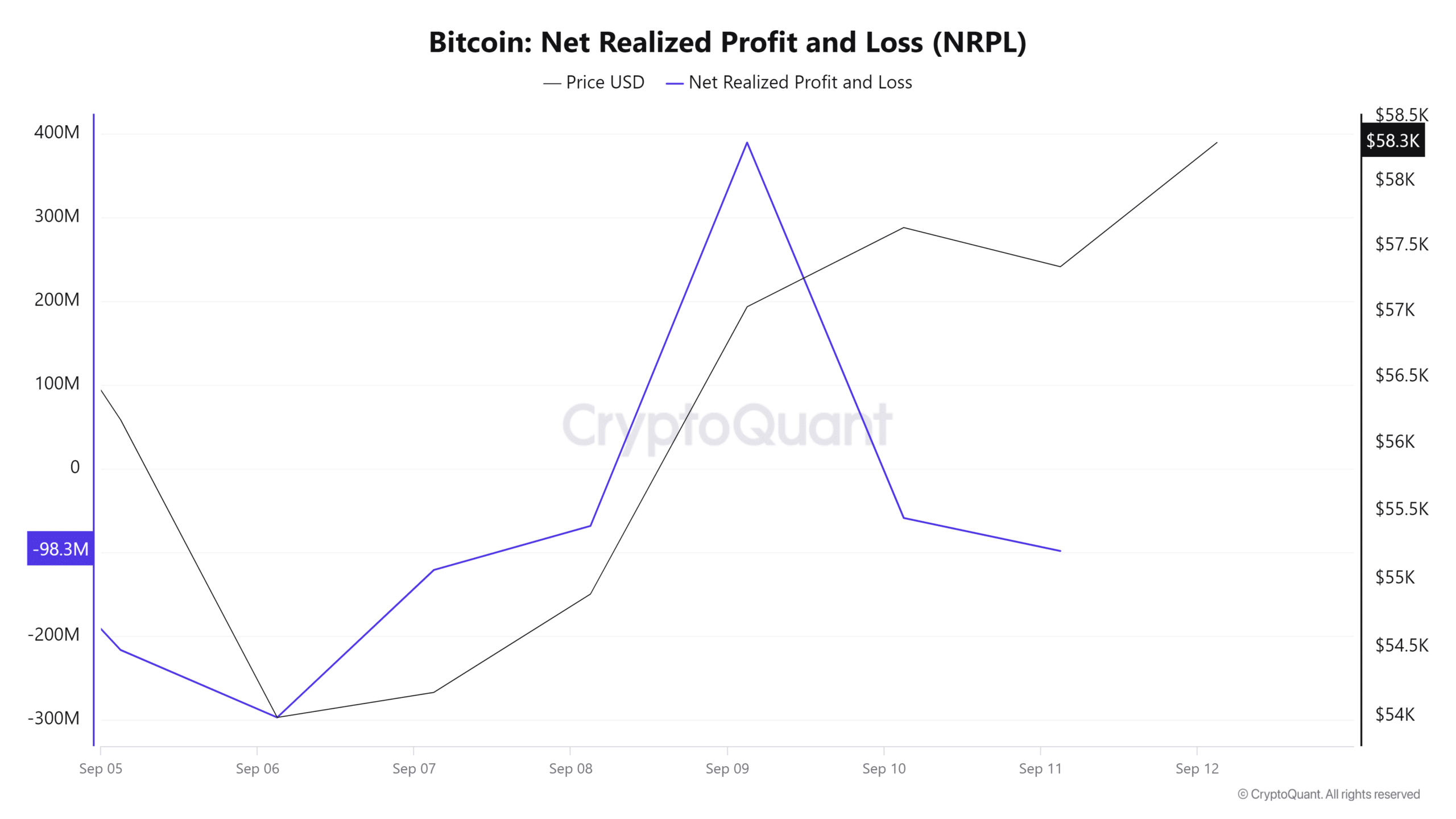

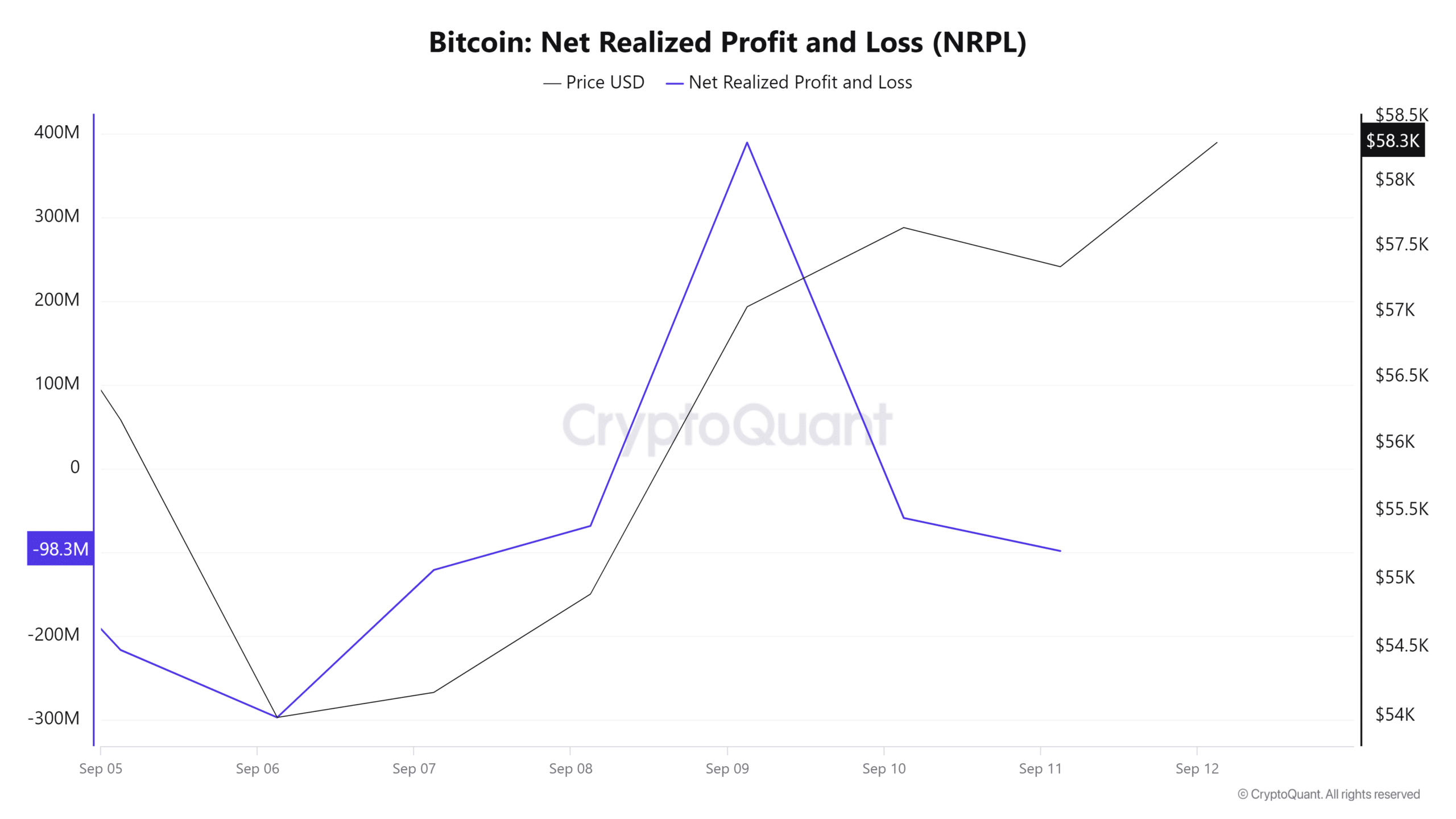

Moreover, Bitcoin’s NRPL has turned from optimistic to detrimental, indicating capitulation. This meant that buyers have misplaced confidence within the crypto’s route and have been promoting no matter their losses.

Due to this fact, based mostly on this evaluation, BTC’s bear section will proceed, and the costs are prone to expertise continued corrections. Thus, if bears proceed to dominate, Bitcoin will drop to the $56k help stage.

Supply: CryptoQuant