- BTC has declined by 3.64% in 24 hours.

- An analysts predicts an additional decline, if $55355 assist fails to carry.

Defying market traits, Bitcoin [BTC] noticed a inexperienced September. Nevertheless, the final two days it has skilled a pointy decline. As of this writing, Bitcoin was buying and selling at $61,407. This marked a 4.31% decline on weekly charts.

Previous to this, BTC was on an upward trajectory mountaineering by 5.99% on month-to-month charts. Nevertheless, since hitting a excessive of $66,508, it has declined to succeed in a low of $60,164.

This latest worth motion has sparked widespread dialogue inside the crypto group. Inasmuch, fashionable crypto analyst Man of Bitcoin steered a possible decline citing ABC construction on Elliot’s wave -B.

What the evaluation reveals

The analyst posited that BTC has damaged a micro assist which may lead to additional decline.

Supply: X

In response to this evaluation, the market is bearish which might lead to two situations.

The primary situation is that BTC will type an ABC correction the place Wave-A has began and the costs are declining. The important thing right here is that Wave-B will fail to push the value above earlier highs. Due to this fact, on this situation, the BTC would maintain its assist above $55,355.

Nevertheless, in second situation Bitcoin will break beneath the $55,355 assist degree thus getting into a five-wave construction to the draw back, indicating a a lot steeper decline.

The evaluation offered by ManofBitcoin suggests a possible draw back following the latest worth motion. Nevertheless, it’s important to find out what different fundamentals recommend.

Supply: Santiment

For starters, Bitcoin’s Value DAA divergence has remained detrimental over the previous week. This means that the present worth BTC rally isn’t supported by fundamentals as on-chain actions have declined.

Such market situation implies that the value progress is unsustainable because it alerts a insecurity and fading curiosity.

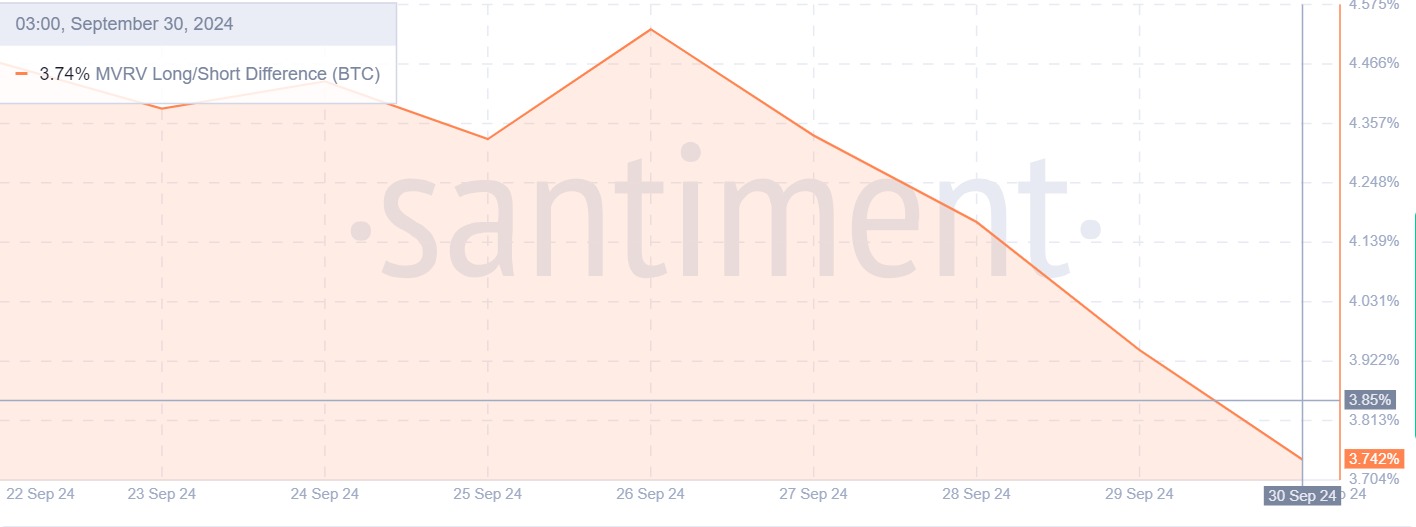

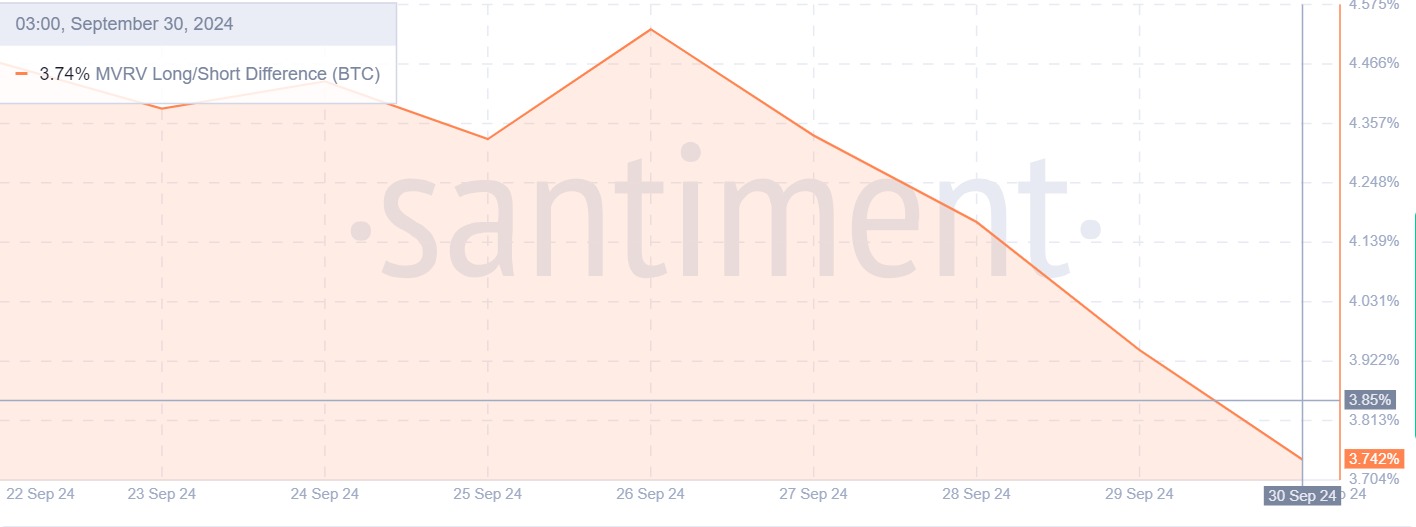

Supply: Santiment

Moreover, MVRV’s lengthy/brief distinction has declined over the previous week from a excessive of 4.5% to three.7%. Such a decline means that the market is in a stage the place long-term holders, are now not keen to carry as a lot, and short-term holders is likely to be promoting to keep away from losses.

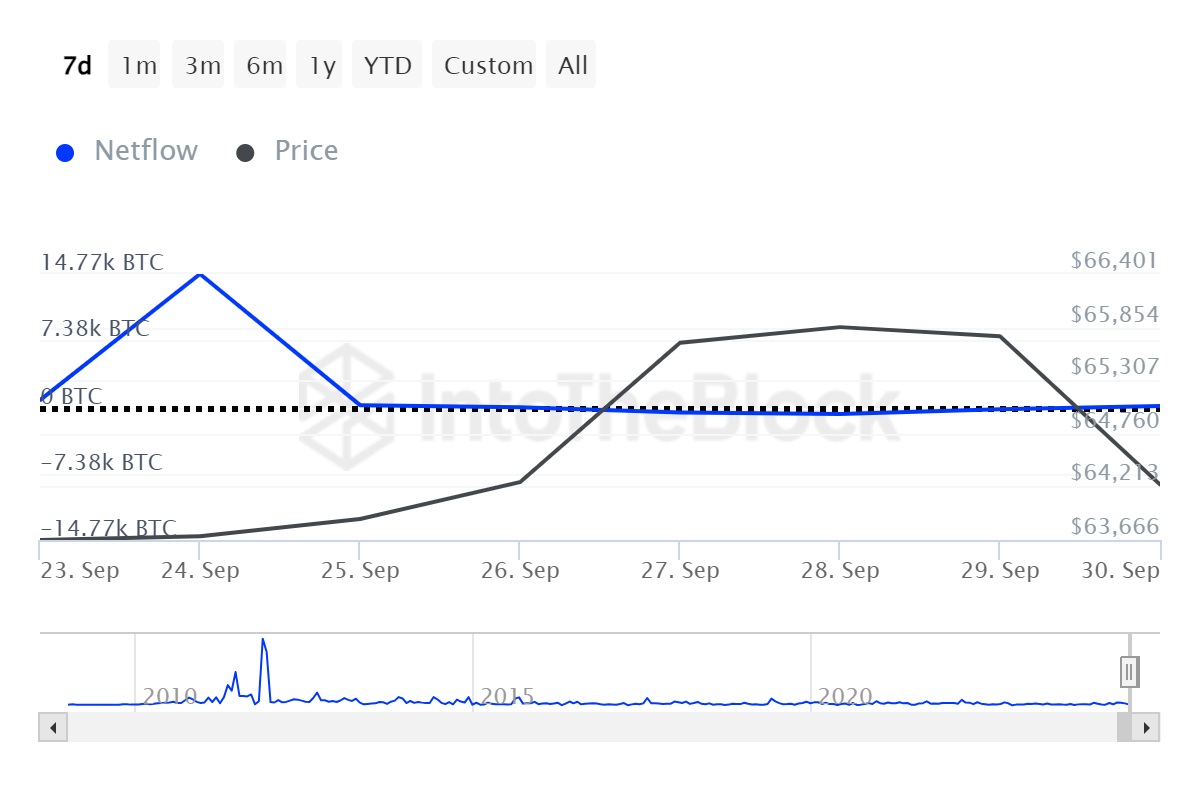

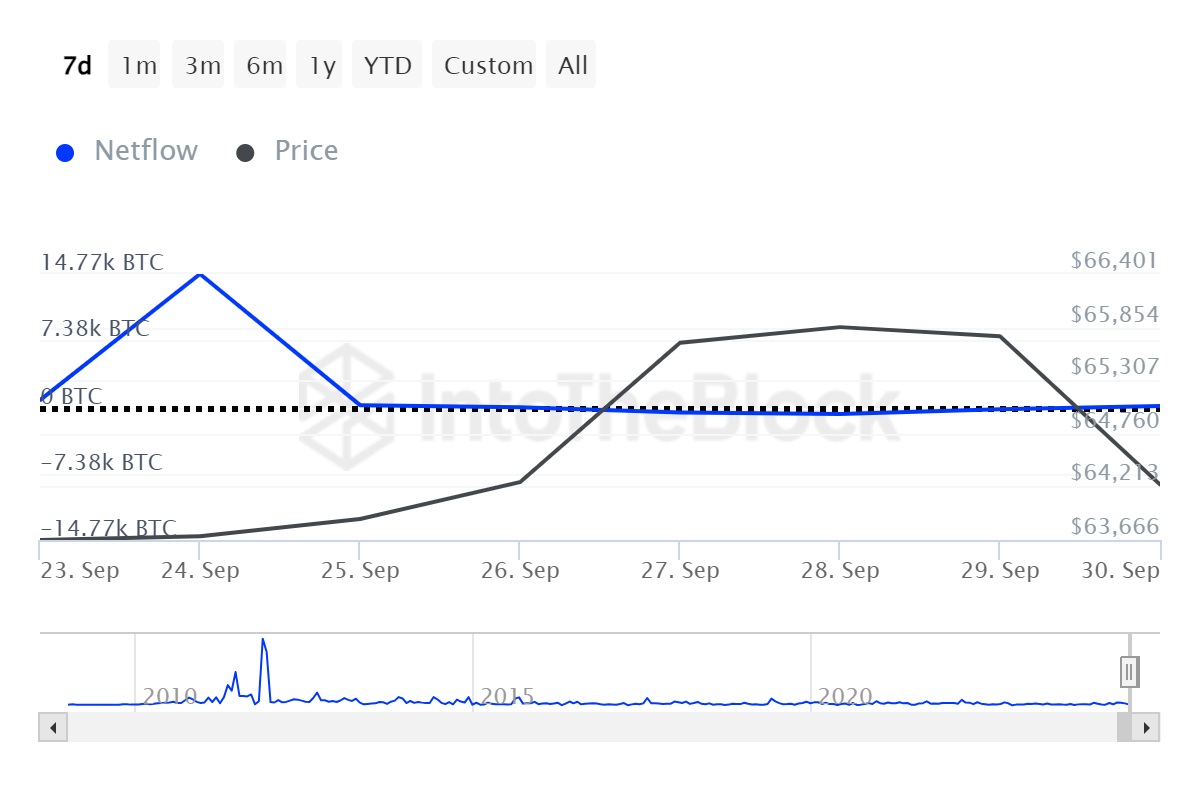

Supply: IntoTheBlock

Lastly, Bitcoin’s giant holders’ netflow has hit detrimental ranges since twenty fifth September. This means that giant holders should not opening new positions whereas they’re closing the prevailing positions.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Lowering funds circulate from giant holders alerts detrimental market sentiment as excessive outflow alerts profit-taking or avoiding additional losses.

Merely put, Bitcoin is experiencing a detrimental market sentiment with bears making an attempt to take over the market. As such, if these situations maintain, BTC will decline to $59,899. Nevertheless, a reversal would see Bitcoin reclaim $62675 ranges.