- Outstanding figures like Vinnik, Bankman-Fried, and Zhao have confronted DOJ expenses for cash laundering

- Widespread crypto-exchange KuCoin was additionally slapped with comparable expenses

Cryptocurrencies have more and more grow to be related to cash laundering actions, with notable figures like Sam Bankman-Fried and Changpeng Zhao dealing with jail phrases. A brand new participant could be added to that record now, with Alexander Vinnik, co-founder of BTC-e, a bootleg crypto-exchange, pleading responsible to comparable expenses.

In response to a press release from the U.S. Division of Justice (DoJ),

“A Russian nationwide pleaded responsible right now to conspiracy to commit cash laundering associated to his function in working the cryptocurrency trade BTC-e from 2011 to 2017.”

In response to the identical, Alexander Vinnik, aged 44, performed a major function as one of many operators of BTC-e, acknowledged as one of many largest digital foreign money exchanges globally.

BTC-e beneath DoJ’s radar

BTC-e operated from round 2011 till its closure by legislation enforcement in July 2017. This era noticed the trade facilitating transactions exceeding $9 billion, whereas catering to over a million customers worldwide. This included a notable buyer base in the USA as effectively.

In its assertion, the DoJ claimed,

“BTC-e was one of many main methods by which cyber criminals all over the world transferred, laundered, and saved the legal proceeds of their unlawful actions.”

BTC-e’s operations relied closely on shell corporations and affiliate entities that lacked correct registration with FinCEN. It additionally uncared for fundamental anti-money laundering (AML) and Know Your Buyer (KYC) insurance policies.

Alexander Vinnik executed the setup of quite a few such shell corporations and monetary accounts worldwide to facilitate BTC-e’s transactions.

Now, a federal district courtroom decide will decide the sentence for Vinnik, contemplating numerous components together with U.S. Sentencing Pointers.

Right here, it’s value noting that again in 2017, FinCEN imposed vital civil cash penalties totaling round $122 million in opposition to BTC-e and Vinnik for wilfully violating U.S. AML legal guidelines.

KuCoin too?

In a current growth, the DoJ additionally charged KuCoin, a significant cryptocurrency trade, alongside its founders Chun Gan and Ke Tang. The fees introduced in opposition to them embody conspiring to violate the Financial institution Secrecy Act and conspiring to function an unlicensed money-transmitting enterprise.

The DoJ claimed,

“Since its founding in 2017, KuCoin has obtained over $5 billion and despatched over $4 billion, of suspicious and legal proceeds.”

Taken collectively, these developments spotlight the continued challenges confronted by authorities in combating monetary crimes throughout the cryptocurrency ecosystem.

What do the figures say?

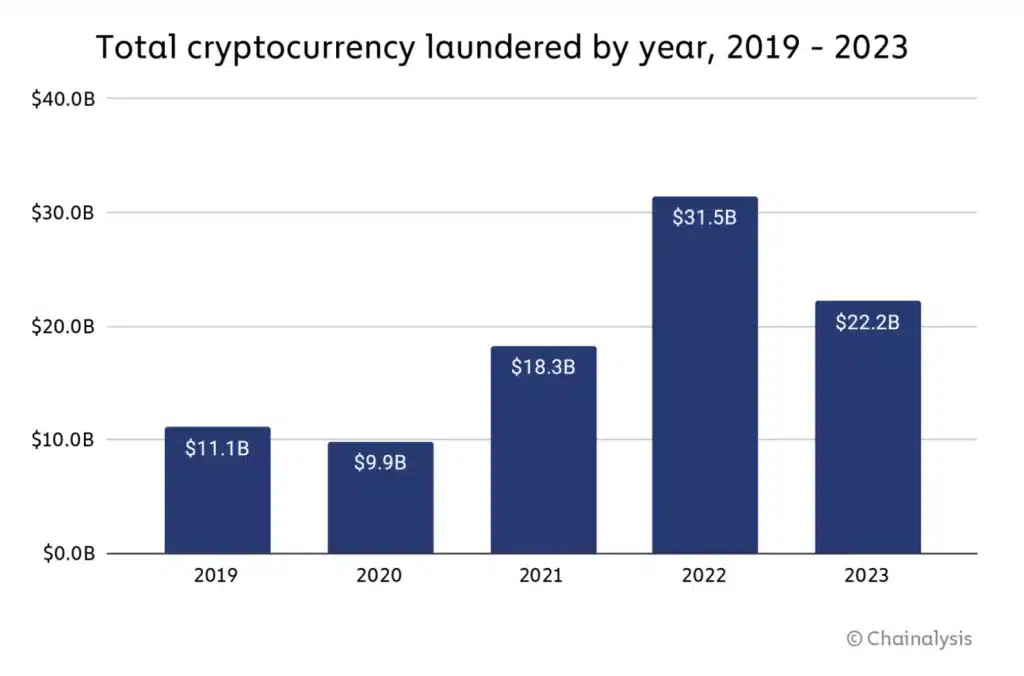

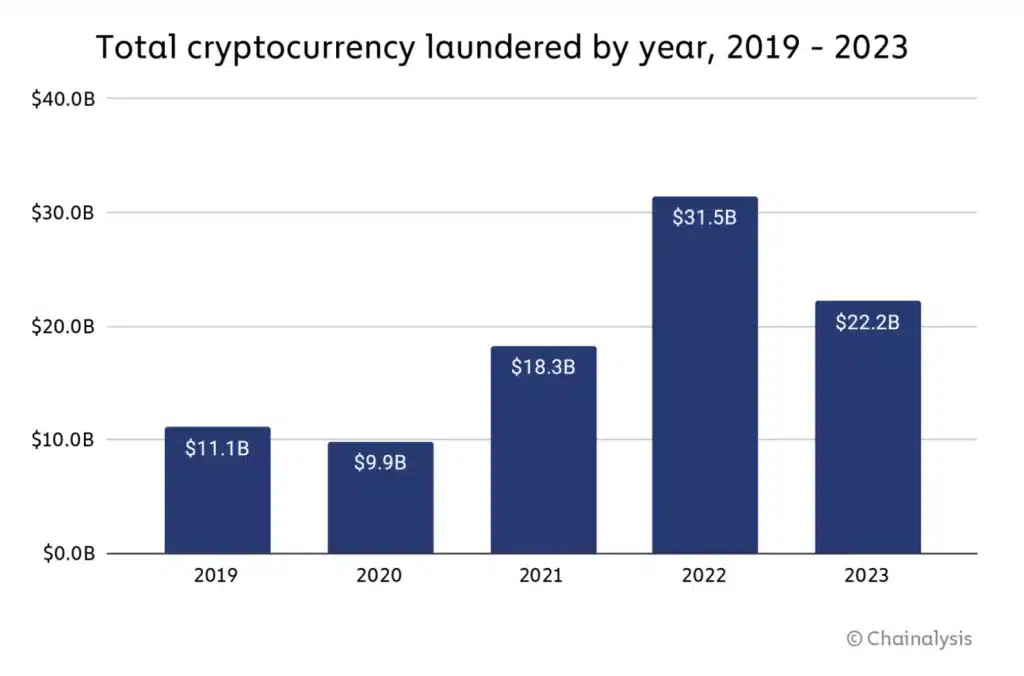

A current report by Chainanalysis, nevertheless, paints a extra constructive image of the crypto-space. In response to the blockchain knowledge platform, there was a pointy decline in cash laundering actions in 2023, particularly when in comparison with 2022.

Supply: Chainalysis