- Bitcoin demonstrated resistance in opposition to the draw back regardless of leveraged longs liquidations.

- The present of energy continues as Bitcoin ETFs accumulate, elevating probabilities of a $70,000 value.

Bitcoin [BTC] is on the verge of pushing above $70,000. Whereas this may increasingly appear daring to state. It was just some weeks that the cryptocurrency struggled to remain above $60,000.

A transparent shift has occurred available in the market, making it simpler for the bulls to push increased.

Bitcoin demonstrated sturdy demand within the final six days, an indication that the bulls are again in management as soon as once more, after cooling off within the first 10 days of October.

In different phrases, it seems that BTC is as soon as once more constructing on the identical momentum that was current in September.

There are a couple of the reason why a $70,000 Bitcoin price ticket might happen in a matter of days or even weeks.

Bitcoin demonstrated a whole lot of volatility within the final 24 hours, together with a wave of promote strain, pulling it again simply shy of the $68,000 value stage.

Nonetheless, this was adopted by a requirement resurgence, pushing value again up and avoiding extra draw back.

Bitcoin snaps again regardless of leverage shake off

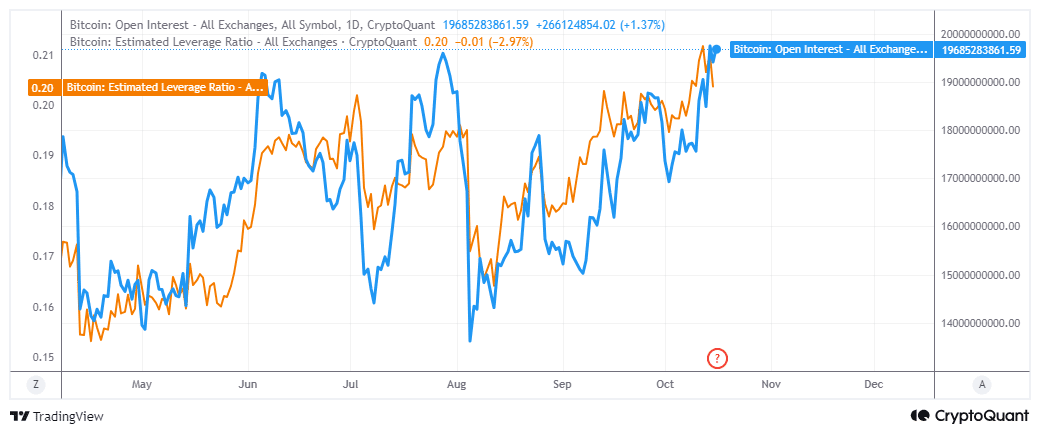

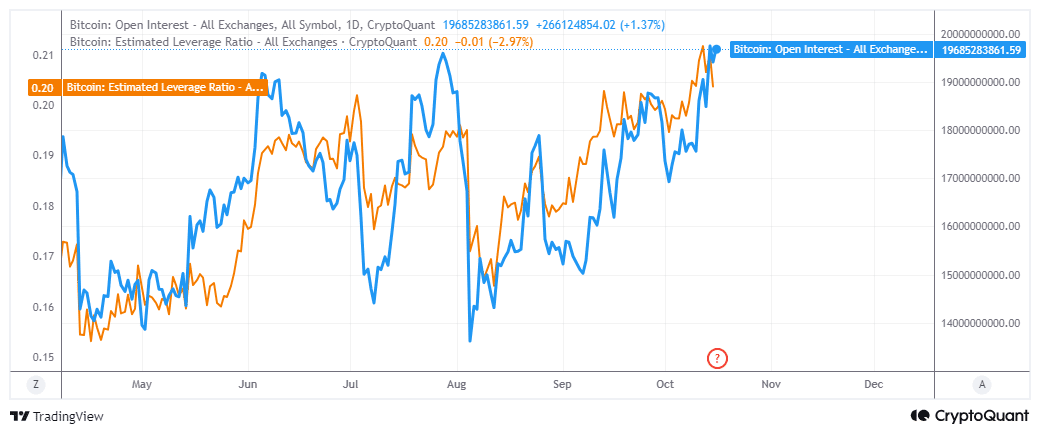

BTC’s excessive volatility throughout Tuesday’s buying and selling session had the makings of a leverage shake-off. It’s because its Open Curiosity was the best that it has been in historical past.

On prime of that, the estimated leverage ratio additionally soared to a brand new native excessive.

Supply: CryptoQuant

Excessive leverage with corresponding open curiosity are often a set-up for liquidations. Particularly throughout instances of maximum optimism and as soon as the pullback happens, it dents the sentiment usually.

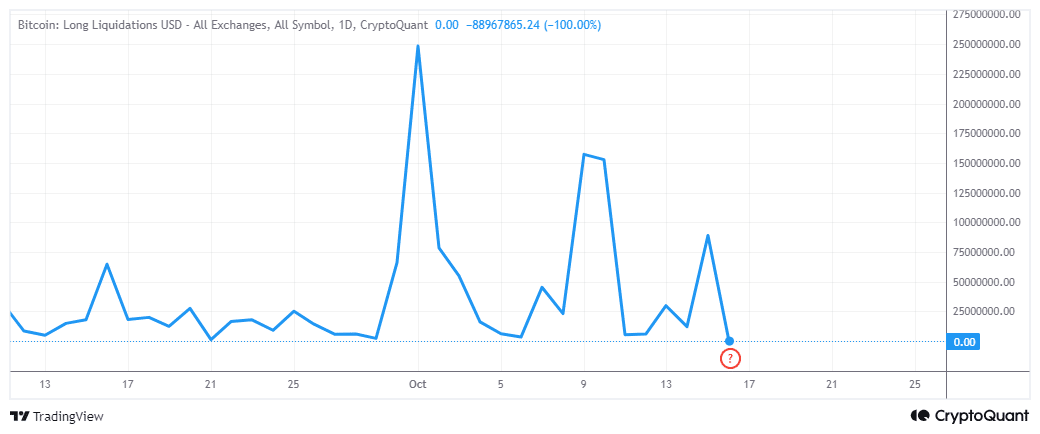

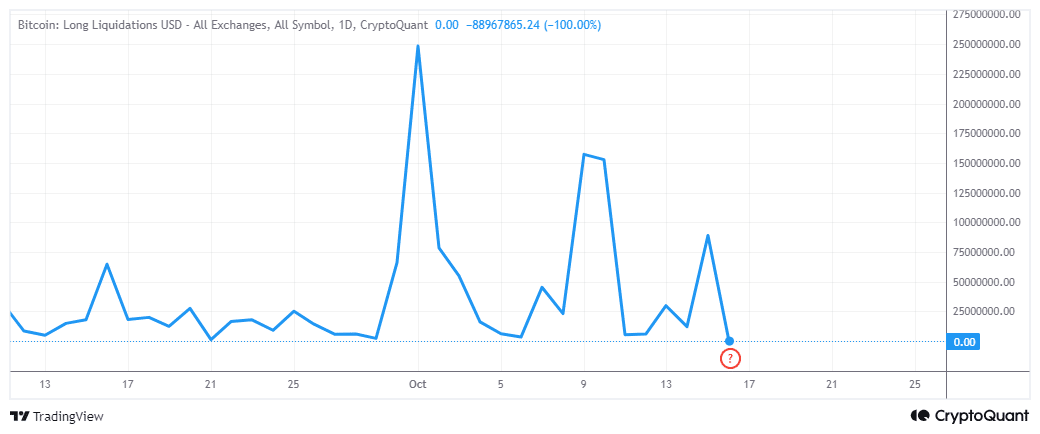

Nonetheless, that was not the end result that performed out throughout Tuesday’s buying and selling session.

Lengthy liquidations peaked at $88.9 million on 15 September. Nonetheless, demand shortly snapped again, pushing value again above $67,000.

Supply: CryptoQuant

The above final result confirmed the rising optimism in Bitcoin’s capacity to seize extra positive aspects. On prime of that, the latest demand resurgence was characterised by heavy accumulation by Bitcoin ETFs.

Recent reports revealed that Bitcoin ETFs amassed over $500 million value of BTC within the final 24 hours.

Equally, ETFs amassed over $500 million value of BTC on the 14 of October. These findings indicated that institutional demand was additionally leaning on the bullish aspect.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

This additional explains why the cryptocurrency is now resisting the draw back. It additionally backs the expectations that the bullish will probably push above $70,000 very quickly.

On prime of that, a significant catalyst (the U.S. elections) might add extra gas to the rocketing BTC costs relying on the end result.