JamesBrey

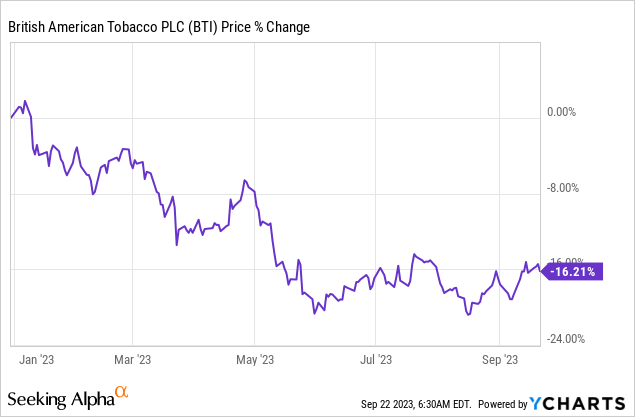

Shares of British American Tobacco (NYSE:BTI) have declined 16% yr thus far. Nonetheless, British American Tobacco is a well-run tobacco agency, achieves constant profitability and has continuous second in its non-traditional product class that features its vapour model vuse… which is seeing sturdy gross margin momentum resulting from rising product uptake. Moreover, the brand new product classes are on the brink of attaining profitability which might result in an upside revaluation of British American Tobacco’s shares within the close to time period. Since BAT is at present buying and selling at a P/E ratio of solely 7.3X and is predicted to generate $49B in free money circulate within the subsequent 5 years, I consider the danger profile is extremely compelling!

Earlier ranking

I rated British American Tobacco a powerful purchase in February — The Market Is Incorrect About This 7.2% Yield — resulting from sturdy momentum in new product classes. Contemplating that the corporate is seeing exceptionally sturdy momentum in its vapour class, pushed by sturdy product adoption and pricing, I consider British American Tobacco has appreciable earnings shock potential going ahead. I talk about BAT’s gross margin momentum, which is important, in addition to the corporate’s compelling FCF steerage. British American Tobacco has guided for ~£40.0B ($49.1B) in free money circulate within the subsequent 5 years of which I count on a substantial quantity to be returned to shareholders.

Vapour merchandise might drive earnings outperformance

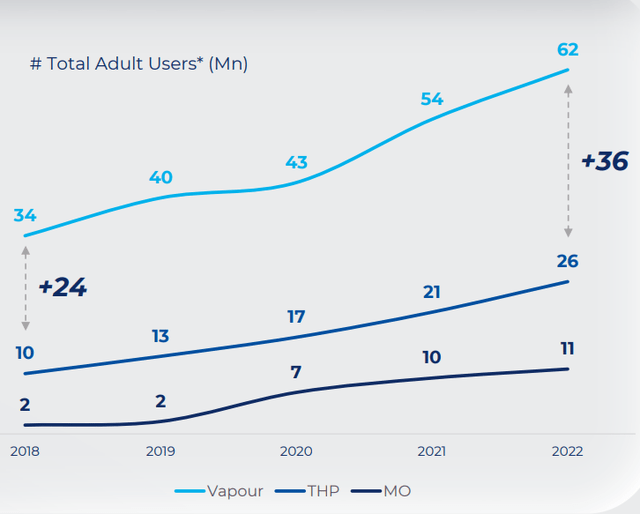

British American Tobacco owns the vuse model which sells vapour merchandise to shoppers. Vuse has been instrumental in driving cargo and earnings development within the non-traditional product class for British American Tobacco and the section is seeing accelerating product uptake from shoppers, particularly within the youthful demographic. The variety of people who undertake vapour merchandise is on a fast upswing whereas on the identical time the variety of people who smoke is reducing.

Supply: British American Tobacco

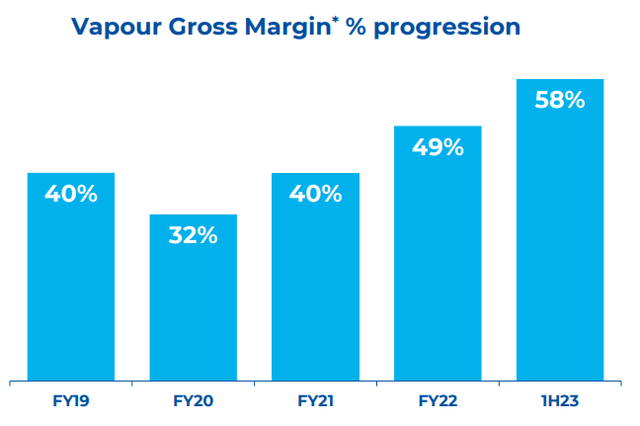

Apart from an growth of the addressable vapour market, British American Tobacco is seeing sturdy section gross margin growth: within the first half of FY 2023, British American Tobacco’s vapour section gross margin expanded 9 PP to 58%, implying that gross margins nearly doubled since FY 2020. Sturdy pricing energy in addition to cargo development are the elemental drivers of this distinctive efficiency.

Supply: British American Tobacco

Going ahead, I count on new product classes to symbolize a better share of BAT’s consolidated revenues, with vapour merchandise main the best way. Within the first six months of FY 2023, new product revenues accounted for 12% of whole revenues and I might count on this proportion to step by step enhance within the coming years. Product adoption is probably going going to extend in addition to youthful people who smoke gravitate in direction of vapour and heated tobacco merchandise. According to previous developments, I might additionally count on a lower in cigarette cargo volumes which might be compensated for with new prospects within the new product classes.

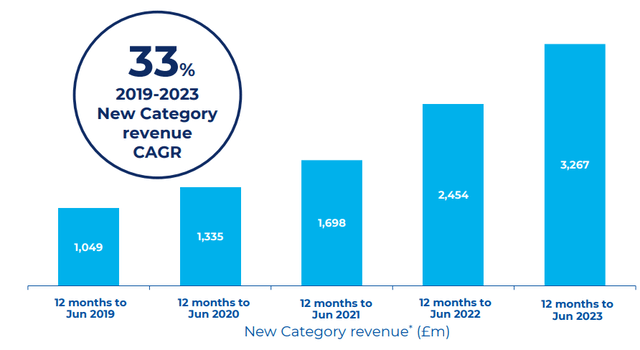

Vapour merchandise contribute significantly to the income momentum that British American Tobacco experiences. Within the final twelve months, new class revenues soared 33% to £3.3B ($4.0B). Income from new classes elevated 29.0% to £1.7B ($2.1B) within the first half of the yr whereas consolidated revenues had been up 4.4% to £13.4B $(16.5B). In different phrases, new product classes, led by vapour, are rising greater than 6 instances sooner than British American Tobacco’s consolidated prime line.

Supply: British American Tobacco

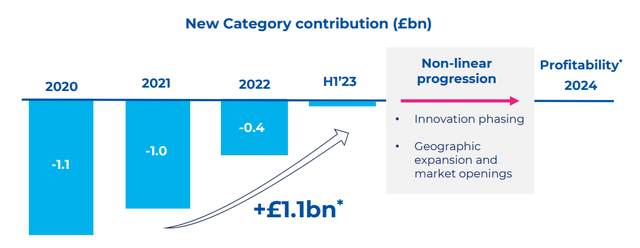

Different various merchandise embrace heated tobacco and oral tobacco merchandise. The momentum of vapour merchandise particularly, nevertheless, is why British American Tobacco is simply on the brink of attaining new class profitability (anticipated for FY 2024). Within the first half of FY 2023, the tobacco agency nonetheless made a small loss on its new class merchandise, but when vapour momentum continues on its present trajectory, then FY 2024 might really be a serious inflection yr for British American Tobacco. The long run objective for BAT is to generate £5.0B ($6.1B) in new class income by FY 2025.

Supply: British American Tobacco

Free money circulate return play

British American Tobacco is seeing sturdy momentum in new class revenues, as proven above, however the true worth of an funding lies within the capital returns that traders can count on.

Between FY 2019 and FY 2022, British American Tobacco generated £29.3B ($35.9B) in free money circulate. Of this quantity, BAT returned £21.1B ($26.0B) to shareholders as dividends and buybacks. Dividend funds alone totaled £19.1B ($23.4B) throughout this time.

In whole, British American Tobacco returned 72% of its free money circulate to shareholders within the final 4 years. The corporate additionally lately issued a powerful free money circulate forecast: British American Tobacco guided for ~£40.0B ($49.1B) in free money circulate over the subsequent 5 years. Assuming a secure 72% free money flow-payout ratio, traders can count on the return of £5.8B ($7.1B) in free money circulate yearly.

Valuation of BTI vs. rivals

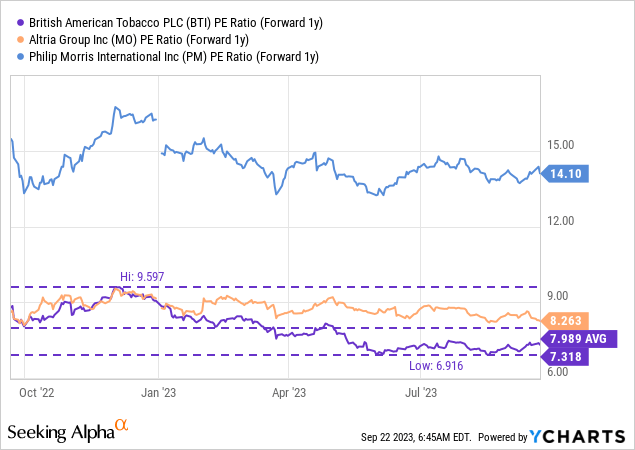

British American Tobacco is the most affordable tobacco firm that dividend traders can purchase. BAT trades at a P/E ratio of seven.3X which compares favorably in opposition to a P/E ratio of 8.3X for Altria Group (MO) and a P/E ratio of 14X for Philip Morris Worldwide (PM). I fee each Altria (funding thesis) and Philip Morris (funding thesis) a maintain, however given the clear valuation benefit and compelling development potential, particularly within the vapour enterprise, British American Tobacco stays a powerful purchase for me. I consider BAT might fairly commerce at a P/E ratio of 10X which suggests a good worth of roughly $46.

Dangers with British American Tobacco

British American Tobacco operates within the tobacco trade which is notorious for lawsuits, escalating promoting restrictions and falling cigarette cargo volumes because the share of people who smoke within the inhabitants is shrinking. Whereas British American Tobacco does have an offset, the event and development of a brand new product portfolio, traders have to be ready to proceed to see low-single digit prime line development.

Whereas the vapour market is thrilling from a development perspective, the sector can also be vulnerable to costly litigation. What would change my thoughts about my funding in BAT is that if the corporate did not maintain its new class momentum (income development, gross margin growth) or noticed a drop-off in free money circulate.

Closing ideas

British American Tobacco is a well-run tobacco franchise and I consider the draw back revaluation that occurred thus far in FY 2023 will not be justified. Latest outcomes confirmed that British American Tobacco’s core enterprise is worthwhile and the corporate expects constructive earnings contributions from its various product classes in FY 2024. Vapour gross margins are rising quickly resulting from pricing energy and product adoption. Reaching new class profitability could be a milestone achievement for the tobacco firm and will probably end in an upside revaluation. Contemplating that shares of British American Tobacco are ridiculously low cost with a P/E ratio of seven.3X, I consider the danger profile is much more skewed to the upside than it already was at first of the yr!