Marina Vedernikova/iStock by way of Getty Pictures

Introduction

Is not it straightforward to seek out arguments in favor of a sure inventory? There are after all many the explanation why an investor may resolve to purchase a specific inventory, however a excessive dividend yield is unquestionably one of many extra apparent causes, aside from a growth-laden narrative (e.g. synthetic intelligence, GLP-1 receptor agonists).

From this angle, the tobacco sector gives us some fairly apparent alternatives, not less than so it appears. With present dividend yields of 9.4% and 9.1% respectively, Altria Group, Inc. (MO) and British American Tobacco p.l.c. (NYSE:BTI, OTCPK:BTAFF) are the obvious examples, however Philip Morris Worldwide (NYSE:PM) is definitely no imply feat both with a yield of 5.5%.

Whereas I imagine that dividend (progress) investing is a technique with many benefits, additionally from a psychological perspective, it could be slightly silly to choose such shares simply due to their excessive dividend yields. Granted, PM, MO and BTI are all what I’d name blue-chip corporations they usually all have a really lengthy working historical past, however it’s nonetheless necessary to take a more in-depth look, but with out falling prey to evaluation paralysis.

On this article, I’ll take a recent take a look at the “Huge 3”. I put myself within the footwear of an investor who has determined to scale back the variety of his holdings and – because the proprietor of BTI, MO, and PM – promote a tobacco inventory. Subsequently, I’ve taken a slightly conservative, possibly even skeptical stance. I’ll element which of the three corporations has the weakest model portfolio, the riskiest stability sheet and the weakest profitability, whereas intentionally ignoring valuation. All too usually, a mediocre inventory is purchased as a result of it’s low-cost. This can be a viable technique for some traders, however the typical, long-term investor is finest served by shopping for nice corporations at a good worth.

A Look At The Corporations’ Portfolios Reveals A Clear Laggard

All three corporations are predominantly lively within the premium cigarettes phase. For instance, virtually 90% of cigarettes bought by Altria (the corporate solely operates within the U.S.) are Marlboro cigarettes, whereas the low cost phase solely accounted for six% of cigarette quantity in 2022. Philip Morris Worldwide’s cigarette portfolio is rather more diversified, however Marlboro nonetheless accounts for nearly 40% of gross sales in 2022. At BTI, what it refers to as its “strategic manufacturers” (Dunhill, Kent, Fortunate Strike, Pall Mall, Rothmans, Newport, Pure American Spirit and Camel), accounted for 66% of 2022 cigarette quantity.

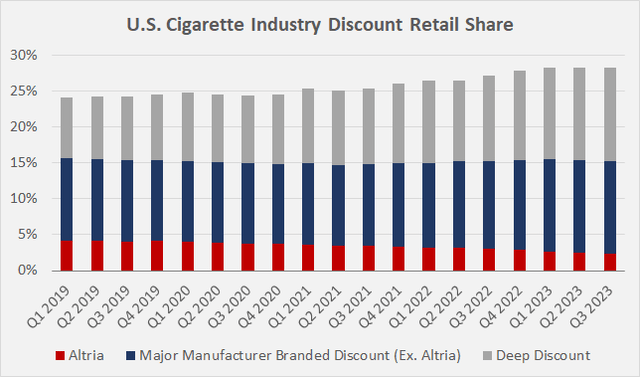

Due to their concentrate on premium cigarettes, all three corporations have robust pricing energy, which (along with effectivity enhancements) is a crucial driving issue of their continued revenue progress regardless of declining volumes. Nonetheless, in instances of excessive inflation, customers are inclined to commerce down, which limits Huge Tobacco’s scope for worth will increase. Determine 1 exhibits the continued weak point of Altria’s low cost phase, but in addition that of different main producers working within the U.S. resembling British American and Imperial Manufacturers (OTCQX:IMBBY, OTCQX:IMBBF, see my comparative evaluation with BTI).

Determine 1: U.S. cigarette trade low cost retail share on a quarterly foundation (personal work, primarily based on Altria Group, Inc. filings)

In my opinion, the information exhibits not solely that the key producers are slightly weak within the low cost phase, but in addition that particularly Altria’s worth proposition is getting worse. Nonetheless, this isn’t essentially attributable to poor execution. Smaller rivals, resembling Vector Group (VGR), profit from a value benefit below the Grasp Settlement Settlement, whose funds rely on the quantity of cigarettes bought every year (e.g. p. 4, VGR 2022 10-K).

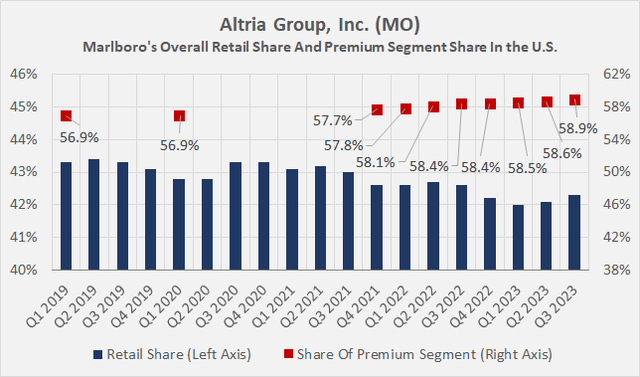

Whereas this sounds worrying, I do not assume the rising competitors from low cost manufacturers needs to be overstated. On this context, it was encouraging to see, for instance, PMI reporting 2% quantity progress for Marlboro in 2022 (p. 3, PM 2022 10-K ) and Altria persevering with to report a rise in Marlboro’s market share within the U.S. premium phase (crimson squares, Determine 2). Additionally, it appears just like the market share of deep low cost model is leveling off as inflation moderates.

Determine 2: Marlboro’s general retail share and share of the premium phase within the U.S. (personal work, primarily based on Altria Group, Inc. filings)

Taken collectively, I feel it’s truthful to conclude that Altria and British American function a quasi duopoly in premium cigarettes within the U.S., whereas British American, Philip Morris, and to a lesser extent Imperial Manufacturers and Japan Tobacco (OTCPK:JAPAF, OTCPK:JAPAY) kind an oligopoly in the remainder of the world. I count on the key gamers to proceed to exert their robust pricing energy, however I feel the continued decline in Altria’s market share (blue bars in Determine 2) is not less than a bit of worrying and value maintaining a tally of. Its important competitor within the U.S., BTI, continues to see market share positive factors (+10bps in 2022, +60bps in 2021 and +45bps in 2020).

Altria’s comparatively weak place can also be necessary from the attitude of smoke-free merchandise. Altria is basically targeted on acquisitive diversification (e.g., the disastrous acquisition of its stake in Juul Labs), whereas PMI’s continued heavy funding in R&D (I mentioned its comparatively excessive capital expenditure in one other article) has resulted in its market-leading heated tobacco platform IQOS. As a result of termination of its advertising settlement with Altria in October 2022 (see this text), PMI will have the ability to market IQOS itself within the U.S. from Might 2024. It’ll probably make the most of the distribution capabilities it gained by way of the acquisition of Swedish Match, which can also be the producer of the market-leading oral nicotine pouch model Zyn (slide 7 of this presentation). British American is the corporate behind Vuse-branded e-vapor merchandise, and I feel it is truthful to say that the corporate may be very profitable on this space (mentioned right here). Its efforts in heated tobacco are much less profitable, and it lacks the robust presence in oral nicotine merchandise that PMI gained by way of its very sensible (and fairly priced) acquisition of Swedish Match. Nonetheless, I do not assume it is a stretch to contemplate BTI the clear quantity two in smoke-free merchandise.

Whereas Altria is creating its personal heated tobacco merchandise (see this text) and just lately acquired e-vapor firm NJOY Holdings, Inc., the corporate’s future within the smoke-free area stays slightly opaque. Subsequently, and because of the comparatively weak efficiency in cigarette volumes and model focus threat, I think about the U.S.-focused firm to be the weakest when it comes to portfolio high quality and concrete future prospects.

All in all, of the “Huge 3” I’d promote Altria inventory if I needed to, and really feel most comfy with my funding in Philip Morris Worldwide (however as so usually security comes at a worth). Nonetheless, that does not imply I actually assume Altria inventory is a promote. The primary purpose why I’ll maintain on to my place – regardless of the portfolio weak point/uncertainty – is the truth that cigarettes are still very affordable within the U.S., with a pack costing just like Russia, Sweden, Bulgaria, Switzerland and Mexico on a buying energy parity foundation. Moreover, it’s actually stunning to see that, in contrast to most international locations on this planet, the affordability of cigarettes within the U.S. has not really changed between 2010 and 2020. In fact, traders must also pay attention to the “fats tail” threat arising from the regulatory perspective, which is especially related for Altria.

The Weakest Play From A Profitability Perspective

Tobacco corporations are recognized for his or her extraordinarily excessive profitability. Cigarettes are very low-cost to fabricate, all main gamers have extremely developed distribution capabilities and the trade is consolidated. Since cigarette promoting is banned in most international locations, advertising expenditures are additionally very low. The Grasp Settlement Settlement, as talked about earlier, treats small corporations extra favorably, however it’s truthful to say that the prices concerned are manageable.

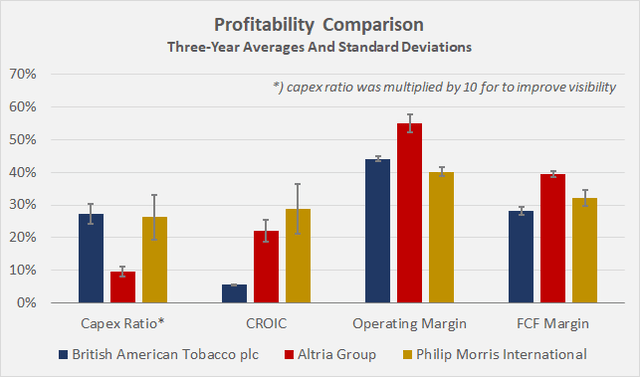

Determine 3 compares 4 key profitability ratios. The capex ratio (capex divided by internet gross sales) – which has been scaled by an element of 10 for higher visibility – is broadly an identical for BTI and PM, which spent virtually thrice as a lot on capex as Altria within the interval 2020 to 2022. At first look, this implies that Altria is essentially the most worthwhile.

Determine 3: Comparability of 4 profitability metrics for Altria Group, Philip Morris Worldwide, and British American Tobacco plc (personal work, primarily based on firm filings)

Nonetheless, for my part, the low capex ratio is an indication that Altria continues to under-invest within the enterprise. Granted, sustaining the core Marlboro model doesn’t require a lot upkeep capex (recall Determine 1 – Marlboro continues to realize share within the premium phase). Nonetheless, I feel the distinction in capital expenditure is basically attributable to PMI and BTI making vital investments in heated tobacco and vaping merchandise. Contemplating that Altria has began creating its personal heated tobacco machine (SWIC, serving a small consumer niche) and expects to commercialize heated tobacco merchandise below the Ploom model (joint venture with Japan Tobacco) within the U.S., it is just affordable to count on a rise in capital expenditures and thus a lower in free money move profitability. Nonetheless, Altria’s underlying profitability continues to be considerably greater than PM and BTI, each when it comes to working earnings and money earnings, so I’d not over-interpret the anticipated enhance in capex ratio. Nonetheless, contemplating the already fairly payout ratio, the necessity for greater investments is probably going one purpose for the corporate’s revised dividend policy.

With regard to reaching acceptable returns for shareholders, I in contrast the three main tobacco corporations when it comes to money return on invested capital (CROIC). This can be a derivation of the well-known ROIC, which takes under consideration free money move as an alternative of internet working revenue after tax. As an apart, I’ve adjusted free money move for stock-based compensation and dealing capital actions on a three-year rolling common foundation.

British American Tobacco is by far the worst performer on this context, with a three-year common CROIC of simply 5.6%. That is effectively under its CAPM-derived (Capital Asset Pricing Mannequin) derived value of fairness, which varies between 10.5% and 15.8% relying on the beta chosen. Nonetheless, the apparently poor result’s partly because of the acquisition of Reynolds American Inc. by BTI in 2017, which added a big quantity of goodwill to the stability sheet. Excluding goodwill, BTI’s money return on invested capital has averaged 8.4% over the past three years. That is higher, however nonetheless fairly poor for a tobacco firm. Furthermore, it’s debatable as as to whether goodwill needs to be excluded when calculating CROIC.

In reference to the adjustment of invested capital for goodwill, it needs to be famous that PMI additionally has a substantial quantity of goodwill on its stability sheet ($19.7 billion on the finish of 2022, which corresponds to virtually a three-fold enhance in comparison with 2021 year-end), which is basically attributable to the acquisition of Swedish Match. In consequence, PMI’s CROIC was solely 21% in 2022, in comparison with 36% in 2021. Clearly, the sharp decline in 2022 can also be the principle purpose for the excessive normal deviation. The decline is worrying at first sight, however it needs to be stored in thoughts that the money move contribution of Swedish Match (not less than $500 million with robust progress) is just partially mirrored in PMI’s 2022 money move assertion because of the timing of the acquisition. Going ahead, it’s subsequently (and in addition because of the nonetheless largely untapped synergy potential) solely affordable to count on PMI’s CROIC to get well, though it can in all probability take a while earlier than it reaches the 30% mark.

Taken collectively, all three corporations are – as anticipated – solidly worthwhile, however I think about BTI to be the weakest attributable to its poor CROIC (even on a goodwill-adjusted foundation). Nonetheless, from a money profitability perspective, I’d not overstate Altria’s high place, as greater capex spending will probably be required sooner or later to (lastly) achieve traction within the heated tobacco and vaping area. Given BTI’s robust place in e-vaping, PMI’s upcoming launch of the main IQOS franchise within the U.S., and naturally the dominance of Zyn nicotine pouches, there’s a threat of potential malinvestments at Altria (acquisition and capex-wise), in an effort to play catch-up and thereby doubtlessly sacrificing a few of its nonetheless very stable profitability.

A Look At The Steadiness Sheet High quality Of Altria, British American Tobacco, And Philip Morris Worldwide

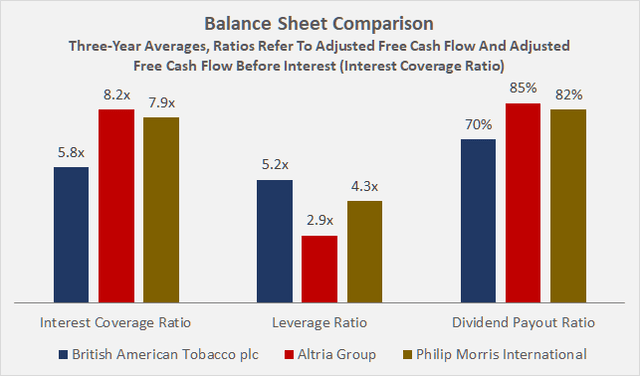

It is common information how Altria Group blemished its stability sheet with the pricey acquisition of its minority stake in Juul Labs. The corporate’s fairness ratio turned unfavourable in 2021 and confirmed a shareholders’ deficit of $3.4 billion on the finish of the third quarter of 2023. Nonetheless – and I do not need to be misunderstood as excusing the missteps of Altria’s administration – I do not assume this growth is worrying. In one other article, I defined why I do not give a lot weight to a unfavourable ebook worth (assuming working fundamentals are robust) and why I want to have a look at internet debt relative to free money move and curiosity protection as an alternative.

Altria’s internet debt has remained comparatively steady for the reason that transaction and presently stands at $23.5 billion. As Determine 4 exhibits, its leverage ratio stays effectively below management at thrice adjusted free money move and an curiosity protection ratio of greater than eight instances free money move earlier than curiosity. Additionally it is value noting that Altria has a big “hidden” asset on its stability sheet – its stake in Anheuser-Busch InBev SA/NV (BUD). Altria owns 185 million restricted shares and 12 million frequent shares, which had a complete market worth of $11.9 billion on the finish of 2022 (carrying worth $9.0 billion). The worth of the stake peaked at virtually $13.2 billion on the finish of March 2023, then fell to $10.2 billion – primarily because of the Bud Mild controversy – however consequently recovered to $12.4 billion presently. By promoting its stake at a worth that’s nonetheless under what I personally imagine is truthful worth for BUD inventory, Altria might scale back its leverage to 1.4 instances adjusted free money move. That is fairly spectacular, but when administration decides to maneuver ahead with the transaction, I count on a mixture of debt discount and share buybacks (Altria inventory is presently an excellent cope with an 11% free money move yield).

Determine 4: Evaluation of the stability sheet high quality of Altria Group, Philip Morris Worldwide, and British American Tobacco plc (personal work, primarily based on firm filings)

Talking of “hidden” belongings, I feel it is value highlighting British American’s 29% stake in ITC Ltd. (a serious Indian client items, packaging, software program, and until recently also hotels conglomerate). Basically, BTI’s leverage appears fairly regarding, at greater than 5 instances adjusted free money move. Nonetheless, contemplating that the stake in ITC was value greater than £12 billion on the finish of 2022 (£1.9 billion ebook worth) and has since elevated to virtually £16 billion, I do not assume the leverage is overly regarding. Though I extremely doubt that administration has any intention of promoting this prime asset, the transaction might theoretically scale back leverage to a few instances adjusted free money move.

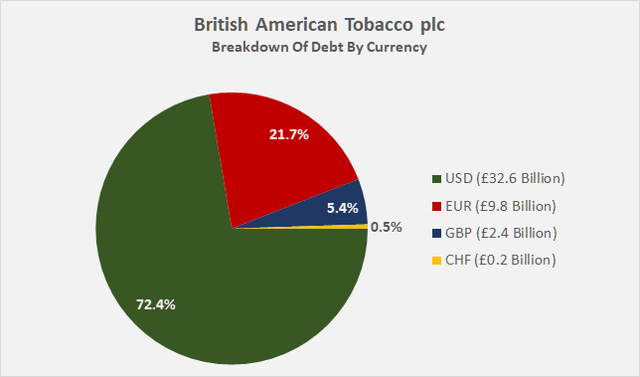

That being stated – and I imagine that is one purpose for the inventory’s poor efficiency – traders must also be aware of BTI’s sizable U.S. dollar-denominated debt (Determine 5). If a menthol ban goes into impact and the corporate experiences vital gross sales declines attributable to elevated smoking cessation and switching to different non-menthol manufacturers (doubtlessly from rivals), a cloth portion of its dollar-denominated money move could be jeopardized, which in flip would harm its potential to pay down debt and weaken its curiosity protection ratio. As well as, a menthol ban would probably lead to a big impairment of goodwill and sure a write-down of intangible model belongings. For instance, if BTI have been to put in writing off all of its goodwill from the acquisition of Reynolds American (roughly £48 billion), its fairness ratio would fall from 49% to 18%.

However, I feel Huge Tobacco will have the ability to handle the looming menthol ban within the U.S. (a number of international locations within the E.U. function good examples). Nonetheless, whereas BTI is positioned fairly effectively by way of its broadly diversified model portfolio, it suffers from a focus threat in Newport cigarettes (market chief in U.S. menthol), and I imagine that Altria is best positioned from the attitude of people who smoke switching to non-menthol options, as Marlboro cigarettes are recognized to be accessible with and with out menthol taste.

Determine 5: British American Tobacco plc (BTI, BTAFF): Breakdown of debt by foreign money (personal work, primarily based on information from the corporate’s web site)

Lastly, PMI’s debt appears rather more critical than a number of years in the past, which is after all associated to the latest heavy investments in smoke-free merchandise (acquisition of Swedish Match and IQOS advertising rights consideration paid to Altria):

Determine 6: Philip Morris Worldwide Inc. (PM): Internet debt since 2019 (personal work, primarily based on firm filings)

Together with Swedish Match’s contribution of $500m in free money move, PMI’s leverage ratio on the finish of the third quarter of 2023 was 4.3 instances adjusted free money move. I estimate its present curiosity protection ratio to be barely lower than eight instances free money move earlier than curiosity, primarily based on the present excellent bonds, their rates of interest, and an assumed 3.5% curiosity PMI receives on its $3.0 billion in money and money equivalents.

For the quantity of debt the corporate took on final yr, that is truly fairly stable, and I feel PMI may be very effectively positioned to pay down debt. Granted, the dividend payout ratio is presently 80% of free money move, however administration has said that it’ll de facto droop share repurchases and solely slowly enhance the dividend till the debt is again in examine. I feel it is a very smart strategy, though the corporate might handle its present debt load even when rates of interest certainly keep “greater for longer”. Within the context of free money move progress and therefore improved potential to pay down debt, traders ought to be aware PMI’s robust progress prospects and in addition the extremely favorable economics of heated tobacco sticks and oral nicotine pouches.

The concentrate on lowering debt after such a big acquisition can also be smart from a credit standing perspective. The corporate presently has a long-term credit rating of A2 from Moody’s with a steady outlook. The score was solely just lately affirmed, and though the company highlighted PMI’s enterprise prospects fairly positively, it doesn’t count on the corporate to return to a “Moody’s-adjusted gross leverage [of] 2.5x” earlier than the top of 2025 – a yr longer than beforehand anticipated.

Compared, Altria’s long-term credit rating is A3 (steady outlook), largely attributable to regulatory fat-tail threat. British American ranks the weakest (Baa2), however Moody’s has just lately upgraded the rating outlook to positive, largely attributable to stable developments within the smoke-free phase (faster than expected profitability) and the present robust earnings efficiency (partly attributable to favorable foreign money results, after all).

Taken collectively, I feel every of the three corporations has a steady stability sheet and I discover it troublesome to establish an apparent laggard on this context. British American advantages from its kind of well-known stake in ITC, which makes its leverage far much less extreme than the pure debt determine suggests. Nonetheless, the slightly excessive proportion of U.S. greenback denominated debt (greater than 70% of whole debt) regardless of solely modest U.S. gross sales (45% of 2022 internet gross sales) is a threat to regulate. Altria has the bottom leverage ratio within the group – which might even fall considerably if the proceeds from a hypothetical sale of the BUD stake have been used fully to pay down debt – however it’s value maintaining a tally of the suspected underinvestment and relatively weak portfolio outlook, which might result in vital future investments and thus a weakening of the leverage ratio. The rise in Philip Morris’ leverage is comprehensible, and I feel it is secure to imagine that the undisputed market chief in smoke-free merchandise will have the ability to step by step return to a traditional (2 to 2.5 instances free money move) leverage ratio.

Conclusion

On this article, I took a considerably vital stance when contemplating an funding in Huge Tobacco.

Reframing the query from “What to purchase?” to “What to promote?”, a number of specifics have been mentioned that recognized Altria Group a transparent laggard from a portfolio perspective. Aside from the corporate’s failure to realize a foothold in smoke-free merchandise, its concentrate on promoting Marlboro cigarettes (virtually 90% of cigarette quantity) is a focus threat value contemplating, even when the corporate continues to realize market share within the premium phase.

From a profitability perspective, BTI is the worst performer attributable to its poor CROIC (even after adjusting for goodwill) and its free money move margin under 30%. The latter is considerably stunning given the corporate’s publicity to the extremely worthwhile U.S. market (45% of internet gross sales in 2022), however is actually a sign of brand name diversification and better publicity to lower-priced cigarettes – not a nasty place in a excessive inflation setting.

Nonetheless, I’d not overstate Altria’s main profitability, as greater capex spending will probably be required sooner or later to (lastly) achieve traction within the heated tobacco and vaping area. Given BTI’s robust place in e-vaping, PMI’s upcoming launch of the main IQOS (ILUMA) franchise within the U.S., and naturally the dominance of Zyn nicotine pouches, there’s a threat of potential malinvestments at Altria (acquisition and capex-wise), in an effort to play catch-up and thereby doubtlessly sacrificing a few of its nonetheless very stable profitability.

From a stability sheet perspective, I discover it troublesome to establish an apparent laggard. British American advantages from its kind of well-known stake in ITC, which makes its leverage far much less extreme than the pure debt determine suggests. Nonetheless, the discrepancy between U.S. dollar-denominated debt and gross sales is a threat to regulate. Altria has the bottom leverage of the three corporations, and a sale of the BUD stake and subsequent debt compensation would additional derisk the stability sheet. Nonetheless, the suspected underinvestment and relatively weak portfolio outlook might result in vital future investments and thus a weakening of the leverage ratio a decline in free money move profitability.

For these causes, I think about Altria to be the weakest of the three corporations mentioned on this article. Nonetheless – and I feel I’ve made it clear that it could be Altria inventory if I needed to decide one to promote – I need to emphasize that I do not assume the French bulldog subsequent to the 2 bigger canines within the headline picture is a good illustration of Altria in comparison with British American Tobacco and Philip Morris Worldwide Inc. Altria nonetheless has so much going for it, resembling its robust model energy by way of Marlboro, stable stability sheet, main profitability, and shareholder-friendly administration. Subsequently, I’ll undoubtedly persist with my place.

Thanks for taking the time to learn my newest article. Whether or not you agree or disagree with my conclusions, I at all times welcome your opinion and suggestions within the feedback under. And if there’s something I ought to enhance or develop on in future articles, drop me a line as effectively. As at all times, please think about this text solely as a primary step in your individual due diligence.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.