Prykhodov

Funding Rundown

I feel that BP p.l.c. (NYSE:BP) is maybe some of the strong and secure choices within the power area proper now. The corporate provides a strong yield of round 4.5% and trades at what I’d contemplate a really interesting low cost to the remainder of the sector, that’s even after a run-up of the share worth of about 25% within the final 12 months. The market cap is now over $100 billion and the corporate has been ready to do that because of very sound diversification of the operations and the flexibility to increase effectively given the quantity of FCF they generate.

Whereas the power trade has traditionally traded at comparatively low multiples, even within the present market atmosphere, BP’s valuation stays under the trade’s 5-year common p/e of 8.7. This means that there could also be an alternative for buyers to amass BP shares at a sexy worth level, contemplating the corporate’s sturdy underlying efficiency and monetary self-discipline. The corporate lately launched that they’re launching a $1.5 billion buyback program one which appears to start in Q3 no less than. BP goals to 2023 divert over 60% of the FCF from the operations to shareholders as a substitute. With practices like these within the palace, I feel that BP provides a really compelling long-term image that I wish to put money into, ensuing within the purchase ranking I’ve and preserve for them. I’m overlaying them once more a lot as a result of the place is up almost 17% since, and updating my view I feel is critical. BP nonetheless displays sturdy qualities even at this greater worth level and I proceed to be a purchaser.

Firm Segments

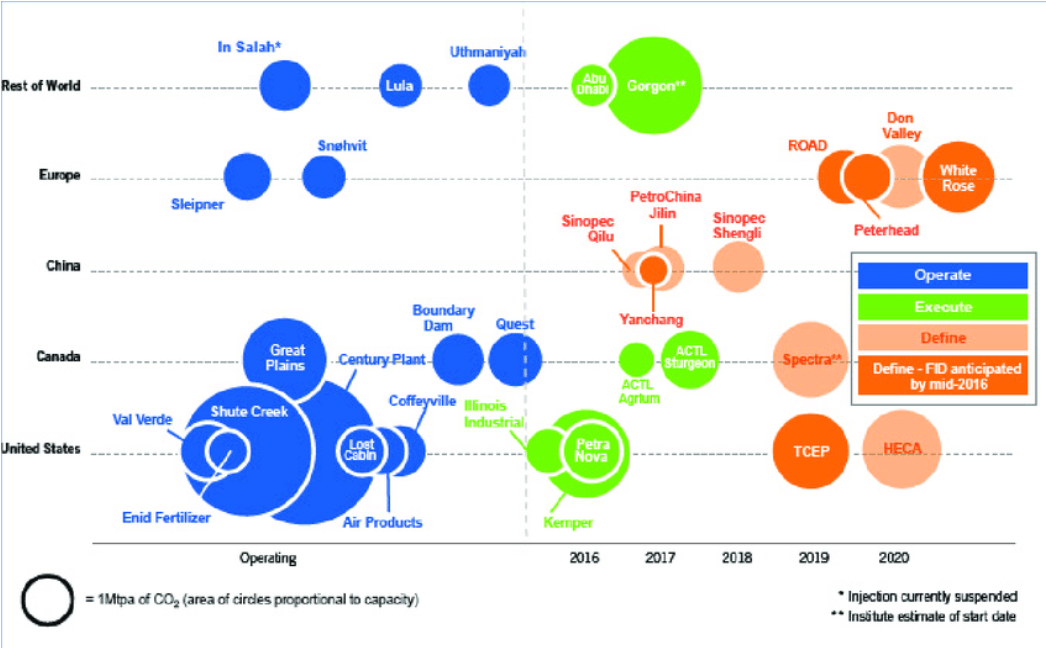

BP operates via three vital enterprise segments: Fuel & Low Carbon Vitality, Manufacturing & Operations, and Clients & Merchandise. Within the Fuel & Low Carbon Vitality section, BP is actively engaged within the growth of low-carbon power options, together with wind, photo voltaic, and hydrogen applied sciences. Notably, the corporate has expanded its focus to incorporate Carbon Seize and Storage initiatives, demonstrating its dedication to mitigating carbon emissions and addressing environmental considerations. The CCS market, though comparatively nascent, is experiencing strong demand and substantial investments.

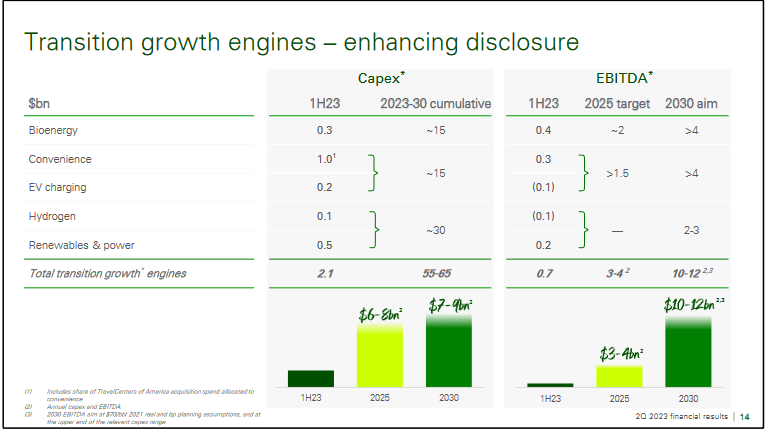

Investor Presentation

In addition to the above-mentioned areas that BP focuses on, in addition they invest in renewable or transitional power sources as seen above. Between 2023 and 2030 BP is anticipating to drastically enhance the CAPEX throughout many areas like EV chagrin, Hydrogen, and renewables & energy to seize the greenway that’s washing over the sector and be on the forefront of that. I feel that may be a nice step for them to take as they don’t seem to be only a purebred power play in a single area of interest market, however relatively a fruits of a number of ones, and diversifying like this I feel was anticipated to a sure diploma. It makes me additional bullish although to see that they’re anticipating to spend quite a bit to not fall behind opponents within the area.

The Compelling Case For CCS Tasks

BP is making vital strides within the realm of CCS initiatives, and the outlook seems promising. One notable growth is BP’s settlement to amass a 40% stake within the Viking carbon seize and storage mission situated within the North Sea. This strategic transfer aligns with BP’s dedication to sustainable power options and emissions discount.

CCS Tasks (vox)

Along with its involvement in CCS initiatives, BP has unveiled formidable plans for a low-carbon inexperienced power cluster in Valencia, Spain. This visionary mission units its sights on reaching as much as 2GW of electrolysis capability by 2030. The first goal is to remodel the BP Castellon refinery right into a globally vital inexperienced hydrogen manufacturing website. The attractiveness of CCS within the present market panorama can’t be overstated, with a sturdy CAGR of 14% projected till 2032. Authorities incentives, resembling funding tax credit and funding, are driving this progress and making a conducive atmosphere for firms like BP to make vital strides in CCS initiatives. These incentives not solely promote environmental duty but in addition provide compelling monetary incentives for firms seeking to put money into cleaner, greener applied sciences.

Valuation

On a valuation foundation, BP nonetheless displays a variety of interesting elements I feel. The inventory trades at a 30% low cost primarily based on earnings to the power sector. This along with a close to 4% dividend yield leaves a variety of upside potential and shareholder worth in my view.

On a p/s foundation, BP trades very low as properly, almost 70% under the power sector. Evaluating that to friends like Equinor ASA (EQNR) and TotalEnergies SE (TTE) which each commerce at greater p/s multiples proper now with TTE being the bottom at FWD p/s 0.71. On a dividend foundation, TTE has the best one at 4.59%. However BP has the bottom payout ratio by far of the group, at simply 3.93% in comparison with TTE at 27%. This leaves much more sustainability to the dividend of BP and fewer chance of it being reduce. This quantities to BP trying like essentially the most interesting selection of the three.

Dangers

Investing in BP entails publicity to the inherent volatility of commodity costs, which considerably affect the corporate’s income streams. This publicity could result in fluctuations in revenues, as evidenced by BP’s efficiency over the previous decade, which has seen durations of each progress and contraction. Nonetheless, it is essential to acknowledge that BP’s progress trajectory stays strong, primarily as a result of enduring significance of oil as an power supply, a significance anticipated to persist for a few years to come back.

oilprice.com

In latest occasions, the prices of oil have displayed a constant downward pattern over the previous 12 months. This downward strain on oil costs provides a component of uncertainty to BP’s EPS estimates. It is difficult to make definitive projections on this dynamic market atmosphere, and the potential of downward revisions to EPS estimates looms, notably if market situations exhibit weak point or if demand for oil experiences a decline. BP, as a significant participant within the power sector, is properly conscious of the cyclical nature of the trade. It has tailored to navigate via these market fluctuations and continues to discover alternatives in renewable and sustainable power sources. Whereas oil stays a major a part of its portfolio, BP is actively positioning itself for a future the place power diversification is essential. This I feel highlights the truth that BP stays an interesting choice within the power area and to additional reward shareholders within the firm they’ve introduced vital dividends and buyback will increase too. This I feel showcases that the administration of BP has an optimistic view of the present market and that short-term headwinds aren’t indicative of the broader outlook for oil and gasoline as they proceed to be vital sources of power for us.

Remaining Phrases

What I feel is the main issue behind a purchase for BP proper now could be the numerous buybacks and dividend will increase they’re doing. Within the final quarter, the dividend was raised by 10% and a $1.5 billion buyback program was introduced. This speaks volumes concerning the dedication that BP has to shareholders I feel. In addition to that although, BP can be buying and selling at what I contemplate a really interesting worth level. The earnings are at a reduction of over 30% to the remainder of the sector and that’s in my view ample to warrant a purchase right here. Trying on the p/s although, right here we get a 68% low cost primarily based on FWD estimates. The marketplace for renewables is just going to extend, however the extra conventional power markets like gasoline and oil will nonetheless be with us for a very long time, making certain that BP has a big market to serve nonetheless. I’m bullish on the outlooks of the enterprise and might be ranking it a purchase as such.