GaryAlvis

Simply over a 12 months in the past, I wrote on Boot Barn (NYSE:BOOT), noting that important negativity was already priced into the inventory after its ~55% correction and that any pullbacks under $55.00 would offer shopping for alternatives. Since then, the inventory has massively outperformed its small-cap friends within the Retail Sector (XRT), rallying practically 100% off this purchase zone earlier than peaking in early August at $104.00 per share. This spectacular share value efficiency may be attributed to the corporate’s spectacular execution in opposition to its long-term targets with distinctive unique model penetration (~$550+ million in FY2023), continued margin growth on a trailing-five-year interval and appreciable white area with a number of the finest unit economics sector-wide (~1.5-year payback on new shops). On this replace, we’ll take a look at the corporate’s most up-to-date outcomes, how its valuation stacks up after its sharp correction, and whether or not the inventory is providing a margin of security.

Boot Barn, October 2022 Replace – Looking for Alpha Premium/PRO

Latest Outcomes & FY2024 Outlook

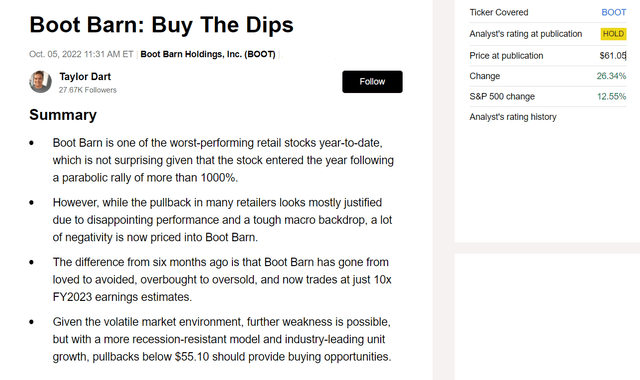

Boot Barn launched its fiscal Q1 2024 leads to August, reporting quarterly income of ~$383.7 million, a 5% improve year-over-year. Whereas this was a sequential decline from the 11% reported in fiscal This fall 2023, it is necessary to notice that the corporate was up in opposition to some steep comps by lapping fiscal Q1 2023, developing in opposition to 19% progress, translating to a two-year common gross sales progress charge of 12%. As well as, the macro outlook actually hasn’t improved for the common shopper even when Boot Barn advantages from having a big chunk of its assortment thought of to be ‘useful’, with private financial savings charges persevering with to pattern decrease in the USA, touchdown at 3.9% most just lately, down from a peak of 5.2% final 12 months. Plus, these gross sales figures actually are higher than what we have seen from a number of different retailers, with a two-year stacked comp gross sales progress of seven.1% simply beating American Eagle (AEO) and Foot Locker’s (FL) damaging two-year stacked comp gross sales progress.

Boot Barn – Quarterly Income – Firm Filings, Creator’s Chart

Digging into the outcomes slightly nearer, the corporate famous that its AUR was up within the interval which helped with merchandise margin growth, and the corporate has continued to develop quickly as a proportion of gross sales, up 1600 foundation factors vs. fiscal Q1 2021 ranges to ~38%. And whereas the corporate did see some margin strain on account of a deleverage in shopping for, occupancy, and DC prices, gross margins nonetheless got here in at a really respectable 37.0%, up practically 1000 foundation factors on a 3-year foundation. Lastly, on growth, the corporate opened 16 new shops, is monitoring at ~30% of deliberate retailer openings for the 12 months (16/52), and expects to finish the 12 months at ~400 shops, giving it one of many highest unit progress charges within the Retail Sector.

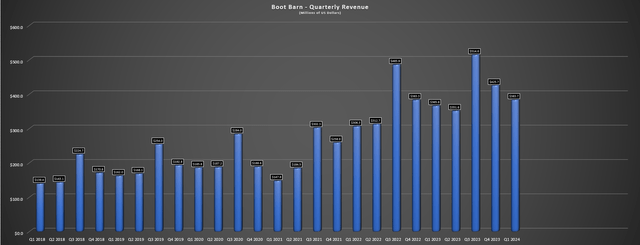

That stated, whereas the outcomes had been fairly passable and the corporate’s progress has been nothing wanting unimaginable, Boot Barn is anticipating to have a choppier 12 months for gross sales with an anticipated same-store gross sales decline of 4% in FY2024 on the mid-point (beforehand 4.5%), and with complete web gross sales of ~$1.73 billion (up 2% from earlier outlook). Luckily, this isn’t going to weigh practically as a lot on earnings as a few of its friends which have needed to be extra promotional over the previous few years, and annual EPS could also be declining vs. its peak in FY2022 ($6.18), however will nonetheless be up ~170% from FY2021 ranges if the corporate can meet its steerage midpoint for annual EPS at $5.20. This robust earnings retention may be attributed to continued margin enchancment from unique model penetration (1000 foundation level higher margins vs. third-party manufacturers) and the corporate is forecasting even additional progress on this class this 12 months.

Boot Barn – Unique Model Gross sales – Firm Presentation

Lengthy-Time period Potential

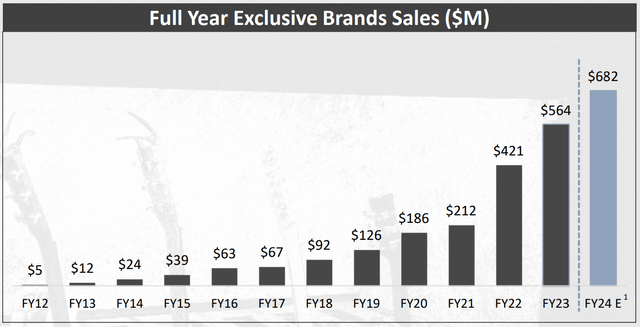

Shifting over to the corporate’s long-term potential, the corporate believes it has important room to develop given that it is the chief in a $40 billion {industry} and is assured that it could actually develop to as much as 900 shops in the USA (125% progress vs. year-end 2024 retailer depend estimates). Notably, in contrast to some firms which can be rising with mediocre unit economics and 4+ 12 months paybacks, Boot Barn’s fast progress is supported by persistently bettering unit economics, with the corporate rising sq. footage from 10,000 to 12,000 since its IPO mannequin idea, however greater than doubling 1st-year common gross sales to ~$1.7 million and bettering its return on funding to ~75% (1.3-year payback) vs. 32% beforehand. These unit economics are unimaginable, and stack up in opposition to a number of the finest manufacturers within the sector, like Aritzia (OTCPK:ATZAF) which just lately cited sub-1-year paybacks at its Tampa location, and Wingstop (WING) with lower than two-year paybacks on its shops.

Boot Barn – Retailer Economics – Firm Web site

Outdoors of those distinctive economics, Boot Barn additionally continues to obtain glowing evaluations in the case of awards, ranked as America’s Finest Retailer in 2023 and Finest Clothes Retailer, with a ~95% rating, coming in forward of different iconic manufacturers like Dior, LEGO, Dooney & Burke, and Von Maur. So, with robust buyer satisfaction scores, industry-leading unit progress, and constant optimistic same-store gross sales progress, there is no purpose to imagine the corporate cannot obtain its lofty targets. And assuming the corporate can proceed to persistently develop its retailer depend and profit from related or larger unique model penetration, Boot Barn may simply generate $8.00+ in annual EPS long-term. Lastly, it is price noting that the corporate has managed to perform its progress with low debt, not leveraging up like others to make main acquisitions or borrowing closely at excessive charges to fund progress.

That stated, this can be a market the place small caps are indifferent from fundamentals and most traders are unwilling to pay up for progress as they’ve up to now. And whereas Boot Barn has a robust funding thesis, I do not assume it is ever been extra necessary up to now decade to make sure an enough margin of security. Let’s check out the valuation under:

Valuation

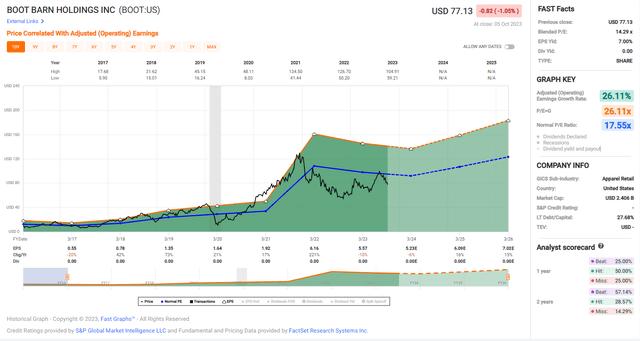

Primarily based on ~30.5 million shares and a share value of $79.00, Boot Barn trades at a market cap of ~$2.41 billion and an enterprise worth of ~$2.81 billion. This locations it in an analogous place to friends within the Retail Sector like American Eagle, City Outfitters (URBN), and Nordstrom (JWN) from a capitalization standpoint, however Boot Barn stands out exceptionally nicely vs. these friends with it managing to 10x annual EPS since 2017, trouncing the comparatively low progress charges of this peer group. Not surprisingly, these larger progress charges and phenomenal execution have helped the inventory to command a premium a number of vs. its friends, evidenced by its buying and selling at a mid-double digit ahead P/E ratio vs. a lot of its friends buying and selling at a median ahead earnings a number of of ~9.0. And as we are able to see under, Boot Barn has traditionally traded at ~17.5x earnings, which might usually recommend that the inventory is undervalued at present ranges (~15.0x ahead earnings vs. ~17.5x traditionally).

Boot Barn – Ahead Estimates & Historic Earnings A number of – FASTGraphs.com

That stated, the present atmosphere differs materially from the final decade, and when traders can gather a risk-free ~4.7%, I believe it is best to make use of a reduction to historic multiples to worth shares, until charges can be lower imminently. On condition that this does not seem like the case, I believe a extra conservative a number of for Boot Barn is 14.0x ahead earnings, a 20% low cost to its historic a number of. And whereas the inventory could also be ~25% off its highs, the inventory remains to be buying and selling at ~15.0x FY2024 earnings and ~17.2x ahead free money circulate on an enterprise worth foundation, suggesting not practically sufficient margin of security at present ranges. Therefore, I’d argue {that a} honest worth for the inventory even when we look ahead to FY2025 is $86.00 per share, pointing to solely 10% upside from present ranges.

Though this factors to some upside to its honest worth estimate, I desire to attend for a big margin of security when shopping for small and mid-cap shares, and in the case of sub $5.0 billion capitalization names, I’m on the lookout for a minimal 25% low cost to honest worth. If we apply this low cost to Boot Barn, this factors to an excellent purchase zone for the inventory of $65.00 or decrease, suggesting the inventory would wish to say no a lot additional to drop into a brand new low-risk purchase zone. Clearly, I may very well be fallacious right here and I could also be too conservative, with no assure that the inventory drops again to those ranges. Nevertheless, I desire to purchase firms once they’re hated and buying and selling at an enormous low cost to honest worth, and whereas this was the case final October for Boot Barn, I do not see this because the setup right now, which in my opinion makes different names like Pet Valu (PET:CA) which can be much less delicate to the macro atmosphere (staples tilt) and much more hated as extra compelling reward/threat setups.

Abstract

Boot Barn is without doubt one of the better-run names within the small-cap Retail Area and the corporate has finished a powerful job of delivering in opposition to its targets over the previous a number of years. That is evidenced by a near-tripling of income progress from 2016 to 2023 whereas rising gross margins by over 500 foundation factors within the interval. Nevertheless, whereas the inventory was providing a substantial margin of security final 12 months because it plummeted ~60% from its highs, that very same setup is not accessible right now, with Boot Barn buying and selling at solely a slight low cost to its historic a number of and this historic a number of arguably being wealthy given the rate of interest atmosphere we’re in right now. So, whereas I see BOOT as one of many top-10 names within the Retail Area given its capability to over-deliver on guarantees, I would wish to see a pullback under $65.00 to get extra within the inventory from a valuation standpoint.