- Each meme cash have a bearish construction on the 4-hour chart.

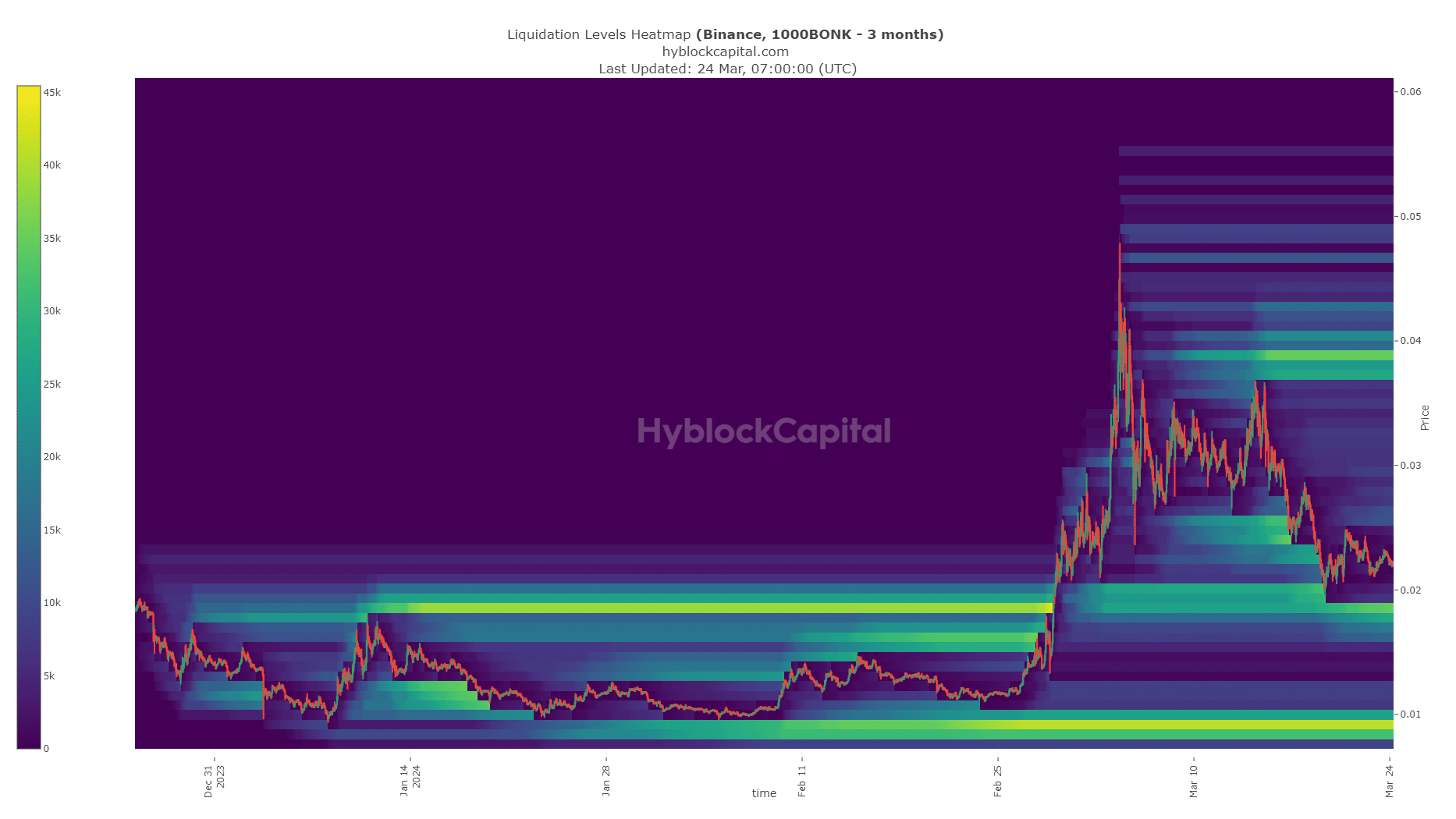

- The liquidation heatmap and HTF construction confirmed BONK had a great likelihood of restoration.

Two widespread meme cash Bonk [BONK] and dogwifhat [WIF] exhibited sturdy bearish sentiment within the quick time period. The approaching week may see extra promoting strain heaped on these tokens.

Consumers lacked the power to reverse the short-term downtrend. The sentiment throughout the market was impartial or bearish as Bitcoin [BTC] dithered above the $64k stage at press time.

BONK capital outflow was troubling for traders

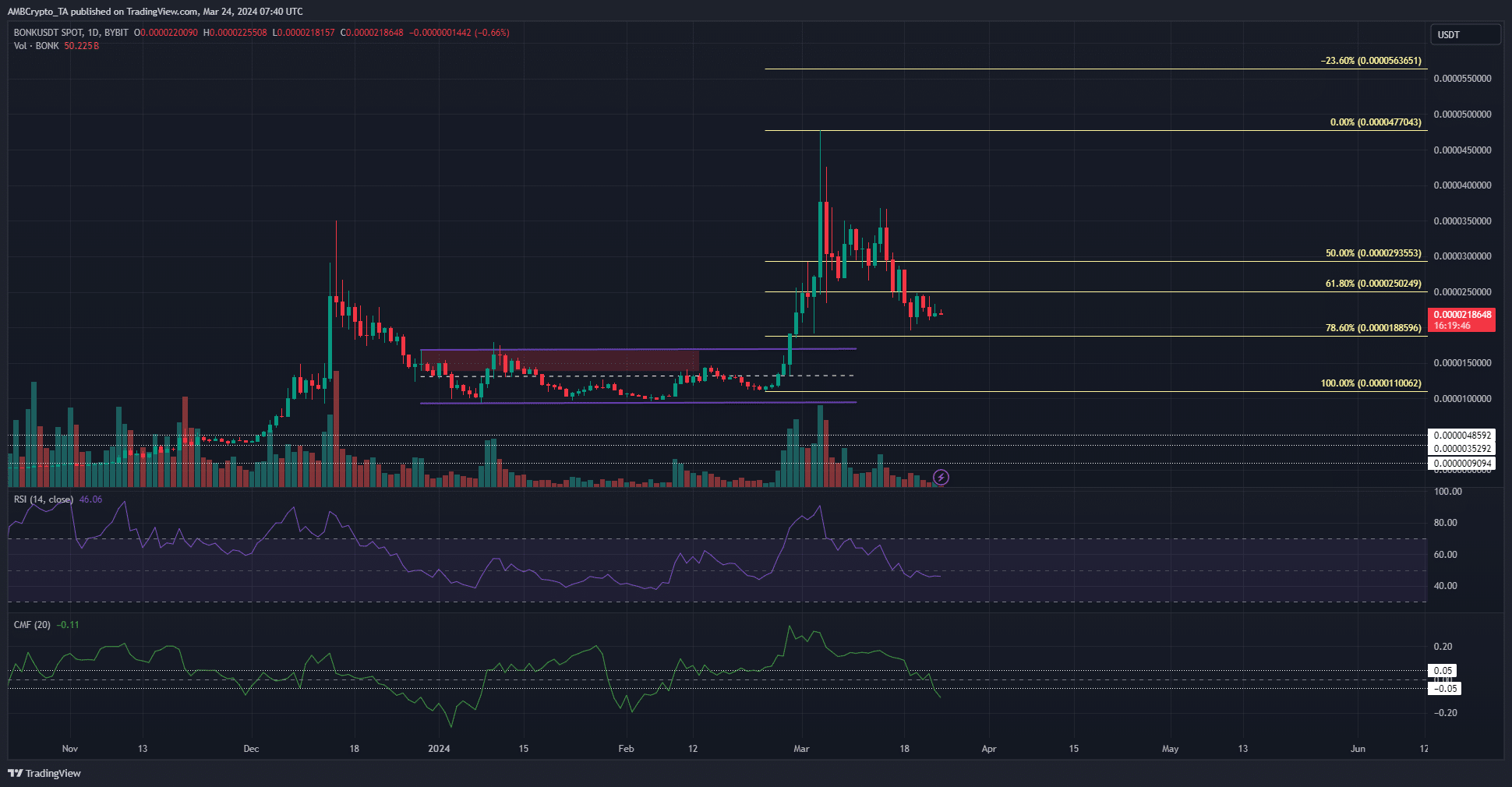

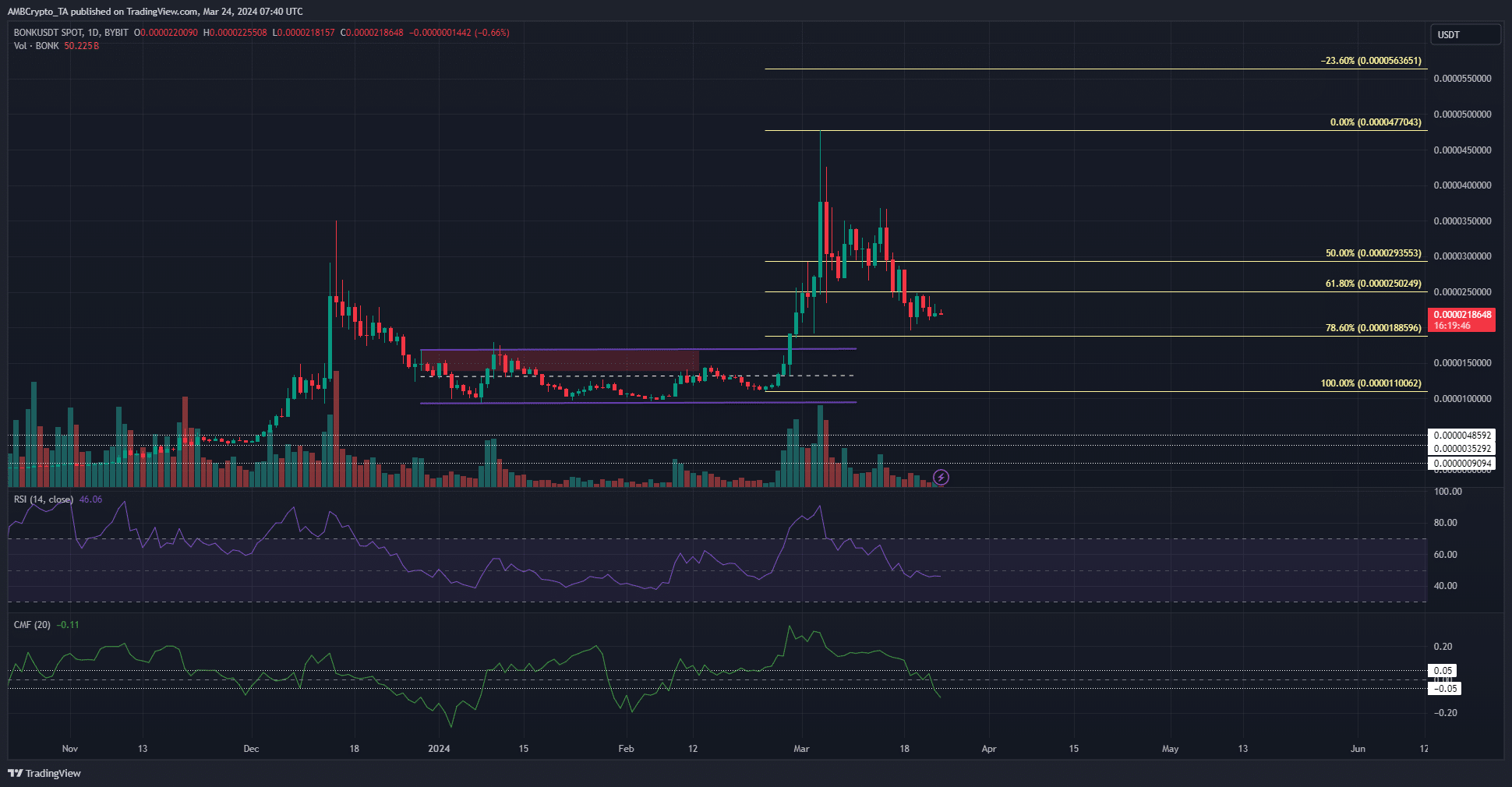

Supply: BONK/USDT on TradingView

The one-day chart mirrored a bullish construction, however costs had been hovering above the 78.6% Fibonacci retracement stage.

Furthermore, the RSI slipped beneath the impartial 50 mark per week, handing the reins to the bears.

A drop beneath the 78.6% stage at $0.00001885 would point out that BONK is headed to the swing low at $0.000011. A bearish market construction would turn out to be extra seemingly on this state of affairs.

Other than the RSI, the Chaikin Cash Stream (CMF) indicator additionally underlined bearishness. It fell beneath -0.05, a stage merchants use to filter weak indicators. It signaled notable capital circulation out of the BONK market.

The liquidation heatmap confirmed a brilliant band on the $0.0000177-$0.0000185 space. It was a pocket of liquidity that would appeal to BONK costs decrease earlier than a rally might be initiated.

To the north, the $0.0000372-$0.0000388 space was one other important pocket. In between, the liquidation ranges had been comparatively sparse, which means costs may traverse between these areas shortly.

WIF Bulls unable to win the group over

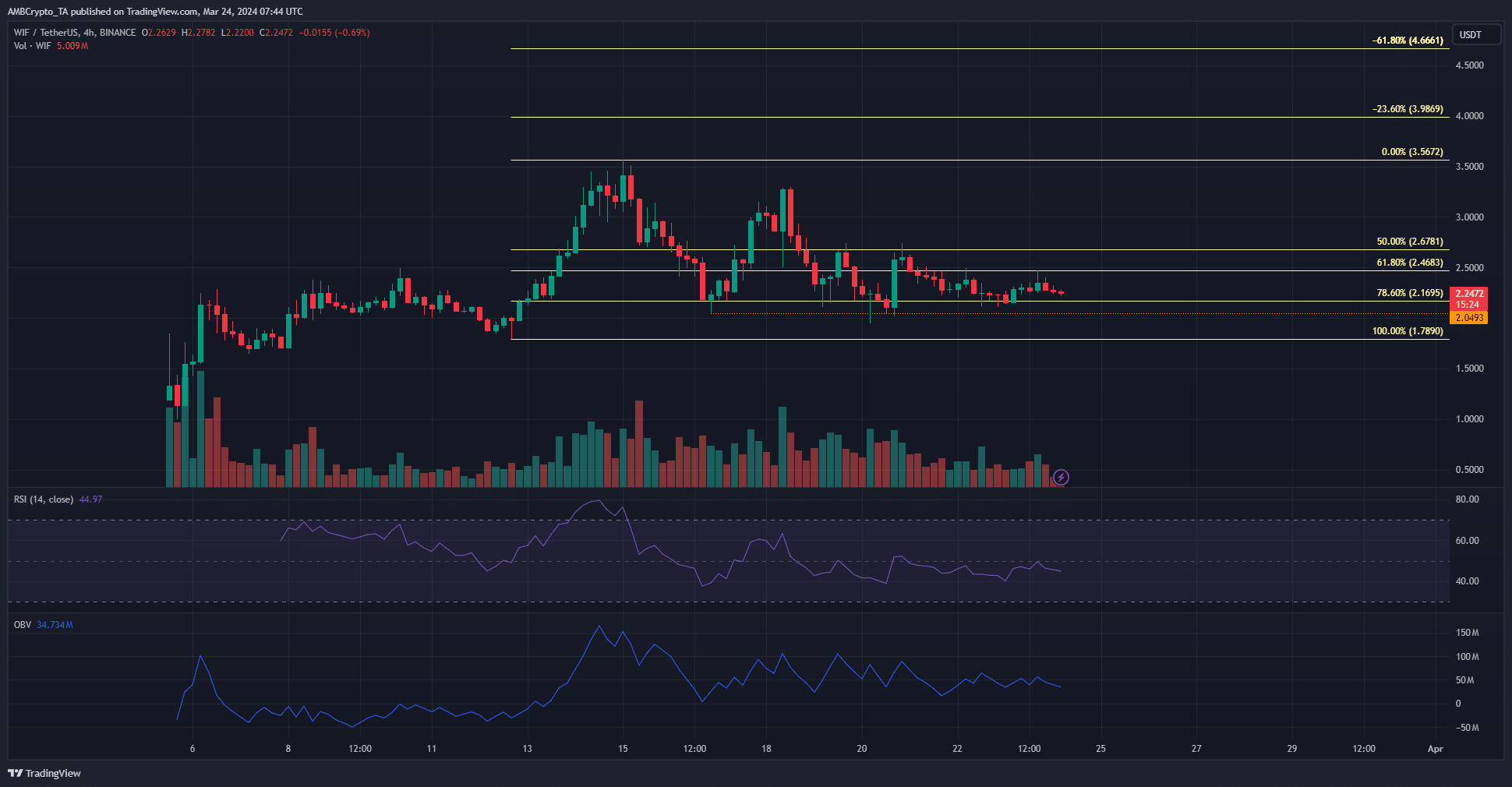

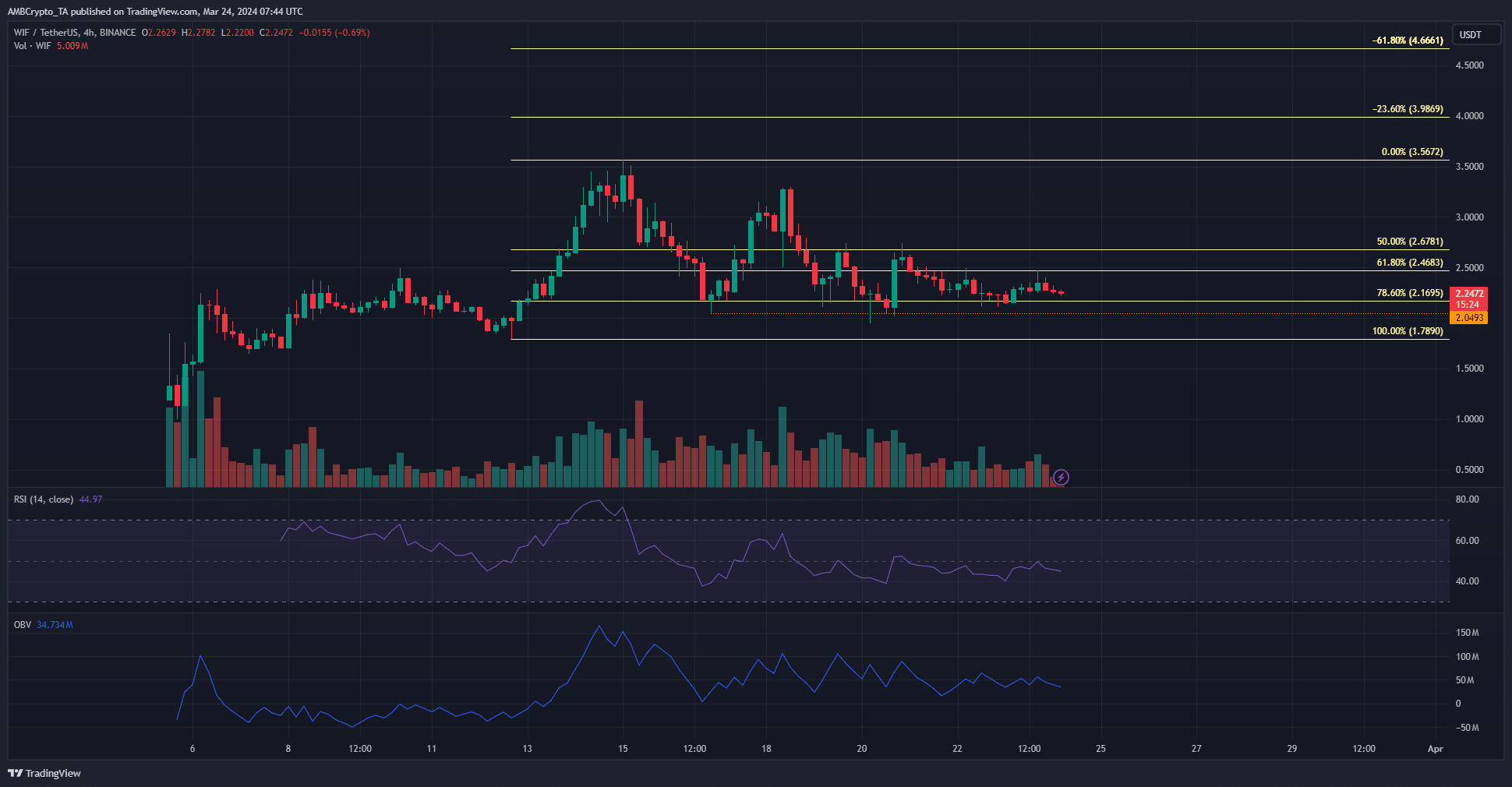

Supply: WIF/USDT on TradingView

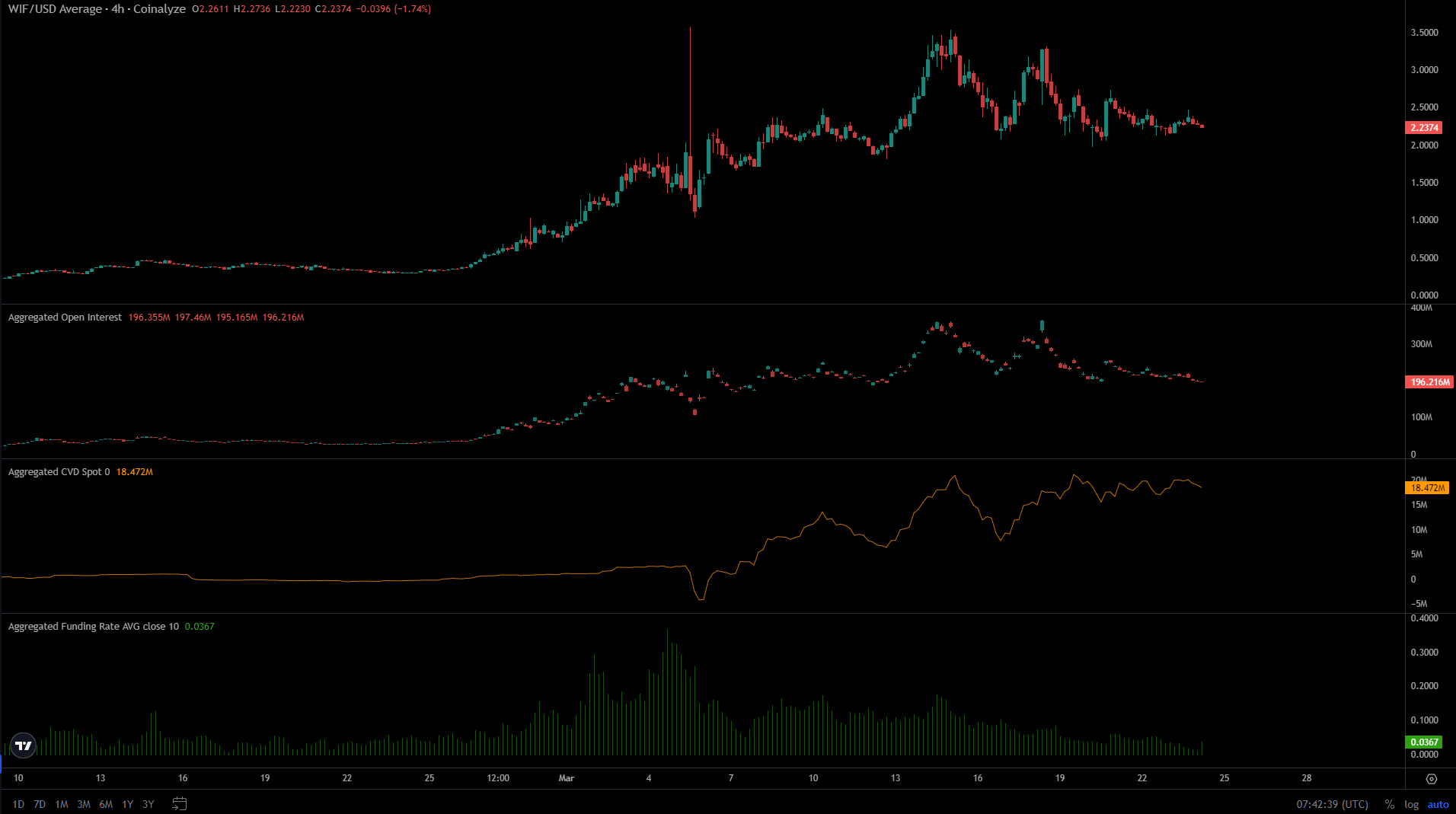

The 4-hour chart has a bearish market construction. The swing low at $2.04 set on the sixteenth of March was breached on the twentieth.

The momentum has additionally been firmly bearish because the 18th of March, because the RSI remained beneath impartial 50.

WIF must climb again above $3.3 to flip the 4-hour timeframe construction bullishly. The proof of the previous ten days confirmed that bulls lacked the power to power this restoration.

The OBV has moved sideways over the previous week, and the buying and selling quantity was comparatively low.

The Open Curiosity chart fell decrease over the previous week alongside costs. This mirrored bearish sentiment and speculators selecting to stay sidelined. Brief promoting has not ramped up but.

Is your portfolio inexperienced? Take a look at the WIF Revenue Calculator

Surprisingly, the spot CVD has been flat previously 4 days. This was an encouraging signal for WIF bulls within the quick time period.

It meant that the promoting quantity within the spot markets was low, and if sentiment may shift bullishly in some way, the bulls may push costs increased.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.